Global Sports Nutrition Market Size, Share, Trends & Growth Forecast Report Segmented By Distribution Channel (Fitness Institutions, Large Retail & Mass Merchandisers, Small Retail, Drug & Specialty Stores, Online), Type (Creatine, BCAA, Protein Powder, Iso Drink Powder, Supplement Powder, RTD Protein Drinks, Protein Bars, Carbohydrate/Energy Bars, Iso & Other Sports Drinks, Carbohydrate Drinks) and and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis (2025 to 2033)

Global Sports Nutrition Market Size

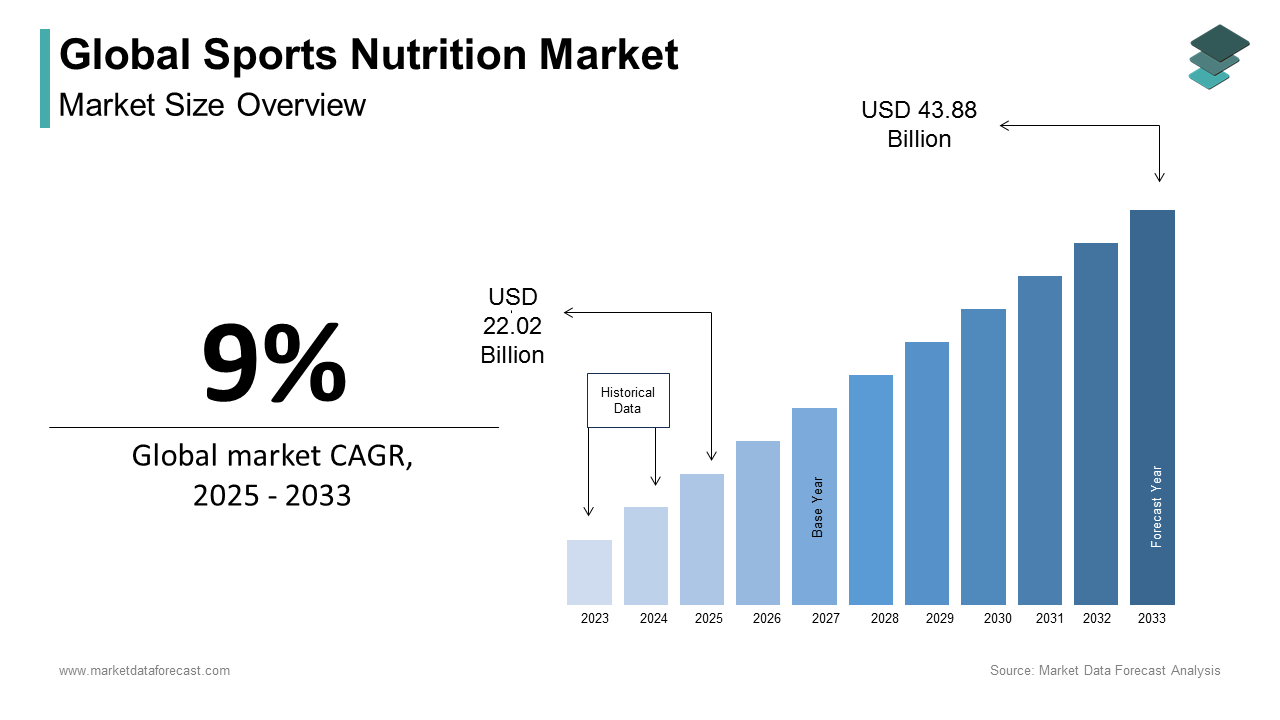

The global sports nutrition market size was valued at USD 20.20 billion in 2024. The global market growth is expected to be worth USD 22.02 Billion in 2025 and is further expected to grow at a CAGR of 9% during the forecast period and reach a value of USD 43.88 Billion by 2033.

Sports nutrition is consumed mainly by athletes to replenish their body water levels. Lifestyle and recreation users are increasingly favoring these products. Sports nutrition plays a vital role in enhancing the strength of athletes as it comprises various minerals, vitamins, supplements, and so on, produced by proteins, carbohydrates, and fats. Sports nutrition products comprise supplements, protein drinks, carbohydrate drinks, protein bars, carbohydrates/energy, protein powder, isotonic powder drinks, capsules/tablets, and other supplements. These products are developed and consumed by athletes and bodybuilders to improve overall health, performance, and muscle growth. Bodybuilders are the leading users of sports supplements, which include energy bars and drinks, protein bars, and dietary supplements made with ingredients like creatine, caffeine, linoleic acid, and taurine.

