Global Personalized Nutrition Market Size, Share, Trends, & Growth Forecast Report - Segmented By Product Type (Functional Food, Dietary Supplements, Nutraceuticals, Sports Nutrigenomics, Digitized DNA-Based Diet Routine, Active Measurement, Standard Measurement And Functional Drink), Application (Inherited Diseases, Additional Supplements, Lifestyle Diseases, Medicinal Supplements, Sports Nutrition And Standard Supplements), End Use (Wellness & Fitness Centres, Hospitals, Ambulatory Care, Clinics, Home Care, Institutions And Direct-To-Consumer), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

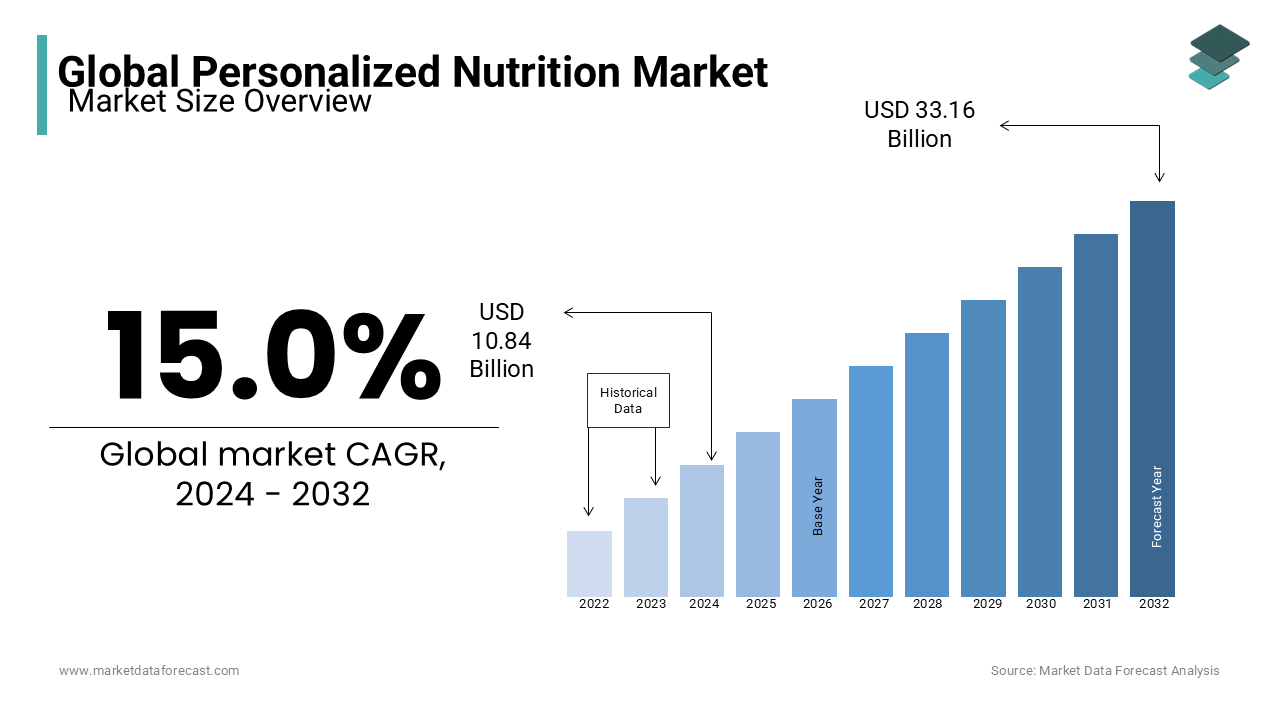

Global Personalized Nutrition Market Size

The global personalized nutrition market size was worth USD 10.84 in 2024 and is predicted to be worth USD 12.47 billion in 2025 to USD 38.15 billion by 2033, growing at a CAGR of 15.0% during the forecast period.

The expanding interest in personalized arrangements because of the rising well-being mindset, the developing pattern of advanced answers for human services, and the maturing populace across districts are a portion of the main considerations that are anticipated to add to the development of the personalized nutrition market during the gauge time frame. Besides, the moving shopper patterns, for example, an expansion in the inclination for great dietary food, as indicated by their supplement profile is anticipated to support the improvement of personalized approaches for nutrition, adding to the market development.

