Global Empty Capsules Market Size, Share, Trends and Growth Analysis Report – Segmented By Product (Gelatin and Non-gelatin), Therapeutic Application, End User and Region - Industry Forecast (2025 to 2033)

Global Empty Capsules Market Size

In 2024,the global empty capsules market was valued at USD 2.09 Billion and it is expected to reach USD 4.03 Billion by 2033 from USD 2.25 Billion in 2025, growing at a CAGR of 7.57% during the forecast period.

MARKET DRIVERS

The growing demand for nutraceuticals and dietary supplements is one of the key factors propelling the global empty capsules market growth.

The awareness among people regarding the health benefits associated with the consumption of nutraceuticals and dietary supplements has grown dramatically over the last several years. In addition, the increasing desire from people to maintain a healthy lifestyle is another major factor fuelling the consumption of dietary supplements, which is eventually anticipated to result in the increasing demand for empty capsules. According to the Council for a Responsible Nutrition Survey, in the U.S., more than 170 million people are taking dietary supplements where multivitamins, vitamin D, vitamin C, and Vitamin B/B complex are effective supplements. Usually, dietary supplements and nutraceuticals are delivered as capsules as they are convenient and easy to swallow. However, owing to the benefits associated with empty capsules, such as personalized dosing, easy consumption, and protects the ingredients from environmental factors such as light, moisture, and oxygen, empty capsules are used to encapsulate the dietary supplements. The growing demand for empty capsules from the pharmaceutical industry further promotes the market’s growth rate.

The pharmaceutical industry is the largest consumer group for empty capsules.

The manufacturers of various drugs worldwide run their operations continuously to meet the growing demand from patients. The increase in the pharmaceutical industry is anticipated to result in the growth of the empty capsules market as empty capsules have gained popularity as the convenient and cost-effective delivery option to serve various drugs. In addition, increasing usage of empty capsules in clinical trials and drug discovery is further anticipated to boost the market growth.

The rising adoption of technological developments in the manufacturing of empty capsules is contributing to market growth.

The empty capsules market has experienced several technological developments in the recent past. These developments have improved the efficiency, quality, and safety of manufacturing processes. One such technological development in the empty capsules market is automated capsule-filling machines integrated with the latest technologies such as AI, ML, and robotics. Using automated capsule filling machines, the manufacturers can automate the process of filling capsules with personalized dosing of drugs or supplements. In addition, 3D printing technology is another notable technological development in the empty capsules market. Currently, various shapes, sizes, and release profiles of capsules are manufactured by market participants with the help of 3D printing.

In addition, the growing number of COVID-19 cases worldwide is adding fuel to the growth rate of the empty capsules market owing to the increased need for empty capsules to handle the growing cases. Besides, ongoing research on developing quality empty capsules with support from government organizations accelerates the market's growth rate to an extent. Furthermore, a growing number of chronic incidences worldwide are increasing the demand for empty capsules. In addition, increasing pressure on clinical trial studies to introduce a vaccine for COVID-19 diseases enormously makes the market grow moving forward.

Furthermore, increasing demand for vegan or halal capsules and the growing need for personalized formulations are anticipated to favor the growth rate of the global empty capsules market during the forecast period.

MARKET RESTRAINTS

The shortage of skilled labor in the laboratories and stringent rules and regulations by governmental authorities to approve only high-quality drugs are hampering the growth of the empty capsules market. In addition, the growing availability of other drugs at lower prices and fluctuations in raw materials costs are factors hindering market growth. Furthermore, religious issues are also restraining market growth. Along with this, the lack of knowledge about the usage of these products in rural areas is slowly limiting the empty capsules market's growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.57% |

|

Segments Covered |

By Product, Therapeutic Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leader Profiled |

Capsugel, ACG Worldwide, Suheung Co Ltd., Bright Pharmacaps Inc., Capscanada Corporation, Medi-Caps Ltd |

SEGMENTAL ANALYSIS

By Product Insights

The gelatin capsules segment is expected to grow at a significant CAGR during the forecast period. Factors such as the growing usage of gelatin capsules in the pharmaceutical industry, their easy availability, and the ability to deliver drugs effectively are some major factors propelling segmental growth. In addition, the advantages associated with the gelatin capsules such as the ability to mask unpleasant odors and tastes of certain drugs, their ease of swallowing, and their compatibility with a wide range of active ingredients, are further promoting the growth rate of the segment. Gelatin capsules are widely used capsules to encapsulate dietary supplements and nutraceuticals. The growing demand for dietary supplements and nutraceuticals is anticipated to result in the increasing need for gelatin capsules, which is estimated to fuel the segment's growth rate. Furthermore, the growing geriatric population and increasing adoption of these capsules by older people are contributing to segmental growth.

