Family Entertainment Centers Market Size, Share, Trends & Growth Forecast Report – Segmented By Demographics, Facility Size, Revenue Source, Application, Type, & Region - Industry Forecast From 2024 to 2033

Global Family Entertainment Centers Market Size

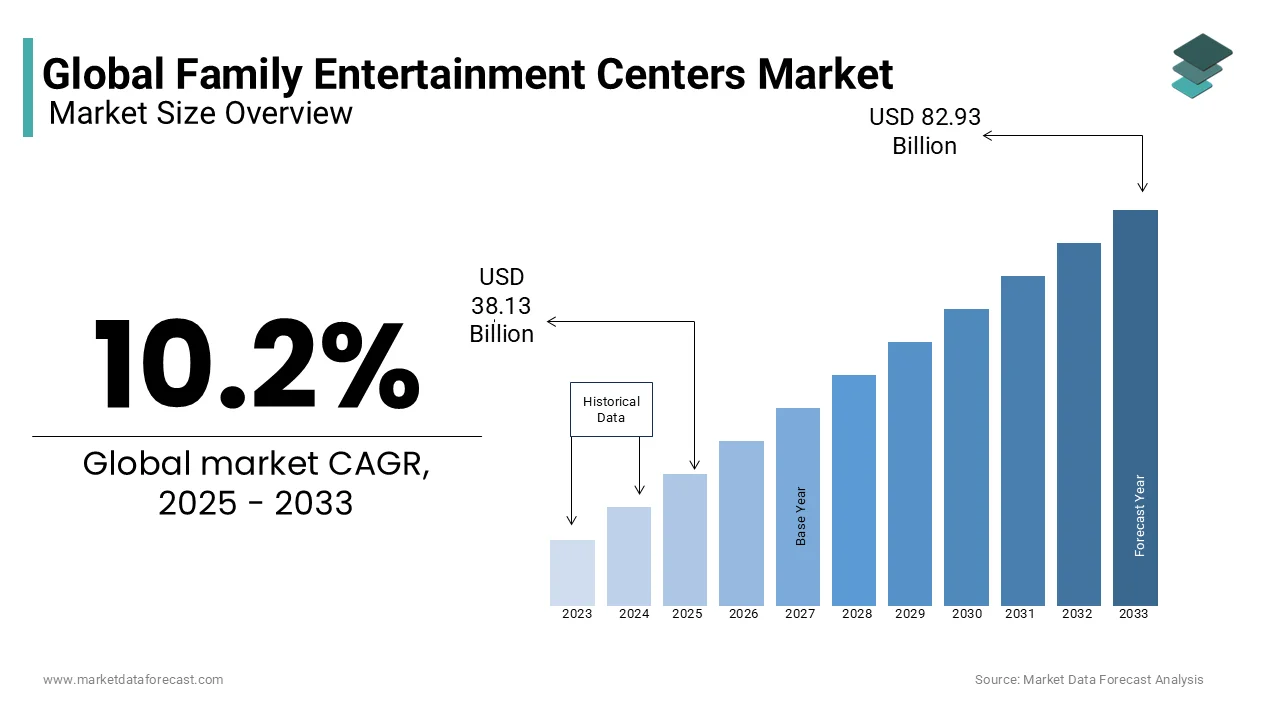

The global family entertainment centers market was worth USD 34.60 billion in 2024. The global market is projected to grow at a CAGR of 10.2% from 2025 to 2033 and the global market size is expected to be worth USD 82.93 billion by 2033 from USD 38.13 billion in 2025.

Family entertainment centers (FECs) are small amusement parks or entertainment zones that mainly serve local communities in small and large cities. FECs are designed to keep the entire family engaged, usually at a much lower per-person price than a regular amusement park. It provides different options like arcades, gaming consoles, video games, soft play areas, indoor playground systems, redemption machines, children's rides, skill-based machine games, and games based on virtual and augmented reality.

Current Scenario of the Global Family Entertainment Centers Market

The family entertainment centers market is steadily growing. The FECs and Mixed User Leisure Entertainment centers (MULE) have transformed to provide enjoyment and are changing again to entertain the fresh ‘kidult’ market with social enjoyment places and social competition. The market is also seeing the evolution of game technology. The increasing incorporation of Virtual Reality (VR) in games is among the main trends in this market and is anticipated to have a positive influence during the estimation period.

