Asia Pacific Automotive Glass Market Size, Share, Trends & Growth Forecast Report By Product (Tempered Glass, Laminated Glass), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), Application (Windscreen, Backlite, Sidelite), End-use (OEM, Aftermarket), and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC) – Industry Analysis From 2025 to 2033

Asia Pacific Automotive Glass Market Size

The size of the Asia Pacific automotive glass market was valued at USD 8 billion in 2024. This market is expected to grow at a CAGR of 5.86% from 2025 to 2033 and be worth USD 13.36 billion by 2033 from USD 8.47 billion in 2025.

Automotive glass encompasses windshields, side windows, rear windows, and sunroofs, each playing a critical role in enhancing passenger safety, comfort, and vehicle performance.

MARKET DRIVERS

Rising Demand for Advanced Safety Features

The growing emphasis on vehicle safety is a significant driver propelling the Asia Pacific automotive glass market. In addition, the integration of head-up displays (HUDs) and augmented reality (AR) windshields has intensified demand for high-performance glass capable of supporting advanced functionalities. The convergence of regulatory mandates, technological advancements, and consumer preferences positions advanced safety features as a key catalyst for sustained growth in the automotive glass market.

Increasing Penetration of Electric Vehicles (EVs)

The exponential growth of the electric vehicle (EV) market in the Asia Pacific serves as another major driver for automotive glass. According to industry experts and projections, EV sales in the region are projected to account for 40% of total vehicle sales by 2030, driven by government incentives and consumer awareness about environmental impact. Automotive glass plays a pivotal role in EVs, particularly through lightweight designs that reduce vehicle weight and improve energy efficiency. Apart from these, the integration of solar-embedded glass systems enhances energy generation capabilities, aligning with the transition to sustainable mobility. The synergy between regulatory support, technological innovation, and consumer demand positions the EV sector as a transformative force in the automotive glass market.

MARKET RESTRAINTS

High Costs of Implementation and Maintenance

A significant restraint impacting the Asia Pacific automotive glass market is the high cost associated with implementation and maintenance of advanced glass systems. This financial barrier is particularly challenging for small-scale automakers, who struggle to balance affordability with technological innovation. In addition, the lack of standardized repair networks for specialized glass creates challenges for end-users, leading to higher maintenance expenses. Governments across the region are attempting to address these issues through subsidies and policy reforms, but progress remains slow due to entrenched practices and limited outreach.

Limited Awareness Among End-Users

Another critical restraint is the limited awareness among end-users about the benefits of advanced automotive glass compared to traditional alternatives. According to the Federation of Indian Chambers of Commerce and Industry, a major share of small-scale vehicle owners in rural areas rely on conventional glass systems, unaware of the superior performance and reliability offered by modern solutions. This knowledge gap is exacerbated by inadequate marketing and educational campaigns, leaving consumers hesitant to invest in advanced technologies. Also, misconceptions about higher operational costs and limited availability further deter adoption, despite advancements in technology addressing these issues. Regulatory bodies in countries like Thailand and the Philippines are attempting to address these challenges through awareness programs, but progress remains slow due to limited funding and outreach.

MARKET OPPORTUNITIES

Adoption of Smart Glass Technologies

A burgeoning opportunity in the Asia Pacific automotive glass market lies in the increasing adoption of smart glass technologies, driven by the global push for autonomous mobility and energy-efficient solutions. Like, smart glass systems, such as electrochromic and suspended particle devices (SPDs), enable real-time control of light transmission, making them indispensable for applications like sunroofs and privacy windows. For instance, vehicles incorporating electrochromic glass achieve a reduction in cabin temperature, reducing the need for air conditioning and improving energy efficiency. Further, the integration of augmented reality (AR) windshields enhances navigation and safety features, addressing challenges posed by urban driving conditions. Governments across the region are incentivizing the development of these technologies through research grants and policy reforms, providing additional impetus for their adoption.

