Europe Agriculture Equipment Market Size, Share, Trends & Growth Forecast Report, Segmented By Equipment Type, Application, Automation, Application And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Agriculture Equipment Market Size

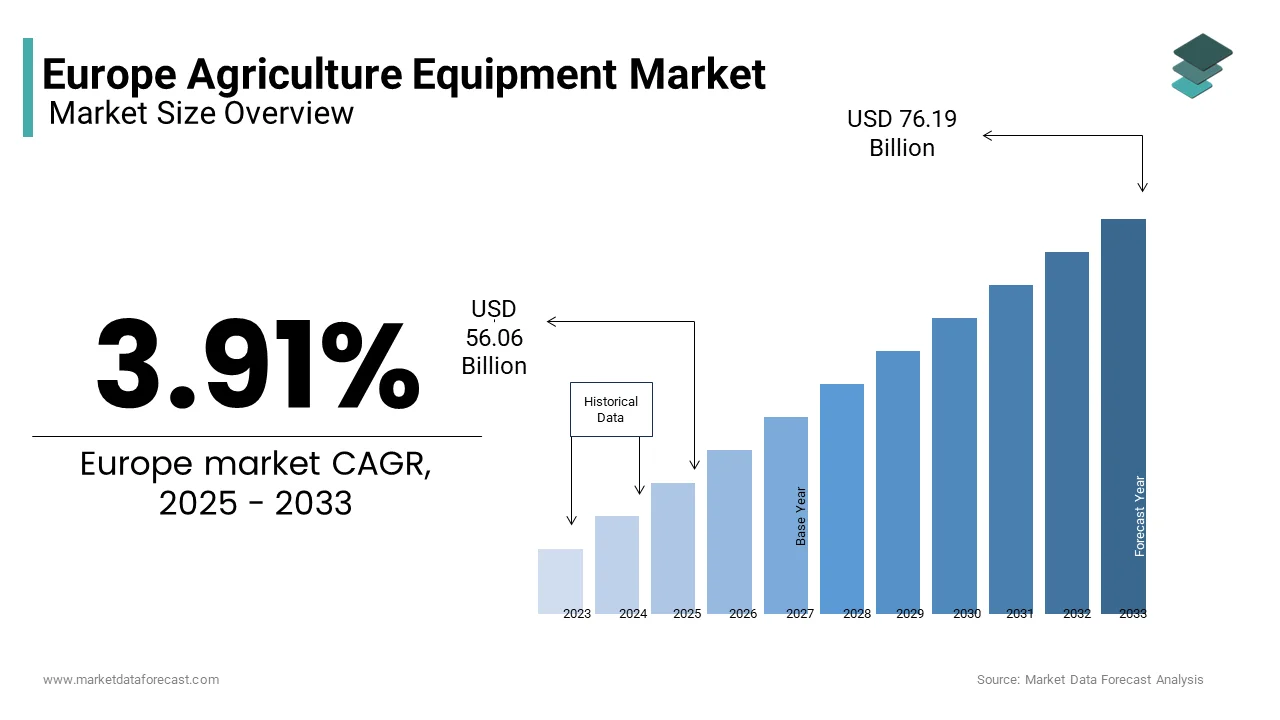

The European agriculture equipment market size was valued at USD 53.95 billion in 2024 and is anticipated to reach USD 56.06 billion in 2025 from USD 76.19 billion by 2033, growing at a CAGR of 3.91% during the forecast period from 2025 to 2033.

The Europe agriculture equipment market is enabling efficient farming practices in one of the world’s most advanced agricultural economies. Tractors, combine harvesters, and other equipment dominate the landscape, with the need for mechanization in large-scale farming operations. The adoption of precision farming technologies has further bolstered demand, with CEMA estimating that smart farming solutions now influence 30% of equipment purchases.

MARKET DRIVERS

Rising Demand for Precision Farming Technologies

Precision farming is revolutionizing agriculture in Europe, with the demand for advanced equipment equipped with GPS, IoT, and AI capabilities, which is leveraging the growth of the market. This technological shift has led to a surge in demand for high-tech tractors and planting equipment, which integrate sensors and automation. The European Commission notes that over 40% of farms in Western Europe have adopted some form of precision farming, creating a robust market for compatible machinery. Additionally, governments are incentivizing farmers to adopt sustainable practices, further boosting equipment sales.

