Europe Cold Chain Market Size, Share, Trends & Growth Forecast Report By Type (Transportation, Monitoring Components & Storage), Temperature Type (Chilled and Frozen), Application, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Cold Chain Market Size

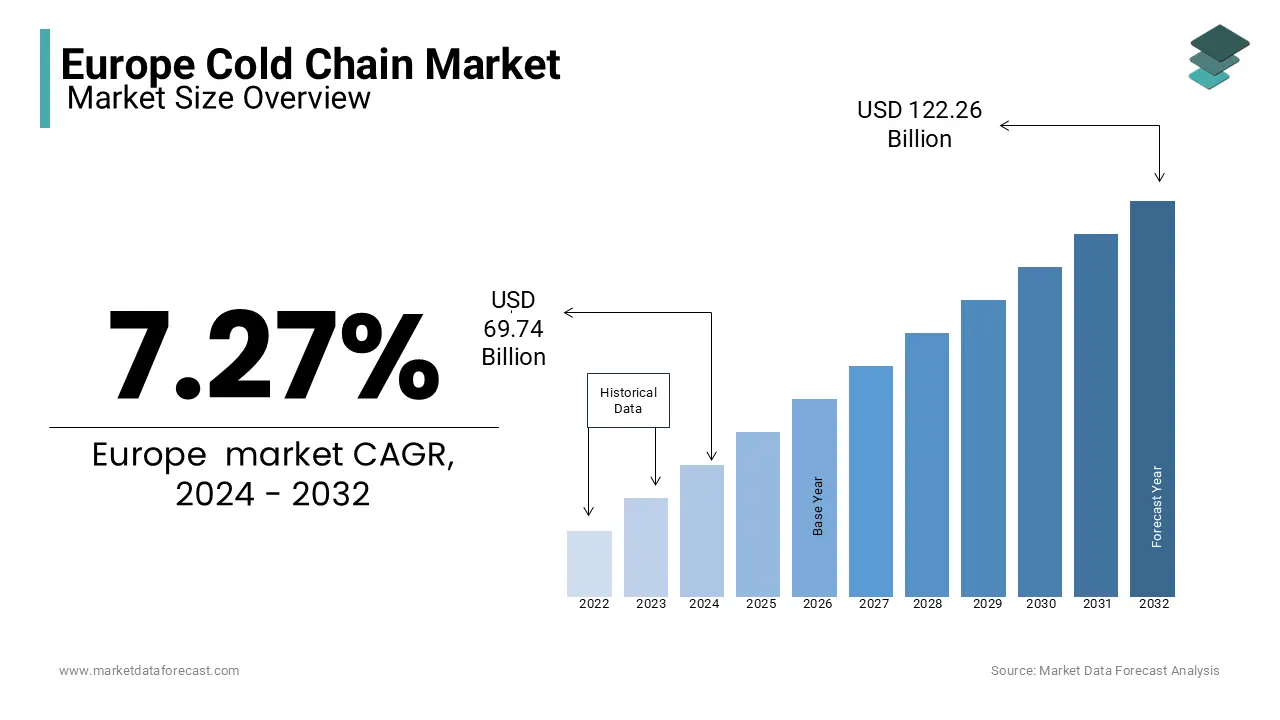

The cold chain market size in Europe was valued at USD 69.74 billion in 2024. The global market size is further estimated to be worth USD 131.16 billion by 2033 from USD 74.81 billion in 2025, growing at a CAGR of 7.27% from 2025 to 2033.

The cold chain can be defined as the technology necessary to maintain a product within a specific low-temperature range from harvest/production to consumption. Cold Chain units should be designed to keep the temperature within the preferred range and avoid temperature changes. This means that the goods contained in the shipment must be brought to the required temperature before loading into the freezer, and special storage and unloading/loading facilities are required. In addition, it is necessary to maintain proper temperature conditions in the supply chain and monitor temperature-sensitive products. The cold chain is a supply chain logistics system that aims to effectively track perishable food, food, pharmaceuticals, and healthcare services while ensuring freshness. Monitoring and production management depend on the hardware and software selected for monitoring. The cold chain is widely used in the food, agricultural and pharmaceutical sectors to ensure a stable and temperature-regulated supply chain. Cold chains are necessary when it comes to temperature-sensitive products and logistics. By using a cold chain, you can increase the shelf life of your product while maintaining its biochemical and physical properties.

MARKET DRIVERS

The growing awareness of food and beverage safety in the supply chain is driving the demand for the European cold chain market. The demand for the European Cold Chain market is on the rise as demand for organized retail increases and consumer awareness to mitigate food waste increases. Changes in consumer behavior, the growth of e-commerce, and the advancement of technology are key factors driving the European Cold Chain market. Furthermore, the huge development potential of emerging markets and uncharted regions offers new development opportunities for players operating in the European Cold Chain market for the food industry. Increasing demand for refrigeration in the pharmaceutical (healthcare) and food and beverage industries will drive the European Cold Chain market growth during the forecast period.

