Asia Pacific Commercial Drone Market Size, Share, Trends & Growth Forecast Report By Point of Sale (OEM, Aftermarket), System (Platform, Payload, Datalink, Ground Control Station, Launch & Recovery), Platform (Micro, Small, Medium, Large), MTOW, Range, and Country (India, China, Japan, South Korea, Australia) – Industry Analysis From 2025 to 2033.

Asia Pacific Commercial Drone Market Size

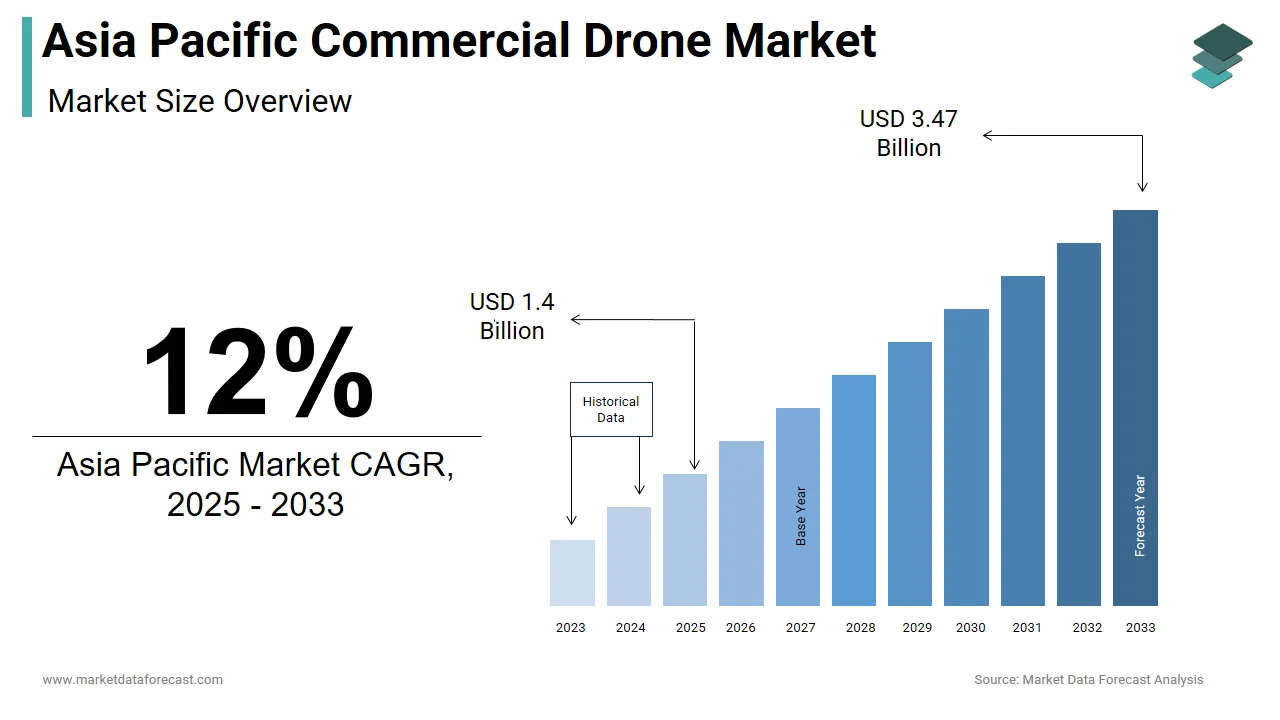

The size of the Asia Pacific commercial drone market was worth USD 1.25 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 12% from 2025 to 2033 and be worth USD 3.47 billion by 2033 from USD 1.4 billion in 2025.

Commercial drones are unmanned aerial vehicles (UAVs) equipped with advanced sensors, cameras, and data analytics tools, enabling them to perform tasks ranging from precision farming to disaster management. In recent years, governments across the region have actively embraced drone technology.