Increasing Focus on Sustainable Agriculture

Sustainability is a key driver shaping the agriculture equipment market in Europe. As per the European Environment Agency, agriculture accounts for 10% of the EU’s greenhouse gas emissions, prompting stricter regulations on resource use. Equipment manufacturers are responding by developing energy-efficient machinery powered by alternative fuels like biofuels and electricity. Moreover, innovations in spraying equipment, such as precision nozzles, are aimed at reducing chemical usage by 30% with the EU’s Green Deal objectives. This focus on sustainability not only attracts environmentally conscious buyers but also ensures compliance with evolving regulatory standards.

MARKET RESTRAINTS

High Initial Investment Costs

The cost of acquiring advanced agriculture equipment remains a significant barrier, particularly for small and medium-sized farms. The high expenses are prohibitive for smaller operators in the agriculture field, which hinders the growth of the market. Although financing options exist, interest rates and loan terms often deter investment. Additionally, maintenance costs for technologically advanced equipment further strain budgets. This financial burden limits market penetration in Eastern Europe, where funding opportunities remain limited.

Supply Chain Disruptions and Raw Material Shortages

Supply chain disruptions have emerged as a critical restraint for the agriculture equipment market. According to the European Chemicals Agency, shortages of raw materials like steel and aluminum have escalated production costs by 20-25%. Geopolitical tensions and logistical bottlenecks have exacerbated these challenges is leading to delays in manufacturing and delivery. As per a report by Deloitte, 35% of European manufacturers experienced production halts due to material shortages in 2022. These disruptions not only increase lead times but also undermine long-term contracts, forcing companies to explore localized sourcing options despite higher costs.

MARKET OPPORTUNITIES

Adoption of Autonomous Farming Equipment

Autonomous farming equipment represents a transformative opportunity for the market, driven by advancements in AI and robotics. These machines offer significant advantages, including reduced labor dependency and enhanced operational efficiency. A study by PwC indicates that autonomous equipment can lower labor costs by 25% while increasing productivity by 30%. Furthermore, the EU’s Horizon Europe program allocates €95 billion for innovation in smart farming, providing a strong impetus for the development and adoption of autonomous solutions. This trend positions Europe as a global leader in next-generation agriculture technology.

Expansion into Emerging Markets within Europe

Eastern European countries present untapped potential for agriculture equipment manufacturers. These regions are transitioning from manual to mechanized farming, creating substantial demand for affordable yet efficient machinery. As per a report by the Food and Agriculture Organization, 60% of farms in Eastern Europe lack modern equipment by offering a lucrative growth avenue. Additionally, government initiatives like Poland’s “Agro Plus” program provide subsidies for equipment purchases. Manufacturers targeting these markets can achieve significant market share expansion.

MARKET CHALLENGES

Regulatory Compliance and Certification Requirements

Stringent regulatory frameworks pose a significant challenge for the agriculture equipment market. According to the European Commission, manufacturers must comply with over 200 environmental and safety standards, including emissions regulations under Stage V of the EU’s Non-Road Mobile Machinery Directive. Smaller players struggle to keep pace, leading to consolidation and reduced competition.

Aging Farmer Population and Labor Shortages

The aging farmer population in Europe exacerbates labor shortages by impacting equipment utilization. According to Eurostat, the average age of farmers in the EU is 60, with only 11% under the age of 40. This demographic imbalance reduces the pool of skilled operators capable of handling advanced machinery. While automation offers a partial solution, the transition requires significant training and investment.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.91% |

|

Segments Covered |

By Equipment Type, Application, Automation, Sales Channel, and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Aaxa Technologies Inc., Acer Inc., Coretronic Corporation, Sony Corporation, Canon Inc., Aiptek International Inc,, Koninklijke Philips NV, LG ElectronicInc.NNC Samsung Group, Miroir USA. |

SEGMENTAL ANALYSIS

By Equipment Insights

The tractors segment accounted in holding 35.4% of the Europe agriculture equipment market share in 2024, with their versatility and indispensability in various farming operations, from plowing to transportation. Tractor sales in Europe reached 200,000 units in 2022, with compact and utility tractors witnessing steady demand. The adoption of precision farming technologies has further fueled growth, as modern tractors integrate GPS and IoT systems to enhance efficiency. Additionally, government subsidies for eco-friendly machinery have encouraged farmers to upgrade to low-emission models that will further propel the growth of the market.

