Global Adhesion Barrier Market Size, Share, Trends & Growth Forecast By Product, Product Form, Surgical Application and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Adhesion Barrier Market Size

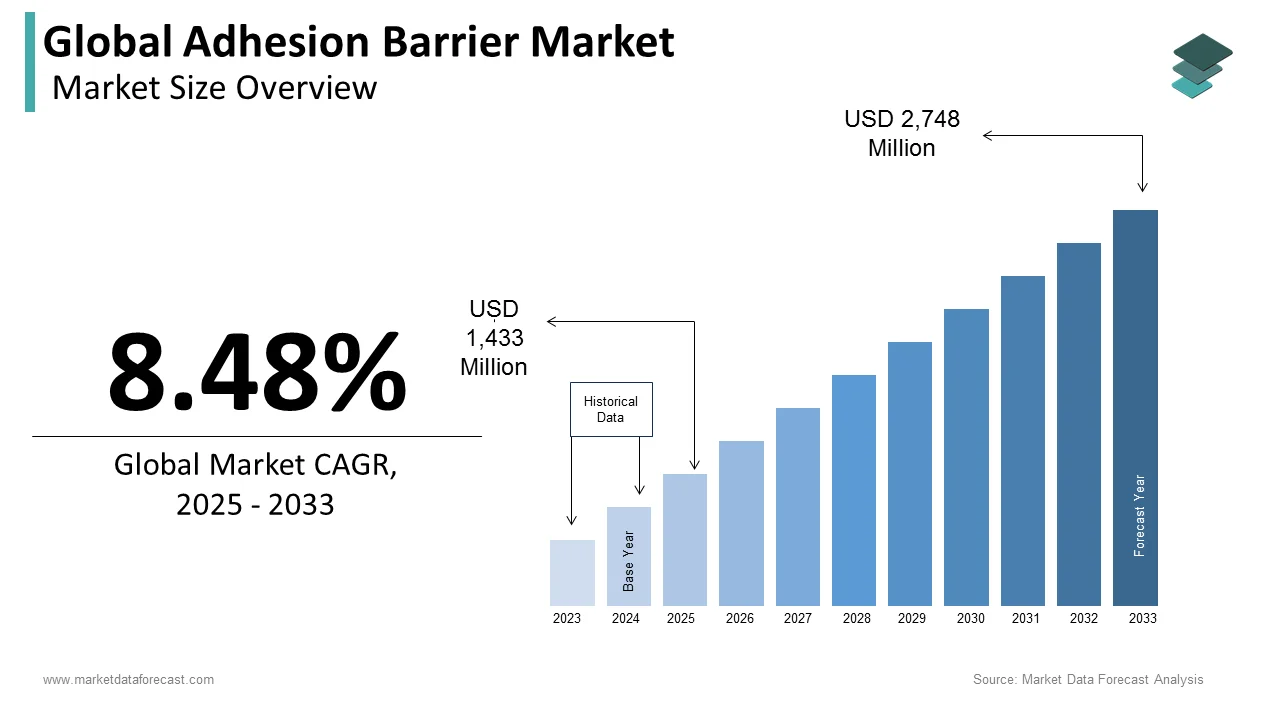

The global adhesion barrier market was worth US$ 1,321 million in 2024 and is anticipated to reach a valuation of US$ 2,748 million by 2033 from US$ 1,433 million in 2025, and it is predicted to register a CAGR of 8.48% during the forecast period 2025-2033.

A band of scar tissue connecting two parts of tissue that weren't attached before is called adhesion; it appears as thick fibrous bands or thin sheets of tissue, looking like plastic wrap. This mechanism in our body is activated during the reaction of any tissue disturbance by the body's repair mechanisms, like surgery, radiation therapy, infection, or trauma, causing inflammation, the most common places being the pelvis, abdominal cavity, and heart. Adhesion barriers are used to avoid this natural defense mechanism of the body. An adhesion barrier is a medical implant used to decrease unusual internal scarring, followed by surgery to detach the internal tissues and organs during healing. These barriers are used for surgical procedures in the department of gynecology, orthopedic, cardiovascular, reconstructive, and urological surgeries.

MARKET DRIVERS

YOY's growth in the aging population undergoing surgical procedures is one of the major factors propelling the global adhesion barrier market. YOY growth in the incidence of various cancers is expected to act favorably on the adhesion barrier market.