MARKET DRIVERS

Rising Demand for Precision Agriculture

Precision agriculture stands as one of the most compelling drivers propelling the Asia Pacific commercial drone market forward. With the region accounting for notable share of global agricultural output, the need for efficient farming practices is paramount. Drones equipped with multispectral imaging and GPS technology enable farmers to monitor crop health, optimize irrigation, and apply fertilizers with pinpoint accuracy. In India alone, the government launched the “Digital Sky Platform” initiative in 2021, which facilitated a significant number of drone deployments in rural areas within two years.

Expanding E-commerce and Logistics Sector

The burgeoning e-commerce industry in the Asia Pacific region has created unprecedented demand for last-mile delivery solutions, further fueling drone adoption. China’s State Post Bureau estimates that online retail sales in the region reached $3.5 trillion in 2022, with logistics providers struggling to meet delivery timelines in densely populated urban centers and remote rural areas. Drones offer a viable solution by reducing delivery times and operational costs. Similarly, Singapore’s Urban Redevelopment Authority notes that drones have cut parcel delivery times majorly in suburban neighborhoods. The scalability of drone logistics is evident in Indonesia.

MARKET RESTRAINTS

Regulatory Hurdles and Airspace Restrictions

One of the most significant restraints facing the Asia Pacific commercial drone market is the complex web of regulatory frameworks governing airspace usage. While countries like Japan and Australia have established clear guidelines, many others lack cohesive policies, creating uncertainty for operators. According to the International Air Transport Association, inconsistent regulations across the region have led to delays in drone project approvals, with some initiatives taking up to 18 months to secure necessary permits. Besides, restricted airspace zones near airports and military installations limit operational flexibility. Malaysia’s Department of Civil Aviation reports that over 60% of potential drone applications are hindered by no-fly zones, particularly in urban areas.

Public Concerns Over Privacy and Security

Privacy and security concerns represent another critical restraint impacting the Asia Pacific commercial drone market. As drones increasingly capture high-resolution imagery and collect sensitive data, public apprehension about misuse has grown. A survey conducted by the Australian Institute of Criminology revealed that 72% of respondents expressed unease about drones being used for unauthorized surveillance. Similarly, South Korea’s National Human Rights Commission documented over 500 complaints in 2022 related to privacy violations involving commercial drones. Such incidents undermine public trust and prompt stricter enforcement measures. For example, Thailand’s Personal Data Protection Act imposes hefty fines on companies found mishandling personal information collected via drones. Moreover, cybersecurity threats pose additional risks, with a major increase in drone-related cyberattacks across the region since 2020.

MARKET OPPORTUNITIES

Integration with Artificial Intelligence and IoT

The convergence of artificial intelligence (AI) and the Internet of Things (IoT) presents a transformative opportunity for the Asia Pacific commercial drone market. AI-powered drones can analyze real-time data to make autonomous decisions, enhancing efficiency across various applications. For instance, in disaster management, drones equipped with AI algorithms can identify survivors and assess damage faster than human teams. Similarly, IoT connectivity enables seamless coordination between multiple drones, creating swarm systems capable of covering large areas. Australia’s Commonwealth Scientific and Research Organisation states that IoT-enabled drone networks have improved environmental monitoring accuracy by 35%. The economic potential is substantial; PricewaterhouseCoopers estimates that AI-driven drone services could generate substantial billions globally by 2025, with the Asia Pacific region expected to claim a significant share.

Expansion into Emerging Markets

Emerging markets within the Asia Pacific region offer untapped potential for commercial drone adoption. Countries like Vietnam, Bangladesh, and the Philippines are witnessing rapid urbanization and industrialization, driving demand for innovative technologies. In Bangladesh, the Ministry of Power, Energy, and Mineral Resources highlights that drones are being deployed to inspect solar farms, reducing maintenance costs. Meanwhile, the Philippines’ Department of Information and Communications Technology notes that drones are instrumental in mapping uncharted territories, aiding infrastructure development. These nations’ willingness to embrace digital transformation positions them as key growth drivers.