- According to the report 'An Ericsson ConsumerLab Insight,’' published by Telefonaktiebolaget LM Ericsson, most of the surveyed gamers anticipate growth in the gaming industry mainly due to the utilization of AR. AR technology is also estimated to rise by 67% in the next five years.

FECs also offer private celebrations like birthday parties and corporate events, and they are attractively located in areas like malls, where consumers generally visit. Various facilities provided by the entertainment centers are gaining traction among youth and children, contributing to significant market growth in the past years.

Moreover, these have witnessed considerable growth across the world since customers have increasingly prioritised their leisure opportunities since COVID-19. However, progress precedes the pandemic as producers of amusement machines have launched more alluring experiences coupled with higher cashless payment and contactless methods that serve the existing customer base. In addition, the market is also seeing an escalating demand for new experiences. The development of FECs has been mainly propelled by a rise in the volume of adult and teen consumers who are transitioning from engaging in collectable action strategy and war-themed arcade gaming at home. According to industry experts, the FECs serve the demands of the younger public searching for social and physical entertainment has taken the place of traditional amusement arcades. Other places addressing this audience contain multi-functional leisure and entertainment spaces with cinetainment, mini-golf, bowling, boutique bowling and karting venues that contribute social enjoyment to the theatre scene.

Presently, the standard arcade does not fall, it failed to adjust or modify and was replaced by a video-console-savvy modern audience desired. They required mini amusement park-style methods, and they demanded a great degree of fun and entertainment.

MARKET DRIVERS

The growing disposable income, availability of diversified gaming and entertainment options, and favourable youth demographics are some of the major factors propelling the global family entertainment centers market growth.

Moreover, the continuous introduction of the latest FECs supporting family activities, F&B integration, participatory play, substantial rising investments by malls, and a combination of new technologies like virtual reality gaming, 3D technology, and others offer opportunities to expand the market.

- As per the report, IT Industry Outlook published by CompTIA Properties – virtual and augmented reality are among the top 20 emerging technologies.

The increasing advancements in the latest technologies used in the entertainment and gaming industry will bolster the global market revenue in the coming years. The primary target audiences of the family entertainment centers are children between 8 and 14 years of age and their parents. The growing population pool in the Asian regions, the rising disposable incomes of the people, and the growing trend of unique experiences among youth are majorly driving market value growth worldwide.

The escalation in the significant changes in customer preference for special event celebrations is raising the standards for the family entertainment centers, leading to growth opportunities. The availability of various entertainment and celebration facilities at these centers is gaining people's attention for parties, birthdays, events, and celebratory gatherings, which promote market growth opportunities during the forecast period. The market players ' implementation of various market strategies, like the introduction of overall packages for families, friends, and colleagues and various loyalty schemes to offer ads and special discounts, are propelling the global market share due to increased visits by people.

MARKET RESTRAINTS

The high costs associated with the initial establishment and maintenance are the major factors restraining the family entertainment centers market. As the family entertainment centers provide various facilities like games, food, and arcade studios, the costs for the machinery and the need to maintain advanced technologies are all estimated to be challenging for the market players.

- According to a study by YouGov, despite a broad agreement that museums provide a pleasant experience with, 8 out of 10 customers in the United States with 81 per cent and Britain with 79 per cent accepting their appeal.

Companies need help to continuously meet customers' demands when seeking new and updated entertainment options. The continuous increase in ticket prices is expected to hamper the market growth as it is tough for middle-income families to afford. Various strict regulations regarding food and entertainment activities concerning safety and effectiveness are expected to limit the introduction of new strategies that hinder market expansion. Another primary factor impedes market revenue is repeatedly attracting customers, as the entertainment centers cannot make instant and continuous changes.

MARKET OPPORTUNITIES

The multi-activity indoor play centres provide potential opportunities for the expansion of the family entertainment centers market. These are viewed as a true transformation and a very attractive investment. These places were planned and created to provide a great number of recreational experiences in one venue and satisfy the need for leisure activities from varied customers. At the core of this development in the market, there exists a diverse range of offerings that combine unique and traditional activities, like virtual reality, arcade games, ninja courses, indoor playgrounds, escape games, karting circuits, challenge games, interactive games, climbing walls, trampoline parks, laser tag, and bowling. Hence, this factor is expected to propel the market forward.