On the other hand, the non-gelatin capsule segment captured a substantial share of the worldwide market in 2023 and is projected to have the highest CAGR in the coming years. The growing demand for vegan and halal capsules is one of the key factors driving segmental growth. As a result, the major consumers of non-gelatin capsules are vegetarians or people who follow a halal diet.

By Therapeutic Application Insights

The dietary supplements and vitamins segment occupied the largest share of the global market in 2023. The segment is anticipated to grow at a healthy CAGR during the forecast period owing to the rising demand for these supplements due to COVID-19 disease. In addition, rising health awareness, changing lifestyles, and growing health concerns further contribute to the segment's growth rate. Furthermore, factors such as the advantages associated with using empty capsules for dietary supplements, such as ease of consumption and the ability to mask the taste and odor of the supplements, promote the segment's growth.

The antibiotic and antibacterial drugs segments held a substantial share of the global empty capsules market in 2023 and are predicted to grow at a promising CAGR due to increasing incidences of various health problems. The cough and cold preparations segment captured a considerable share of the global market in 2023 and is anticipated to have a steady CAGR during the forecast period.

By End User Insights

The pharmaceutical industry had the largest share of the global empty capsules market in 2023 and is anticipated to showcase a healthy CAGR during the forecast period. The usage of empty capsules is highest in the pharmaceutical industry compared to all the other industries, contributing to the segment’s domination. In addition, factors such as the growing population worldwide suffering from various diseases and the growing number of research and development activities are further anticipated to fuel the segment’s growth rate.

On the other hand, the nutraceutical segment is anticipated to showcase a promising CAGR during the forecast period owing to the growing consumption of nutraceuticals. In addition, the awareness among people regarding the health benefits of nutraceuticals is accelerating their consumption and eventually resulting in the growing demand for empty capsules.