MARKET CHALLENGES

Limited Battery Life and Technological Constraints

A persistent challenge hindering the Asia Pacific commercial drone market is the limited battery life of UAVs, which restricts their operational range and duration. Most commercial drones currently offer flight times ranging from 20 to 40 minutes, severely limiting their utility in large-scale projects. This limitation results in frequent interruptions, particularly in industries like mining and forestry, where extended coverage is essential. For example, in Indonesia’s palm oil plantations, drones often require multiple battery swaps to complete a single survey, increasing labor costs. Besides, adverse weather conditions exacerbate these constraints; the Meteorological Service Singapore reports that heavy rainfall reduces drone flight efficiency. While advancements in lithium-sulfur batteries hold promise, widespread adoption remains years away.

High Initial Costs and Maintenance Expenses

The high initial costs associated with acquiring and maintaining commercial drones pose another formidable challenge. Advanced drones equipped with cutting-edge sensors and imaging systems can cost substantial amount of money, making them inaccessible to small and medium enterprises. Like, a significant portion of businesses in the Asia Pacific region cite affordability as a barrier to entry. Furthermore, maintenance expenses add to the financial burden, with routine servicing accounting for major share of total ownership costs, as reported by the Hong Kong Productivity Council. In countries like Nepal, where infrastructure is underdeveloped, repair facilities are scarce, leading to prolonged downtimes. These cost-related challenges underscore the need for scalable pricing models and government subsidies to democratize access to drone technology, ensuring broader participation in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Point of Sale, Systems, Platform, Mtow, Range, Function, Type, Mode of Operation, End-Use, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC. |

|

Market Leaders Profiled |

DJI (China), Parrot Drone SAS (France), EHANG Holdings Limited (China), Aerovironment, Inc. (US), The Boeing Company (US),and others. |

SEGMENTAL ANALYSIS

By Point of Sale Insights

The OEM segment dominated the Asia Pacific commercial drone market by commanding a market share of a 65.7% in 2024. This dominance is driven by the region's rapid industrialization and the increasing demand for advanced, ready-to-deploy drones tailored to specific applications. One key factor propelling the OEM segment is the growing adoption of drones in agriculture. According to the Food and Agriculture Organization, a significant share of the world’s agricultural land is located in the Asia Pacific , making it a hotspot for precision farming technologies. OEMs like DJI and Yuneec are capitalizing on this trend by offering specialized drones equipped with multispectral sensors, which have been shown to improve crop yields. Another driving factor is the emphasis on scalability and reliability. OEMs provide drones that are rigorously tested for durability, ensuring seamless operations in challenging environments such as mining and disaster management. For instance, South Korea’s Mining Safety and Health Administration reports that drones supplied by OEMs reduce site inspection times, while maintaining high accuracy levels. Furthermore, governments across the region are incentivizing OEM purchases through subsidies. Australia’s Civil Aviation Safety Authority notes that businesses opting for OEM drones receive tax breaks, encouraging wider adoption.

The aftermarket segment is projected to grow at a remarkable CAGR of 18.5% during the forecast period. It is associated to the increasing need for customization and maintenance services. A significant factor behind this growth is the rising complexity of drone systems. Local providers like Asteria Aerospace report a 50% increase in aftermarket revenue since 2022. Another critical driver is the integration of emerging technologies. Aftermarket solutions, such as AI-based software upgrades and sensor enhancements, enable drones to perform more sophisticated tasks. Also, the proliferation of e-commerce has spurred demand for retrofitting existing drones with advanced payload systems. Singapore’s Urban Redevelopment Authority highlights that logistics firms adopting aftermarket upgrades experience a reduction in delivery costs .

By Systems Insights

The platform segment held the largest share of the Asia Pacific commercial drone market i.e. 40% of the total value in 2024. This dominance is linked to the region’s diverse topography, which necessitates versatile platforms capable of operating in varied environments. For instance, Japan’s Geospatial Information Authority emphasizes that drones used in disaster-prone areas must be lightweight yet durable, driving demand for advanced platforms. Companies like Yamaha and Hyundai are at the forefront, developing platforms that can withstand typhoon conditions, which occur frequently in Southeast Asia. Another contributing factor is the integration of renewable energy sources into drone platforms. According to the Australian Renewable Energy Agency, solar-powered drones have extended flight durations, making them ideal for environmental monitoring projects. In Bangladesh, the Ministry of Environment and Forests reports that solar drones cover more area during wildlife surveys compared to traditional models. Moreover, the affordability of modular platforms has made them accessible to small-scale operators.