Current Scenario of the Global Personalized Nutrition Market

Currently, the personalized nutrition market is witnessing significant growth owing to the emergence and integration of digital technologies and advancement in this field. Also, the market received more financial support and a higher number of research projects were commenced post-COVID-19. Moreover, the expanding interest in personalized arrangements because of the rising well-being mindset, the developing pattern of advanced answers for human services, and the maturing populace across districts are a portion of the main considerations that are anticipated to add to the development of the personalized nutrition market during the gauge time frame. Besides, the changing buyer patterns, for example, an expansion in the inclination for great dietary food, as indicated by their supplement profile is anticipated to support the improvement of personalized approaches for nutrition, adding to the market development.

Additionally, the industry as of now is led by the United States which holds a 60 per cent share and India adds 2 per cent to this market. In the North American industry, customer needs for personalized nutrition goods and services are rising consistently. This pattern is propelled specifically by the advancement of new technologies.

MARKET DRIVERS

The growing interest for personalization and rising awareness of physical wellness and diet among people are propelling the growth of the personalized nutrition market.

The escalating application of new technologies is driving the personalized nutrition market growth. Moreover, investor push propels a rising start-up sector for this market. A robust technology thrust in the fields of D2C testing and DNA sequencing devices, like DNA and at-home blood testing kits, along with solutions for business big data analysis has been pushed forward by surging investor attention in the bio-medical domain for the past two decades. Further, big players in the pharmaceutical and food processing industries are backing the PN start-up sector more lately. This has facilitated PN companies to provide cost-effective (however still costly for the majority) testing for nutritional and biomarkers advice based on modern software-powered solutions for interpretation and analysis of data, simply available for customers through smartphone applications.

The growing interest in customization and raising awareness of physical and mental wellness and diet among people due to busy lifestyles are propelling the growth of the personalized nutrition market. As indicated by the latest study of the International Food Council's (IFIC) latest Food and Health Survey, 80% of respondents were astounded by clashing data about food and nutrition. The rest, 59%, showed this settled on them feeling uncertain about their decisions and that it transformed shopping into an unpleasant encounter. Innovative advances around there are being grown. Shoppers are progressively searching for science-based and information-driven dietary arrangements that are custom-made to their particular well-being objectives. Late advances in diagnostics and following the well-being boundaries are assisting with addressing these necessities of clients by permitting people to find key data about their well-being and health markers.

MARKET RESTRAINTS

The personalized nutrition market faces several hindrances, consisting of low purchaser mindfulness, absence of logical examination and constraints in the reception of cutting-edge computational information-driven advancements. The requirement for a personalized nutrition computational framework remains a significant test for the expansion of the market growth during the conjecture time frame.

In addition, the market players encounter a variety of technical and commercial obstacles that presently look tough to address in the coming years. To make available superior quality services the fundamental science is intricate and includes incorporating huge information streams into scientifically valid guidance from personal lifestyle data, biomarkers and DNA. Even though various companies or suppliers incorporate nutritionists majority of the counsel is created by algorithms which increases technical problems with quality control besides the “data supply chain” from several examination and research laboratories to the “rules” which support algorithm design, all impacting scientific credibility. For personalized nutrition players utilising wet lab tests, like for blood and DNA, the transportation and laboratory services are still costly and require significant expenditure to increase laboratory ability with expanding customer quantity are substantial even if contracted to international third parties.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15% |

|

Segments Covered |

By Product Type, Application, End Use And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC; PESTLE Analysis. Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Amway (US), BASF (Germany), DSM (Netherlands), Herbalife Nutrition Ltd (US), DNAfit (UK), Care/of (US), Nutrigenomix (US), Zipongo (US), Viome (US), Habit (US), and Atlas Biomed Group Limited (UK) |

SEGMENTAL ANALYSIS

By Product Type Insights

The dietary supplements and nutraceuticals segment is believed to have captured the top position under this category of the personalized nutrition market in recent years. The segment has gained significant attention and financial support which led to the rise in the study in this field with over 69000 articles on dietary supplements via PubMed between 2012 and 2022. Apart from this, As the segment’s market size has expanded and become more attractive, the significance of maintaining product quality has surged, as have the difficulties related to this job. Hence, the appeal for world quality standards and improved emphasis on the regulatory problem connected with DS are important, as mislabeled or adulterated items may evade current laws, resulting in a rise in the prevalence of severe reactions (of which a certain number can be deadly) due to adulterants or pollutants in the product instead of the ingredients contained in the supplements. But, for a greater level of individualization, there are products or solutions personally accepted for therapeutic or preventive measures or steps. This is especially valid for personalized dietary supplements, which hold one-third of the personalized nutrition market.