Expansion into Emerging Applications

Another significant opportunity stems from the expansion into emerging applications, such as fleet management, logistics, and public transportation. Moreover, the growing emphasis on smart cities has propelled the use of solar-embedded glass in public transportation systems, where they generate auxiliary power and optimize energy consumption. Governments across the region are incentivizing the adoption of these technologies through subsidies and infrastructure investments, further amplifying demand.

MARKET CHALLENGES

Cybersecurity Vulnerabilities in Smart Glass Systems

A significant challenge facing the Asia Pacific automotive glass market is the heightened risk of cybersecurity vulnerabilities, particularly as smart glass systems become increasingly integrated with connected technologies. For instance, a study by the Chinese Academy of Cyber Security highlights that vehicles equipped with connected smart glass are susceptible to hacking incidents, leading to unauthorized access and potential misuse of sensitive information. Further, the lack of standardized cybersecurity protocols creates inconsistencies in protection measures, leaving stakeholders vulnerable to emerging threats. Governments in countries like Japan and South Korea are attempting to address these issues through policy reforms, but progress remains slow due to limited technological expertise and fragmented regulatory frameworks.

Technological Limitations in Extreme Weather Conditions

Another pressing challenge is the technological limitations of automotive glass in extreme weather conditions, such as heavy rain, fog, or snow. According to the World Meteorological Organization, a major portion of road accidents in the Asia Pacific region occur during inclement weather, showing the need for reliable visibility-enhancing systems. Besides, the integration of hydrophobic and anti-fog coatings, while promising, faces challenges related to high costs and limited scalability. Governments across the region are incentivizing the development of these technologies through subsidies and research grants, but progress remains slow due to technical complexities and resource constraints.