The payload segment is poised to expand at a CAGR of 22% which is driven by the growing sophistication of drone applications. A key factor is the demand for high-resolution imaging systems in industries such as construction and urban planning. South Korea’s National Land Planning Corporation states that drones equipped with LiDAR payloads achieve mapping accuracy rates of 98% , significantly higher than conventional methods. This has led to widespread adoption in infrastructure development projects across the region.

Apart from these, advancements in thermal imaging technology are boosting payload demand.

By Platform Insights

The small drones segment prevailed in the Asia Pacific market by capturing a 55.8% share due to their versatility and cost-effectiveness. Their compact size makes them ideal for applications such as parcel delivery and aerial photography. According to China’s State Post Bureau, small drones completed over 2 million deliveries in rural areas in 2023, demonstrating their utility in remote regions. Furthermore, their affordability has democratized access.

Another driving factor is regulatory leniency. Australia’s Civil Aviation Safety Authority permits small drones to operate without extensive licensing, unlike larger models. This flexibility has encouraged widespread adoption in sectors like journalism and media. Thailand’s Broadcasting Authority notes that small drones are now used in 80% of outdoor filming projects , revolutionizing content creation.

Medium drones Segment is experiencing explosive rise, with a CAGR of 25% that is fueled by their ability to carry heavier payloads and cover larger distances. A major driver is their role in precision agriculture. Japan’s Rural Development Administration states that medium drones equipped with crop-spraying systems treat more farmland than smaller counterparts. This efficiency boost has made them indispensable in countries like Indonesia, where palm oil plantations span vast areas. Moreover, medium drones are increasingly deployed in search-and-rescue missions. Their adaptability to harsh weather conditions also enhances their appeal.

By MTOW Insights

The <25 KG segment is the biggest category in the Asia Pacific commercial drone market. This control over the market is rooted in the segment's adaptability to diverse applications and its compliance with regulatory frameworks. For instance, drones under 25 KG are widely used in agriculture, where their lightweight design allows for precise crop monitoring without causing damage to fields. Another key factor driving the segment’s leadership is its affordability and ease of operation. Australia’s Civil Aviation Safety Authority notes that drones weighing less than 25 KG require minimal certification, making them accessible to small businesses and startups. In Vietnam, the Ministry of Industry and Trade notes that majority of commercial drones purchased by SMEs fall into this weight category. Furthermore, advancements in battery technology have extended flight times for these drones, enhancing their utility in sectors like journalism and environmental monitoring. These attributes ensure the <25 KG segment remains the backbone of the market.

The 25-170 KG segment is projected to grow at a robust CAGR of 24.8% which is supported by its ability to handle heavier payloads and cover longer distances. A primary driver is its increasing adoption in logistics and cargo delivery. This efficiency has made them indispensable for e-commerce giants like JD.com and Alibaba. Another contributing factor is their role in infrastructure inspection.

By Range Insights

The Visual Line of Sight (VLOS) segment commanded a 60.8% share of the Asia Pacific commercial drone market, owing to its simplicity and widespread applicability. VLOS operations are particularly prevalent in agriculture, where farmers rely on drones to monitor crops within visible distances. According to reports, VLOS drones have been instrumental in reducing pesticide usage by 30%, promoting sustainable farming practices. Their ease of use and lower operational complexity make them ideal for small-scale operators.

Another driving factor is regulatory support. Moreover, the affordability of VLOS systems has made them accessible to emerging markets like Indonesia. These factors cement VLOS as the dominant range category.

The Beyond Visual Line of Sight (BVLOS) segment is set to expand at a CAGR of 28% which is fueled by breakthroughs in autonomous navigation and regulatory reforms. A major driver is its application in long-distance logistics. Another key factor is the integration of AI and IoT technologies.

