Global Coiled Tubing Market Size, Share, Trends, & Growth Forecast Report – Segmented By Type (Offshore, Onshore), Service (Well Intervention & Production, Drilling, Perforating, Fracturing, Engineering Services, Milling Services, Nitrogen Services, Others.), End-Use (Oil & Gas Industry, Construction Industry, Engineering Procurement, Others), & Region - Industry Forecast From 2024 to 2032

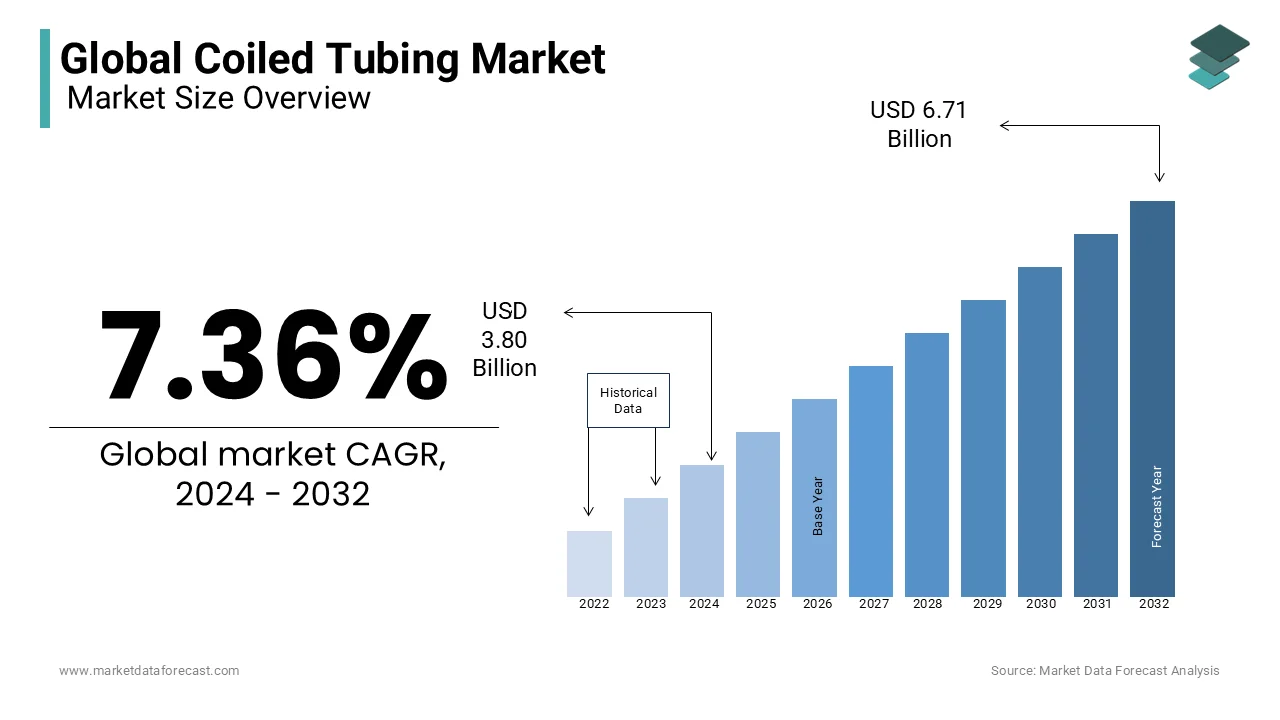

Global Coiled Tubing Market Size (2024-2032):

The size of the global coiled tubing market was worth USD 3.54 Billion in 2023. The global market is anticipated to grow at a CAGR of 7.36% from 2024 to 2032 and be worth USD 6.71 billion by 2032 from USD 3.80 billion in 2024.

The global coiled tubing market is expected to grow in a considerable way. The growth of the market is attributed to the benefits of coiled tubing over wirelines that the former does not rely on gravity. Therefore, chemicals can be injected into the wellbores of highly deviated wells with the usage of the product.

MARKET DRIVERS

The increase in oil and gas production around the world along with the rising penetration of Coiled Tubing (CT) in the intervention in excellent services is one of the critical factors for the growth of the global coiled tubing market.

