Global Drip Irrigation Market Size, Share, Trends and Growth Analysis Report – Segmented By Component (Emitters/Drippers, Drip Tubes/Drip Mainlines, and Pressure Pumps, Filters, Values, Fittings and Accessories), Crop Type (Orchards, Field Crops, Fruits & Nuts, Vegetables, and Others), Application (Surface and Subsurface), And Region (North America, Europe, Asia Pacific, Latin America, Middle East And Africa) – Industry Analysis From (2025 to 2033)

Global Drip Irrigation Market Size

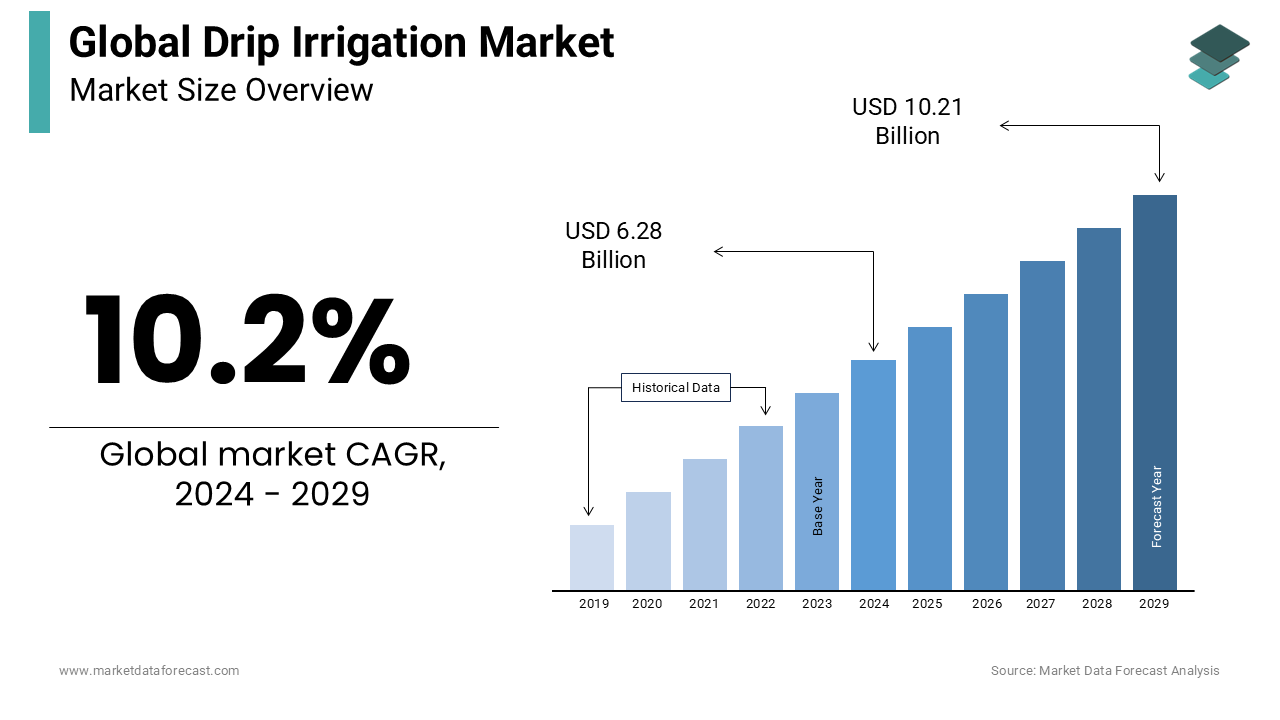

The global drip irrigation market was valued at USD 6.28 billion in 2024 and is anticipated to reach USD 6.92 billion in 2025 from USD 15.05 billion by 2033, growing at a CAGR of 10.2% from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL DRIP IRRIGATION MARKET

The drip irrigation system is a delivery mechanism that provides water from above or below the surface to the roots of plants. Drip irrigation offers multiple advantages, such as the distribution of water, lower maintenance costs, reduced water wastage, leaching elimination, decreased soil erosion, and decreased weed growth.