COUNTRY LEVEL ANALYSIS

China was the leader in the Asia Pacific commercial drone market by accounting for 40.8% of the region’s total value in 2024. The country’s dominance stems from its robust manufacturing ecosystem and aggressive investments in R&D. Domestic companies like DJI control a large share of the global drone market, leveraging economies of scale to offer affordable yet advanced solutions. The Chinese government’s “Made in China 2025” initiative has further accelerated drone adoption, with subsidies boosting sales by 25% annually. Agriculture is a key growth driver. Also, e-commerce giants like JD.com have deployed drones for last-mile delivery, completing over 5 million shipments in rural areas.

Japan is contributing majorly to the regional market. The country’s focus on precision agriculture and disaster management drives its drone adoption. Similarly, the National Institute of Advanced Industrial Science and Technology highlights that drones have reduced disaster response times, aiding recovery efforts during earthquakes and typhoons. Regulatory reforms also play a pivotal role. Japan’s Civil Aviation Bureau has streamlined BVLOS operations, fostering innovation. Companies like Yamaha have capitalized on this, developing drones tailored for rice paddy inspections, which cover a considerable share of Japan’s agricultural land.

India is a lucrative market. This is propelled by its vast agricultural sector and burgeoning startup ecosystem. The Indian Ministry of Civil Aviation reports that over 10,000 commercial drones were registered in 2024, reflecting rapid adoption. Initiatives like the “Digital Sky Platform” have simplified regulatory processes, boosting sales. Agricultural applications dominate. The Ministry of Agriculture states that drones have treated 5 million hectares of farmland , reducing water usage. Additionally, startups like IdeaForge are pioneering drone-based surveillance, with a improvement in border security.

Australia contributes key share to the market and is leveraging its advanced regulatory framework and emphasis on environmental monitoring. Mining is another key sector. The Minerals Council of Australia notes that drones reduce site inspection times, enhancing safety and efficiency. In addition, logistics firms like Toll Group have adopted drones for rural deliveries, cutting costs.

South Korea is driven by its focus on smart city development and industrial automation. The Ministry of Land, Infrastructure, and Transport reports that drones are integral to Seoul’s smart city initiatives, reducing traffic congestion. Technological advancements further bolster growth.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC commercial drone market profiled in this report are DJI (China), Parrot Drone SAS (France), EHANG Holdings Limited (China), Aerovironment, Inc. (US), The Boeing Company (US), and others.

TOP LEADING PLAYERS IN THE MARKET

DJI (Dà-Jiāng Innovations)

DJI, headquartered in Shenzhen, China, is a global leader in drone technology and plays a pivotal role in shaping the Asia Pacific commercial drone market. The company’s cutting-edge innovations in aerial imaging, AI integration, and autonomous navigation have set industry benchmarks. DJI’s platforms cater to diverse sectors, including agriculture, logistics, and disaster management, enabling scalable solutions for businesses of all sizes.

Yamaha Motor Co., Ltd.

Yamaha Motor has established itself as a key player in the Asia Pacific market through its specialized drones designed for agricultural applications. The company’s focus on crop-spraying drones has revolutionized precision farming, particularly in Japan and Southeast Asia. By leveraging its expertise in engine technology and automation, Yamaha has created durable and efficient systems tailored to regional needs.

Terra Drone Corporation

Terra Drone, based in Japan, is renowned for its expertise in industrial inspection and surveying solutions. The company’s advanced payload systems and data analytics capabilities have made it a preferred choice for infrastructure monitoring and mining operations. Terra Drone’s emphasis on BVLOS operations and its collaboration with global tech firms have positioned it as a trailblazer in long-range drone applications.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Partnerships and Collaborations

Key players in the Asia Pacific commercial drone market are increasingly forming alliances with governments, research institutions, and private entities to expand their reach. For instance, partnerships with agricultural ministries enable companies to tailor drone solutions for localized farming practices.

