Global Milk Market Size, Share, Trends, & Growth Forecast Report - Segmented By Product Type (Skimmed Milk Powder, Liquid Milk, Whey Protein, Whey Milk Powder, Yogurt, Cheese, Butter, Others), Distribution Channel (Convenience Stores, Supermarkets & Hypermarkets, Online And Others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Milk Market Size

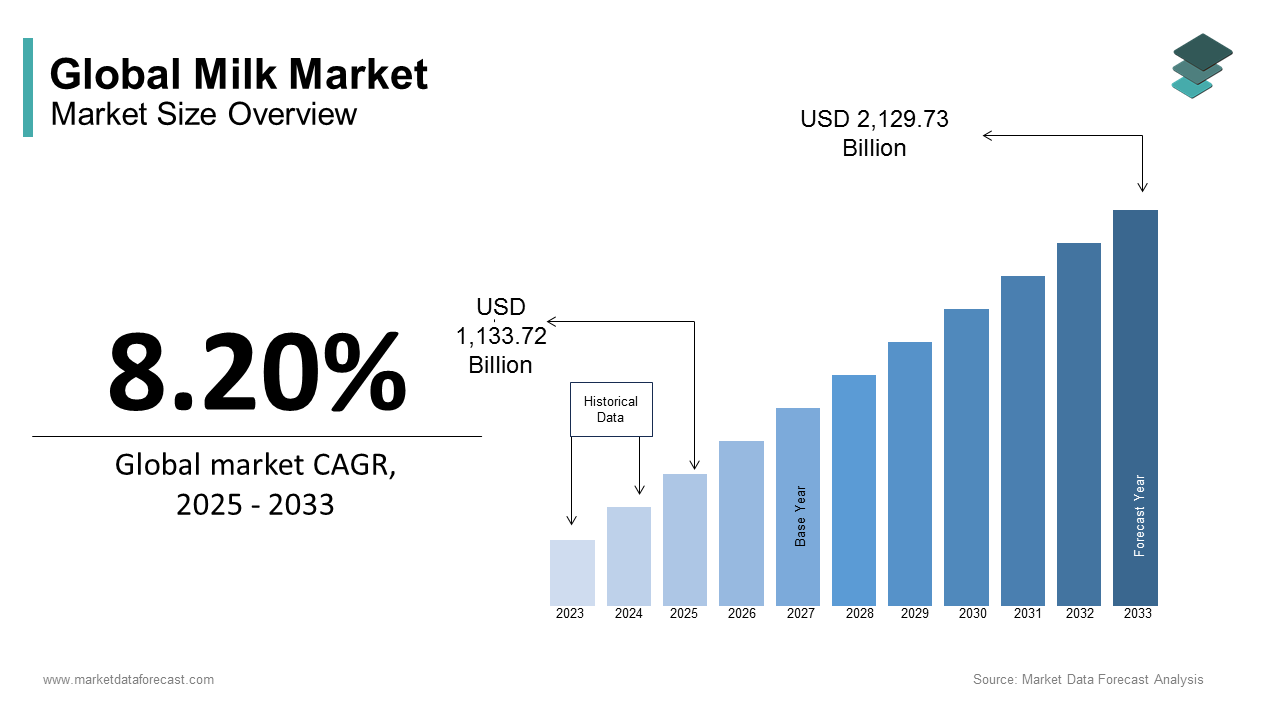

The global milk market was expected to be worth USD 1,047.80 Billion in 2024 and is anticipated to be worth USD 2,129.73 billion by 2033 from USD 1,133.72 billion In 2025, growing at a CAGR of 8.20% during the forecast period.

Milk is one of the first categories of food adopted by humanity and is considered an important part of human nutrition. Milk is defined as a company that deals with the processing and collection of animal milk for human consumption. Common dairy animals include cattle, goats, buffalo, camels, and sheep. The milk obtained from these animals can be consumed directly and transformed into ice cream, cheese, butter, condensed milk, and yogurt. These products provide a variety of nutrients, such as calcium, protein, zinc, magnesium, vitamin D, and B12. The health benefits associated with milk motivated the population of all sectors to consume dairy products. Milk is considered a packet of essential nutrients for the human body and is highly recommended as a source of calcium and healthy fats. The growing demand for milk products is driven by a growing population, higher income levels, and increased health awareness.

MARKET DRIVERS

With the wide demand for dairy products and an active role in the global food industry, milk plays an important role in the growth of the world economy.