MARKET DRIVERS

The uncontrollable population growth and their need for a constant supply of food products is highly influencing the agricultural sector, which is the primary factor driving the global drip irrigation market. In addition, the depletion of water sources around the globe is also driving the need for effective water delivery systems to optimize water supply and reduce overall wastage. Also, the benefits of these systems, like enhanced yield, improved quality, accurate water control, and delivery of nutrients, are promoting their adoption in farming practices. In addition, the increased implementation of novel practices in farming because of supportive government regulations and incentives is also promoting growth in the drip irrigation market.

The ongoing technological developments have resulted in the implementation of new features like sensors, smart irrigation systems, precision farming, and others to boost overall efficiency and sustainability in crop cultivation. Besides, the recent trend of global warming is hindering the pattern of seasons and resulting in uncertain weather conditions. Therefore, there is a huge emphasis on effective solutions to ensure water supply at required times and maintain water levels according to climatic changes. Further, the rising awareness among farmers about the benefits of drip irrigation along with the demand for specialty crops, is propelling the global market growth. Moreover, rapid growth in greenhouse infrastructure, lower installation and maintenance costs, high efficiency, and high crop yields are supposed to create promising opportunities for the drip irrigation market in the coming years.

MARKET RESTRAINTS

The primary limitation of the drip irrigation market is the initial setup costs of this system among small and medium-scale farmers. In addition, the compatibility challenges with traditional agricultural practices and water quality also impact the adoption of these delivery systems. The surge in electricity expenses and unreliable supply in developing nations are creating a negative influence on the rapid growth of the global market. Also, the lack of proper training and knowledge to install and operate the drip irrigation systems is questioning their implementation among cultivators.

Besides, the emitters should be maintained properly to avoid clogging or any impurities in water, resulting in additional costs. Also, the lack of access to proper payment solutions and financial assistance is limiting the global drip irrigation market. Furthermore, the resistance from farmers to adopt new technologies in some of the developing nations, small and fragmented lands, and supply chain disturbances are also posing a threat to the global drip irrigation market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.2% |

|

Segments Covered |

By Component, Crop Type, Application and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Lindsay Corporation, Netafim Limited, Rain Bird Corporation, Valmont Industries, Inc., Metzer Group, Jain Irrigation Systems Limited, Azud, Hunter Industries, The Toro Company, Rivulis Irrigation, T-L Irrigation Company, Chinadrip Irrigation Equipment Co., Irritec S.p.A, Antelco, Elgo Irrigation Limited, KSNM Drip, EPC Industries Ltd, Raindrip, Inc., Goldenkey, and Eurodrip SA. |

SEGMENTAL ANALYSIS

Global Drip Irrigation Market Analysis By Component

The emitters/drippers segment accounted for the dominant portion of the global drip irrigation market and is likely to witness the highest demand over the forecast period because of the easy installation and cost-efficient options. The use of these drippers in row crops and field crops in both commercial and residential applications is propelling their adoption in crop cultivation.

Similarly, the drip tubes/drip mainlines segment is also estimated to increase at a significant rate in the predicted period because of the rising demand for field crops and supportive government initiatives.

Global Drip Irrigation Market Analysis By Crop Type

The field crops type dominated the global drip irrigation market owing to advantages like better yields, less expenses, and optimum water and fertilizer supply to plants. Also, the high costs of field crops are promoting their cultivation globally. In addition, the augmenting demand for crops like corn, sugarcane, and others is also boosting sales in this segment. Similarly, the orchards segment is also predicted to witness considerable growth in the coming years.

Global Drip Irrigation Market Analysis By Application

The surface segment held the lion’s share in the drip irrigation market and is predicted to continue its dominion in the outlook period. The rising adoption of surface applications in row crops, vines, and other trees is supporting their rapid implementation. Besides, the easy installation and maintenance, along with cost-effective options, drive their demand in the international marketplace.

REGIONAL ANALYSIS

The Asia Pacific region dominated the global drip irrigation market and is expected to register the highest growth rate in this market with the increasing agricultural practices in nations like India, China, Thailand, and Vietnam. The surge in the local population, along with the scarcity of water sources, is boosting the need for advanced irrigation systems. China and India are the leading players in this region with the expanding agriculture sector and implementation of technological processes in water management. China is a leading producer and exporter of micro-irrigation system parts. In addition, India is also witnessing a surge in the adoption of these systems owing to the supporting government initiatives like the Micro Irrigation fund and the need to find alternatives to rainwater. Drip irrigation systems are likely to find huge demand in this region in the coming days.