Investment in R&D and AI Integration

Leading companies are prioritizing R&D to develop next-generation drones equipped with AI and IoT capabilities. By integrating machine learning algorithms, these drones can perform complex tasks autonomously, such as predictive maintenance and real-time data analysis.

Expansion into Emerging Markets

To strengthen their foothold, key players are targeting emerging economies like Vietnam, Indonesia, and the Philippines. By offering affordable and scalable solutions, they aim to tap into untapped potential in sectors such as e-commerce, logistics, and environmental monitoring. Localization strategies, including training programs and after-sales support, further enhance their market penetration.

COMPETITION OVERVIEW

The Asia Pacific commercial drone market is characterized by intense competition, driven by rapid technological advancements and increasing demand across industries. Established players like DJI and Yamaha dominate the landscape, leveraging their expertise in manufacturing and innovation to maintain leadership. However, the market also witnesses the emergence of niche players like Terra Drone, which focus on specialized applications such as industrial inspections and surveying. The competitive environment is further intensified by startups entering the fray, bringing disruptive technologies and cost-effective solutions.

RECENT MARKET DEVELOPMENTS

- In April 2023, DJI launched its new Agras T50 series, a drone specifically designed for agricultural spraying. This move aimed to address the growing demand for precision farming solutions in Southeast Asia, enhancing its regional presence.

- In June 2023, Yamaha Motor partnered with Vietnam’s Ministry of Agriculture to deploy crop-spraying drones across rice paddies. This initiative was part of Yamaha’s strategy to expand its footprint in emerging markets and promote sustainable farming practices.

- In August 2023, Terra Drone acquired a Singapore-based startup specializing in BVLOS technology. This acquisition enabled Terra Drone to enhance its long-range inspection capabilities, catering to infrastructure projects in urbanized regions.

- In October 2023, DJI collaborated with Australia’s Civil Aviation Safety Authority to streamline BVLOS regulations. This partnership positioned DJI as a key advocate for policy reform, facilitating broader adoption of advanced drone operations.

- In December 2023, Yamaha Motor introduced a modular drone platform for logistics providers in Indonesia. This innovation allowed businesses to customize payloads, addressing the unique challenges of last-mile delivery in remote areas.

MARKET SEGMENTATION

This Asia Pacific commercial drone market research report is segmented and sub-segmented into the following categories.

By Point of Sale

- OEM

- Aftermarket

By Systems

- Platform

- Payload

- Datalink

- Ground Control Station

- Launch & Recovery System

By Platform

- Micro

- Small

- Medium

- Large

By Type

- Fixed Wing

- Rotary Wing

- Hybrid

By Mode of Operation

- Remotely Piloted

- Optionally Piloted

- Fully Autonomous

By Function

- Passenger Drones

- Inspection & Monitoring Drones

- Surveying & Mapping Drones

- Spraying & Seeding Drones

- Cargo Air Vehicles

- Others

By End-Use

- Agriculture

- Insurance

- Energy

- Mining & Quarrying

- O&G

- Transport, Logistics & Warehousing

- Journalism & Media

- Arts, Entertainment & Recreation

- Healthcare & Social Assistance

By MTOW

-

<25 KG

- 25-170 KG

- >170 KG

By Range

- Visual Line Of Sight

- Extended Visual Line Of Sight

- Beyond Visual Line Of Sight

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific commercial drone market?

The Asia Pacific commercial drone market is driven by rapid adoption in agriculture, infrastructure, logistics, and public safety, supported by government incentives, tech innovation, and strong manufacturing in China and Japan

2. What challenges affect the Asia Pacific commercial drone market?

The Asia Pacific commercial drone market faces challenges like high initial and maintenance costs, strict regulations, limited battery life, privacy concerns, and airspace restrictions in urban areas

3. What opportunities exist in the Asia Pacific commercial drone market?

Major opportunities in the Asia Pacific commercial drone market include AI and IoT integration, expansion in emerging markets, growth of e-commerce delivery, and demand for advanced inspection and precision agriculture solutions

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]