The growth of the adhesion barrier market is primarily driven by the growing adoption of adhesion barriers by surgeons because post-surgical adhesions give rise to different complications in different surgeries, like infertility in women after gynecological surgeries, severe abdominal pain in the case of abdominal surgeries, and some physical deterioration in patients after neurological surgeries. Also, approximately 60% of small bowel obstructions in adults are caused by adhesions, contributing to the development of chronic pelvic pain; fibrous bands around the intestine are formed, which restricts blood flow and leads to tissue death in extreme cases. Looking up to these severe effects of post-surgical adhesions, the importance of adhesion barriers is increasing in the market. In addition, surgeons prefer adhesion barrier films in the case of women, where adhesions occur after postpartum gynecological surgeries, leading to swelling, prolonged discomfort, infertility, and other related gynecological diseases.

The growing number of postoperative difficulties associated with invasive surgeries further promotes the adhesion barrier market growth.

The rising focus on R&D by the key market participants to develop and launch new adhesion barrier products is expected to accelerate the market's growth rate. Furthermore, favorable reimbursement policies and growing awareness regarding the benefits of adhesion barriers add fuel to the global adhesion barrier market growth. Additionally, intestinal adhesions result in pain due to obstruction while pulling or stretching during physical workouts. Furthermore, deep breathing or shortness of breath and pain result from adhesions above the liver, and adhesions involving the vagina or uterus cause pain. Therefore, adhesion barriers are used to reduce the incidence of adhesions, which helps reduce small bowel obstruction and laparoscopic surgery. In addition, they are also used in open and laparoscopic surgery, which are also cost-effective and help to prevent adhesion-related problems.

MARKET RESTRAINTS

High costs associated with the treatment of surgeries are likely to hamper the global adhesion barrier market growth during the forecast period.

Nausea, small bowel obstruction, blood clot in the lungs called pulmonary embolism, abscess, vomiting, deep vein thrombosis, diarrhea, adrenal insufficiency, intestinal paralysis (ileus), and fever are some of the complications or side effects that occur due to the use of film adhesion barriers. Lack of awareness among the patients, particularly people living in rural areas, hinders market growth. In addition, strict rules and regulations associated with the products and devices and therapeutic approvals restrict the market. Postoperative side effects, unfavorable government policies, limited applications of a few of the product types, and the unwillingness of surgeons to adopt the adhesion barriers are further expected to hinder the global adhesion barrier market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.48% |

|

Segments Covered |

By Product, Product Form, Surgical Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Baxter International Inc., Medtronic Plc., C. R. Bard, Inc., Johnson & Johnson, Sanofi Group, Atrium Medical Corporation, Integra Lifesciences Corporation, Anika Therapeutics Inc., FzioMed, Inc., and MAST Biosurgery AG, and Others. |

SEGMENTAL ANALYSIS

By Product Insights

In 2024, the synthetic adhesive barriers segment led the adhesive barrier market based on the product. The high bioresorbable and biocompatibility properties are driving the rise. Adhesive artificial barriers are also cost-effective, which boosts segment development marginally. The widespread availability of industrial synthetic adhesion barriers contributes to the segment's superiority. Such segments, such as regenerated glycol, polyethylene, and hyaluronic acid cellulose, are further separated. Because of its ability to attract and retain a considerable amount of moisture, hyaluronic acid dominates.

The natural adhesion barriers segment is also estimated to account for a significant market share over the forecast period, subdivided into fibrin, collagen, and protein. Among these, the collagen and protein segment is anticipated to hold the largest market share owing to its various advantages, safety in its use, and durability it provides. Furthermore, the fibrin segment is also foreseen to grow at a healthy CAGR, mainly due to its high application in various industries, leading to the increasing adoption of fibrin products.

By Product Form Insights

Based on the product form, the film adhesion barrier segment dominated the Adhesion Barrier market in 2024 and is anticipated to witness significant growth during the forecast period. The segment growth is primarily driven due to its low cost and increasing use of film form adhesion in various surgeries. Furthermore, several clinical pieces of data confirm the efficacy and protection of these types of adhesion, resulting in consumer expansion. One of Genzyme's most famous film adhesion barriers is Seprafilm, a chemically modified carboxymethylcellulose, which adheres to the tissues. It is a sticky transparent film that slowly gets absorbed by the body in seven days and is mainly used for certain types of pelvic laparotomy or abdominal surgery.