MARKET DRIVERS

Lifestyle Changes and Increased Demand from Recreational User Groups

The rising number of health clubs and gyms and increasing health awareness are expected to drive the global market expansion over the forecast period. In addition, rapid urbanization and rising disposable incomes are influencing people to purchase sports nutrition products and the growing adoption of healthy snacks, which are likely to accelerate the growth of the sports nutrition market. Athletes and bodybuilders have been the leading consumers of sports nutrition products worldwide, but they have been widely adopted among lifestyle users. Developing countries have enormous growth potential in sports nutrition products due to increased disposable income and a high proportion of young people. The escalating demand for nutritional products that contain plant-based ingredients and are rich in immunity-boosting ingredients and protein content drives global market growth. The growing adoption of sedentary lifestyles inducing chronic diseases is majorly allowing people to adopt physical activities and sports; rising demand for sports nutrition is propelling the expansion of the global market size.

The growing participation in sports among the younger population across the globe is enhancing the demand for sports nutrition worldwide, leading to market growth. Sports nutrition includes protein powders, energy bars, and beverages essential for athletic performance. Fats, carbohydrates, and proteins support maintaining energy levels, so sports nutrition is highly adopted among consumers. The growing awareness regarding the advantages of sports nutrition and continuous investments by the market players in developing innovative, efficient, and healthy nutritional products required by the sports people is estimated to augment the global market share growth. The accelerating demand for clean and efficient labeled products will escalate the adoption rate globally with increased market growth opportunities.

MARKET RESTRAINTS

Availability of Counterfeits at an Affordable Price

These products do not meet food safety standards, and high levels of counterfeit products affect the sales of reputable companies and disrupt the market position. Therefore, the availability of these products and limited food safety standards will hinder the market expansion. The limited awareness and presence of alternatives and consumers choosing natural and organic consumption of protein, fats, and carbohydrates through vegetables, fruits, and other sources are estimated to impede the market growth opportunities during the forecast period. Another factor restraining market growth is the high cost of premium products, which may restrict access to low-income people's incomes. The presence of specific side effects associated with the continuous consumption of these products, such as nausea, insomnia, and headaches, will limit the adoption of sports nutrition, leading to limited market expansion.

MARKET OPPORTUNITIES

Easy Accessibility of Nutritional Supplements

E-commerce has increased sales of these products, especially in emerging economies such as India, China, and Brazil. In addition, various companies in the market are starting their businesses through digital platforms to increase their share. In developed countries, a high proportion of the obese population is driving the market. Moreover, as the number of youths with a career in the sports sector increases, the demand for sports nutrition products is increasing. It is expected to fuel this market within the scheduled period with a substantial increase in national and international sporting events. The growing research activities to develop innovative and effective formulations are expected to fuel the market growth opportunities in the forecast period. Manufacturers' rising introduction of new flavors and products is gaining traction among consumers, which will positively impact the market's growth worldwide in the coming years.

MARKET CHALLENGES

The huge competition among the market players requires continuous efforts from the manufacturers to introduce various innovative products, which is a challenge for them. Most sports people prefer something other than sports nutritional supplements due to potential dangers like the presence of illegal or banned substances, inaccurate ingredient amounts, and false claims about health, which are expected to limit the market expansion possibilities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9% |

|

Segments Covered |

By Type, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Iovate Health Sciences, Abbott, Quest Nutrition, MusclePharm Corporation, B.A. Sports Nutrition, Cardiff Sports Nutrition, Orgain, Cliff Bar & Company, Glanbia plc, and General Nutrition Centers Inc. |

SEGMENTAL ANALYSIS

By Type Insights

Sports supplements had the largest revenue share in the global sports nutrition market. These supplements include BCAA, Creatinine, which belongs to the amino acids category, protein powder, ISO drink powder, and supplement powder, which belongs to the protein content category. The protein powder segment held the prominent CAGR due to increased awareness regarding healthy and nutritional supplements for fitness, and health is driving the segment's growth. The growing number of gyms and fitness clubs globally is fuelling the segment's growth with a comprehensive adoption rate.

