Global Infant Nutrition Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Infant Milk Formula, Follow-Up Milk Formula, Growing Up Milk Formula, Specialty Baby Milk Formula), Formulation (Powder, Liquid Concentrate, Ready to Feed), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis (2025 To 2033)

Global Infant Nutrition Market Size

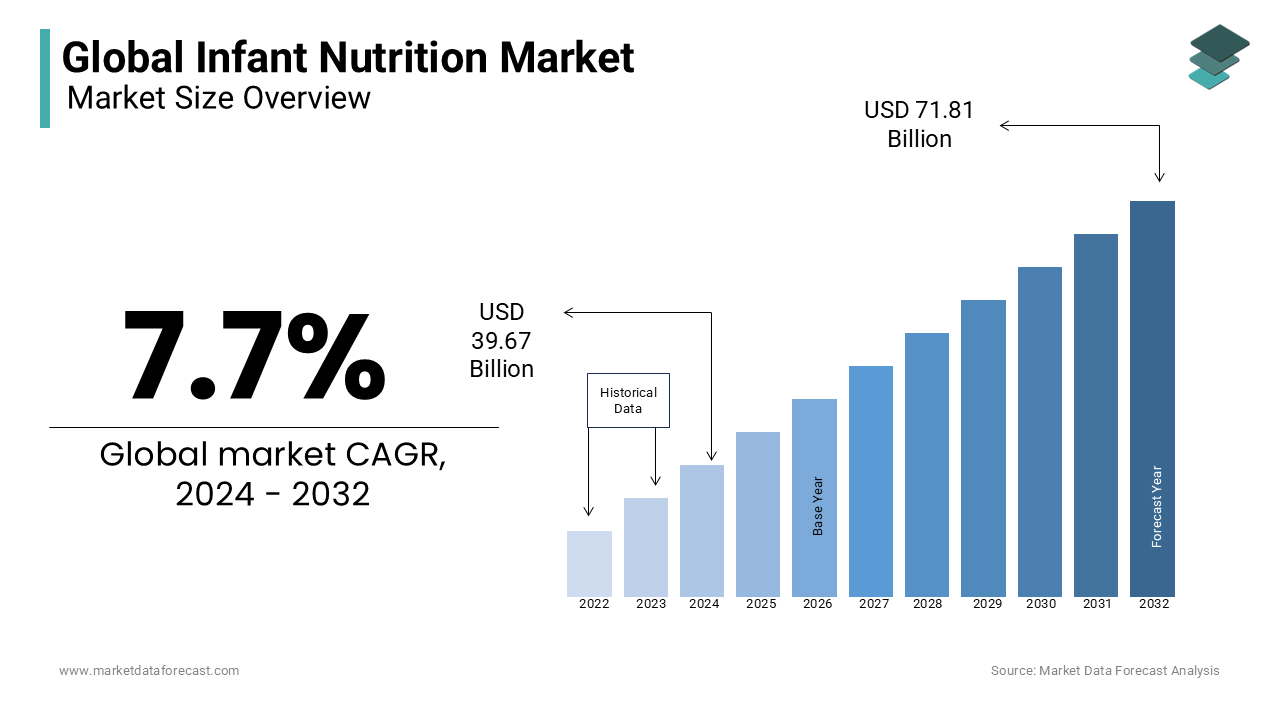

The Global Infant Nutrition Market size was worth US$ 39.67 billion in 2024, and is anticipated to be worth USD 77.33 billion by 2033 from USD 42.72 billion In 2025, growing at a CAGR of 7.70% during the forecast period.. Nutrition is one of the most important factors affecting children's development and growth

The infant nutrition market is made up of a wide range of products, from baby formulas to baby food. Infant nutrition is generally produced to feed babies under 12 months of age and is made in liquid or powder form. Infant nutrition promotes healthy growth and development of babies, improves cognitive ability and progress, prevents allergies, and increases gastrointestinal health and immunity. Child Nutrition is a personalized nutritional blend designed to enhance the overall nutritional value of child nutrition products, including vitamins (primarily vitamin D), minerals, amino acids, and nucleotides. Infant nutrition is a substitute for breast milk. The first six months after birth play a vital role in the development of the child, and the most important thing is to ensure optimal nutrition during this period. Breast milk is considered nutritious, and it contains carbohydrates, proteins, minerals, fats, and vitamins that are essential for children's development. However, in some cases, the mother may not be able to make breast milk or breastfeed for other reasons. In a few instances, infant nutrition products act as suitable substitutes.

One of the main factors that are expected to support this market growth is an increase in the number of women that joined the postpartum workforce, mothers are unable to consume lactates, and fathers seeking additional sources of nutrition for their babies will promote the sale of ingredients in the coming years.

MARKET DRIVERS

Nutrients help babies to grow and develop, improve cognitive abilities and development, prevent allergies, and improve gastrointestinal health and immunity.

