Global Automotive Wheel Market Size, Share, Trends, & Growth Forecast Report, Segmented By Rim Size (13-15,16-18,19-21,>21 inch), Material (Steel, Alloy, Carbon Fiber), Off-highway (Construction & Mining, Agriculture Tractors), Vehicle Type (Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicle), Vehicle Class (Economy, Mid-Priced, Luxury-Priced), End-User (OE, Aftermarket), And Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa), Industry Analysis Forecast From 2025 to 2033

Global Automotive Wheel Market

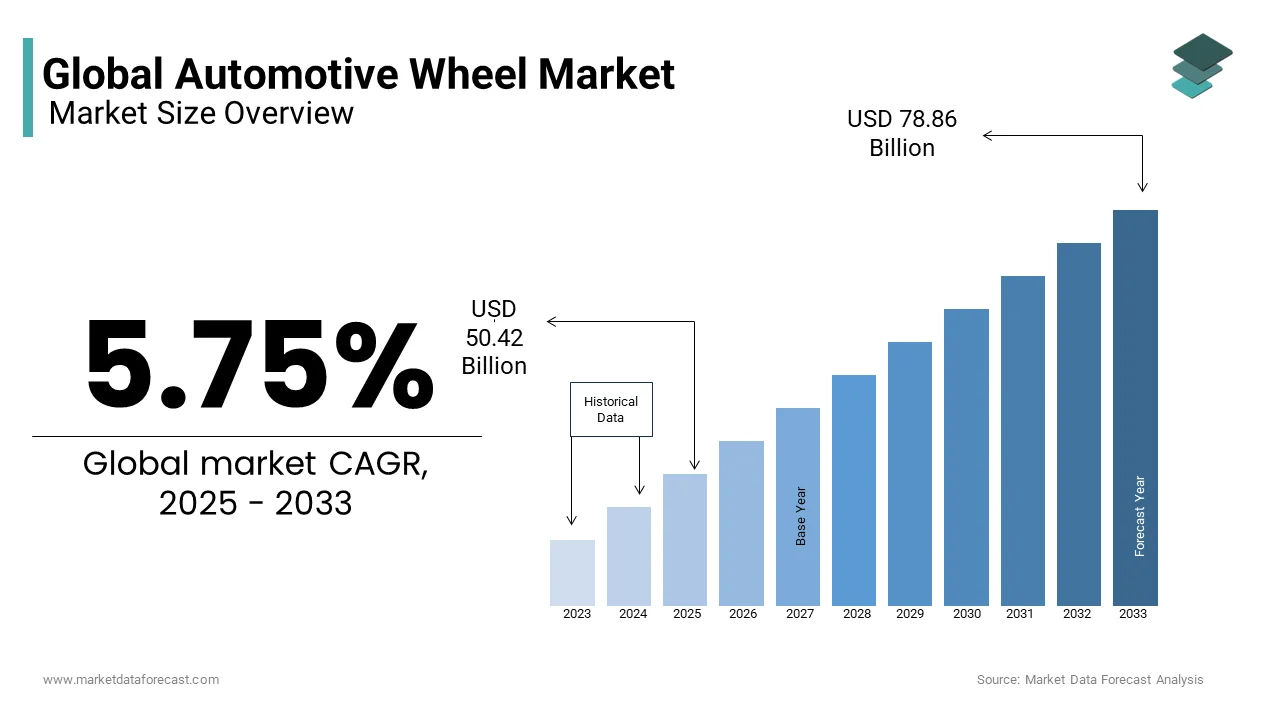

The global automotive wheel market was valued at USD 47.68 billion in 2024 and is anticipated to reach USD 50.42 billion in 2025 from USD 78.86 billion by 2033, and growing at a CAGR of 5.75% during the forecast period from 2025 to 2033.

MARKET DRIVERS

The increasing demand for lightweight materials, rising production of vehicles, and improvisation of vehicle dynamics are the primary factors that drive the global automotive wheel market in the near future. Automotive wheels are made with the help of a mold. The mold comprises molten metal. Therefore, as the metal cools, the wheel becomes solid and rigid. Automotive wheels are made up of various casting processes, including low-pressure casting and gravity casting. The different types of automotive wheels include steel wheels, alloy wheels, split-rim wheels, and forged and cast wheels. The most commonly used in the market are alloy wheels. These are considered more expensive than steel wheels due to the lighter and fuel economy of the vehicle. These were manufactured in various designs. Therefore, steel wheels are more cost-efficient compared to other wheels. In addition, steel wheels can stand up in the worst climatic conditions. These are some of the characteristics of wheels that boost the growth of the global automotive market.