SEGMENTAL ANALYSIS

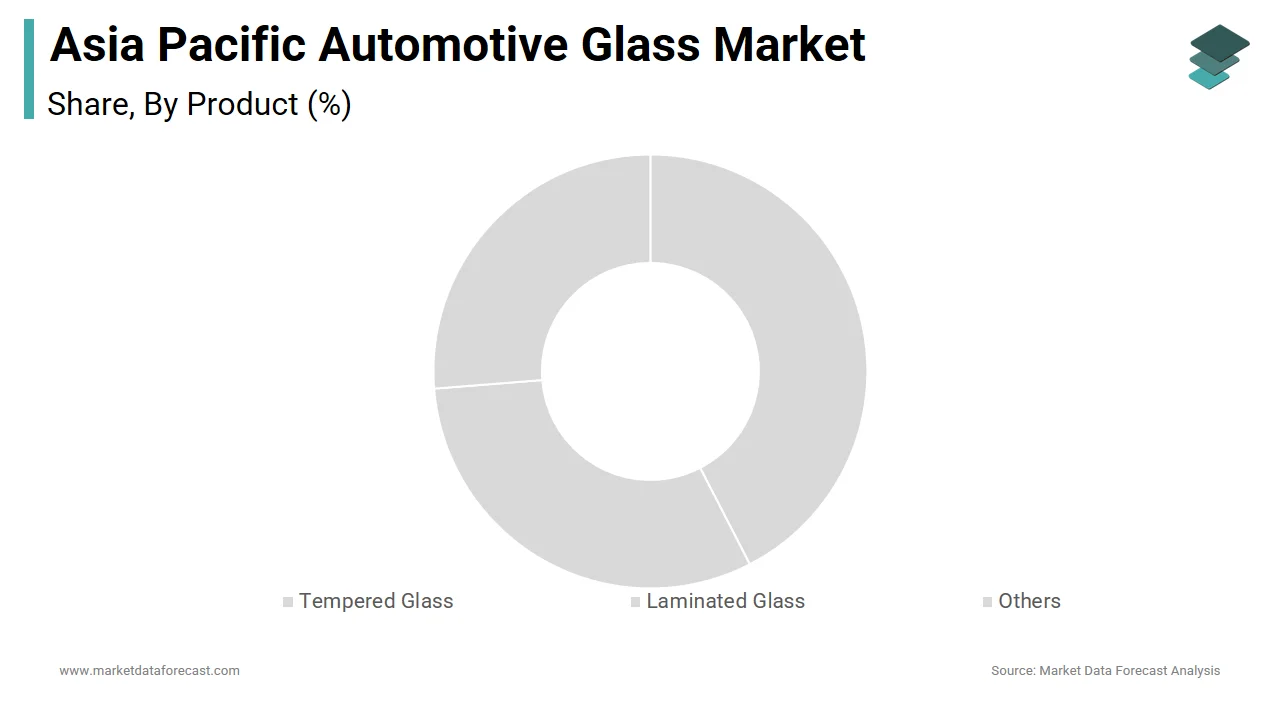

By Product Insights

The tempered glass segment prevailed in the Asia Pacific automotive glass market by commanding a significant share of 55.8% as of 2024. This segment's dominance is driven by its widespread application in side and rear windows due to its superior strength and safety features. A key factor driving this segment is the increasing production of passenger vehicles in the region. In 2022, the International Organization of Motor Vehicle Manufacturers (OICA) reported that China alone produced over 27 million vehicles, accounting for nearly 32% of global vehicle production. Tempered glass is preferred for its cost-effectiveness and compliance with safety regulations, making it indispensable for mass-market vehicles. Another critical driver is the rising demand for lightweight materials in automotive design. Also, tempered glass aligns perfectly with this trend, as it reduces vehicle weight without compromising safety. Furthermore, stringent government regulations mandating the use of shatterproof glass in vehicles have bolstered tempered glass adoption. For instance, Japan’s Road Transport Vehicle Act mandates the use of safety glass in all vehicles, further reinforce tempered glass's position.

The laminated glass is the fastest-growing segment, with a projected CAGR of 9.3% during the forecast period. This development is caused by increasing consumer demand for advanced safety features and noise reduction capabilities. One major factor is the growing emphasis on occupant safety. A report by the World Health Organization highlights that road traffic injuries are a leading cause of death in the Asia Pacific region, prompting governments to enforce stricter safety standards. Laminated glass, which provides better protection against penetration and shattering, is becoming a preferred choice for windshields. Urbanization and the rise of electric vehicles (EVs) are also propelling laminated glass adoption. Laminated glass offers acoustic insulation, reducing cabin noise—a feature highly valued in EVs. In addition, its ability to integrate advanced technologies like heads-up displays (HUDs) and augmented reality systems has made it a key component in premium vehicles.

By Vehicle Type Insights

The segment of passenger cars became the largest category in the Asia Pacific automotive glass market by holding a market share of approximately 65.4% in 2024. This dominance is attributed to the region’s rapidly growing middle-class population and urbanization trends. Also, the primary driver is the surge in vehicle ownership, particularly in emerging economies like India and Indonesia. Similarly, Indonesia’s automotive industry association, Gaikindo, notes that passenger car sales increased in the same year. Government incentives and favorable policies are also boosting demand. For example, China’s "New Energy Vehicle" subsidy program has encouraged consumers to purchase passenger cars equipped with advanced safety features, including high-quality automotive glass. Moreover, the proliferation of ride-hailing services like Grab and Ola has increased fleet purchases, further driving demand for automotive glass.

Light commercial vehicles segment is the rapidly emerging one, with a CAGR of 8.7% from 2023 to 2030. This progress is propelled by the booming e-commerce sector and urban logistics demand. E-commerce giants are expanding their delivery networks across the region, necessitating a robust fleet of LCVs. These vehicles often require specialized glass solutions for durability and visibility, fueling market growth. Apart from these, infrastructure development projects are contributing to LCV adoption. Construction firms rely heavily on LCVs for material transport, further driving demand for automotive glass.