Another key prospect is mixed reality, which holds to be the potential future of the FECs, which will ultimately benefit the market. While many players have conducted a trial run with virtual reality (VR) to improve their array of attractions, Mixed Reality (MR) could be the transformative solution your place requires. MR mixes components of both AR and VR, integrating virtual items with the real world.

MARKET CHALLENGES

Accessibility and cybersickness challenges are impeding the growth of the family entertainment centers market. Today, several FECs have VR sets to maximise their enjoyment and overall experience. One of the critical problems with VR is cybersickness, a kind of motion sickness which can happen when the mind receives clashing signals regarding position and movement in a virtual surrounding. This problem can be especially noticed in VR settings, impacting a significant share of consumers, particularly young children, and women, and potentially restricting the customer scope for VR attractions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.2% |

|

Segments Covered |

By Demographics, Facility Size, Revenue Source, Application, Type and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Dave & Buster’s, CEC Entertainment, Inc., Cinergy Entertainment, KidZania, Scene 75 Entertainment Centers, The Walt Disney Company, Lucky Strike Entertainment, FunCity, Smaaash Entertainment Pvt. Ltd., LegoLand Discovery Centre, and others. |

SEGMENTAL ANALYSIS

By Demographics Insights

The families with children (9-12) and teenagers segments are the most revenue-contributing segments to the global market, and the same trend is likely to continue over the forecast period. The families with children (9-12) segment dominate with a significant share because 60% of the visitors are school-aged kids who are more enthusiastic and coordinated, which drives the segment growth.

The teenagers segment is estimated to grow fastest during the forecast period. The growing trend of arcade games and amusement parks is enhancing teenagers' interest, leading to global market growth.

By Revenue Source Insights

The entry fees and ticket sales sector led the overall family entertainment center market, and this trend is estimated to continue throughout the period. The ticket prices for entry are high and mandatory, which enhances the market revenue. The presence of specific packages for families and friends with different price ranges is the most widely adopted type, contributing to the expansion of the market revenue.

The food and beverage sector is expected to expand the most, owing to the rise in the availability of various food options for kids and adults. Furthermore, individuals also prefer family/indoor entertainment centers as a location of choice for corporate parties and birthday parties for children and adults. This trend escalates revenue generation from the food and beverage segment in family entertainment centers. The market players focus on introducing premium food to gain people's attention and accelerate market growth opportunities.

By Facility Size Insights

The 20,000 to 40,000 sq. ft segment dominated the global market. Most small and medium family entertainment centers are established in a minimum 20,000 sq. ft area, which drives the segment growth. Most of the major market players are establishing their facility in 1 to 2 acres, which is expected to accelerate the 1 to 10 acres segment growth in the coming years as the market players plan to incorporate dining and entertainment facilities, which require more land space.

By Application Insights

The arcade studios segment held a significant revenue proportion in the family entertainment centers market. The increased adoption of technology and the growing popularity of animation and 3D graphics are gaining more attention among children, leading to segment growth. The growing interest of people in creativity and films is enhancing the rise of arcade studios' revenue, leading to market growth.

The AR and VR Gaming zones segment is projected to grow at the fastest rate in the coming years due to game technological advancements.

By Type Insights

The children's entertainment centers segment dominated the global market revenue with a prominent growth rate. Most schoolchildren visit entertainment centers, which are incorporated with various recreational facilities and games. These engaging activities are expected to develop the children's social skills, ensuring active learning.

Adult entertainment centers are gaining traction due to the growing technological facilities they provide, attracting youth for socialization and entertainment purposes.

