Global Bottled Water Market Size, Share, Trends & Growth Forecast Report - Segmented By Product Type ( Still Water, Carbonated Water, Flavoured Water And Functional Water), Distribution, And Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Global Industry Size, Share, Trends, Demand, Growth and Competitive Analysis Forecast Research Report 2025 to 2033

Global Bottled Water Market Size

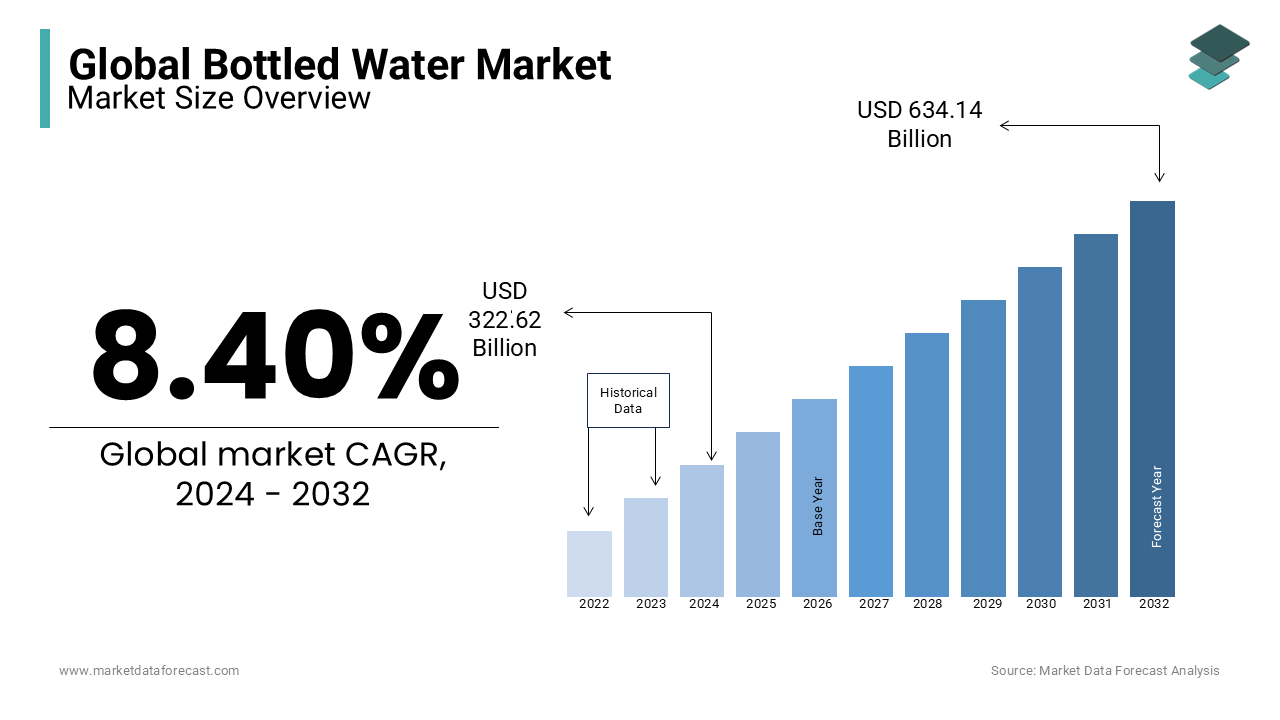

The Global Bottled Water Market size was valued at USD 322.62 billion in 2024, and the global market size is expected to reach USD 666.74 billion by 2033 from USD 349.72 billion in 2025. The market's promising CAGR for the predicted period is 8.40%.

Currently, the bottled water market is immensely big. The industry is thriving due to its easy availability and affordable cost. Similarly, people from the United States are drinking water greater than ever, not less than for the most fundamental type of liquid packaging, bottled water. In reality, from the hydration point of view, US customers would better opt for this form of water instead of a faucet. Moreover, in 2022, the overall quantity of this water sold stood at 15.9 billion gallons, its biggest number ever, crossing the mark of carbonated soft drinks for a straight seventh year. Based on retail dollars, sales in 2022 closed in on 46 billion dollars, raised from the previous 40.8 billion dollars in 2021.

Another key market is Germany where, as per the German Environment Ministry, water is part of the most stringently supervised food items, positioning it as one of the purest tap waters around the world. However, 22 per cent of the Germans reported that they suffered a side effect from the consumption of their tap water. Additionally, Asia Pacific is also a major bottled water market with China and India as the leading industries.

MARKET DRIVERS

The lack of drinking water in some regions primarily drives the global market for bottled water. Drinking contaminated water increases your risk of developing gastrointestinal issues, reproductive issues, and neurological abnormalities, among other health issues, majorly bacterial and viral infections, another primary factor contributing to the market growth. Worldwide demand for bottled water is driven by the population's growing knowledge of the adverse effects of tainted water. The quick expansion of the bottled water industry across the global markets has been primarily attributed to the simple accessibility of bottled water in various retail settings, including grocery, supermarkets, and convenience stores.