There are certain factors that drive market growth, such as increasing workforce, increasing spending on children's health, and growing demand for organic baby food. Parents currently spend more on their babies compared to the previous year due to various social factors. Children are now considered more protected than before. According to many surveys, parents spend a lot of money on babies, sometimes with guilt, shame, and social anxiety. In recent years, the number of young working mothers has increased significantly. It has been a critical factor in promoting the growth of the global infant food nutrition market. This is because working mothers rely primarily on processed infant nutrition products. Therefore, organic food is one of the fastest-growing sectors in the food industry and has experienced double-digit growth in most developed markets compared to the single-digit growth rate of conventional food.

Global demand is increasing due to factors such as parents' desire to provide healthier foods for their babies. In addition, in many developing markets, factors such as the growth of the middle class, rapid urbanization, and the higher participation rate of women in the labor force have led to the adoption of convenience-oriented lifestyles, making make baby food and infant formulas even more. The growing middle-class population in emerging and developing countries has broken new ground in the infant nutrition market as the need for products compatible with working mother hours increases. In the coming years, the global infant nutrition market is anticipated to show healthy growth. In recent years, sales of infant nutrition products in developed countries have experienced single-digit growth rates.

MARKET RESTRAINTS

For the limited use of ingredients in baby food, the low fertility rate of the government and food department and strict quality controls may hamper the infant nutrition market.

Additionally, barriers to market entry are regulatory hurdles associated with obtaining approvals for infant formula and food manufacturing.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.7% |

|

Segments Covered |

By Type, Formulation, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Ausnutria Hyproca, Abbott Laboratories, Bristol-Myers Squibb Company, Glanbia plc, Pfizer, Inc, GlaxoSmithKline plc, Mead Johnson, Nestlé S.A, Perrigo Nutritionals, and Danone Nutricia |

SEGMENTAL ANALYSIS

Global Infant Nutrition Market Analysis By Type

The infant milk formula segment is gearing up with the highest share of the market. This growth is attributed to increasing awareness among parents over the availability of natural or organic products that are completely safe for newborn babies. The trend towards promoting good health and well-being of babies with the best nutritional formula milk is sustainable and can elevate the growth rate of the market. The clear acceptance among parents to safely use formula milk for babies with the launch of modern feeding bottles is also attributed to the escalating growth rate of this segment.

Specialty baby milk formula is gearing up to have a steady growth rate during the forecast period 2024-2032. Babies suffering from various illnesses or any specific feeding issue can greatly utilize this specially made baby formula with added vitamins and nutrients. This is so effective for sensitive babies that it helps in improving their wellbeing. This product is not the same as the regular infant milk formula that can be given to everyone. Pediatricians prefer this product only for special babies who might have preterm birth and have suspected food allergies.

The rising expenditure on the health of babies with utmost care and parents’ consciousness to choose the best for their children are all enhancing the growth rate of the market to an extent.

Global Infant Nutrition Market Analysis By Formulation

The powder segment is leading with the dominant share of the market. The powder can be mixed with water that can be readily mixed within no time. This is more effective than any kind of formulation, and it is highly recommended by healthcare providers as well. Women who are not able to breastfeed due to various reasons completely depend on powdered formula milk for infants, which is cost-effective and provides necessary nutrients for the baby. According to the National Institute of Health, 70% of infants receive infant formula milk as their first feed in China, where the prevalence increases gradually every month. This prevalence indicates that the demand for the powder formulation segment will rise in the coming years as well