The sports food sector, which includes protein bars and energy bars, is expected to grow fastest during the forecast period. Escalation of product launches, ease of availability, and ease of carrying are gaining traction among consumers, which is estimated to augment the market growth in this segment. For Instance, Bodybuilding.com launched its own private labeled line of protein crunch bars, available in two flavors: chocolate peanut butter and cookies and cream.

By Distribution Channel Insights

The fitness institutions segment dominated the global sports nutrition market revenue with a significant market share. The increasing number of fitness institutions globally and rising awareness among consumers regarding health and well-being contribute to the segment's growth. Most consumers prefer to visit and select the standard product required for their body, and the professionals in these institutes guide the consumers in choosing the right product. These factors are driving the segment growth, leading to global market expansion.

Large retail and specialty stores are estimated to have steady growth rates during the forecast period due to the presence of various products in one place, allowing consumers to choose easily. The online segment is estimated to have the fastest growth during the forecast period due to consumers' increased adoption of digital platforms for shopping. Online retailers are providing various offers with products and brands, which is gaining traction among consumers, leading to higher adoption, which will augment the market growth in the forecast period.

REGIONAL ANALYSIS

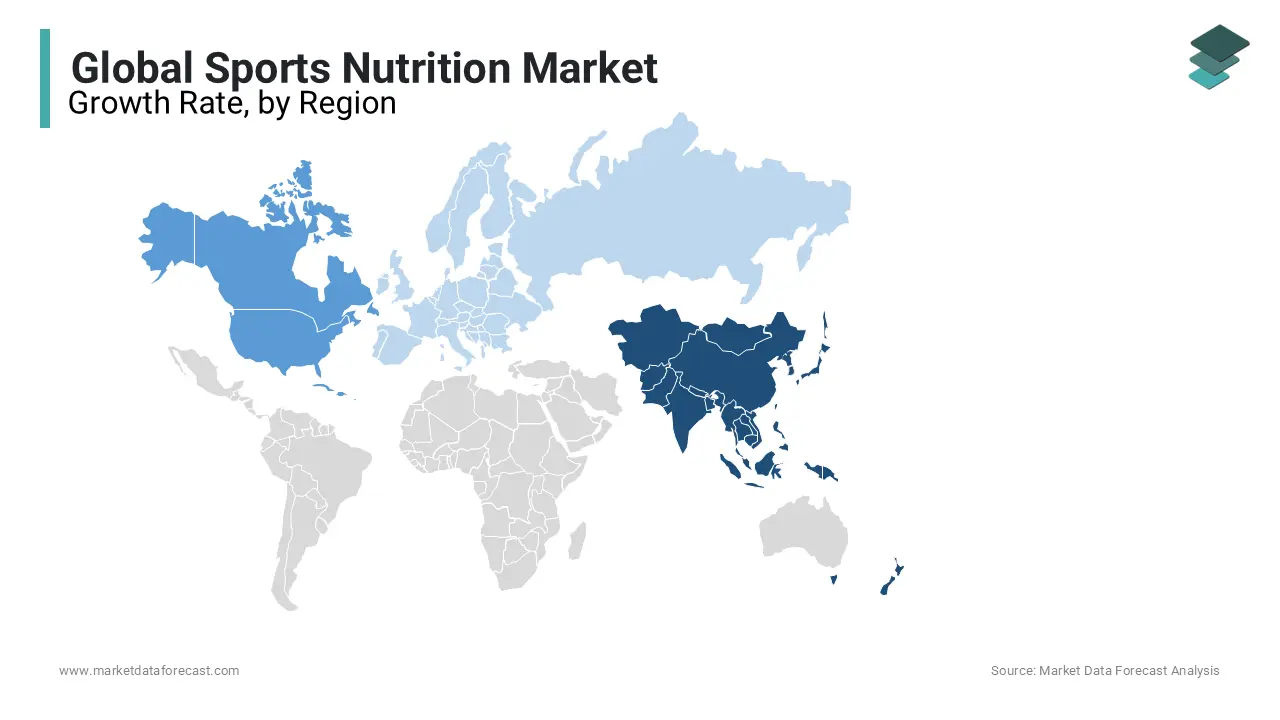

The Asia Pacific region dominated the global sports nutrition market with a significant market share in 2023 due to increasing awareness among people regarding health and well-being. The escalating product launches and increasing sports activities across the region, majorly in countries like India and China, are boosting the market growth opportunities in the region. Digital infrastructure has been enhanced in emerging countries such as India and China, providing significant opportunities for online platforms to promote the sale of sports nutrition products. Besides, various initiatives taken by the governments of China, Japan, Singapore, Malaysia, and India to increase their participation in sports are expected to lead the regional market during the forecast period. In October 2023, in India, Steadfast Nutrition, a sports and wellness nutrition-focused company, announced the launch of their campaign 'Make India Protein Efficient' to acknowledge the solutions to focus on the nation's protein deficit.

North American region held second in the global sports nutrition market, with a prominent market share in 2023. Government initiatives promoting an increasing number of gyms and fitness centers and rising sports-related activities across the region drive the demand for sports nutrition products, leading to regional growth. Furthermore, the number of new product launches in the sports supplement category is increasing, and the presence of the key market players in the United States and Canada are some of the key factors driving the growth of the regional market.

The number of athletes in Europe is expected to increase significantly, and the demand for supplements will increase, leading to the local market's growth. Also, several companies in the region offer sports supplements through online channels. However, in recent years, European people have started consuming sports supplements to maintain a healthy lifestyle and control weight, driving market growth.

