Global Dairy Products Market Size, Share, Trends, & Growth Forecast Report – Segmented By Application (frozen Food, Bakery And Confectionery And Clinical Nutrition), Type (lactose Free Milk, Cream And Frozen , Cheese, Yoghurt, Butter, Buttermilk, Ice Cream And Others), And Region (North America, Europe, Asia Pacific, Latin America, And Middle East & Africa) - Industry Analysis (2025 To 2033)

Global Dairy Products Market Size

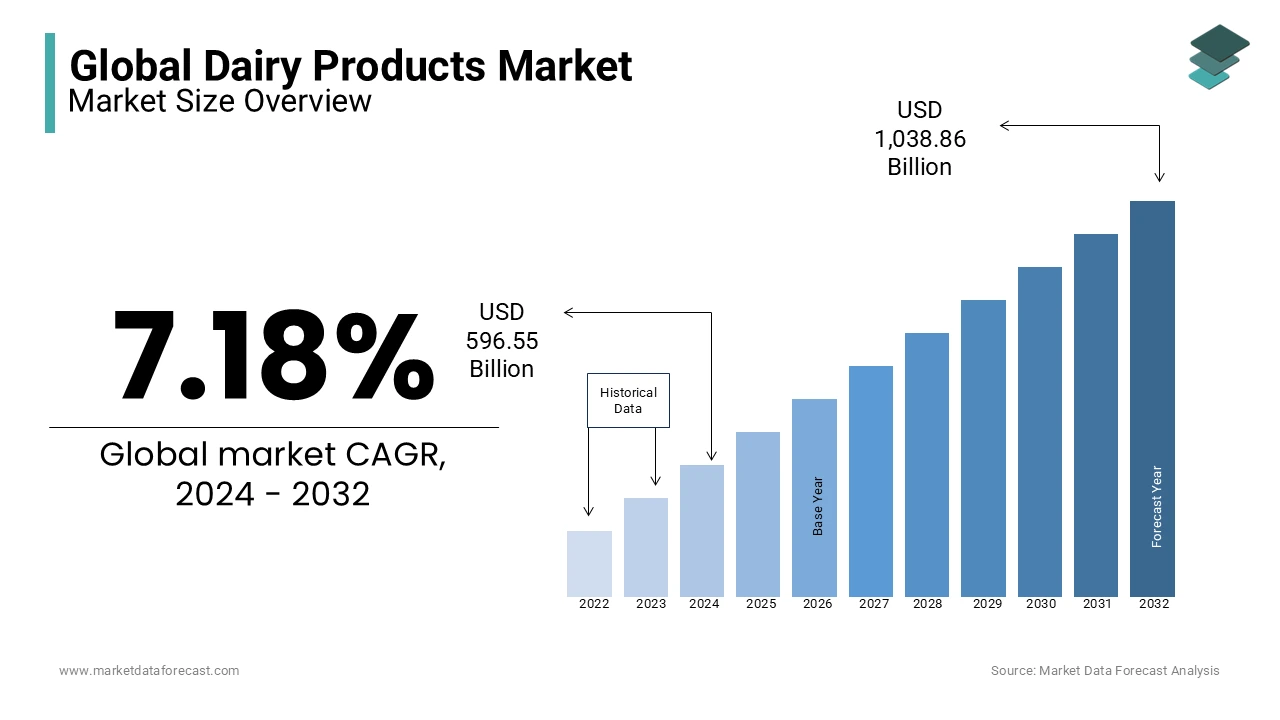

The size of the global dairy products market was valued at USD 596.55 Billion in 2024. The global market is expected to grow at a CAGR of 7.18% from 2025 to 2033 and be worth USD 1.13 trillion by 2033 from USD 639.38 billion in 2025. The dairy industry is among the most dynamic markets around the world and is multiplying in almost all demographics.