The spraying equipment segment is lucratively growing with a CAGR of 9.8% during the forecast period, with the increasing focus on minimizing chemical usage while maximizing crop yields. Innovations such as precision nozzles and drone-based spraying systems have gained traction, particularly in Western Europe. As per a report by the European Environment Agency, these technologies reduce pesticide application by 30% by aligning with EU regulations.

By Application Insights

The land development and seed bed preparation segment dominated the Europe agriculture equipment market with an estimated share of 28.7% in 2024. This dominance is attributed to the intensive land use in Europe, where over 40% of the total land area is dedicated to agriculture. Large-scale farms in Germany and France rely heavily on equipment like plows, harrows, and cultivators to optimize soil conditions for planting. According to the European Commission, investments in soil health and land preparation have increased by 15% since 2020, driven by policies promoting sustainable farming practices. Additionally, advancements in mechanization, such as GPS-guided tillage equipment that have enhanced operational efficiency.

The plant protection segment is likely to achieve the fastest CAGR of 10.5% in the coming years. This growth is fueled by the rising demand for pest and disease control solutions amid increasing crop vulnerabilities due to climate change. Moreover, the integration of AI-powered sensors in plant protection machinery enables real-time data analysis by improving accuracy and reducing chemical usage.

COUNTRY ANALYSIS

Germany led the Europe agriculture equipment market with a 25.9% share in 2024. Germany’s large-scale farms in regions like Bavaria and Lower Saxony rely heavily on mechanized solutions to optimize productivity. According to CEMA (European Agricultural Machinery Association), German farmers invest approximately €5 billion annually in upgrading machinery, supported by government subsidies aimed at promoting sustainable practices. Additionally, Germany’s robust manufacturing base and engineering expertise ensure a steady supply of high-quality machinery is gearing up new opportunities for the market to grow in next coming years.

The Polish market for agricultural equipment is expected to achieve a projected CAGR of 8.5% during the forecast period. This growth is driven by the transition from manual to mechanized farming, supported by government initiatives like the “Agro Plus” program, which provides subsidies for equipment purchases. The country’s young farmer population focuses on EU funding programs aimed at modernizing rural infrastructure will amplify the growth of the market.

Top 3 Players In The Market

John Deere

John Deere, headquartered in the United States. The company’s success is rooted in its commitment to innovation and sustainability, as evidenced by its development of autonomous tractors and electric machinery. John Deere’s advanced precision farming solutions, including GPS-guided systems and AI-powered analytics, cater to the growing demand for efficiency and resource optimization. Its strong distribution network spans across Europe, ensuring widespread accessibility.

CNH Industrial

CNH Industrial specializes in combine harvesters and forage equipment. The company’s focus on sustainability is reflected in its development of low-emission machinery that complies with Stage V emissions standards. CNH Industrial collaborates closely with universities and research institutions to advance precision farming technologies, ensuring cutting-edge solutions for farmers. Its customer-centric approach, offering tailored machinery for diverse farming needs and enhances its appeal in both Western and Eastern Europe. CNH’s strategic acquisitions have further expanded its footprint, enabling it to address untapped markets effectively.

AGCO Corporation

AGCO Corporation is recognized for its high-performance planting and spraying equipment. The company leverages advanced technologies, such as IoT and AI, to offer smart farming solutions that enhance productivity and reduce resource usage. AGCO’s acquisition of regional firms, such as a French manufacturer in 2023, has strengthened its presence in Southern Europe and bolstered its product portfolio. Its commitment to sustainability is evident in its development of hybrid machinery by aligning with EU Green Deal objectives. AGCO’s global reach and innovative capabilities ensure its continued growth in the competitive European market.

Top Strategies Used By Key Players

- Product Innovation: Companies like John Deere and AGCO invest heavily in R&D to develop next-generation machinery, such as autonomous tractors and AI-powered spraying equipment. These innovations not only enhance productivity but also address environmental concerns by aligning with EU regulations.

- Strategic Partnerships: Collaborations with technology providers, universities, and agricultural organizations are a cornerstone of market strategies. For instance, CNH Industrial partners with French universities to advance precision farming technologies by ensuring cutting-edge solutions for farmers.

- Acquisitions and Expansions: To expand their geographic footprint and product portfolios, companies are increasingly pursuing mergers and acquisitions. AGCO’s acquisition of a French firm in 2023 exemplifies this strategy, enabling the company to tap into new markets and strengthen its supply chain capabilities.