By Application Insights

The sports nutrition segment is presently the most prevailing application of the personalized nutrition market. According to a survey, sports supplements are the fourth most consumed specific supplement and only behind vitamin or mineral supplements, followed by speciality supplements and then botanicals and herbs. Also, the segment continues to have a major presence in North America, especially in the United States where dietary supplements (DS) are consumed by a notable share of people. However, the market faces challenges because special dietary supplements for sports performance or bodybuilding are also part of the three most problematic DS types in the country along with weight loss and sexual enhancement supplements. Moreover, in the last two decades, sports supplements have positioned themselves as a pillar among athletes. Besides this, most of the accessible proof backs the advantageous effects of certain supplement ingredients, for example, bicarbonate, B-alanine and creatine, on some kinds of action or work (for instance, they seem to be potent in combat sports), and also others, like polyphenols, vitamin B12, C and D, omega-3 fatty acids and caffeine. Additionally, the application of sports supplements has surged in athletes, however, it has also prevailed among the general population. Hence, the growth of the sports supplement industry is accelerating the progress of criteria, rules, and regulations that are required to be standardized globally for the purpose of consumer protection

By End User Insights

The direct-to-consumer segment accounted for the biggest market share of the personalized nutrition market. There is a growing necessity for these items in the direct-to-consumer (D2C) category because of the increasing health awareness and rising emphasis on nutrition in total medical and well-being among consumers. Furthermore, the idea or understanding of wellness has experienced a transition in the past few years with growing customer awareness and society’s willingness to spend more to remain in control of their mental and physical and mental health. As per research, the modern-day incorporated wellness sector consists of up to six dimensions, involving improved nutrition and health, enhanced mindfulness and sleep, physical health and better appearance via sustainable beauty services and items.

