Global Plant-based Protein Market Size, Share, Trends & Growth Forecast Report By Type (Isolates, Concentrates, Protein Flour), Application (Protein Beverages, Dairy Alternatives, Meat Alternatives, Protein Bars, Processed Meat, Poultry & Seafood and Bakery Products), Source (Soy, Pea, Wheat and Others), And Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis (2025 to 2033)

Global Plant-based Protein Market Size

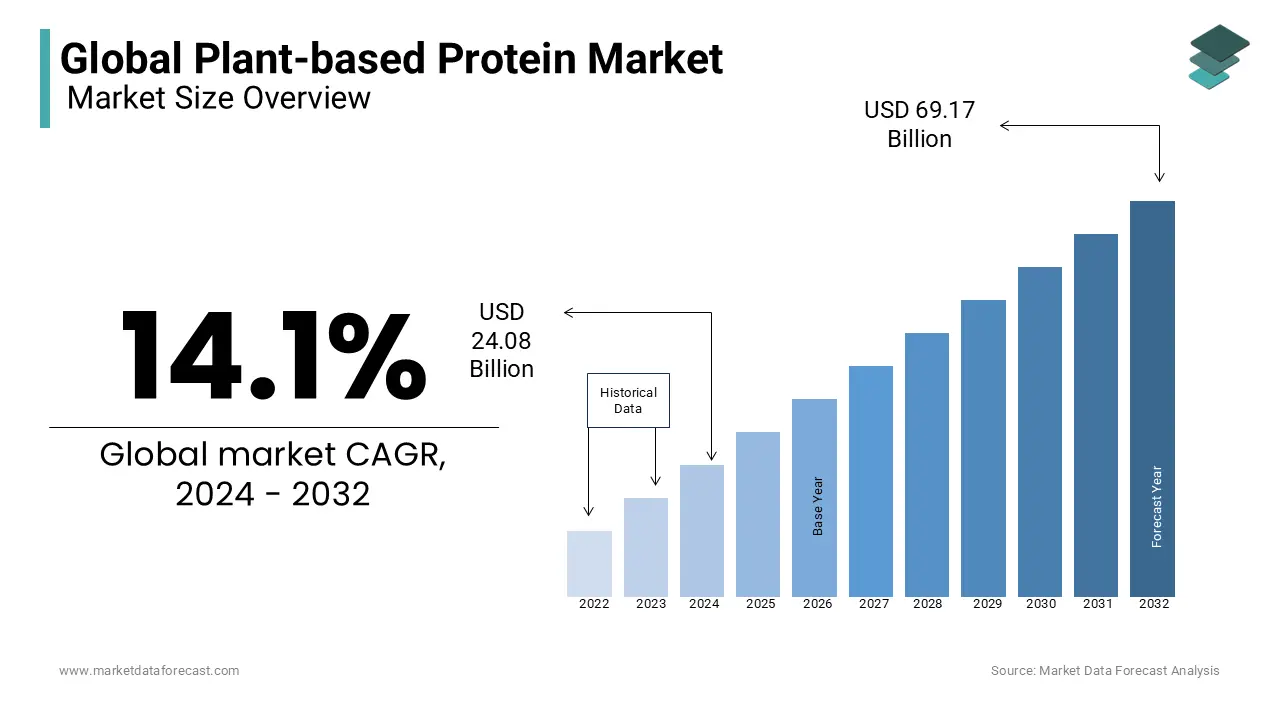

The global plant-based protein market size was valued at USD 24.08 billion in 2024. The global market size is estimated to grow at a CAGR of about 14.1% from 2025 to 2033 and be worth USD 78.94 billion by 2033 from USD 27.48 billion in 2025.

Plant protein is the food source of protein that is obtained from plants. These include pulses, tofu, soya, tempeh, seitan, nuts, seeds, and certain seeds and peas. Plant proteins are highly nutritious as they are good sources of protein and provide other nutrients such as fiber, vitamins, and minerals. Protein is a vital nutrient responsible for our bodies' growth, maintenance, and repair, influencing consumers to ensure enough high-quality protein every day to keep our bodies healthy. The plant protein sources, except soya and quinoa, are "incomplete." This is because plant protein sources tend to lack at least 1 of the nine essential amino acids.

The plant protein market includes protein ingredients obtained from plants as a source. The items considered are produced by organizations with their obtainment framework and homesteads as a piece of the agribusiness unit. The new compositional research and altered high-dampness expulsion process are helping develop the plant protein market. For instance, plant protein-based chocolates liberated from creature protein compensate for a decent interest in the market for purchasers who don't expend dairy. Plant-based milk has watched a noteworthy development lately, with an expanding number of individuals going without dairy choices. This inventive product offering of the prepared-to-eat item with no trade-off in taste and surface has supported the global plant-based protein market. These factors have escalated the plant-based protein market to witness considerable growth in the past years, and it is anticipated to have significant growth during the forecast period.