The wide range of applications in upstream gas and oil activities like drilling, well completion, well cleaning, and other events is a cost-effective technology and is getting preferred for horizontal and highly deviated wells are the drivers that are positively driving the market., Moreover, the low labour cost for the maintenance and the operations in applications of this coiled tubing technology encourages adopting this technology.

MARKET RESTRAINTS

The decreasing prices of oil, globally and the rising in the size of horizontal wells are some of the critical challenges to the growth of the global coil tubing market., In addition, the stringent regulations of governments of various nations and the declining count of rigs are the factors that are hindering the coil tubing market globally.

MARKET OPPORTUNITIES

The increasing focus on deepwater drilling coupled with demand for large-diameter coiled tubing will create some substantial growth opportunities for the global coiled tubing market growth., Additionally, with the recent growth in offshore and deepwater drilling, the consumption of coiled tubing is calculated to gain traction worldwide.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 – 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2032 |

|

CAGR |

7.36% |

|

Segments Covered |

By Type, End-Use, Service, and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Schlumberger Ltd, Halliburton, Baker Hughes Inc., Archer, Trican Well Service Ltd, C&J Energy Services Inc., Key Energy Services Inc., RPC Inc., Sanjel Corporation, Nabors Industries Ltd, Superior Energy Services Inc and Weatherford International Ltd., Calfrac Well Services Ltd., and Others. |

SEGMENTAL ANALYSIS

Global Coiled Tubing Market Analysis By Type

Based on Type, the onshore segment is expected to increase at the highest CAGR during the forecast period. The growth of domestic shale gas and tight oil reserves is driving a significant increase in the production of crude oil and natural gas in the region. This has resulted in improved efficiency of operations to increase the production of oil and gas wells. The value of onshore oil & gas wells depends on acquiring land, capitalized exploration, construction, installation, refining, and transport.

Onshore fields have been generating for more than 150 years now, and most of them are being exhausted at faster rates. Such oil fields are experiencing a decline in production and resource operators are investing in various recovery and intervention methods to increase and maximize well output. In the sense of good operation, coiled tubing services are used to achieve the most optimal levels of production. Thus, a higher rate of onshore field deterioration creates demand for the onshore-coiled tubing market.

Global Coiled Tubing Market Analysis By End-Use

Based on End-Use, Oil, and Gas to account for the largest share of the world market during the forecast period. This rise in the demand for the market can be attributed to the growing demand for gas and oil, which is a direct result of the increase in vehicle population and urbanization.

Although the Oil and Gas segment holds a considerable market share, it is not likely to increase at a tremendous rate due to the strict rules and regulations around the globe on oil and gas leakage, water contamination, the environment, and public health caused due to the oil and gas industry.

Global Coiled Tubing Market Analysis By Service

Well, intervention and production hold the largest market share. The evolving trends that drive this development make it essential for companies in this segment to keep up with the growing pace of the market. Well Intervention & Development, is expected to reach more than US$ 4.3 billion by 2025, owing to healthy profits that add significant momentum to global growth.