North America is also predicted to record significant growth in the global drip irrigation market. The United States is the leading nation in this region because of the extensive use of groundwater for irrigation. The rising demand for agriculture, coupled with the rising adoption of advanced water delivery systems in commercial facilities, is driving the demand for the drip irrigation business in this area.

Europe is also a notable player in this market, with an established agriculture industry in nations like the United Kingdom, Italy, Greece, Cyprus, and Spain. The supportive government reforms like irrigation subsidies and public water rights, increased adoption of greenhouse practices, and rise in the use of geographic information systems and remote-control systems are propelling the European drip irrigation market.

Latin America, with nations like Brazil and Argentina, is an emerging player in the global drip irrigation market. The government-regulated agriculture and the increasing need for sustainable farming are driving the business in this locale. In addition, the large plantations of corn and soybean that need regular water supply are creating growth potential in this region.

Middle East and Africa is also a relatively smaller market for the drip irrigation market. However, there is a huge untapped opportunity in these nations because of the improved government spending and augmented need for food products in this area.

KEY MARKET PLAYERS

Lindsay Corporation, Netafim Limited, Rain Bird Corporation, Valmont Industries, Inc., Metzer Group, Jain Irrigation Systems Limited, Azud, Hunter Industries, The Toro Company, Rivulis Irrigation, T-L Irrigation Company, Chinadrip Irrigation Equipment Co., Irritec S.p.A, Antelco, Elgo Irrigation Limited, KSNM Drip, EPC Industries Ltd, Raindrip, Inc., Goldenkey, and Eurodrip SA. Some major key players are involved in the global drip irrigation market.

RECENT HAPPENINGS IN THIS MARKET

- In November 2023, Rivulis, a leading firm in micro irrigation systems, launched its new initiative to offer extensive knowledge to farmers and agri-business entities around the world. The drip irrigation guide from Rivulis ensures world-class operation to improve the yield and quality of crops.

- In March 2023, Jain International Trading B.V., a division of Jain Irrigation, completed its merger with Rivulis and formed MergeCo. The newly formed entity continues using the products of Jain Irrigation in established markets because of the long-term supply agreement signed during the merger.

- In February 2023, Netafim, an Israel-based drip irrigation company, started its first manufacturing unit in Morocco. Through this new plant, Netafim aims to improve the adoption of precision drip irrigation systems and strengthen crop cultivation in the country.

MARKET SEGMENTATION

This market research report on the global drip irrigation market is segmented and sub-segmented into the following categories.

By Component

- Emitters/Drippers

- Drip Tubes/Drip Mainlines

- Pressure Pumps

- Filters

- Valves

- Fittings and Accessories

By Crop Type

- Orchards

- Field Crops

- Fruits & Nuts

- Vegetables

- Others

By Application

- Surface

- Subsurface

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what is the current size of the global drip irrigation market?

The current size of the drip irrigation system market is USD 6.92 billion in 2025.

what is the expected growth value of the global drip irrigation market?

The global drip irrigation market is expected to grow to USD 8.8 billion by 2028, growing at a compound annual growth rate (CAGR) of 10.2% during the forecast period from 2025 to 2033.

what segment highly dominating in the global drip irrigation market?

The emitters/drippers segment accounted for the dominant portion of the global drip irrigation market and is likely to witness the highest demand over the forecast period because of the easy installation and cost-efficient options.

which region accounted for the largest share in the global drip irrigation market?

The Asia Pacific region dominated the global drip irrigation market and is expected to register the highest growth rate in this market with the increasing agricultural practices.

what are the key market players involved in the drip irrigation market?

Lindsay Corporation, Netafim Limited, Rain Bird Corporation, Valmont Industries, Inc., Metzer Group, Jain Irrigation Systems Limited, Azud, Hunter Industries, The Toro Company, Rivulis Irrigation, T-L Irrigation Company, Chinadrip Irrigation Equipment Co., Irritec S.p.A, Antelco, Elgo Irrigation Limited, KSNM Drip, EPC Industries Ltd, Raindrip, Inc., Goldenkey, and Eurodrip SA. Some major key players are involved in the global drip irrigation market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com