MARKET DRIVERS

Growing Incidence of Intolerance for Animal Protein

The National Institute of Allergy and Infectious Diseases uncovered that eggs, milk, fish, red meat, soy, and nuts bring about 90% of food sensitivity. Because of animal protein sensitivities, many meat buyers are slanted toward meat substitutes made of veggie lover protein, which eventually drives the plant protein market. As indicated by the reference rundown of allergen information assortment, the allergen from chicken meat ranges from 0.5-5% in Southern Europe. Pea protein, previously perceived as a total protein with the essential amino acid profile, contains egg-like potential that can be joined into a few egg-based items, similar to pasta, vermicelli, cakes, and treats. As indicated by the United States Centers for Disease Control and Prevention, 12.2 million individuals are experiencing food hypersensitivity, of which 66% is related to egg sensitivity.

The rising awareness regarding the advantages of protein and developing interest in protein-rich eating regimens, growing emphasis among people on wellbeing and health patterns, increasing attention on meat options by consumers, rising demand from the food and beverage industry, and the progressions in ingredient advancements such as microencapsulation are fuelling the growth rate of the global market. Plant-based proteins are primarily used in applications like meat alternatives. According to the latest research conducted by key players and local governments, consumers are looking for meat alternatives to reduce their meat consumption. This has resulted in a decline in the demand for meat. For example, processed meat manufacturers gradually use pea proteins as an alternative, which results in more profits.

The growth of the plant-based protein market is further driven by the growing number of item dispatches, extensions, and ventures by significant players, buyers eliminating meat utilization and receiving plant-based proteins, nutritional benefits offered by plant-based food, and expanding inclination of buyers for the reception of a veggie lover diet. The expanding vegan and flexitarian lifestyles of the people are boosting the adoption of plant-based proteins, leading to the expansion of the global market size. According to The Food Science and Health Database Organization data, approximately 22 million UK citizens have embraced a flexitarian lifestyle, indicating a significant shift towards healthier eating habits, particularly among influential millennials.

MARKET RESTRAINTS

There is a high possibility of nutritional deficiencies among vegans, limiting market growth opportunities. Even though there are numerous plant-based protein sources, some vital nutrients are primarily found in animal products, which may be lacking in the vegan diet, which is estimated to limit the adoption rate. Vitamin B12 and omega-3 fatty acids are crucial for the body's functions and neurological health and are exclusively present in animal-derived foods such as fish, meat, dairy, and eggs. Most of the vegan people experience these deficiencies. The presence of stringent regulations by the Food and Drug Administration (FDA) for approval of the products regarding quality and efficacy will be challenging for the market players in expanding the market growth. The rising concerns regarding the adulteration of products with genetically modified (GM) ingredients to meet the increasing demand for the products are expected to hinder the market growth rate in the coming years. Government regulators in the Asia Pacific and Europe have mandated the declaration of GM/non-GM status on food packaging. The GM ingredients are linked to allergic reactions and may contain herbicidal residues, which pose challenges for their production and use in plant-based food products. Plant-based proteins are often considered incomplete proteins, which need to be consumed in combination with other foods to serve as complete proteins. Some plant-based proteins are high in carbohydrates, which makes them not a choice for low-carb diet consumers. These limitations will impede the plant-based protein market's growth opportunities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.1% |

|

Segments Covered |

By Type, Application, Source and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill Inc, Archer Daniels Midland, DuPont, Kerry Group, Glanbia PLC, Tate & Lyle PLC, Ingredion Inc, Burcon NutraScience Corp, Axiom Foods, Royal DSM N.V. and Sotexpro S.A. |

SEGMENTAL ANALYSIS

By Type Insights

Based on type, the isolates segment dominated the market and accounted for 46.7% of the global market share in 2023. The isolates segment is also estimated to be the fastest-growing region and showcases a CAGR of 9.08% during the forecast period. Protein isolates comprise a considerable amount of protein and improve digestibility in individuals. Isolates are finding huge demand in protein and nutrition-oriented products, such as sports nutrition, protein drinks, and dietary supplements. In the last few years, isolates have been demanded more by athletes, bodybuilders, and vegetarians and have gained extensive application in various beverages and dairy products due to their different functional properties.

The concentrates segment captured a substantial share of the global market in 2023 and is predicted to grow at a CAGR of 7.44% during the forecast period. The growing usage of plant-based protein concentrates in various food products such as snacks, beverages, and meat substitutes is propelling the expansion of the concentrates segment in the global market.