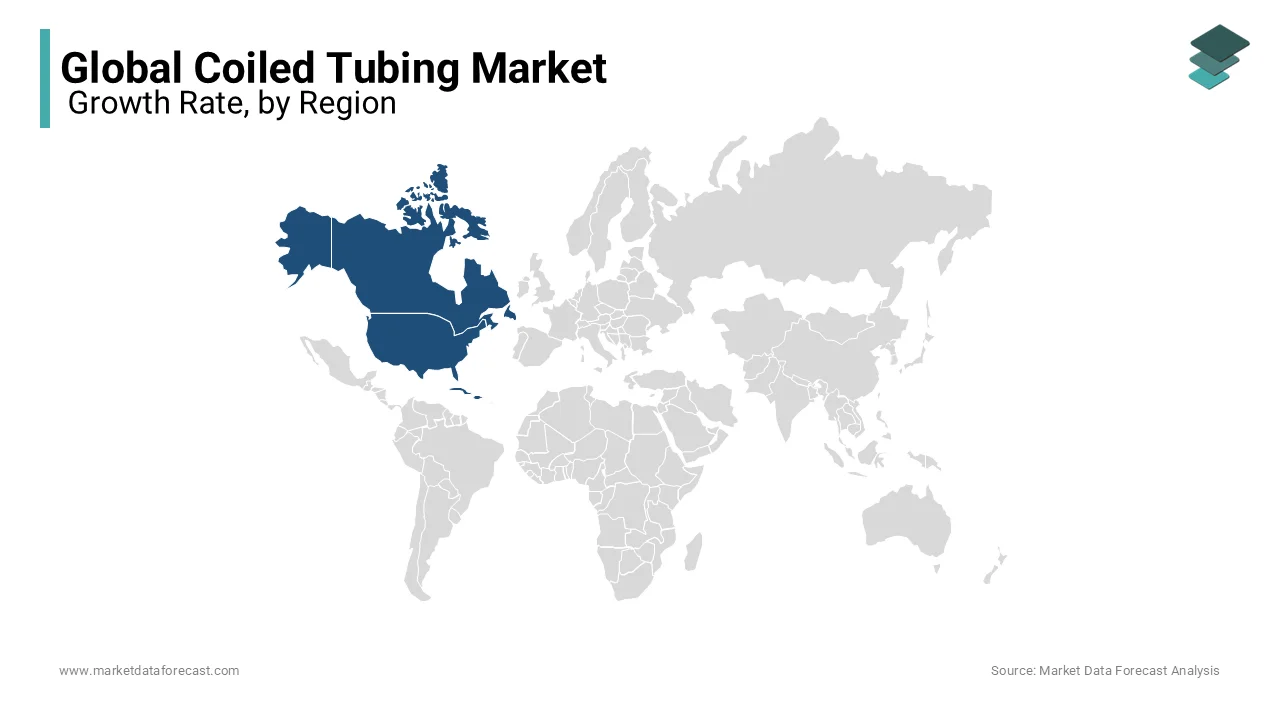

REGIONAL ANALYSIS

Geographically, North America is expected to be the largest market between 2024 and 2032, powered by the rise in non-paralleled resources in the US and Canada. In addition, demand for coiled tubing operations in offshore fields in the Gulf of Mexico and other offshore fields in the US is expected to drive market growth.

KEY PLAYERS IN THE GLOBAL COILED TUBING MARKET

Companies playing a prominent role in the global coiled tubing market include Schlumberger Ltd, Halliburton, Baker Hughes Inc., Archer, Trican Well Service Ltd, C&J Energy Services Inc., Key Energy Services Inc., RPC Inc., Sanjel Corporation, Nabors Industries Ltd, Superior Energy Services Inc and Weatherford International Ltd., Calfrac Well Services Ltd., and Others.

RECENT HAPPENINGS IN THE GLOBAL COILED TUBING MARKET

- In November 2018, at the Abu Dhabi International Petroleum Exhibition & Conference, Schlumberger unveiled Concert well-tested live performance technology. New technology brings real-time surface and hole calculation, data analysis, and communication capabilities to well-testing.

- In September 2019, Halliburton announced the purchase of a new line of Western (UK) electro-mechanical downhole cutting equipment and tubing punches. Such facilities provide operators with a safe and reliable alternative to traditional pipe recovery and well-life-cycle intervention from discovery to abandonment.

DETAILED SEGMENTATION OF THE GLOBAL COILED TUBING MARKET INCLUDED IN THIS REPORT

This research report on the global coiled tubing market has been segmented and sub-segmented based on type, end-use, service and region.

By Type

- Offshore

- Onshore

By End-Use

- Oil & Gas Industry

- Construction Industry

- Engineering Procurement

- Others

By Service

- Well Intervention & Production

- Drilling

- Perforating

- Fracturing

- Engineering Services

- Milling Services

- Nitrogen Services

- others

By Region

- North America- U.S., Canada.

- Europe - UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic & Rest of Europe.

- Asia Pacific -India, China, Japan, South Korea, Australia & New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, and Singapore & Rest of APAC.

- Latin America- Brazil, Mexico, Argentina, and Chile & the Rest of LATAM.

- Middle East & Africa - KSA, UAE, Israel, rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, rest of MEA.

Frequently Asked Questions

1. What is the Coiled Tubing Market growth rate during the projection period?

The Global Coiled Tubing Market is expected to grow with a CAGR of 7.36% between 2024-2032.

2. What can be the total Coiled Tubing Market value?

The global coiled tubing market size is expected to reach a revised size of USD 6.71 billion by 2032.

3. Name any three Coiled Tubing Market key players?

Sanjel Corporation, Nabors Industries Ltd, and Superior Energy Services Inc are the three Coiled Tubing Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com