- Sustainability Initiatives: Compliance with environmental regulations is a priority for all major players. John Deere and CNH Industrial have launched initiatives to reduce carbon footprints and promote water conservation by positioning themselves as leaders in green technologies.

- Customer-Centric Solutions: Tailoring products to meet specific customer needs is another key strategy. For example, John Deere offers modular solutions that can be adapted for both small-scale and large-scale applications by ensuring flexibility and scalability for its clients.

COMPETITION OVERVIEW

The Europe agriculture equipment market is characterized by intense competition, which is driven by technological advancements, regulatory pressures, and evolving consumer demands. Leading players such as John Deere, CNH Industrial, and AGCO Corporation dominate the market, leveraging their expertise in precision farming and sustainable solutions to differentiate themselves. However, smaller players and regional firms are also gaining traction by offering cost-effective solutions and focusing on niche applications.

According to the European Agricultural Machinery Association (CEMA), the market’s competitive landscape is shaped by several factors, including pricing, product quality, and compliance with environmental regulations. The shift toward sustainable agriculture has intensified competition, with companies investing heavily in R&D to develop eco-friendly alternatives to traditional machinery. Moreover, the rise of autonomous farming equipment has created new opportunities for differentiation, with players competing to provide innovative solutions for labor shortages and resource optimization.

Strategic partnerships and collaborations with agricultural organizations are also critical, as they ensure long-term contracts and enhance brand reputation. Despite economic uncertainties and supply chain disruptions, the market remains resilient, with innovation and customer-centric strategies driving sustained growth.

RECENT HAPPENINGS IN THIS MARKET In

- April 2023, John Deere introduced a new line of autonomous tractors equipped with AI and IoT capabilities. This innovation enhances operational efficiency and reduces labor dependency, aligning with Europe’s focus on smart farming.

- June 2023, CNH Industrial announced a partnership with French universities to advance precision farming technologies. This collaboration strengthens its R&D capabilities and positions the company as a leader in innovation.

- September 2023, AGCO acquired a French agriculture equipment manufacturer to expand its geographic footprint and enhance its product portfolio. This move solidifies AGCO’s presence in Southern Europe and bolsters its supply chain capabilities.

- January 2024, John Deere announced a €100 million investment in R&D to develop electric and hybrid machinery. This initiative aligns with EU environmental goals and positions John Deere as a pioneer in sustainable farming solutions.

March 2024, CNH Industrial launched a new line of low-emission combine harvesters designed to meet Stage V emissions standards. This innovation reinforces CNH’s commitment to sustainability and regulatory compliance.

KEY MARKET PLAYERS

AGCO Corporation, Agromaster Agricultural Machinery, Argo Tractors S.p.A, Bellota Agrisolutions, China National Machinery Industry Corporation, CLAAS KGaA mbH, CNH Industrial N.V., Deere & Company, Escorts Limited, Iseki & Co. Ltd, JC Bamford Excavators Ltd, Kubota Corporation, Mahindra & Mahindra Limited, SDF Group. Some of the market players are dominating the Europe agriculture equipment market.

MARKET SEGMENTATION

This research report on the Europe agriculture equipment market is segmented and sub-segmented into the following categories.

By Equipment Type

- Agriculture Tractor

- Harvesting Equipment

- Irrigation and Crop Processing Equipment

- Agriculture Spraying and Handling Equipment

- Soil Preparation and Cultivation Equipment

- Others

By Application

- Land Development

- Threshing and Harvesting

- Plant Protection

- After Agro Processing

By Automation

- Manual

- Semi-automatic

- Automatic

By Sales Channel

- Original Equipment Manufacturers (OEM)

- Aftermarket

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe agriculture equipment market?

The European agricultural equipment market's current size is 56.06 billion in 2025

How big is the Europe agriculture equipment market?

The Europe agriculture equipment market size is anticipated to reach USD 56.06 billion in 2025 from USD 76.19 Bn by 2033, growing at a CAGR of 3.91% from 2025 to 2033

Who are the key players that are dominating the Europe agriculture equipment market?

AGCO Corporation, Agromaster Agricultural Machinery, Argo Tractors S.p.A, Bellota Agrisolutions, China National Machinery Industry Corporation, CLAAS KGaA mbH, CNH Industrial N.V and Etc...

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com