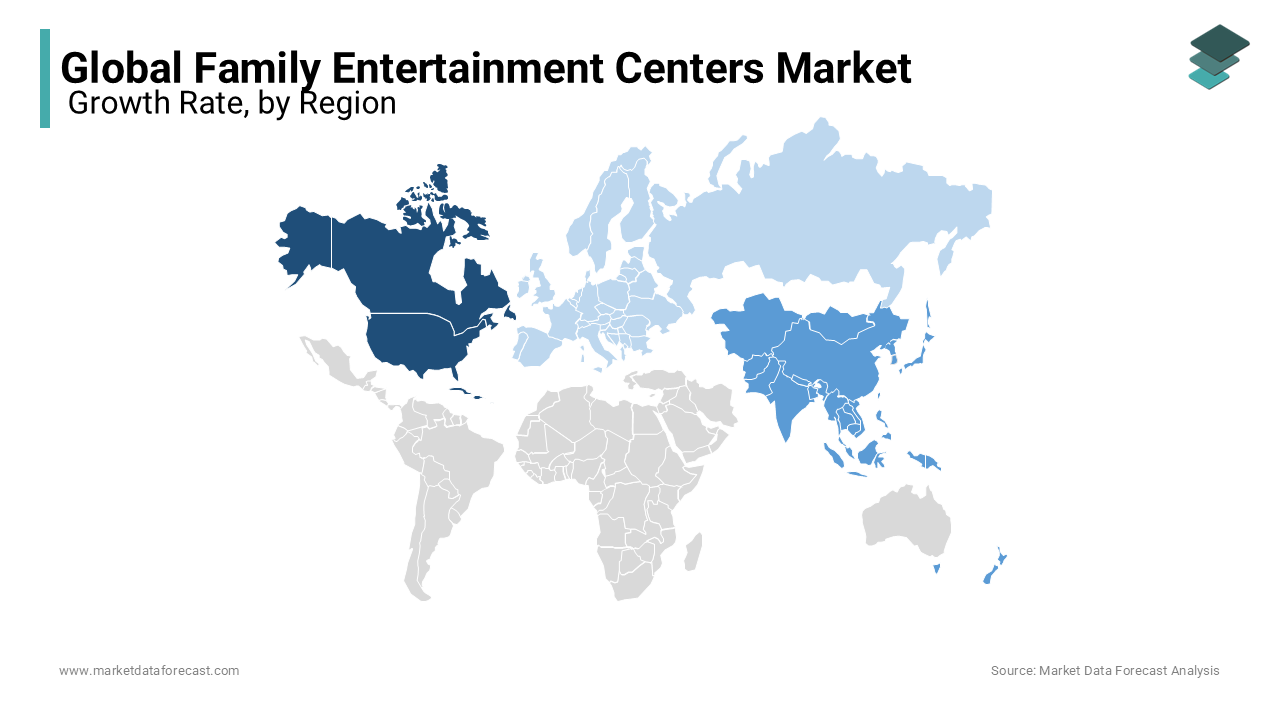

REGIONAL ANALYSIS

The North American region dominated the global market revenue as it recorded the highest revenue from the United States. The presence of various key market players in the U.S., higher adoption of technological advancements, and favorable infrastructure are boosting the expansion of the family entertainment centers market in the North American region. According to the Ease of Doing Business report published by the World Bank, the United States is second in doing Business. The growing urbanization and the number of teenagers seeking interest in gaming are driving the growth of the regional market size. The escalating establishments of the many malls in the U.S. and Canada, where the presence of entertainment centers is attracting people, positively impact the expansion of the market revenue across the region.

- According to a study by IAAPA, families in North America, on average, will go to a completely feature-rich family amusement center 3.2 to 4.6 times annually. The study also shows that the usual expenditure at a family entertainment center ranges between 12 dollars and 22 dollars per visit, subject to the activity mix.

The Asia Pacific region is projected to have a significant growth rate during the forecast period due to rising technological advancements and the adoption of urbanization in countries like Japan, China, and India. The region is becoming another hub for various Businesses due to the growing economic standards of various countries, which is approximately the impact of the regional market expansion. The growing population and rising disposable incomes allow them to spend on entertainment, fueling the market growth opportunities.

- As per a study, the Asia Pacific region and the United Arab Emirates show a considerably different scenario, with just 5 per cent of customers saying they don’t go to theme parks

For individuals who frequently go to theme parks, the main motivation seems to be the quest for quality time and outings with friends and family. This motive for going is particularly common in the APAC region and the United Arab Emirates, where over a quarter, i.e. 28 per cent and 27 per cent respectively, of people state it as their major reason for visiting theme parks. In total, 23 per cent of theme park visitors throughout all regions signal that spending time with dear ones is their key reward for buying a ticket.