REGIONAL ANALYSIS

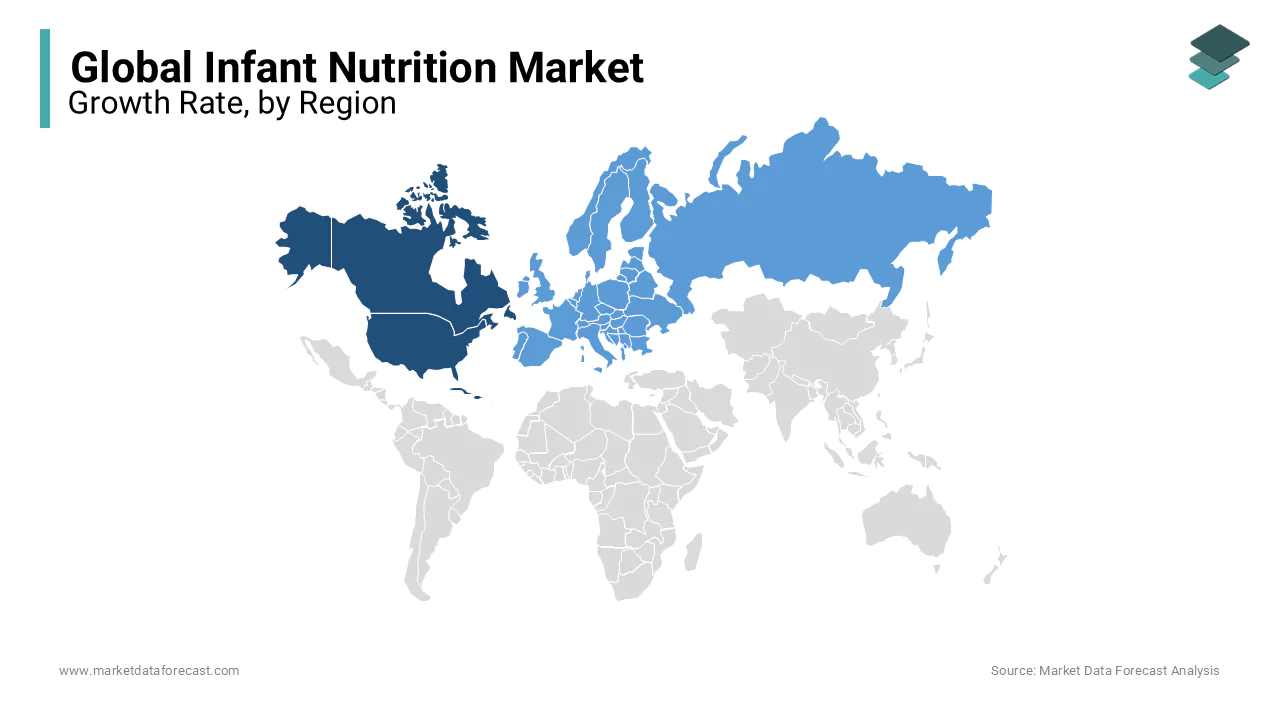

In terms of geography, North America occupies the largest market in terms of sales. Factors such as high disposable income, the presence of large companies in the region, and well-developed pharmaceutical and biotech industries are attributed to market growth in the area. Along with increased awareness and disposable income, high per capita health expenditures are contributing to the growth of the regional market. The average age of American women is growing as young women increasingly prioritize their careers over family planning. As a result, parents' interest in baby health and nutrition is driving the growth of the North American market.

Furthermore, consumers in developed countries are willing to pay a higher amount for their products due to the general perception of healthier and safer products than traditional products.

Europe is the second-largest market for infant formula due to its excellent manufacturing facilities and high energy consumption per baby. The Asia Pacific region is foreseen to show the highest growth rates in the coming years. Factors such as the growth of the baby boomer population, the increase in disposable income and high urbanization contribute to the growth of the Asia Pacific market. It is also a leader in emerging markets with slowing sales in developed countries. China's massive population base and rapidly growing consumers with increasing purchasing power are highly attractive to multinational brands. However, in 2008, the baby and toddler melamine issue still dominated the market and created an environment in which consumers care about the health and safety of babies.

KEY PLAYERS IN THE GLOBAL INFANT NUTRITION MARKET

Major Key Players in the Global Infant Nutrition Market are Ausnutria Hyproca, Abbott Laboratories, Bristol-Myers Squibb Company, Glanbia plc, Pfizer, Inc, GlaxoSmithKline plc, Mead Johnson, Nestlé S.A, Perrigo Nutritionals, and Danone Nutricia.

RECENT HAPPENINGS IN THE MARKET

- January 2019: An Arla Foods Amba subsidiary called Arla Foods Ingredients introduced a new infant formula called Easy Digest Whey Protein. The company aims to reduce gastrointestinal problems by changing the amount of protein used.

- September 2019: Researchers from the Technical University of Denmark and the University of Kyoto have found a new infant formula that is as good as breast milk. It contains the same sugar and can be administered to children who are not breastfed.

- BASF (Germany) and GlycoSyn (USA) have formed associations focused on child nutrition. This included the development and commercialization of human milk oligosaccharides (HMO).

- In 2019 BASF launched the first PREBILAC 2'-FL HMO for the infant nutrition market. Therefore, many essential companies participate, and the market is very competitive.

DETAILED SEGMENTATION OF GLOBAL INFANT NUTRITION MARKET INCLUDED IN THIS REPORT

This research report on the global infant nutrition market has been segmented and sub-segmented based on type, formulation, & region.

By Type

- Infant Milk Formula

- Follow-on Milk Formula

- Growing Up Milk Formula

- Specialty Baby Milk Formula

By Formulation

- Powder

- Liquid Concentrate

- Ready to Feed Formula

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the current trends driving growth in the infant nutrition market?

The market is witnessing a shift towards organic and natural baby food products due to increased consumer awareness regarding health and wellness. Demand for innovative packaging solutions such as pouches and easy-to-use containers is rising, catering to busy parents looking for convenience.

2. How are regulatory changes impacting the infant nutrition market?

Stringent regulations and guidelines regarding labeling, safety, and nutritional content of baby food products are influencing product development and marketing strategies. Increased scrutiny of marketing practices and health claims for infant nutrition products is pushing companies to ensure transparency and compliance with regulations.

3. What are the current trends driving growth in the infant nutrition market?

The market is witnessing a shift towards organic and natural baby food products due to increased consumer awareness regarding health and wellness. Demand for innovative packaging solutions such as pouches and easy-to-use containers is rising, catering to busy parents looking for convenience.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com