Asia-Pacific Pregnancy Testing Market Size, Share, Trends & Growth Forecast Report By Product Type, Test Type and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of Asia-Pacific), Industry Analysis 2025 to 2033

Asia-Pacific Pregnancy Testing Market Size

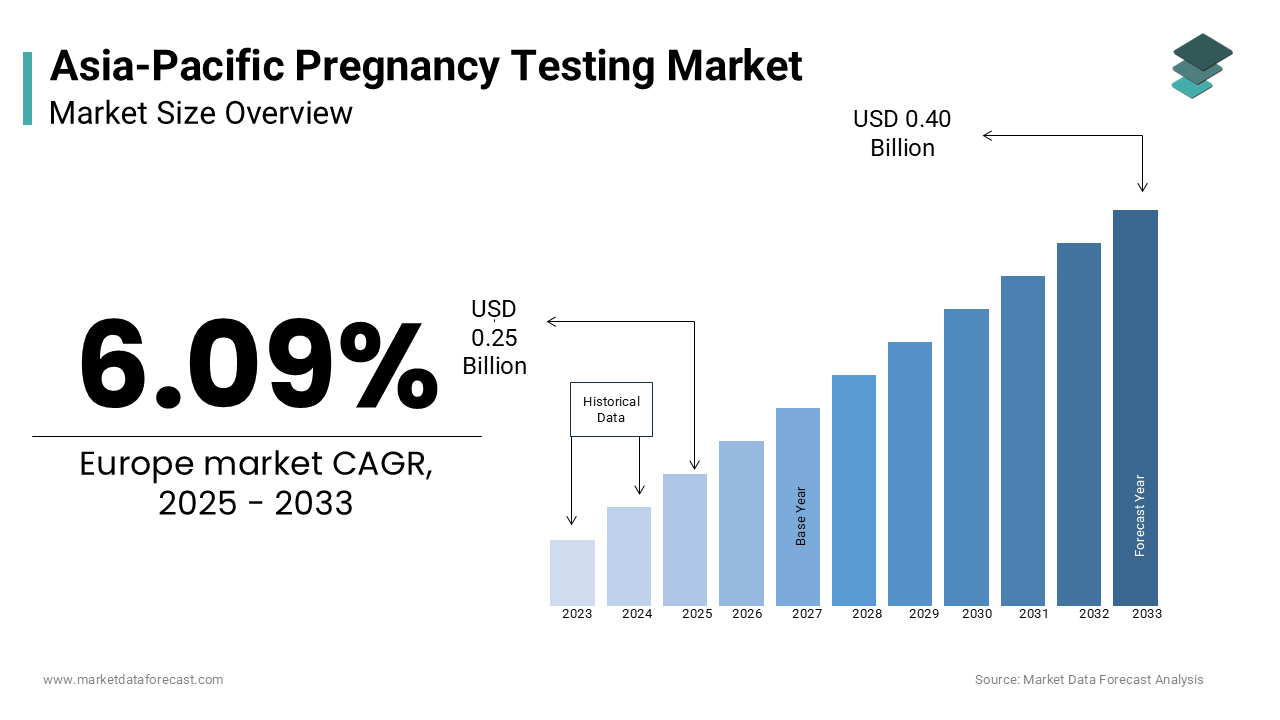

The pregnancy testing market size in Asia Pacific was valued at USD 0.24 billion in 2024. The regional market size is expected to be worth USD 0.40 Billion by 2033 from USD 0.25 billion in 2025, growing at a CAGR of 6.09% between 2025 and 2033.

Pregnancy tests, which detect the presence of human chorionic gonadotropin (hCG) hormone, are essential tools for early pregnancy detection. In the Asia-Pacific region, adolescent pregnancy remains a pressing concern. The United Nations Population Fund (UNFPA) reports that annually, over 3.7 million births occur to adolescent girls aged 15-19. Adolescent fertility rates are notably high in the Pacific, with 51 births per 1,000 girls, and Southeast Asia, with 43 births per 1,000 girls. Additionally, unintended pregnancies contribute to the demand for pregnancy testing. The World Health Organization (WHO) indicates that unintended pregnancy rates vary across regions, influencing the need for accessible and reliable pregnancy testing methods.