Over the years, the milk industry has improved product safety through specialization, modernization, and integration. Also the development of world trade has also affected the profitability of dairy farms. Farmers now have easy access to advanced technologies that help quantify information to monitor a variety of tasks, such as turf and livestock management. Apart from this, a variety of robotics, smartphone data applications, satellite systems, and drones are also available on the market to help farmers make profitable and efficient decisions. Additionally, there is a growing demand for clean-label products that are free of additives, artificial preservatives, or chemicals. This requires manufacturers to expand their product portfolio with the introduction of organic dairy products. Greater efficiency and use of concentrated feed in large dairy farms. The farm consolidation process continued, including moving the farms away from watercourses and city centers, guided by current regulations to control environmental damage. Dairy is an important part of the rural economy of developing nations like India and is an important source of employment and income. However, the milk production per animal is considerably lower compared to other large milk producers. The nutritional benefits of dairy products are one of the main drivers of growth in the global dairy market. The rich vitamins, minerals, and proteins present in milk make dairy products essential for humans. For example, the calcium content of milk is an important part of infant nutrition because it helps develop healthy bones and teeth in young children.

Additionally, vitamin D reduces the risk of cancer prevention, potassium lowers blood pressure and improves heart health, and fermented milk acts as a source of probiotics that improve gut health. Changes in consumer thinking have brought about a number of changes. Lifestyle changes have led to an increase in demand for value-added dairy products compared to the base product, fluid milk. Consumers are becoming more health-conscious, and the value-added dairy industry is showing little growth. As Indians' consumption capacity increases, so does their willingness to buy healthier superfoods that we call value-added products. The value-added products in the dairy industry are “cheese, saddlebags, ghee, yogurt, and probiotic drinks. The high nutritional value of fermented dairy products is driving sales of yogurt cakes and other dairy desserts. The global milk market is mainly dominated by the butter sector, followed by the cheese and saddlebags sector. The yogurt and dairy desserts segment is expected to grow faster around the world. Other factors responsible for the growth of the milk market include increased consumer spending, population growth, and consumer preference for nutritious foods. The dairy sector and the growing demand for milk-based ingredients are some of the key factors supporting the growth of the market. This could be due to population growth, rising incomes, health awareness, and a thriving food and beverage industry. Another important trend in the industry is the integration of automation technology into dairy farms.

MARKET RESTRAINTS

The growing vegan and vegetarian preferences of the vegetarian population are limiting the consumption of dairy. Lactose intolerance, milk sensitivity, consumer migration to plant foods, and misconceptions related to milk consumption are major limitations in the milk market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.2% |

|

Segments Covered |

By Product Type, Distribution Channel And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Dean Foods, Royal Friesland Campina N.V, China Mengniu Dairy Company Limited, Arla Foods, Kraft Foods Group, Inc., Land O'Lakes Inc., Yili Group, Meiji Dairies Corporation |

SEGMENTAL ANALYSIS

Global Milk Market Analysis By Product Type

Liquid milk is an important dairy product, and the demand for liquid dairy products is growing rapidly as consumer awareness of health and living standards increases. Babies are one of the main drivers in the market for infant formula and baby milk. The global market for infant nutrition reached 2.5 million in 2019 and is expected to grow more than 7% in the next ten years. The increase in milk supply is also supporting the growth of the sector. In most countries, including the densely populated India and China, milk is considered an important part of a healthy diet. Liquid milk accounts for more than 90% of the demand for dairy products in rural areas and more than 85% of urban areas in India.

Global Milk Market Analysis By Distribution Channel

The supermarkets and hypermarkets accounted for almost 50% in terms of sales value in 2018. The strategy of the manufacturer's retail market to reach retail stores is driving sales through supermarkets and hypermarkets. Convenience stores, specialty stores, and e-commerce also account for a significant portion of dairy product sales.