In addition, the introduction and accessibility of many kinds of bottled water products, including mineral, sparkling, and distilled water, have gained popularity in recent decades, supporting the global bottled water market expansion. The demand for bottled water among health-conscious customers has been spurred by the expanding urban population, rising disposable income, increased consumer health consciousness, and more excellent knowledge of waterborne diseases. Additionally, producers are increasingly switching to PET and plant-based water bottles to achieve sustainability due to growing worries about the plastic waste produced by the bottled water business. In developed economies like Europe and North America, the demand for bottled water is anticipated to increase due to these eco-friendly bottles. The global bottled water market expansion is anticipated to be significantly aided by creative packaging. The use of environmentally friendly materials in the manufacture of bottles greatly aids in fostering a favorable brand perception among consumers. Another strategy used by producers to distinguish their bottled water goods and cater to more affluent consumers is premiumization. The makers emphasize the premium brands' exceptional quality and exclusivity. Therefore, premiumization is crucial in helping manufacturers generate large profits.

MARKET RESTRAINTS

Due to the high energy requirements for water extraction, processing, and bottling, bottled water manufacturers are under growing pressure from environmentalists for their manufacturing practices. The environmental degradation brought on by improper plastic bottle disposal adds another layer to this issue, and it will likely limit the future growth of the global bottled water market. The massive competition from other drinking water sources, such as high-quality tap water in specific regions, will hamper the market growth opportunities. The presence of stringent regulations regarding the safety and quality of bottled water will pose a primary challenge to manufacturers as these regulations can be costly and time-consuming, negatively impacting the company's profit.

MARKET CHALLENGES

The growth of the bottled water market is facing challenges and is expected to witness a notable fall due to the presence of microplastics. Apart from this, it also leads to an increase in plastic pollution which is hindering the expansion of the market. Moreover, the production of plastic bottles also consumes a significant amount of oil. Likewise, the manufacturing of plastic bottles in the United States yearly needs around 17.6 million barrels of oil. Also, globally bottling of water utilizes approximately 2.7 million tons of plastic every year. In addition, economic factors affect the market growth rate. Tap water charges around 0.002 dollars per gallon in contrast to the 0.89 to 8.26 dollars per gallon cost for bottled water. As far as 40 percent of this water originates from the tap, which shows customers are spending thousands or hundreds of times greater for a delusion of purity. This product usually is priced higher than 1 dollar for 8 to 12 ounces, totalling over 10 dollars per gallon. Furthermore, social justice is another key aspect hampering the market expansion. Packaged water manufacturers cause damage to the environment by exhausting aquifers and additional groundwater reserves. Therefore, all the factors seriously challenge the way forward for the market.

MARKET OPPORTUNITIES

The circular economy presents potential new business opportunities for the bottled water market, mitigates ecological impact and enhances resource productivity. Refillable bottles are the future of this water industry, leaving well behind single-use to relieve the earth of the 35.3 metric tons of PET manufactured each year across the globe. Bottled water made from single-use plastic is part of the highly over-manufactured and detrimental materials. However, a new choice for the future comprises the advantages of being greatly recyclable, extremely reusable, strong and lightweight - refillable aluminium bottles. Compared to conventional plastic one, aluminium bottles can be made durable enough for several refills.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.40% |

|

Segments Covered |

By Product, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Nestlé, PepsiCo, The Coca-Cola Company, DANONE, Primo Water Corporation, FIJI Water Company LLC, Gerolsteiner Brunnen GmbH & Co. KG, VOSS WATER, Nongfu Spring, National Beverage Corp. |

SEGMENTAL ANALYSIS

By Product Insights

More than 40.0% of the total revenue came from the purified segment, which is anticipated to continue leading during the projected period. Since contaminants in running water are typically the source of diseases, including dysentery, diarrhea, and typhoid, consumers are looking for water-saving measures, and businesses are tackling the same problems. The need for contaminated-free water is enhancing the growth of the purified water segment.

The sparkling market is anticipated to increase fastest during the forecast period. Customers' growing preference for sparkling beverages as a healthier alternative to sugary beverages like cola to reduce sugar content is driving the segment's growth. The body's elevated sugar levels cause type 2 diabetes, obesity, and other related health issues, which are influencing people to adopt healthy drinks and positively impacting the segment's growth.

By Distribution Channel Insights

The off-trade segment's revenue share was more significant than 85% in the global bottled market. This section includes all retail establishments, including traditional stores, micro markets, convenience stores, supermarkets, and hypermarkets. The simplicity of choosing the needed brand of bottled water with a specific combination of minerals will drive market expansion throughout the forecast period. The following stores carry various brands, including Aquafina, Dasani, Nestlé, and Danone.