The dairy industry is mainly made up of companies that operate selling milk, cheese and butter products. Dairy industry operators mainly produce products like yogurt, pasteurized milk, cream, and concentrated and evaporated milk. The dairy industry also manufactures alternative dairy products made from soy and other non-dairy ingredients. The dairy industry was particularly volatile due to fluctuating crude oil prices and the economic downturn. Dairy products and beverages, essential elements of our diet, are in high demand and are expected to continue to do so over the outlook period. Because many manufacturers around the world address the needs of the health-conscious public, low-fat, lactose-free, and cholesterol-free dairy products have been marketed. Due to the increased consumption of milk and the environmental benefits associated with commodities, the global demand for dairy products is increasing significantly.

MARKET DRIVERS

The global dairy products market is expected to grow significantly over the prediction period.

The demand for milk and dairy products like cheese and butter increases every day as the world population increases. Global population-based growth, growth in per capita income, increased consumer awareness of the nutritional value of dairy products, and changes in consumer diet patterns are key drivers of market growth. Advanced technology is needed to meet these needs by increasing milk handling capacity and maintaining product quality. In addition, technological advances and innovations to obtain more milk from dairy animals are also expected to accelerate market growth. The use of technologically advanced transportation to maintain the efficiency and quality of dairy products during long-distance exports is also supposed to accelerate the growth of the market. There is no strict regulatory framework, and increased funding from the public and private sectors is spurring growth in the global dairy products market. The thriving agricultural and livestock industry in many parts of the world is responsible for increasing the production of dairy products. Dairy cows are primarily used in the production of numerous dairy products, while buffalo milk is also used in many countries, such as India, Egypt, China, and the Philippines. An increasing number of convenience stores, supermarkets, department stores, and hypermarkets around the world are driving the market growth.

Government arbitration plays a pivotal role in controlling market growth. Due to their nutritional value and benefits, dairy products are also administered to patients whose clinical experts have some disabilities and undergo surgery. The food service and food processing industries and food retailers are the main customers of this product. The governments of the main dairy-producing countries, such as Canada, monitor the price structure and production quantities of the main dairy products. Favorable rules and regulations are formed by government agencies to protect government agencies from fluctuations in foreign market prices. We also monitor dairy storage processes to keep these products longer and avoid unnecessary waste. To capture this growing market demand, the main actors introduced new products with better quality and higher nutritional value. Sedentary lifestyles, unhealthy eating habits, and increased awareness of nutritional foods are estimated to increase market demand. These products include tons of milk, skim milk, low-fat energy drinks, seasonal fruit yogurt, and delicious yogurt sauce. Increasing household incomes, especially in urban areas, are also assumed to change lifestyles and preferences.

MARKET RESTRAINTS

Manufacturers face various challenges during processing to maintain the original taste, texture, and odor of dairy products worldwide.

Therefore, these factors impeded the growth of the global dairy products market. Dairy products are exported to regions where weather conditions, unsatisfied supply, and demand relationships, unfavorable government actions, and currency exchange rates play an important limit.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.78% |

|

Segments Covered |

By Type, Application, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Arla Foods UK Plc, Nestle SA, Fonterra Group Cooperative Limited, Kraft Foods, Inc., Amul, Danone, Meiji Dairies Corp, Groupe Lactalis SA, Unilever N, and Parmalat S.P.A |

SEGMENTAL ANALYSIS

Global Dairy Product Market Analysis By Type

The lactose-free milk segment is leading with the dominant share of the market, whereas cheese is attributed to holding a significant growth rate throughout the forecast period. It is highly recommended for the people who cannot digest the products that contain lactase. The growing number of people who are opting for lactose-free milk products due to various health issues like bloating and others is anticipated to level up the growth rate of the market. According to the National Institute of Health (NIH), 53% of Chinese residents purchase dairy products that are likely to be lactose-free. The need for the intake of dairy products in any form to maintain balanced health is likely to surge the growth rate of the market.