MARKET DRIVERS

Increasing Prevalence of Unintended Pregnancies

The rising prevalence of unintended pregnancies in the Asia-Pacific region is a significant driver of the pregnancy testing market. According to the World Health Organization, unintended pregnancies constitute nearly 45% of all pregnancies worldwide, with substantial variation across Asia-Pacific countries. As per the United Nations Population Fund, 26 million unintended pregnancies in South Asia occur annually. This trend emphasizes the urgent need for accessible and accurate pregnancy testing methods, enabling women to make timely reproductive health decisions. With growing awareness of family planning and reproductive health, the demand for efficient and reliable pregnancy tests has surged, further boosting market growth in the region.

Government Initiatives Promoting Reproductive Health

Government-led initiatives to improve reproductive health services in Asia-Pacific are catalyzing the growth of the pregnancy testing market. Programs aimed at reducing maternal mortality and promoting family planning include expanding access to diagnostic tools like pregnancy tests. The United Nations Population Fund underscores that efforts under the Sustainable Development Goals aim to reduce adolescent birth rates and increase contraceptive use in regions such as Southeast Asia. Increased funding for maternal health programs has facilitated the availability of affordable and quality-assured pregnancy testing kits, making them accessible to both rural and urban populations. These policies significantly contribute to the market's upward trajectory, enhancing maternal and reproductive health outcomes.

MARKET RESTRAINTS

Limited Accessibility in Rural Areas

The World Health Organization reports that nearly 60% of the rural population in low- and middle-income countries, including South and Southeast Asia, lacks access to essential healthcare services. Limited healthcare infrastructure and logistical barriers prevent the widespread availability of pregnancy test kits, leaving many women without timely access to early pregnancy detection. This disparity is particularly pronounced in countries like India and Bangladesh, where rural populations constitute a significant percentage of the total demographic. Addressing this issue is critical for achieving equitable healthcare distribution across the region.

Cultural and Social Stigma

Cultural norms and social stigma surrounding pregnancy, particularly among unmarried women and adolescents, act as a major restraint in the adoption of pregnancy tests. The United Nations Population Fund highlights that adolescent pregnancy rates in Southeast Asia are among the highest globally, yet many young women face societal pressures that deter them from seeking testing or reproductive health services. This stigma leads to delays in pregnancy detection and prenatal care, negatively impacting maternal and child health outcomes. Overcoming these barriers requires targeted awareness campaigns and education programs to reduce stigma and promote the importance of early pregnancy detection for overall health improvement.

MARKET OPPORTUNITIES

Increasing Adoption of Digital and Advanced Pregnancy Test Kits

The Asia-Pacific pregnancy testing market is poised for growth due to the rising adoption of digital and advanced test kits that provide high accuracy and user-friendly features. These innovations cater to tech-savvy consumers and address the limitations of traditional methods. The World Health Organization highlights the importance of accurate diagnostic tools in maternal health improvement, which digital kits provide through early and reliable pregnancy detection. Countries like Japan and South Korea are leading in technology integration, promoting the use of Bluetooth-enabled and app-compatible pregnancy test kits. The shift towards convenience and precision is creating significant opportunities for manufacturers to expand their market share in the region.

Rising Awareness Through Maternal Health Campaigns

Maternal health awareness campaigns in the Asia-Pacific region are driving opportunities for pregnancy test kit adoption. Government programs under the United Nations’ Sustainable Development Goals aim to reduce maternal mortality by increasing access to reproductive health tools, including pregnancy tests. For instance, India’s National Health Mission emphasizes maternal health initiatives, ensuring the distribution of affordable test kits in underserved areas. Additionally, the United Nations Population Fund reports progress in countries like Vietnam and the Philippines, where educational campaigns promote early pregnancy detection. These efforts increase market penetration and enable women to access critical healthcare services, further boosting the demand for pregnancy test kits across the region.