By Application Insights

The windscreen applications segment dominated the Asia Pacific automotive glass market by capturing a market share of 40.4% in 2024. This leading position is driven by regulatory mandates and technological advancements. Governments across the region have mandated the use of laminated glass for windscreens due to its superior safety and durability. For instance, South Korea’s Ministry of Land, Infrastructure, and Transport requires all new vehicles to be equipped with laminated windscreens. This regulation has significantly boosted demand. Technological innovations, such as HUD integration, are also propelling windscreen adoption. Windscreens serve as the primary interface for these systems, ensuring clear visibility and enhancing driver experience.

The sidelites segment is the swiftest expanding, with a CAGR of 7.8% during the forecast period. This growth is fueled by increasing demand for tempered glass in side windows. Consumer preference for safety and aesthetics is a key driver. A survey by J.D. Power reveals that 78% of consumers in the Asia Pacific prioritize safety features when purchasing vehicles. Tempered glass sidelites meet these expectations by providing shatter resistance and UV protection. Moreover, the rise of compact SUVs and hatchbacks is boosting sidelite demand. According to LMC Automotive, compact SUV sales in the region grew by significantly in 2022, with brands like Hyundai and Toyota leading the charge.

By End-Use Insights

The OEM segment accounted for a substantial share of the Asia Pacific automotive glass market. This dominance is driven by strong partnerships between glass manufacturers and automakers. Collaborations like the one between Saint-Gobain and Tata Motors exemplify this trend. Such partnerships ensure consistent supply and quality, meeting the demands of mass production. Apart from these, the growing focus on sustainability has led OEMs to adopt eco-friendly glass solutions, further strengthen their market position.

The aftermarket segment is growing at a CAGR of 6.5%. The rising vehicle parc and aging fleets are key drivers. Urban congestion and accidents are also contributing factors.

COUNTRY LEVEL ANALYSIS

China dominated the Asia Pacific automotive glass market by holding a market share of 40.7%. The country’s dominance is driven by its massive automotive production capacity and supportive government policies. China’s "Made in China 2025" initiative aims to boost domestic manufacturing, benefiting glass producers.

India plays a vital role in this market. Rapid urbanization and government initiatives like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme are key drivers.

Japan is predicted to attain substantial progress in the market. It is driven by its advanced automotive industry and focus on innovation. Companies like Asahi Glass Co. are pioneering smart glass technologies, catering to global demand.

South Korea has an important position in the market which is supported by its robust electronics and automotive sectors. Samsung and LG’s investments in smart glass technologies are propelling growth.

KEY MARKET PLAYERS

Companies dominating the Asia-Pacific automotive glass market profiled in this report are AGC Inc., Fuyao Glass Industry Group Co., Ltd., Nippon Sheet Glass Co., Ltd., Saint-Gobain, Xinyi Glass Holdings Limited, Vitro, Central Glass Co., Ltd., Corning Incorporated, Guardian Industries, TAIWAN GLASS IND. CORP., Şişecam., and others.

TOP LEADING PLAYERS IN THE MARKET

AGC Inc. (Asahi Glass Co.)

AGC Inc. is a global leader in automotive glass, renowned for its innovative solutions and high-quality products. The company plays a pivotal role in shaping the Asia Pacific market through its advanced laminated and tempered glass offerings. AGC has been instrumental in driving the adoption of smart glass technologies, which integrate seamlessly with modern vehicle systems like heads-up displays (HUDs). By collaborating with major automakers across the region, AGC ensures its products meet stringent safety and performance standards. Its commitment to sustainability and eco-friendly manufacturing processes further cements its place in the global automotive glass industry.

Saint-Gobain Sekurit

Saint-Gobain Sekurit is a key player in the Asia Pacific automotive glass market, known for its cutting-edge research and development initiatives. The company focuses on delivering tailored solutions for windshields, sidelites, and backlites, catering to both OEMs and the aftermarket. Saint-Gobain’s emphasis on lightweight materials aligns with the automotive industry's shift toward fuel efficiency and reduced emissions. Its partnerships with leading vehicle manufacturers in the region have enabled it to maintain a strong foothold. In addition, the company’s dedication to innovation ensures its products remain at the forefront of technological advancements.