The increasing production of vehicles, rising prices of raw materials, and growing adoption of carbon fiber in the automotive industry are the major drivers that fuel the global automotive wheel market growth during the forecast period. The manufacturers of developing economies, including China, Japan, and India, adapt to the regional and segment supply and demand patterns. Furthermore, the increasing population, along with rising urbanization, boosts the demand for vehicles among consumers globally. In recent years, the need for various materials has been attributed to the steady growth leading to the increasing raw materials prices. In addition, many industries have adopted carbon fiber since it possesses less weight and high stiffness. These factors play a crucial role in holding the most prominent global automotive wheel market revenue.

MARKET RESTRAINTS

The fluctuation in raw materials prices and lack of standardization play a predominant role in slowing down the growth of the global automotive wheel market. The supply of raw materials that produce the automotive component, including aluminum, steel, magnesium, and others, keeps fluctuating owing to the excess utilization of raw materials in the automotive wheel firms. Moreover, the weight of automobiles gradually increases the vehicle's fuel consumption, which majorly hampers the growth of the global automotive wheel market. The massive, unorganized aftermarket for wheels, engineering barriers, and maintaining a balance among performance, cost, and weight are the prominent factors that push back the growth and revenue of the global automotive wheel market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.75% |

|

Segments Covered |

By Rim Size, Vehicle Type, Vehicle Class, Material, Off-Highway, End User and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Iochpe-Maxion, Superior Industries International, Accuride Corporation, Steel Strips Wheels, Hitachi Metals, Enkei, Citic Dicastal, Zhejiang Wanfeng Auto Wheel, Borbet, Mangels Industrial, Mefro Wheels |

SEGMENT ANALYSIS

By Vehicle Type Insights

Depending on vehicle type, the global automotive wheel market is categorized into commercial vehicles and passenger vehicles. Besides commercial vehicles, passenger vehicles play the dominant role in the global automotive wheel market and are yet to continue their dominance during the forecast period. Most mid-version and premium passenger vehicles, which provide comfort and convenience, utilize alloy wheels. On the other hand, the rising demand for luxury vehicles, the growing purchasing power of consumers, and the increasing demand for safety features and comfort in vehicles tend the passenger vehicles segment to hold the largest share, thus driving the global automotive wheel market in the near future.

By Material Type Insights

The global automotive wheel market is segmented into alloy, carbon fiber, and steel based on material type. The alloy wheel segment holds the largest market due to the increasing demand for lightweight vehicles and improved vehicle dynamics with lightweight alloy wheels. On the other hand, carbon fiber is anticipated to be the fastest-growing segment during 2022 - 2027 due to the rising demand for vehicles with high performance and technological innovations in material composition.

By End-User

Based on end-users, the global automotive wheel market is divided into aftermarket and original equipment manufacturers. The global automotive wheel market for original equipment manufacturers is projected to be the largest and fastest-growing, with an increasing CAGR in the upcoming years. This is because wheels are designed in such a way that the vehicle's life is long-lasting. These are changes in case of damage. Thus, the demand for wheels is more in original equipment manufacturers than aftermarket and propels the global automotive wheel market growth in the next six years.