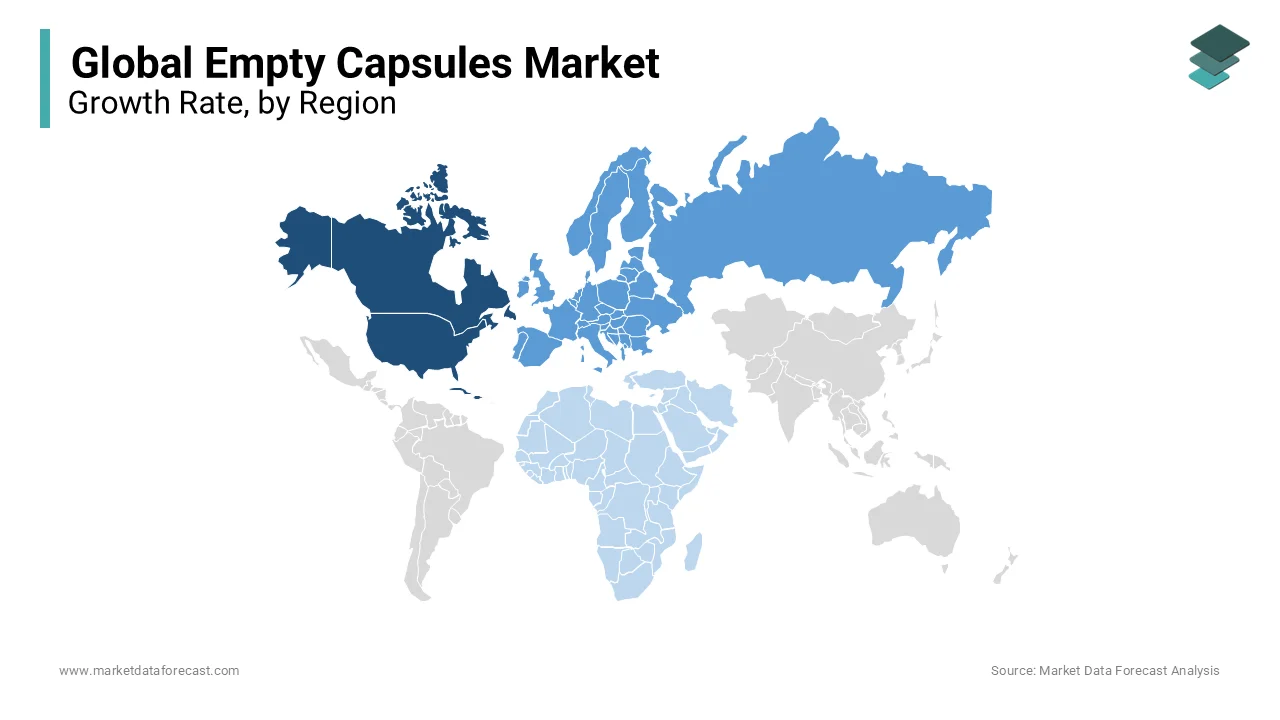

REGIONAL ANALYSIS

North America accounted for the most significant share of the global market in 2023 and is anticipated to continue playing the leading role in the worldwide market during the forecast period. Factors such as the growing pharmaceutical industry, increasing patient population suffering from chronic diseases, and rising consciousness towards health and wellness propel the empty capsules market growth in North America. In addition, the rapid adoption of technological developments and a growing number of product launches are boosting regional market growth. The U.S. led the empty capsules market in North America in 2021, followed by Canada. The growing number of players in the pharmaceutical industry and the easy availability of skilled people in research centers are majorly favoring the U.S market.

Europe accounted for a substantial share of the global market in 2023. During the forecast period, the European market is anticipated to showcase a prominent CAGR owing to its rapid absorption rate and the growing demand for empty capsules. In addition, an increasing number in the patient pool is also a driving factor for the market. Germany and UK occupied over 40% of the share of the European market in 2023 due to the increased support from private and public organizations.

APAC is deemed to have the highest CAGR over the forecast period. India and China are the major countries contributing the most significant share of the regional market. The rising population and growing awareness of empty capsules are leveling up the demand in this market. Besides, constant economic growth in developed countries elevates the market's growth rate in the Asia Pacific.

The Latin American market is estimated to have a considerable share of the global market during the forecast period.

The market in MEA is expected to witness a moderate CAGR in the coming years.

KEY MARKET PLAYERS

Companies playing a leading role in the global empty capsules market are Capsugel, ACG Worldwide, Suheung Co Ltd., Bright Pharmacaps Inc., Capscanada Corporation, Medi-Caps Ltd., Qualicaps, Roxlor, LLC, Snail Pharma Industry Co., Ltd, and Sunil Healthcare Limited.

RECENT HAPPENINGS IN THIS MARKET

- In June 2018, Lonza’s Capsule Delivery Solutions, a leading company in pharmaceutical, launched a new specialty polymer capsule named Capsugel Vcaps. It is a high-quality medicine that extended the company's portfolio in the market.

- In August 2018, Capsugel Colorista was launched by Lonza’s Capsule Delivery Solutions, which is highly unique in compatibility testing. It is a user-friendly capsule where the user can choose a color from a wide array. These are available in the Vcaps® Plus (HPMC) and Coni-Snap® gelatin.

MARKET SEGMENTATION

This research report on the global empty capsules market has been segmented & sub-segmented based on the product, therapeutic application, end-user, and region.

By Product

- Gelatin Capsules

- Non-Gelatin Capsules

By Therapeutic Application

- Antibiotic and Antibacterial Drugs

- Antacid and Ant Flatulent Preparations

- Anti-Anemic Preparations

- Anti-Inflammatory Drugs

- Cardiovascular Therapy Drugs

- Dietary Supplements and Vitamins

- Cough and Cold Preparations

- Other Therapeutic Applications

By End User

- Pharmaceutical Industry

- Cosmetics Industry

- Nutraceutical Industry

- Research Laboratories

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

Which are the significant players operating in the empty capsules market?

Capsugel, ACG Worldwide, Suheung Co Ltd., Bright Pharmacaps Inc., Capscanada Corporation, Medi-Caps Ltd., Qualicaps, Roxlor, LLC, Snail Pharma Industry Co., Ltd, and Sunil Healthcare Limited are some of the significant players operating in the empty capsules market

How much is the global empty capsules market going to be worth by 2033?

As per our research report, the global empty capsules market size is projected to be USD 4.03 Billion by 2033

At What CAGR, the global empty capsules market is expected to grow from 2024 to 2033 ?

The global empty capsules market is estimated to grow at a CAGR of 7.75% from 2024 to 2033

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]