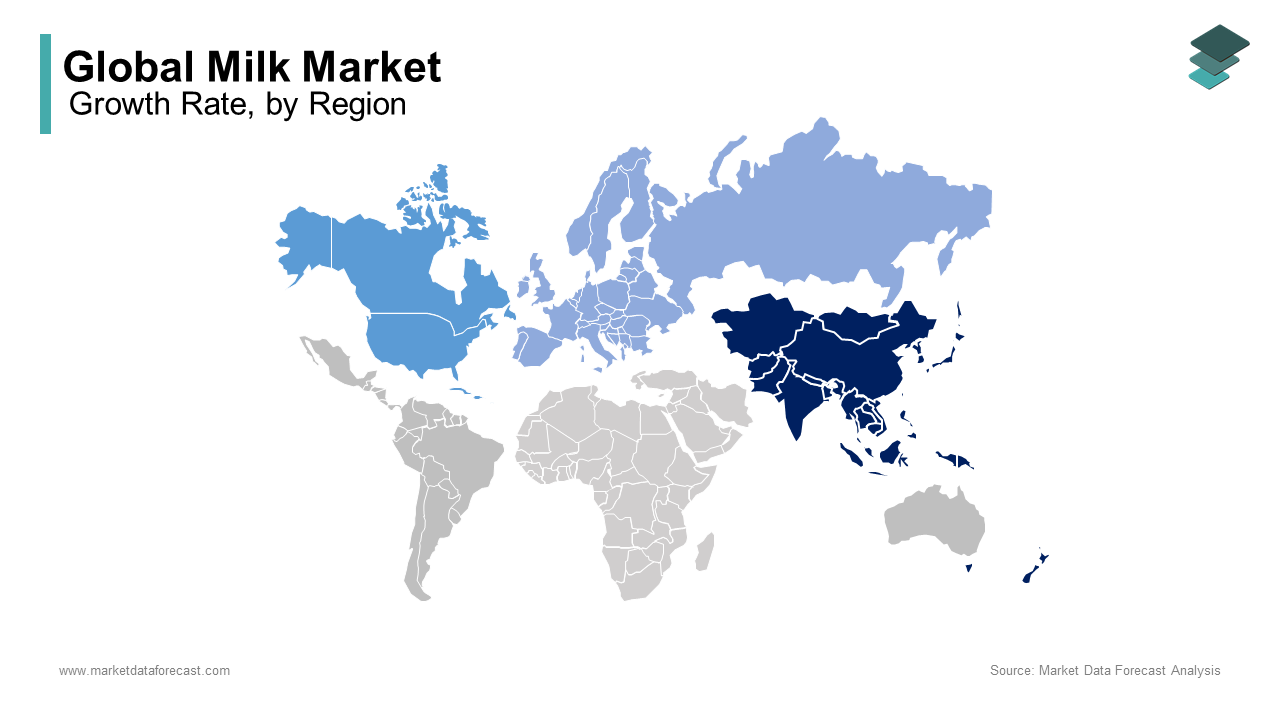

REGIONAL ANALYSIS

In developing countries in Asia Pacific and Europe, dairy product sales account for more than 50% of worldwide sales. This Western market is experiencing a high growth rate mainly due to product innovation and increased consumer health awareness. In the Asia Pacific region, India dominates the market, followed by China and Australia, and demand in Europe is driven by countries such as Belarus and Ukraine. For example, modernization has created business opportunities to reduce greenhouse gas emissions, improve milk quality, and process local dairy products. The Asia-Pacific region has become the largest dairy market due to strong dairy sales in China and rapidly increasing demand for fermented dairy products in India and Indonesia. Asia Pacific's share of the overall dairy market reached 36% in 2019 and is likely to remain dominant during the forecast period as dairy sales are highly profitable at double digits in countries such as Pakistan, Vietnam, India, and Laos.

KEY PLAYERS IN THE GLOBAL MILK MARKET

Major Key Players in the Global milk market are Dean Foods, Royal Friesland Campina N.V, China Mengniu Dairy Company Limited, Arla Foods, Kraft Foods Group, Inc., Land O'Lakes Inc., Yili Group, Meiji Dairies Corporation

RECENT HAPPENINGS IN THE MARKET

- In January 2019, French dairy company Lactalis continued on its way towards the goal of becoming a guilty company by acquiring India-based Prabhat Dairy for $ 23 million to gain a leading market share in West India.

DETAILED SEGMENTATION OF THE GLOBAL MILK MARKET INCLUDED IN THIS REPORT

This research report on the global milk market has been segmented and sub-segmented based on product type, distribution channel, and region.

By Product Type

- Skimmed milk powder

- Liquid milk

- Whey protein

- Butter

- Whey Milk Powder

- Yogurt

- Cheese

- Others

By Distribution Channel

- Convenience Stores

- Supermarkets & Hypermarkets

- Online and Others

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

1. What are the current trends in the milk market?

Trends in the milk market include the rising popularity of plant-based milk alternatives, increasing demand for organic and specialty milk products, growing consumer preference for fortified and functional milk, and the emergence of sustainable and ethical dairy practices.

2. What factors are driving the growth of the milk market?

Factors driving growth include population growth, urbanization, rising disposable incomes, growing awareness of the health benefits of milk consumption, and increasing demand for dairy products in emerging markets.

3. What are the emerging opportunities in the milk market?

Emerging opportunities include developing value-added milk products with added functional ingredients, expanding into new distribution channels like e-commerce, and leveraging technology for precision farming and dairy management.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com