REGIONAL ANALYSIS

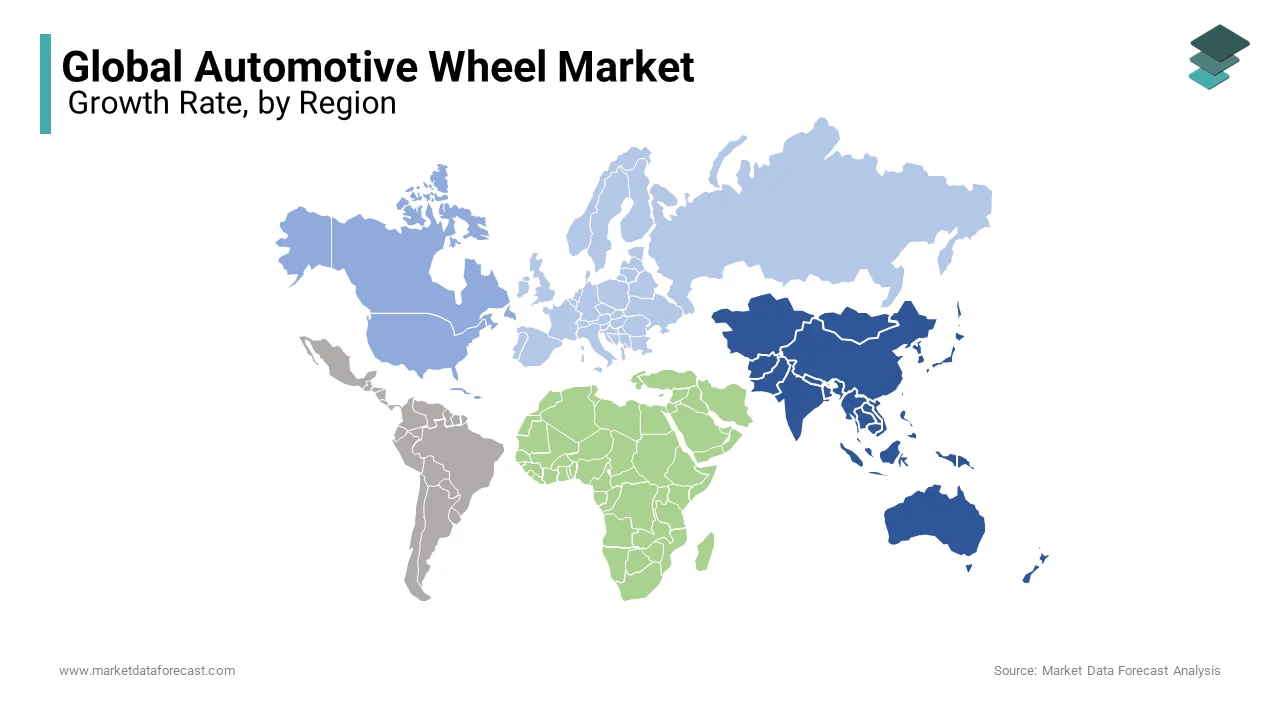

The Asia Pacific predominantly held the most significant global automotive wheel market share and is estimated to sustain its dominance in the near future, owing to the increasing demand for vehicle performance and fuel economy. Moreover, the increasing purchase power of consumers in emerging economies led the Asia Pacific region to have a massive automotive wheel market share.

Furthermore, North America and Europe hold the second and third-largest global automotive wheel market share. Apart from this, the Middle East & African automotive wheel market is estimated to have a significant CAGR respectively during the forecast period.

KEY MARKET PLAYERS

Iochpe-Maxion, Superior Industries International, Accuride Corporation, Steel Strips Wheels, Hitachi Metals, Enkei, Citic Dicastal, Zhejiang Wanfeng Auto Wheel, Borbet, Mangels Industrial, Mefro Wheels. Some of the major key players involved in the global automotive wheel market.

RECENT HAPPENINGS IN THE MARKET

- Hitachi Metals introduced SCUBA aluminum wheels that aim at superior design, reduced weight, and high-precision CAE technology.

- Steel Strips Wheels declared that it tends to manufacture steel wheel rims catering to various segments of the automobile industry and its geographical segments include India and Overseas.

MARKET SEGMENTATION

This market research report on the global automotive wheel market is segmented and sub-segmented into the following categories.

By Rim Size

- 13-15

- 16-18

- 19-21

- 21>inch

By Vehicle Type

- Commercial vehicle

- Passenger Vehicle

By Material Type

- Alloy

- Carbon Fibre

- Steel

By Vehicle Class

- Economy

- Mid-Priced

- Luxury Priced

By off Highway

- Construction & mining

- Agriculture Tractor

By End-User

- Aftermarket

- Original Equipment Manufacturer

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the automotive wheel market in 2025

The global automotive wheel market is expected to be valued at USD 50.42 billion in 2025.

what factors are predicted to dive the global wheel market?

The increasing production of vehicles, rising prices of raw materials, and growing adoption of carbon fiber in the automotive industry are the major drivers that fuel the global automotive wheel market growth during the forecast period.

What are the emerging trends in Automotive Wheels market in North America?

Emerging trends include the use of advanced materials like carbon fiber and forged aluminum, customization options, and the incorporation of smart sensors for tire pressure monitoring in North America.

what segments are covered in the automotive wheel market.

The automotive wheel market is segmented by vehicle type, material type, and end-user.

which is the leading region of the global automotive wheel market?

The Asia Pacific predominantly held the market in 2024. The increasing purchase power of consumers in emerging economies led the Asia Pacific region to have a massive automotive wheel market share.

what are the key market players involved in the global automotive wheel market?

Iochpe-Maxion, Superior Industries International, Accuride Corporation, Steel Strips Wheels, Hitachi Metals, Enkei, Citic Dicastal, Zhejiang Wanfeng Auto Wheel, Borbet, Mangels Industrial, Mefro Wheels. Some of the major key players involved in the global automotive wheel market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com