KEY MARKET PLAYERS

Major players in the global sports nutrition market include Iovate Health Sciences, Abbott, Quest Nutrition, MusclePharm Corporation, B.A. Sports Nutrition, Cardiff Sports Nutrition, Orgain, Cliff Bar & Company, Glanbia plc, and General Nutrition Centers Inc.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Sirio Europe launched two new collagen gummies made explicitly for sports nutrition.

- In February 2023, Olly launched two products, Post-game recovery gummy rings and Pre-game energize gummy rings for the fitness community.

- In January 2022, Hydroxycut, a sports nutrition brand under its parent company, Lovate Health Science, launched "Cut," an energy drink that helps reduce consumers' body fat.

- In April 2022, Abbott released limited quantities of metabolic nutrition formulas to satisfy nutritional needs with the approval of the U.S. FDA. These products are anticipated to boost market growth opportunities.

- In 2018, Amazon launched the private-label sports assistant brand "OWN PWR" for American consumers.

- In 2017, CytoSport, Inc., a subsidiary of Hormel Food Corporation, launched Muscle Milk Protein Bar as an extension of its current sports nutrition division.

- 2017, the vitamin store launched brand-defined stores in nine locations, increasing customer engagement and improving the overall experience.

- NOW Sports, in 2018, alongside Informed Sports, a third-party certification provider, worked on the identification of prohibited substances in its products. These certifications help companies build consumer confidence and improve brand reputation.

- Momentous, a start-up in sports nutrition, introduced its first line of NSG-approved protein powders in 2017. The line comprised AbsoluteZero, ArcFire, and RedShift.

- In 2016, Klean Athlete launched Klean Creatine to help athletes gain muscle mass, increase endurance, and regain fatigue.

MARKET SEGMENTATION

This research report on the global sports nutrition market has been segmented and sub-segmented based on type, distribution channel, & region.

By Type

- Creatinine

- BCAA

- Protein Powder

- ISO Drink Powder

- Supplement Powder

- RTD Protein Drinks

- Protein Bars

- Carbohydrate/Energy Bars

- Carbohydrate Drinks

- ISO & Other Sports Drinks

By Distribution Channel:

- Fitness Institutions

- Large Retail & Mass Merchandisers

- Small Retail

- Drug & Speciality Stores

- Online

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What challenges does the sports nutrition market face?

Challenges include concerns about the safety and efficacy of certain supplements, evolving regulatory standards, and the need for education to help consumers make informed choices about their sports nutrition regimen.

2. How is the sports nutrition market expected to evolve in the future?

The market is expected to continue growing, driven by increasing health and fitness awareness, technological advancements in product formulations, and a focus on personalized nutrition catering to individual needs and preferences.

3. How is the sports nutrition market influenced by trends in clean labeling and natural ingredients?

There is a growing demand for sports nutrition products with clean labels and free from artificial additives. Manufacturers respond by incorporating natural ingredients and avoiding unnecessary additives in their formulations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]