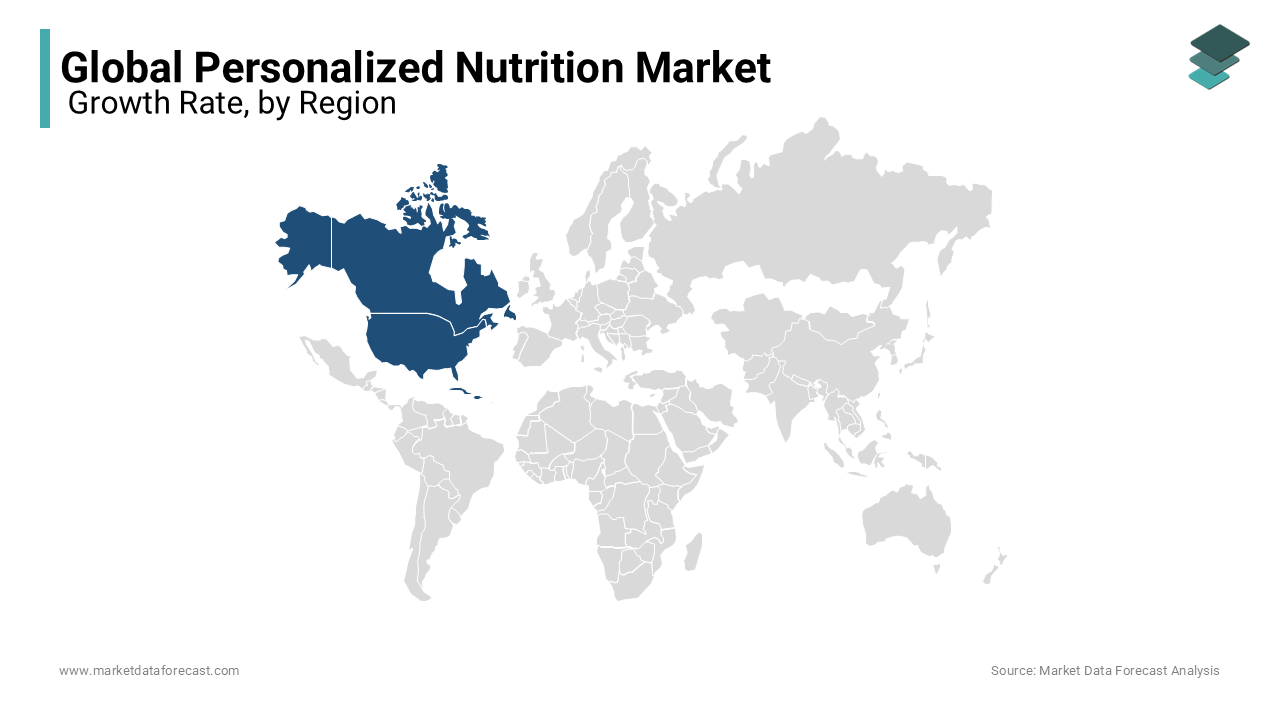

REGIONAL ANALYSIS

North America is anticipated to represent a substantial portion of the global personalized nutrition market during the gauge time frame.

The North American market represented the highest share in 2019. The development of the market in this area is significantly determined by the rising mindfulness among purchasers about their well-being. Key players offering personalized nutrition are available in this locale, which is likewise anticipated to add to the development of the global personalized nutrition market. The area is seeing an expansion in the number of stoutness rates. Moreover, tumultuous and busier ways of life have urged purchasers to settle on particular dietary supplements that are custom-made to their particular necessities. Moreover, the ascent in the pay of purchasers in the locale will likewise add to their expanded purchasing power, which, thus, will urge them to decide on personalized consumption of calories according to their inclinations. The market has seen a remarkable development in the earlier years, inferable from a change in individuals' way of life as far as concentrating on wellness and wellbeing.

KEY PLAYERS IN THE GLOBAL PERSONALIZED NUTRITION MARKET

Major Key Players in the global personalized nutrition market are Amway (US), BASF (Germany), DSM (Netherlands), Herbalife Nutrition Ltd (US), DNAfit (UK), Care/of (US), Nutrigenomix (US), Zipongo (US), Viome (US), Habit (US), and Atlas Biomed Group Limited (UK)

RECENT HAPPENINGS IN THE MARKET

- In May 2024, investigators in a study compared the efficacy of general advice on cardiometabolic health and personalized dietary programs (PDP) and found that less than 1 per cent of the people of the United Kingdom stick to all dietary suggestions, with likewise weak commitment cited in the United States. Several elements influence the changeability of medical intervention to food, hence, effective customized nutrition plans based on way of living and phenotypic biological causes could raise compliance levels with dietary instructions.

- In April 2024, AHARA, a front-runner in individualized nutrition and the only proof-based, food-first nutrition program, launched two latest product characteristics to further improve its customised nutrition scheme for customers. A consumer rewards plan and daily meal program are also accessible to members.

DETAILED SEGMENTATION OF GLOBAL PERSONALIZED NUTRITION MARKET INCLUDED IN THIS REPORT

This research report on the global Personalized Nutrition Market has been segmented and sub-segmented based on product type, application, end-use & region.

By Product Type

- Functional food

- Dietary supplements and nutraceuticals

- Sports nutrigenomics

- Digitized DNA-based diet routine

- Active measurement

- Standard measurement

- Functional drink

By Application

- Inherited diseases

- Additional supplements

- Lifestyle diseases

- Medicinal supplements

- Sports Nutrition

- Standard supplements

By End Use

- Wellness & fitness centers

- Hospitals

- Ambulatory care

- Clinics,

- Home care

- Institutions

- Direct-to-consumer

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What technologies are driving the personalized nutrition market?

Genetic testing, artificial intelligence (AI), machine learning algorithms, and data analytics are crucial in analyzing individuals' unique traits and providing personalized dietary advice.

2. How does genetic testing contribute to personalized nutrition?

Genetic testing helps identify genetic variations related to metabolism, nutrient absorption, and food sensitivities. This information is used to create personalized diet plans better suited to an individual's genetic profile.

3. What are the benefits of personalized nutrition?

Personalized nutrition can improve health outcomes by addressing specific nutritional needs, optimizing nutrient intake, supporting weight management, managing chronic conditions, and reducing the risk of diet-related diseases.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com