Nippon Sheet Glass Co., Ltd. (NSG Group)

Nippon Sheet Glass Co., Ltd. is a prominent player with a significant presence in the Asia Pacific market. The company specializes in producing high-performance automotive glass that meets diverse customer needs. NSG Group’s focus on integrating advanced functionalities, such as acoustic insulation and UV protection, has positioned it as a preferred supplier for premium vehicles. Furthermore, NSG’s commitment to sustainability drives its efforts to develop environmentally friendly glass solutions.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Partnerships and Collaborations

Key players in the Asia Pacific automotive glass market frequently engage in strategic partnerships with automakers and technology firms. These collaborations enable them to co-develop innovative products, such as smart glass and HUD-integrated windscreens, tailored to meet evolving consumer demands.

Expansion of Production Facilities

To cater to the growing demand in the region, leading companies are investing in expanding their production capacities. Establishing new manufacturing plants or upgrading existing facilities allows them to reduce lead times, improve supply chain efficiency, and meet localized requirements effectively.

Emphasis on Sustainability and Innovation

Sustainability has become a cornerstone of growth strategies in the automotive glass market. Companies are increasingly focusing on developing eco-friendly products and adopting green manufacturing practices. Simultaneously, they invest heavily in R&D to introduce innovative features, such as augmented reality-enabled glass and noise-reducing laminates, ensuring they stay ahead of competitors in terms of technological advancements.

COMPETITION OVERVIEW

The Asia Pacific automotive glass market is characterized by intense competition, driven by the presence of global giants and regional players striving to capture larger market shares. Leading companies leverage their technological expertise and extensive distribution networks to maintain dominance. The market is witnessing a surge in demand due to the rapid expansion of the automotive industry, particularly in emerging economies like India and China. This has led to increased rivalry among players vying for contracts with major automakers. Besides, the rise of electric vehicles and autonomous driving technologies has created new opportunities, prompting companies to innovate and differentiate themselves. The competitive landscape is further shaped by regulatory mandates emphasizing safety and sustainability, pushing players to adopt advanced manufacturing techniques.

RECENT MARKET DEVELOPMENTS

- In April 2023, AGC Inc. launched a new production facility in Thailand to enhance its capacity for manufacturing laminated glass. This move strengthened its ability to serve Southeast Asia’s growing automotive sector.

- In June 2023, Saint-Gobain Sekurit announced a partnership with Hyundai Motor Group to develop advanced acoustic windshields for their luxury vehicle lineup. This collaboration bolstered its reputation as an innovator in the premium segment.

- In August 2023, Nippon Sheet Glass Co., Ltd. unveiled a range of UV-protective automotive glass designed specifically for tropical climates prevalent in countries like Indonesia and Malaysia. This initiative expanded its product portfolio and regional appeal.

- In October 2023, AGC Inc. acquired a minority stake in a Chinese EV startup to gain insights into emerging trends and secure long-term contracts. This strategic investment reinforced its position in the EV segment.

- In February 2024, Saint-Gobain Sekurit introduced a recycling program in India to collect and repurpose used automotive glass, aligning with its sustainability goals and enhancing brand loyalty among eco-conscious consumers.

MARKET SEGMENTATION

This Asia Pacific automotive glass market research report is segmented and sub-segmented into the following categories.

By Product

- Tempered Glass

- Laminated Glass

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Application

- Windscreen

- Backlite

- Sidelite

- Others

By End-use

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives growth in the Asia Pacific automotive glass market?

Growth is driven by rising vehicle production, demand for safety features like laminated glass, and innovations such as smart glass and HUD integration in EVs and passenger cars.

2. What challenges affect the Asia Pacific automotive glass market?

High costs of advanced glass, limited repair networks, and low awareness in rural areas about benefits of modern automotive glass hinder market growth.

3. What opportunities exist in the Asia Pacific automotive glass market?

Opportunities include smart glass adoption, expansion in electric vehicles, integration of solar-embedded glass, and growth in aftermarket replacements.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com