Europe is another significant market for family entertainment centers and is expected to witness notable growth during the forecast period. The region has a wealth of activities and destinations that ensure family enjoyment and innovative moments. Moreover, the key players in the European market are Germany, Spain, France, the United Kingdom, the Netherlands, and Italy. Germany has the biggest amusement park in the continent.

KEY PLAYERS IN THE MARKET

Companies playing a significant role in the global family/indoor entertainment centers market are Dave & Buster's, CEC Entertainment, Inc., Cinergy Entertainment, KidZania, Scene 75 Entertainment Centers, The Walt Disney Company, Lucky Strike Entertainment, FunCity, Smash Entertainment Pvt. Ltd., and LegoLand Discovery Centre.

RECENT HAPPENINGS IN THE MARKET

- In July 2024, Launch Entertainment reported the signing of a contract to add 3 new places in Pennsylvania and New Jersey. The latest installations are believed to commence in New Hope, New Brunswick, and Morristown, Pennsylvania, with first place likely to start running in 2025. Moreover, these centers, which will have a bar, a krave restaurant, obstacle courses, an air basketball court, arcade games, and a bowling alley, will be managed and owned by entrepreneurs Keyur Patel, Manan Patel, and Ashish Kumar.

- In April 2024, Emoji Co. and Unis Technology announced the extension of their partnership for new family entertainment centers and intend to introduce in flagship places in Canada, China, and the USA.

- In April 2024, Dave & Buster's, the ultimate entertainment, restaurant, and sports-watching destination for families and friends, levelled up its food offerings by launching a new dine-in menu with 20 premium food and drink items.

- In December 2023, Cinergy Entertainment announced a Movie & Games membership program called Cinergy Elite Plus.

- In June 2023, TVS Racing announced the launch of its first virtual championship at KidZania Experience Zone. The two-month-long championship will be based on the young riders on racing simulators, assembly zones, and design challenges at TVS Racing experience centers.

- In September 2023, Spectrum Metro, an India-based commercial project, launched a 70,000 sq. ft. family entertainment center. Spectrum Metro is a hub for family entertainment and recreational activities, combining an amusement park and sports activities.

MARKET SEGMENTATION

This research report on the global family entertainment centers market has been segmented and sub-segmented based on demographics, facility size, revenue source, application, type and region.

By Demographics

-

Families with Children (0-8)

-

Families with Children (9-12)

-

Teenagers (13-19)

-

Young Adults (20-25)

-

Adults (Ages 25+)

By Facility Size

-

5,000 sq. ft.

-

5,001 to 10,000 sq. ft.

-

10,001 to 20,000 sq. ft.

-

20,001 to 40,000 sq. ft.

-

1 to 10 acres

-

11 to 30 acres

-

over 30 acres

By Revenue Source

-

Entry Fees & Ticket Sales

-

Food & Beverages

-

Merchandising

-

Advertisement

-

Others

By Application

-

Arcade Studios

-

AR and VR Gaming Zones

-

Physical Play Activities

-

Skill/Competition Games

-

Others

By Type

-

Children’s Entertainment Centers (CECs)

-

Children’s Edutainment Centers (CEDCs)

-

Adult Entertainment Centers (AECs)

-

Location-based VR Entertainment Centers (LBECs)

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East and Africa

Frequently Asked Questions

What is the current size of the global family entertainment centers (FEC) market?

The global family entertainment centers market is expected to be valued at USD 34.6 billion in 2024.

Which regions contribute the most to the global family entertainment centers market share?

North America, Europe, and Asia-Pacific are among the leading contributors to the global family entertainment centers market share, with a diverse range of offerings catering to varied preferences.

How is the COVID-19 pandemic impacting the global family entertainment centers market?

The COVID-19 pandemic initially led to temporary closures and reduced footfall in family entertainment centers. However, the market is adapting with enhanced safety measures, online booking systems, and a renewed focus on cleanliness.

Who are the key players in the global family entertainment centers market?

Dave & Buster’s, CEC Entertainment, Inc., Cinergy Entertainment, KidZania, Scene 75 Entertainment Centers, The Walt Disney Company, Lucky Strike Entertainment, FunCity, Smaaash Entertainment Pvt. Ltd., and LegoLand Discovery Centre are some of the key players in the global market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com