Cheese is highly consumed in most countries, such as the US, Canada, India, China, and others. The launch of various food products using cheese to attract health-conscious consumers is estimated to level up the growth rate of the market. According to the United States Department of Agriculture, the consumption of cheese is hitting new records, with 21.6 million tons in 2023. The trend towards Mediterranean or Middle Eastern spices and curries infused with cheese with various flavors is quietly elevating the growth rate of the market.

Buttermilk is esteemed to have prominent growth opportunities in the coming years. People’s awareness towards drinking health beverages like buttermilk especially during hotter days is solely to elevate the growth rate of the market. Buttermilk is one of the best drink with the rich source of calcium which is considered as part of the balanced diet options. Some research studies also show that it can reduce the cholesterol level if a person consumes buttermilk in daily diet.

Global Dairy products Market Analysis By Application

The frozen food segment is attributed to holding the highest share of the market. In modern lifestyles, the prominence to purchase ready-to-eat food products is eventually increasing, and the demand to launch healthy and innovative products is certainly rising by freezing the food items. Frozen food products have longer shelf life and maintain freshness, which is attributed to accelerating the growth rate of the market. These foods are mostly preferred by working-class people who don’t have time to make the food for a longer time. Seeking high-quality food products from consumers and quickly adopting the latest technologies in the F&B industry is solely to level up the growth rate of the market. The launch of consumers’ preferable food products with quality raw materials that can be frozen to not alter the freshness is promptly elevating the market’s growth rate.

The bakery and Confectionery segment is likely to have the highest CAGR by the end of the forecast period. The use of dairy products in bakery and confectionery is highly valuable. Butter is one of the most common products that help bring proper texture, taste, and color to various recipes like cookies, biscuits, and croissants. Milk is probably used in making chocolates with various flavors, which is also enhancing the growth rate of the dairy products market to an extent.