MARKET CHALLENGES

High Prevalence of Counterfeit and Substandard Products

The proliferation of counterfeit and substandard pregnancy test kits poses a significant challenge in the Asia-Pacific market. The World Health Organization estimates that approximately 1 in 10 medical products in low- and middle-income countries is substandard or falsified, impacting the reliability of diagnostic tools. This issue is particularly severe in countries with fragmented regulatory systems, such as India and Indonesia, where counterfeit test kits compromise consumer trust and health outcomes. The lack of strict enforcement mechanisms and quality assurance standards exacerbates the challenge, limiting the adoption of reliable products and undermining market growth potential in the region.

Inadequate Education on Reproductive Health

Limited awareness and education about reproductive health remain significant barriers to the pregnancy testing market in the Asia-Pacific region. The United Nations Population Fund highlights that millions of women, particularly in rural areas of South Asia, lack knowledge about family planning and early pregnancy detection methods. Cultural taboos surrounding reproductive health further prevent open discussions and access to essential tools like pregnancy tests. In Southeast Asia, only 58% of women use modern family planning methods, underscoring the knowledge gap. Addressing these educational challenges requires comprehensive awareness campaigns to improve understanding of reproductive health, enabling women to utilize pregnancy testing and related healthcare services effectively.

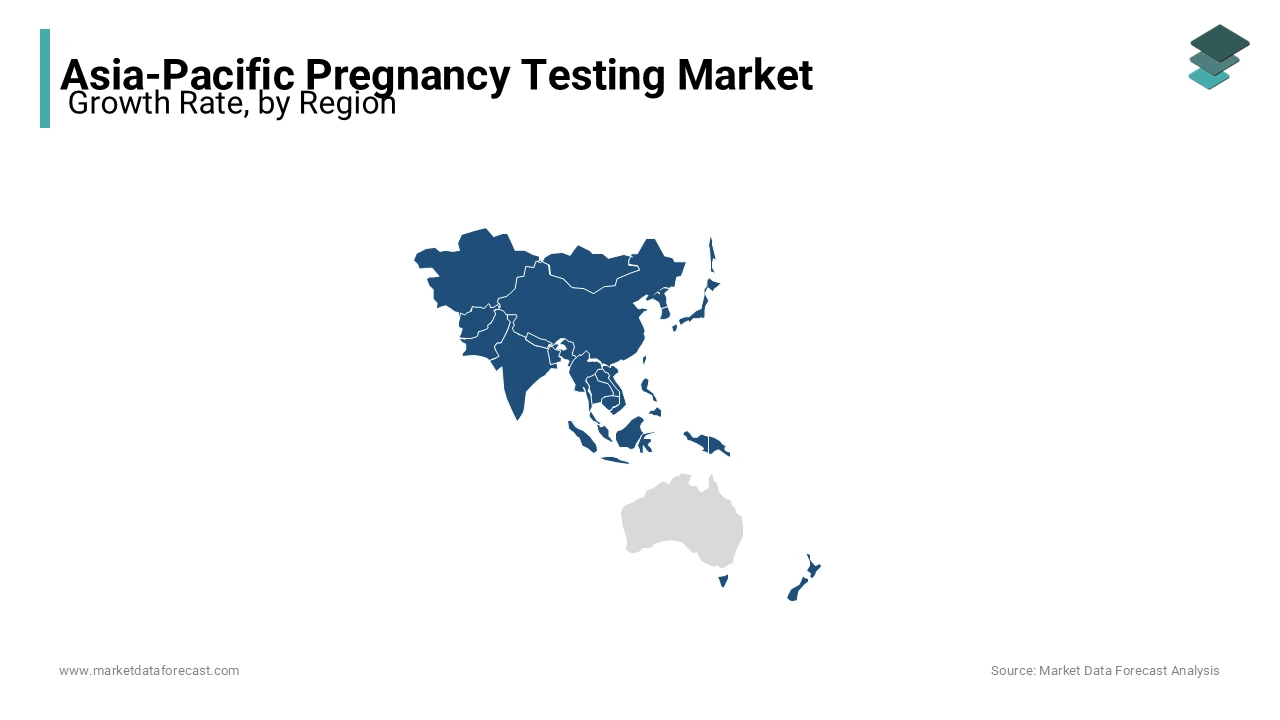

REGIONAL ANALYSIS

India is a leading player in the Asia-Pacific pregnancy testing market, driven by its high fertility rate and large population base. According to the United Nations Population Fund, India records over 25 million pregnancies annually, creating substantial demand for affordable and accessible pregnancy test kits. Rural healthcare initiatives under the National Health Mission, which focuses on maternal and child health, have further increased the availability of pregnancy tests in underserved areas. Additionally, the rise in awareness regarding family planning and early pregnancy detection among urban and semi-urban populations has bolstered the market's growth trajectory, making India a dominant force in the region.

China’s position in the Asia-Pacific pregnancy testing market is bolstered by its large population and advanced healthcare infrastructure. The National Bureau of Statistics of China reports over 14 million annual births, reflecting the consistent demand for pregnancy detection tools. Urbanization and increasing health consciousness among the Chinese population have contributed to the widespread adoption of modern and digital pregnancy test kits. The government’s focus on improving maternal health, including through public health initiatives like Healthy China 2030, has further supported the market. This combination of high demand and government intervention cements China’s leading role in the regional pregnancy testing market.