By Application Insights

The dairy alternatives segment emerged as the largest in 2023, holding 31.7% of the global market share. This domination is primarily attributed to the rising emphasis among consumers on opposing animal cruelty and the increasing adoption of dairy alternatives such as plant-based milk, cheese, and yogurt.

The meat alternatives segment is another leading segment, holding a considerable share of the worldwide market in 2023. The meat alternatives segment is anticipated to showcase a CAGR of 15.5% during the forecast period.

By Source Insights

The soy segment held 40.9% of the global market share in 2023 and stood as the most dominating segment worldwide. The soy segment is also expected to dominate the global plant-based protein market throughout the forecast period. The growth of the soy segment is majorly driven by the mounting popularity and demand for a high-protein diet among consumers. Soy protein is proven to reduce cholesterol levels and cancer risk and improve metabolism, bone mineral density, and others. Soy protein isolates are primarily used in applications like nutritional bars, bakery products, meat alternatives, sports nutrition products, and drinks.

The pea segment is anticipated to grow at a CAGR of 11.88% during the forecast period, owing to the growing use of pea protein in various food and beverage applications.

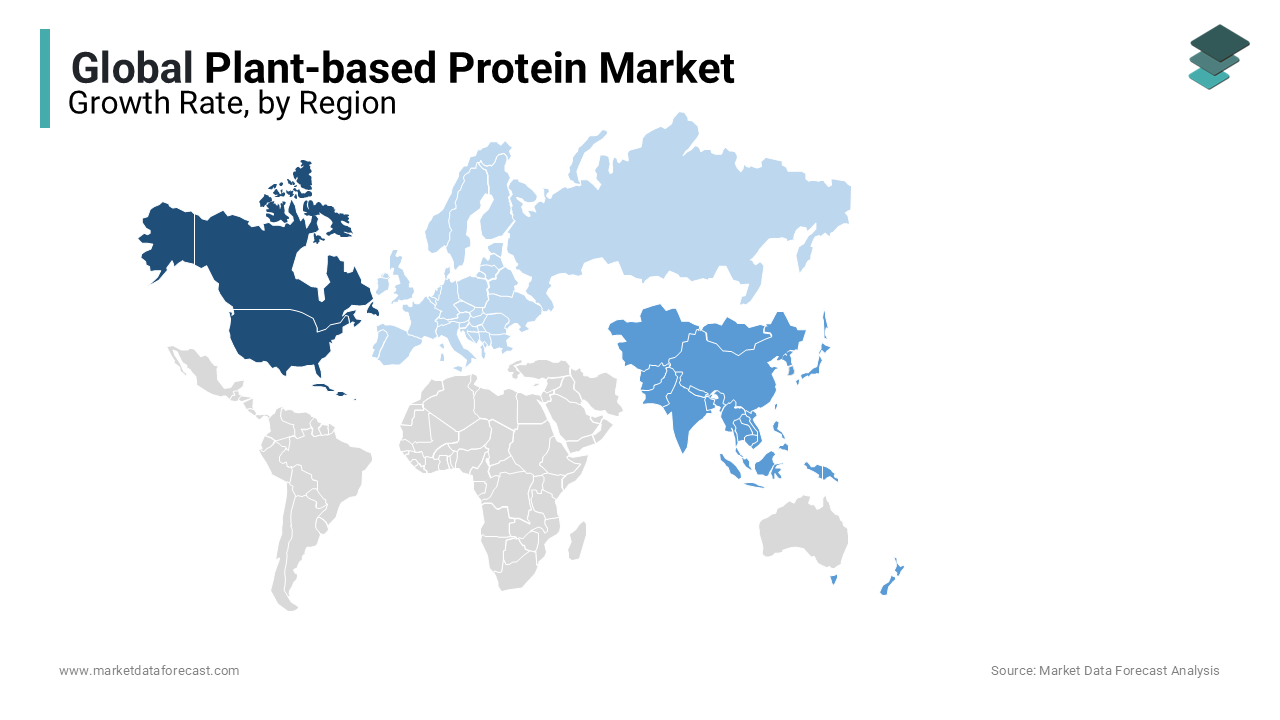

REGIONAL ANALYSIS

North America emerged as the top-performing region in the global plant-based protein market in 2023 and held a 38.6% share worldwide market in 2023. The domination of the North American region in the global market is estimated to continue throughout the forecast period. The interest in plant proteins is developing quickly, inferable from a change in the way of life, absence of adjusted dietary admission, and improved R&D to grow new sorts of plant-protein advanced items. The United States keeps catching the most significant piece of the pie for plant protein, trailed by Canada and Mexico. The interest in handled and low-cholesterol foods has prepared it for the local plant-based protein market. These days, purchasers are changing to other elective items, for example, green-name food items, combined with bringing issues to light of sound and plant-based items because of an expansion in the accessibility of fraudulent items in the market.

