Asia-Pacific Industrial Hemp Market Size, Share, Trends & Growth Forecast Report By Type, Application and Country (India, China, Japan, South Korea, Australia & New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) – Industry Analysis From (2025 to 2033)

Asia-Pacific Industrial Hemp Market Size

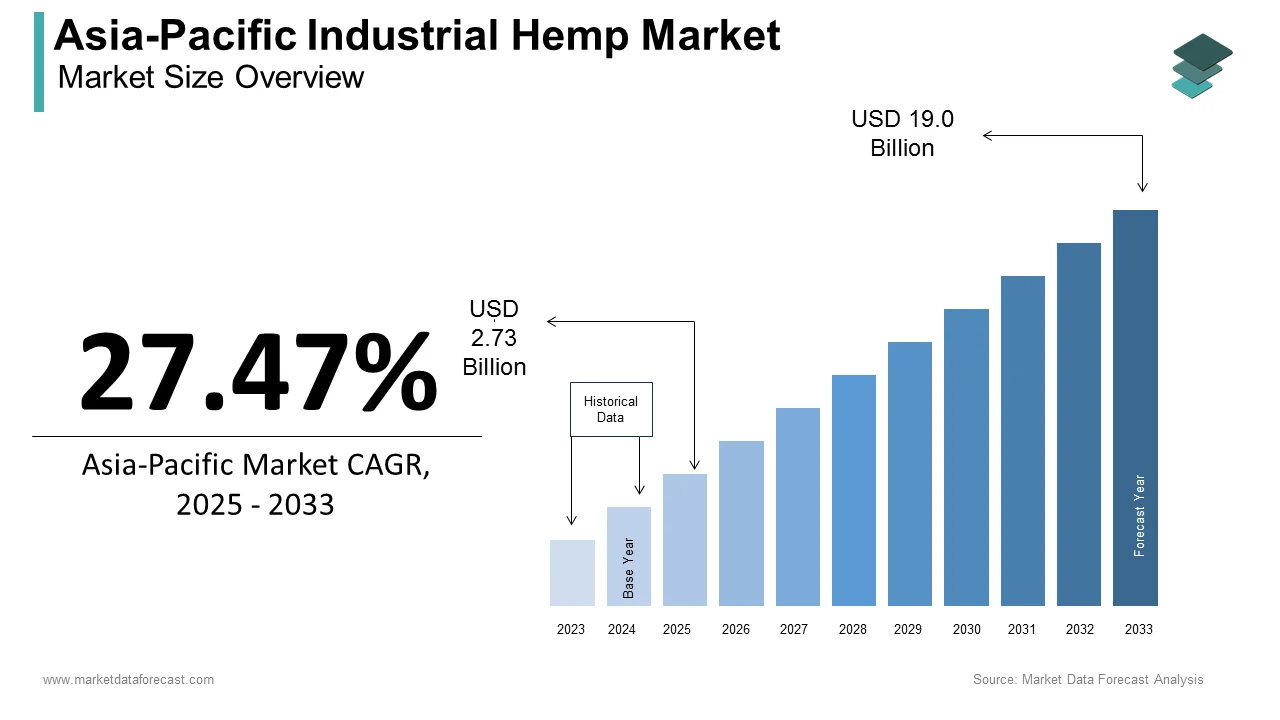

The size of the industrial hemp market in Asia Pacific was valued at USD 2.14 billion in 2024. The Asia Pacific market is expected to be valued at USD 2.73 billion in 2025 and USD 19.03 billion by 2033, exhibiting a CAGR of 27.47% from 2025 to 2033.

MARKET DRIVERS

Increasing Utilization of Hemp Products in the Medical Sector

Increasing Utilization Of Hemp Products In The Medical Sector Is A Key Factor Propelling The Growth Rate Of The Market To The Extent. Also, growing support from the government in this region is greatly influencing the demand of the market. It is a good replacement for plastics where hemp is non-toxic and bio-degradable. This attribute is quietly driving the demand of the market. The textile industries have varied hemp applications, which are solely to fuel the growth rate of the market. In many countries, hemp crop cultivation is legalized due to its major benefits in industries like pharmaceuticals, personal care, food, and beverages. Legalizing the cultivation is one factor for the growing demand of the industrial hemp market in the Asia Pacific. Rising occurrences of cancer, epilepsy, and other diseases where hemp usage has shown effective results are leveraging the growth rate of this market. Government initiatives to create awareness over the use of hemp in medicine are elevating the market's demand tremendously.

MARKET RESTRAINTS

Legal Restrictions on Hemp Cultivation in Some Countries

Farmers have less knowledge of the benefits of hemp in industries and this is slowly hampering the growth rate of the market. In a few countries, the cultivation of hemp is not legal, which is impeding the demand of the industrial hemp market. Also, the government's highly complex regulatory structure is limiting the demand of the market in the Asia Pacific. Fluctuations in the availability of raw materials due to production are to hinder the growth rate. Risk factors associated with the long-term use of hemp in the treatment of various diseases also to a decline in the regional market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of APAC. |

|

Market Leader Profiled |

Hempco, Ecofibre, Hemp Inc., Gencanna, Hempflax BV, Konoplex Group, Hemp Oil Canada, BAFA, Hemp Poland, Dun Agro, Colorado Hemp Works, Canah International., and Others. |

SEGMENT ANALYSIS

By Type Insights

REGIONAL ANALYSIS

The Asia Pacific market has grown faster for the past few years and is estimated to hit the highest CAGR shortly. The growing prevalence of skincare products and raising funds from private organizations are likely to fuel the growth rate of the market. The hemp seed oil adds taste to the vegan diet, which is ascribed to bolster the demand of the industrial hemp market. China held a market size of USD 1.7 billion in 2023 and 20% of total production. The government is allowing to sell the hemp-based products through eCommerce sites with necessary legal approvals. In India, the demand for the industrial hemp market is growing at a faster rate. Indian Narcotics Drugs and Psychotropic Substances (NDPS) Act of 1985 has issued powers for the state governments to give licenses to cultivate the hemp crop for medical purposes. Increasing awareness over the use of industrial hemp in different industries is surging the growth rate of the market in the Asia Pacific.

KEY MARKET PLAYERS

Companies playing a notable role in the Asia Pacific industrial hemp market are Hempco, Ecofibre, Hemp Inc., Gencanna, Hempflax BV, Konoplex Group, Hemp Oil Canada, BAFA, Hemp Poland, Dun Agro, Colorado Hemp Works, and Canah International.

MARKET SEGMENTATION

This research report on the Asia Pacific industrial hemp market has been segmented and sub-segmented into the following categories.

By Type

- Hemp seed

- Hemp seed oil

- CBD hemp oil

- Hemp fiber

By Application

-

Food

- Snacks & cereals

- Soup, sauces, and seasonings

- Bakery

- Dairy & frozen desserts

- Others (cold cereals, pasta, chocolate spreads, and pet food)

- Beverages

- Hot beverages

- Sports & energy drinks

- Ready to drink

- Others (meal replacement drinks, beverage mixes, beverage concentrates, and juice drinks)

- Personal care products

- Textiles

- Pharmaceuticals

- Others (paper, automobiles, construction & materials, furniture, and pet food)

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com