The gels segment is expected to grow at the fastest rate during the forecast period, primarily due to its significant advantages of resorption, safety, ease of application, affordability, and high adoption of gels in various surgeries like carpal tunnel surgery, tendon surgery, and joint or peripheral surgery. One famous example of a gel adhesion barrier is Betamax, a single-use clear fluid gel that acts as a temporary protective barrier to separate tissues. It is used during various surgical procedures since it helps reduce fibrosis, help prevent internal adhesions and reduce the formation of post-surgical adhesions.

By Surgical Application Insights

Based on the application, the cardiovascular surgeries segment is expected to witness the fastest CAGR during the forecast period. The segment's high growth is attributed to the increasing usage of adhesive barriers in cardiovascular surgeries and the proliferation of heart-related diseases. American Heart Association stated that heart causes almost one in four deaths in the United States annually. During regular cardiothoracic treatments, post-surgical heart adhesions pose a serious concern. This fibrous tissue can impair heart function and prevent access to the surgical site during reoperations. Because of this, using a bioresorbable substance during heart surgery has helped to decrease postoperative adhesions, enable reoperation, and prevent problems.

On the other hand, gynecological surgeries recorded the largest share in 2024 and are anticipated to continue their growth during the forecast period. The increasing number of gynecological laparoscopy procedures is primarily boosting the market growth. Also, the rise in the adoption of gel form and film form in various gynecological procedures is leveling up segment growth. Various adhesive barriers are crucial to be used after gynecological surgeries. Inert physical barriers separate the serous surface from the traumatic area and keep them separated for more than three days, helping to prevent the formation of adhesions, which might occur due to pelvic infection, which is more often accompanied by more severe stages of endometriosis.