In 2023, Asia-Pacific was the second-largest regional segment globally, with 28.8% of the worldwide market share. It is the most attractive regional market for plant-based protein and is expected to grow at a promising CAGR of 12.28% during the forecast period. The growing trend of vegetarianism and veganism, especially in countries like India and China, is majorly driving the Asia-Pacific market growth. China is the largest market for plant-based protein in Asia Pacific, followed by India and Japan.

Europe is a noteworthy regional segment in the global market and is expected to grow at a CAGR of 7.78% during the forecast period. Factors such as growing consumer awareness regarding health and environmental issues, increasing adoption of vegan and flexitarian diets, and supportive government regulations promoting plant-based foods propel the plant-based protein market growth in Europe. Germany is the leading player in the European market for plant-based protein.

KEY MARKET PLAYERS

Companies such as Cargill Inc, Archer Daniels Midland, DuPont, Kerry Group, Glanbia PLC, Tate & Lyle PLC, Ingredion Inc, Burcon NutraScience Corp, Axiom Foods, Royal DSM N.V. and Sotexpro S.A. are playing a dominating role in the global plant-based protein market.

Cargill, ADM, Kerry Group, DuPont Danisco, and Glanbia are the leading players in the global plant-based protein market. These companies implement strategies like expansions, mergers and acquisitions and product launches. To gain a competitive edge in terms of revenue, organizations are investing more in innovative products with the aid of new plant proteins like hemp and chia. As of late, ADM (US) extended its geographic impression in Brazil with the development of another soy protein creation complex in Campo Grande, MatoGrossodoSul, Brazil, at an estimation of USD 250 million. The intricate details will make a scope of functional protein focus and be included in ADM's present product offering.

RECENT HAPPENINGS IN THE MARKET

- In November 2023, Nestle India launched a range of plant-based alternatives to traditional seafood, such as vrimp, a plant-based shrimp derived from seaweed, and plant-based alternatives to chicken shreds and eggs. These offerings cater to the growing demand for sustainable and animal-free food choices.

- In July 2023, Burcon NutraScience Corporation and HPS Food and Ingredients Inc. collaborated to launch the first-ever commercially available high-purity, soluble hempseed protein isolate. Due to its improved solubility and functionality, this development opens up new possibilities for using hemp protein in various food and beverage applications.

- In December 2022, Royal DSM introduced Vertis Textured Pea Canola Protein, the first textured vegetable protein fulfilling the criteria of a complete protein while being dairy, gluten, and soy-free. This innovation offers manufacturers a versatile and allergen-friendly option for creating meat-like texture in plant-based products.

- In June 2022, Roquette, a plant-based protein manufacturer, released two novel rice proteins to address the market demand for meat substitute applications. The new Nutralys rice protein line includes a rice protein isolate and concentrate.

- In April 2022, Cargill announced the expansion of its Radipure pea protein product portfolio to the Middle East, Turkey, Africa, and India markets to address increased demand for pea protein as an alternative protein source in these regions.

- In May 2019, Canada's Burcon NutraScience Corporation propelled new pea and canola protein mixes. The firm likewise reported joining a joint dare to assemble a C$65 million pea-protein and a canola-protein business creation office.

- In January 2019, Amazing Grass launched another "Stunning Protein Glow," an option in contrast to creature-inferred collagen supplements.

- In March 2018, Naked Nutrition propelled matcha protein powders related to the ALS Association organization.

MARKET SEGMENTATION

This research report on the global plant-based protein market has been segmented and sub-segmented based on type, application, source and region.

By Type

- Isolates

- Concentrates

- Protein Flour

By Application

- Protein Beverages

- Dairy Alternatives

- Meat Alternatives

- Protein Bars

- Processed Meat

- Poultry & Seafood

- Bakery Product

By Source

- Soy

- Pea

- Wheat

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What are the challenges facing the plant-based protein market?

Challenges include taste and texture issues in some products, higher production costs compared to conventional proteins, and regulatory challenges in labeling and categorization.

2. What trends are driving innovation in the plant-based protein market?

Innovations include the use of new plant sources, improving taste and texture through food processing techniques, and expanding product lines to include ready-to-eat meals and snacks.

3. What are the main sources of plant-based proteins?

Common sources include soybeans, peas, chickpeas, hemp seeds, chia seeds, quinoa, lentils, and nuts like almonds and peanuts.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com