Global Clinical Nutrition Market Size, Share, Trends and Growth Forecast Report – Segmented By Route of Administration (Oral Nutrition, Enteral Nutrition and Parenteral Nutrition), Therapeutic Areas (Malabsorption, Diarrhea, Cancer, Food Allergies, Maldigestion, Diabetes, Short-Bowel Syndrome, Acute Lung Injury and Acute Respiratory Distress), Ingredients Type and Region – Industry Analysis (2024 to 2029)

Global Clinical Nutrition Market Size (2024 to 2029)

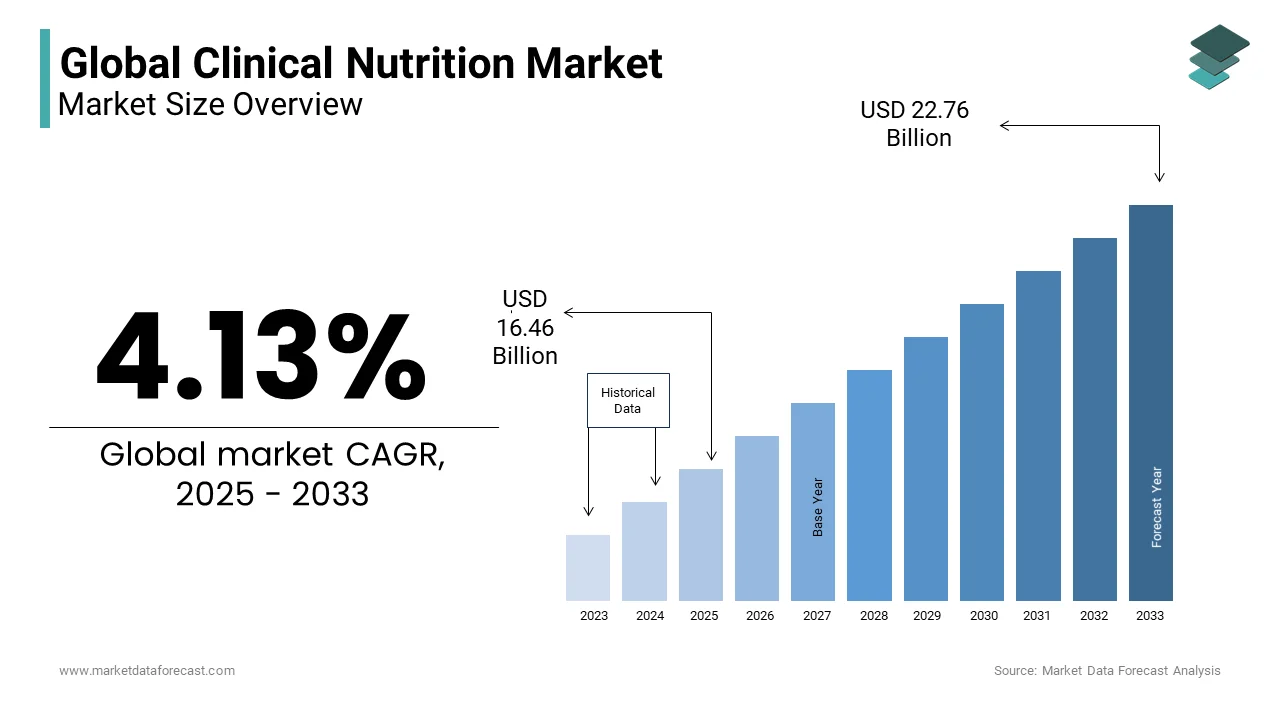

The size of the global clinical nutrition market was valued at USD 15.18 Billion in 2023. The global market is expected to grow at a CAGR of 4.13% from 2024 to 2029 and be worth USD 19.35 billion by 2029 from USD 15.81 billion in 2024.

Clinical nutrition aids in improving absorption, metabolism, digestion, and discharge functions by providing essential nutrients such as minerals, vitamins, and proteins. These products are vital for patients with a high degree of malnourishment, patients in intensive care units, patients recovering from trauma or surgery, and patients suffering from chronic diseases. In addition, it has been found that treating disease-related malnutrition with clinical nutrition therapies can reduce mortality.

MARKET DRIVERS

The rising incidence of metabolic disorders is propelling the growth of the clinical nutrition market.

The number of people suffering from metabolic disorders such as diabetes, obesity, and cardiovascular diseases, among others, has grown gradually over the last few years owing to the rising adoption of sedentary lifestyles and dietary habits. As per the data published by the IDF Diabetes Atlas, an estimated 537 million adults aged between 20 and 79 suffered from diabetes in 2021 and the number is expected to grow further in the coming years. The growing diabetic population is expected to result in the increasing consumption of clinical nutrition products as these products can help manage blood glucose levels and prevent complications. Similarly, obesity is another notable factor that can result in the diagnosis of several metabolic disorders, including type 2 diabetes and cardiovascular diseases. Therefore, many healthcare providers suggest the consumption of clinical nutrition products to fight against the issues of obesity, as these products aid in weight management and promote overall health. According to the statistics published by the World Health Organization (WHO), an estimated 1.6 billion adults worldwide are overweight.