The growth of the cold chain market in Europe is further driven by the ongoing investments by government agencies and private sector companies to build cold store networks, as well as the government's emphasis on improving chain efficiency. Supply for pharmaceutical, dairy, and refrigeration products. Strict regulations on the transportation of food, processed food, and other types of products and drugs require a cold chain monitoring solution. Additionally, rapid urbanization, increased food quality awareness, increased drug use, maintaining a safe vaccine, blood, and drug cold chain, and increased health awareness are driving Europe's cold chain market growth during the forecast period.

Increased trade in perishable goods and increased government support for infrastructure development for cold chain facilities are expected to drive the European cold chain market growth over the forecast period. Increasing demand for cold chain storage facilities, along with the increase in frozen products such as meat, ice cream, and seafood, is an important factor driving the growth of the European Cold Chain market. With the increasing adoption rate of packaged food and beverage products, the food industry is showing an encouraging response to the growth of the European Cold Chain market. The demand for the cold chain market is increasing as the number of organized retail stores in the emerging economy increases. Increasing customer demand for perishable goods, increasing space in retail food chains in multinational companies, expanding use of RFID, barcode scanners in cold storage warehouses will accelerate the European cold chain market growth, RFID technology applied in cold chain applications, and adopted software will be profitable. It will provide growth opportunities in the Europe cold chain market.

MARKET RESTRAINTS

Environmental issues related to greenhouse gas emissions are estimated to be a challenge to the growth of the European cold chain market. Poor product packaging quality in the manufacturing company will damage the product during transportation and reduce the shelf life. The cold chain primarily works to control the temperature. Improper training can destroy product quality, making it unsuitable for end-user use and affecting the European cold chain market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.27% |

|

Segments Covered |

By Type, Type of Temperature, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Burris Logistics, AmeriCold Logistics LLC, Agro Merchants Group LLC, Nichirei Logistics Group Inc., Preferred Freezer Services Inc., Kloosterboer Group BV, Cloverleaf Cold Storage Co., Swire Cold Storage Ltd., Lineage Logistics Holdings LLC and Henningsen Cold Storage Company Co |

SEGMENTAL ANALYSIS

By Type Insights

The storage segment is anticipated to account for the major share of the European market during the forecast period. The growth of the storage segment is majorly attributed to the growing preference for packaged foods around the world. The use of monitoring components in cold chains is increasing, especially with technological advances and the growing need to ensure the integrity, efficiency, and safety of shipments.

By Temperature Insights

The frozen segment is expected to account for a substantial share of the European market during the forecast period. The typical temperature range for frozen products is 18 ° C to -25 ° C. Freezing preserves the flavor, texture, and nutritional value of the product. But it also depends on the type of food ingredients, the use of pretreatment, the choice of freezing and freezing storage options, and the use of suitable packaging. These factors are mainly driving the demand for the use of freezing temperature types for cold chains.

REGIONAL ANALYSIS

Europe will continue to dominate the cold chain market as its large consumer base grows during the forecast period and is expected to boost local demand during the forecast period. The UK cold chain market held the largest share of the European cold chain market. The large food and beverage sector continues to dominate the cold chain industry. In recent years, the emergence of frozen pharmaceutical transport logistics companies of various sizes has achieved exponential growth in the pharmaceutical sector. The rapid demand and development of cold chain infrastructure are propelling Germany's cold chain market growth. Innovations in the pharmaceutical sector are expected to increase demand in the Spain Cold Chain market. The regional expansion of biopharmaceuticals is likely to drive the growth of the France Cold Chain market.

KEY MARKET PLAYERS

Companies playing a leading role in the Europe cold chain market include Burris Logistics, AmeriCold Logistics LLC, Agro Merchants Group LLC, Nichirei Logistics Group Inc., Preferred Freezer Services Inc., Kloosterboer Group BV, Cloverleaf Cold Storage Co., Swire Cold Storage Ltd., Lineage Logistics Holdings LLC and Henningsen Cold Storage Company Co.

MARKET SEGMENTATION

This research report on the Europe cold chain market has been segmented and sub-segmented based on the following categories.

By Type

- Transportation

- Monitoring Components

- Storage

By Type of Temperature

- Chilled

- Frozen

By Application

- Fruits and Vegetables

- Fruit Pulp and Concentrates

- Dairy Products

- Meat and Seafood

- Processed Foods

- Bakery and Confectionery

- Pharmaceuticals

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com