Japan’s strong presence in the pregnancy testing market is fueled by its advanced healthcare infrastructure and emphasis on technological innovation. With one of the most technologically adept populations globally, digital pregnancy test kits have gained significant traction. The Ministry of Health, Labour and Welfare in Japan promotes precision diagnostics to enhance maternal health outcomes, further supporting the adoption of high-quality pregnancy tests. Additionally, Japan’s aging population has prompted policies to encourage childbearing, indirectly boosting demand for reliable pregnancy detection tools. These factors make Japan a key contributor to the growth of the pregnancy testing market in the Asia-Pacific region.

South Korea is a major force in the Asia-Pacific pregnancy testing market, supported by its technological advancements and robust healthcare expenditure. According to the Korean Statistical Information Service, South Korea consistently allocates significant resources to healthcare innovations, including diagnostics. The population’s high awareness of health technologies has led to the rapid adoption of advanced pregnancy test kits, such as digital and app-connected options. Furthermore, South Korea’s emphasis on family planning programs and maternal health under government-backed schemes has driven market growth. These factors position South Korea as a rapidly growing and influential player in the pregnancy testing market.

Australia’s strong healthcare infrastructure and government support make it a significant contributor to the Asia-Pacific pregnancy testing market. Programs like Medicare ensure widespread access to healthcare services, including diagnostic tools like pregnancy test kits. The Australian Institute of Health and Welfare highlights that over 300,000 births occur annually in Australia, driving consistent demand for pregnancy detection solutions. The country’s high health literacy rates and awareness of early pregnancy detection contribute to the popularity of advanced test kits, such as digital options. With a focus on maternal health through public health campaigns, Australia continues to lead as a prominent market player.

KEY MARKET PLAYERS

Companies playing a vital role in the Asia-Pacific pregnancy testing market are Abbott Laboratories, Cardinal Health, Church & Dwight, Germaine Laboratories, Kent Pharmaceuticals, Piramal Enterprises, Prestige Brands Holdings, Procter & Gamble Co., Quidel Corporation, and SPD Swiss Precision Diagnostics.

MARKET SEGMENTATION

This research report on the Asia Pacific pregnancy testing market has been segmented and sub-segmented into the following categories.

By Product

- Pregnancy Test Kits

- Strip Tests

- Midstream Kits

- Cassette Tests

- Digital Tests

- Fertility/Ovulation Tests

- Line Indicator Tests

- Digital Tests

By Test Type

- HCG Blood Test

- HCG Urine Test

- LH Urine Test

- FSH Urine Test

By Distribution Channel

- Hospitals & Specialty Clinics

- Pharmacies

- Online Retail

- Others (Supermarkets and Specialty Retail)

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com