REGIONAL ANALYSIS

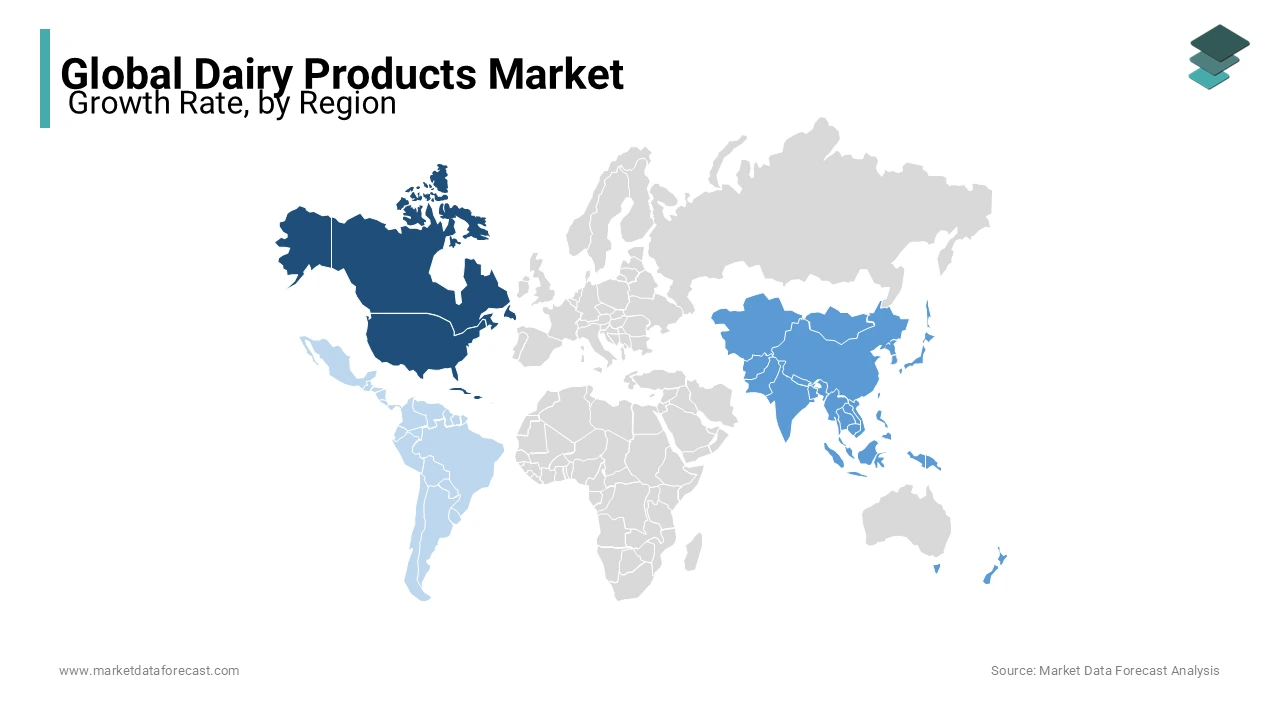

North America is foreseen to dominate the global dairy products market. The main factors that account for the majority are the management of a larger number of livestock, higher production of lactose, a greater perception of nutritional products by people, and the introduction of advanced equipment for milk processing. The Asia Pacific area is expected to be among the fastest-growing regions over the outlook period. India contributes around 16% of dairy production worldwide. Population growth, increased consumption of dairy products, and increased economic growth in the region are major causes of growth. India, called the "oyster" of the global dairy industry, is probably the world's largest producer of dairy products. It is expected to take a large share of the global dairy market. Dairy products such as buttermilk, butter, ghee, bell cheese (cottage cheese), dahi (yogurt), lace, and milk-based sweets are part of the rich culinary tradition of India and are consumed regularly. China, Indonesia, Malaysia, Bangladesh, and Thailand are also seeing increasing demand for dairy products. New Zealand has been a major milk exporter for the past year. New Zealand has been tracked by the European region. Countries such as Mexico, China, and Russia are among the main importers of dairy products worldwide. This declaration modifies trade in terms of dairy consumption in the international market. It is especially used in North America, Europe, Asia Pacific, the Middle East, Africa, and South America. Focus on the main companies operating in the region. Latin America is expected to record high growth rates. It houses Brazil, the second-largest dairy farm in the world after India. Argentina, Peru, Venezuela, Uruguay and Mexico also expect significant growth.

KEY PLAYERS IN THE GLOBAL DAIRY PRODUCTS MARKET

Major Key Players in the Global Dairy Products Market are Arla Foods UK Plc, Nestle SA, Fonterra Group Cooperative Limited, Kraft Foods, Inc., Amul, Danone, Meiji Dairies Corp, Groupe Lactalis SA, Unilever N, and Parmalat S.P.A

RECENT HAPPENINGS IN THE MARKET

- Danone is constantly innovating and manufacturing products to attract a large population base. The company developed a program called Nutriplanet. The program is intended to better identify customer tastes, nutritional needs, and habits. The program also helps local milk producers maintain the quality of their dairy products and improve their farming practices.

- In May 2017, PepsiCo India announced plans to enter the dairy market of India in the near future.

DETAILED SEGMENTATION OF GLOBAL DAIRY PRODUCTS MARKET INCLUDED IN THIS REPORT

This research report on the global dairy products market has been segmented and sub-segmented based on type, application, & region.

By Type

- Lactose-Free Milk

- Cream And Frozen

- Cheese

- Yogurt

- Butter

- Buttermilk

- Ice Cream

By Application

- Frozen Food

- Bakery And Confectionery

- Clinical Nutrition

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are some trends in the dairy products market?

Recent trends include the rise of plant-based alternatives to dairy, increased focus on organic and grass-fed dairy products, and innovations in packaging and convenience formats.

2. What are some challenges facing the dairy products market?

Challenges include volatile milk prices, competition from plant-based alternatives, regulatory changes affecting labeling and production practices, and shifting consumer preferences.

3. How is technology impacting the dairy industry?

Technology plays a significant role in areas such as dairy farming (e.g., automated milking systems), processing (e.g., advanced filtration techniques), packaging (e.g., eco-friendly materials), and distribution (e.g., cold chain logistics).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com