REGIONAL ANALYSIS

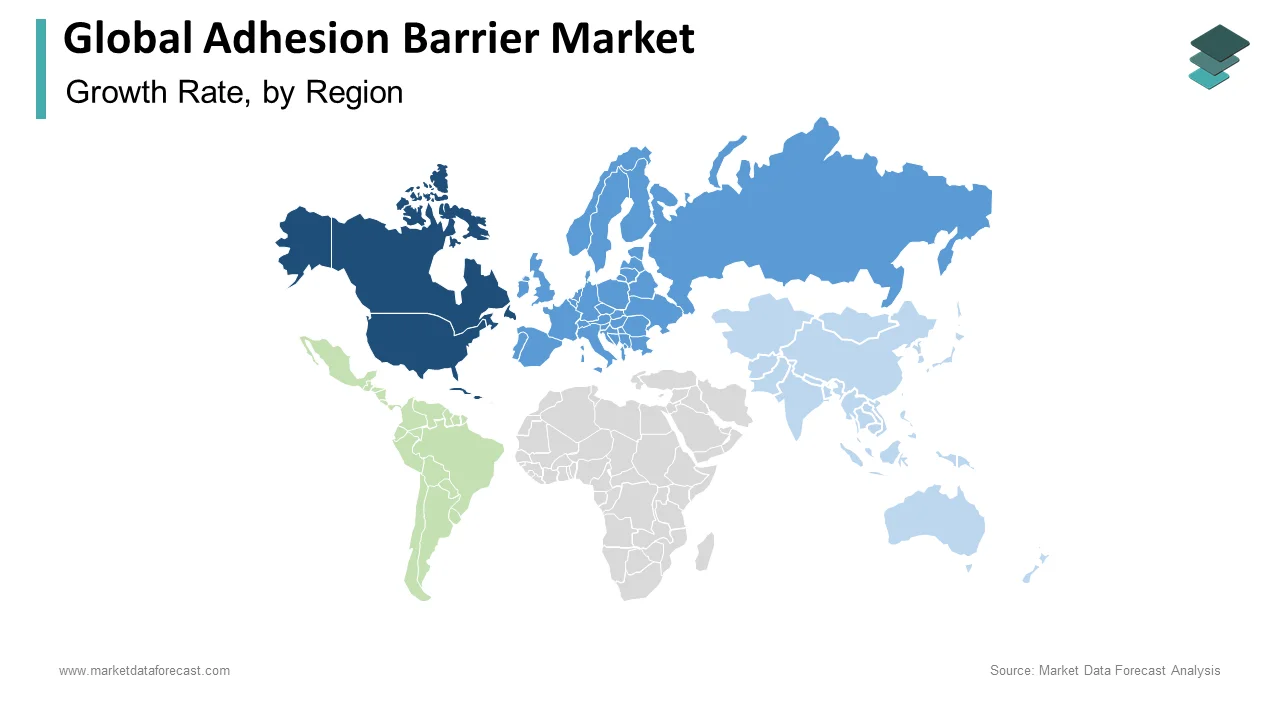

Regionally, the North American adhesion barrier market led the global market in 2024 due to the presence of key market participants and well-developed healthcare infrastructure. The presence of key market players, such as Johnson and Johnson, Anika therapeutic, Integra life sciences, and Barter, further international drives the North American regional market growth. The United States recorded the largest adhesion barrier market share in the North American regional market during the previous year. Moreover, the proliferation of orthopedic conditions and higher adoption of advanced treatment procedures is likely to fuel the market growth in the United States. The Canadian market is slightly contributing to the North American market growth.

During the forecast period, the European adhesion barrier market is projected to showcase significant market growth in the worldwide market. The rising geriatric population in the region and the volume of surgeries and sports-related injuries boost the market growth for Adhesion barriers. The United Kingdom is anticipated to witness the largest market share in the Adhesion market during the forecast period. The market growth is attributed to the country's availability of advanced healthcare infrastructure facilities and the increasing incidence of invasive surgeries.

However, the Asia-Pacific adhesion barrier market is expected to grow the fastest due to increasing awareness regarding adhesion barriers, developing healthcare infrastructure, and rising disposable income levels. The overall disease growth is also rising at an alarming rate in this region. The region's growth is projected to rise in the coming years with a large and growing population in India and China. China dominated the Adhesion barrier market in 2020 and is anticipated to contribute to the regional market growth. Increasing awareness about adhesion formation-related diseases and the significant increase in the geriatric population. The Indian market growth will most likely contribute to the APAC region's growth. The expansion of private-sector hospitals in rural areas and the increased demand for surgical interventions drive better healthcare facilities, medical devices, and technologies.

The Latin American adhesion barrier market is anticipated to grow at a CAGR of 8.4% from 2024 to 2033.

The adhesion barrier market in MEA is expected to be worth USD 104.7 million by 2033.

KEY MARKET PARTICIPANTS

Some of the key players dominating the global adhesion barrier market profiled in this report are Baxter International Inc., Medtronic Plc., C. R. Bard, Inc., Johnson & Johnson, Sanofi Group, Atrium Medical Corporation, Integra Lifesciences Corporation, Anika Therapeutics Inc., FzioMed, Inc. and MAST Biosurgery AG.

RECENT MARKET DEVELOPMENTS

- In February 2022, Gunze Limited obtained medical device approval from TENALEAF, the first absorbable adhesion barrier blade ever created, for its manufacturing and marketing. An absorbable adhesion barrier is beneficial in laparoscopic surgery and reduces postoperative organ adhesions, further improving the patient's clinical outcome.

- In February 2020, Baxter International acquired Seprafilm Adhesion Barrier and associated effects and factors from Sanofi. Baxter's advanced surgery provides clinically various surgical care products used in treating hemostasis, tissue sealing and tissue repair, and many more.

MARKET SEGMENTATION

This research report on the global adhesion barrier market has been segmented and sub-segmented based on the product, product form, surgical applications, and region.

By Product

- Synthetic Adhesion Barriers

- Regenerated Cellulose

- Hyaluronic Acid

- Polythene Glycol

- Natural Adhesion Barriers

- Fibrin

- Collagen & Protein

By Product Form

- Film Adhesion Barriers

- Gel Adhesion Barriers

- Liquid Adhesion Barriers

By Product Form

- Film Adhesion Barriers

- Gel Adhesion Barriers

- Liquid Adhesion Barriers

By Surgical Application

- Gynecological Surgeries

- Cardiovascular Surgeries

- Neurological Surgeries

- Orthopedic Surgeries

- General/Abdominal Surgeries

- Urological Surgeries

- Reconstructive Surgeries

- Other Surgeries

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

At What CAGR, The adhesion barrier market is expected to grow from 2025 to 2033?

The adhesion barrier market size is estimated to grow at a CAGR of 8.48% from 2025 to 2033.

Which region has the highest market share in the Global adhesion barrier market ?

North America region is expected to dominate the revenue during the forecast period in the global adhesion barrier market.

How much is the global adhesion barrier market going to be worth by 2033?

The global adhesion barrier market is estimated to reach USD 2,748 million by 2032.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com