The on-trade segment is estimated to grow moderately during the forecast period. Growing health and hygiene concerns and an increase in COVID-19 instances have pushed customers to choose packaged water over more conventional options in these establishments. Additionally, it is anticipated that opening nightclubs, bars, and outdoor activities at resorts and hotels will increase bottled drinking water consumption through this channel. The increasing market distribution through online sales will enhance the market growth due to the increased adoption of digital platforms.

REGIONAL ANALYSIS

The Asia Pacific region has the highest revenue share and is also predicted to maintain its domination during the forecast period. One of the main factors promoting the market expansion is the rising awareness of the value of health and wellness in nations like China, India, Malaysia, and Indonesia. This is because there is a higher need for sanitary consumables. The demand for bottled options and knowledge of the value of hygienic beverage options are rising, opening up new opportunities for market expansion in the region. The rising disposable incomes of the people, changing lifestyles, and increasing working population are expected to fuel the regional market growth opportunities. According to the United Nations, India was the 12th largest consumer of bottled water in the world by value and 14th biggest by volume in 2022. This report also stated that Singapore and Australia were the biggest per capita consumers of bottled water at 1,129 liters and 504 liters per year.

The North American region is estimated to grow considerably during the forecast period. The rising popularity of healthy living, intense exercise, and other physical and outdoor pursuits further contribute to the region's strong demand for bottled water. Most Americans prefer packaged water to water directly from the faucet because they believe it is safer and more practical. Additionally, the growing consumer demand for environmentally friendly and sustainable packaging options is anticipated to present established manufacturers and fresh competitors with profitable business opportunities.

The European region held third in the bottled water market revenue and is anticipated to have notable growth in the coming years. The expanding tourism industry in Europe, where most people prefer packaged bottled water for safe and reliable drinking, drives market share growth across the region.

KEY PLAYERS IN THE BOTTLED WATER MARKET

Key players in the Bottled Water Market are Nestlé, PepsiCo, The Coca-Cola Company, DANONE, Primo Water Corporation, FIJI Water Company LLC, Gerolsteiner Brunnen GmbH & Co. KG, VOSS WATER, Nongfu Spring, National Beverage Corp.

RECENT HAPPENINGS IN THE MARKET

-

In April 2025, Smart Water launched designed aluminum cans for its alkaline and sparkling waters. These cans are available in supermarket aisles in the United States.

-

In February 2025, The Topo Chico brand launched a range of sparkling mineral water flavors, such as Tonic water, Ginger beer, and Club Soda. These products can be used as mixers in cocktails.

-

In February 2025, Nongfu Spring invested USD 703 million in a new factory in Jiande City, Zhejiang Province. The company plans to cover production, processing, and manufacturing to create a comprehensive industrial base for drinking water and beverage products.

-

In April 2023, Nestle partnered with Acreto, a company focused on sustainable packaging, to launch a new line of bottled water made from 100% plant-based materials.

-

In February 2023, PepsiCo partnered with LanzaTech, a biotech company, to develop a new process for producing bottled water from captured carbon emissions.

-

In September 2023, Bisleri International, India's leading packaged drinking water company, announced the successful restoration of the Ladakh reservoir in the Kyagar region of Tegar Village, Nubar Valley, Leh. The ambitious project by Bisleri aims to strengthen the local community's resilience and reduce the risk of water scarcity.

-

In March 2023, Tata Consumers Products announced substantial investments in its mineral water brands, such as Tata Copper Plus and Himalayan. This development is due to the failure of its plan to acquire the leading bottled water brand, Bisleri. By making this investment, Tata is aiming to strengthen its product portfolio in the Indian market.

-

In February 2023, the bottled water company Bisleri International announced its first overseas partnership with Dubai's Nasser Abdulla Lootah Group to distribute its Bisleri and Vedica brands in Dubai, Sharjah, and Abu Dhabi.

MARKET SEGMENTATION

This research report on the global Bottled Water Market has been segmented and sub-segmented based on Product, Distribution channel, & region.

By Product

- Spring Water

- Purified Water

- Mineral Water

- Sparkling Water

By Distribution channel

- Off-trade

- On-trade

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What drives the demand for bottled water?

Factors driving the demand for bottled water include convenience, portability, perceived safety, taste preferences, concerns about tap water quality, and lifestyle choices.

2.What are the environmental impacts of bottled water?

The production, packaging, and transportation of bottled water can have environmental impacts, including plastic waste generation, energy consumption, and carbon emissions. Recycling programs and the use of eco-friendly packaging aim to mitigate these impacts.

3.What are the trends in the bottled water market?

Key trends in the bottled water market include the growing popularity of premium and functional waters, increased demand for sustainable packaging options, innovation in flavor and packaging formats, and the rise of alternative beverages such as plant-based waters.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]