The growing healthcare expenditure is further fuelling the clinical nutrition market growth.

The rising healthcare spending is expected to result in a growing demand for clinical nutrition products to support patient care. The growing chronic disease patient population contributes to the increasing healthcare expenditure as these patients must undergo continuous medical management and face nutritional issues. In such cases, clinical nutrition products help chronic disease patients to manage their conditions and maintain their nutritional balance, which further results in improved patient outcomes and reduced need for additional medical interventions that can be costly.

An increasing aging population, rapid adoption of technological developments in the manufacturing practices of clinical nutrition products, rising awareness and consumption of clinical nutrition products among the people and growing demand for parental nutrition contribute to the market growth. Furthermore, rising demand for specialized pediatric nutrition, a growing number of preterm births and cases of malnutrition and increasing demand for nutritional support in critical care are fuelling the growth rate of the global clinical nutrition market.

MARKET RESTRAINTS

Poor awareness levels among healthcare professionals and people regarding the benefits of clinical nutrition products are hampering the market growth.

The high cost of some clinical nutrition products and the availability of alternative products are further hindering market growth. Strict regulations and guidelines for clinical nutrition products to enter the market are other notable factors impeding the market growth. Limited reimbursement policies for clinical nutrition products in many countries, unavailability of clinical nutrition products in some countries, and side effects associated with the consumption of clinical nutrition products are further inhibiting the market’s growth rate. Misconceptions about clinical nutrition products and the lack of adequate healthcare infrastructure in some countries are resulting in the poor accessibility and availability of clinical nutrition products, which are diluting the overall market's growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2029 |

|

Segments Covered |

By Route Of Administration, Therapeutic Areas, Ingredients Type, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Leaders Profiled |

Nestle Nutrition, Abbott Laboratories Inc., Gentiva Health Services Inc., Mead Johnson & Company, Kendall, Ajinomoto Co. Inc., Hospira Inc., Hero Nutritionals Inc., Lonza Ltd, Baxter International Inc., B. Braun Melsungen AG, H., J. Heinz Company, American Home Patient Inc. and Fresenius Kabi. |

SEGMENTAL ANALYSIS

Global Clinical Nutrition Market Analysis By Route of Administration

The oral nutrition segment captured the leading share of the clinical nutrition market in 2023 and is expected to continue substantially during the forecast period. Oral clinical nutrition products are relatively less costly compared to enteral and parenteral nutrition products. The growth of the oral nutrition segment is majorly driven by their accessibility and affordability. Oral nutrition supplements can be purchased over the counter without a prescription.

The enteral nutrition segment had a considerable share of the worldwide market in 2023 and is predicted to grow at a noteworthy CAGR during the forecast period. The segmental growth is majorly driven by the growing patient population suffering from diseases such as cancer, neurological diseases, and severe burns. Factors such as the growing patient population suffering from chronic diseases, the growing aging population, and increasing R&D efforts by the market participants to develop enteral feeding devices and enteral clinical products that are more effective and safer to use are expected to boost the segment’s growth rate.

Global Clinical Nutrition Market Analysis By Therapeutic Areas

The diabetes segment held the largest share of the global clinical nutrition market in 2023 and is expected to showcase a promising CAGR during the forecast period. The growing diabetic patient population worldwide is majorly driving segmental growth. According to the data published by the IDF Diabetes Atlas, an estimated 537 million adults aged between 20 to 79 had diabetes in 2021 and this number is expected to grow further in the coming years and contribute to the segmental growth. In addition, increasing awareness among the diabetic patient population regarding the importance of proper nutrition management and personalized nutrition plans to control blood sugar levels are propelling the segment's growth.

On the other hand, the cancer segment is predicted to witness the highest CAGR among all the segments in the worldwide market during the forecast period. The growing cancer patient population and increasing focus from cancer patients on proper nutrition management primarily fuel the segment's growth. As per the statistics published by the American Cancer Society, an estimated 1.9 million new cancer cases were recorded in 2021. The nutritional deficiency in patients due to various cancer treatments such as chemotherapy, hormone therapy, radiation therapy, surgery, immunotherapy, and stem cell transplant is another major factor contributing to the segment's growth.

During the forecast period, the food allergies segment is estimated to hold a considerable share of the global clinical nutrition market and grow at a healthy CAGR owing to the increasing number of specialized nutrition products that can treat food allergies effectively.

Global Clinical Nutrition Market Analysis By Ingredients Type

The vitamins segment accounted for the largest share of the global clinical nutrition market in 2023, and the segment’s lead is expected to continue during the forecast period. Factors such as the increasing number of people suffering from vitamin deficiencies, the growing patient population suffering from various diseases and increasing awareness among people regarding nutrition management and rising demand for personalized nutrition plans are promoting the growth of the segment.

The amino acids segment is estimated to hold a considerable share of the global clinical nutrition market during the forecast period. The growing demand for specialized nutrition products and increasing high protein needs by gimmers and people who participate in sports regularly are contributing to the segmental growth. The rising awareness among people regarding the role that protein plays in being healthy is favoring the segment’s growth rate. The growing efforts by market participants to develop effective nutritional products favor segmental growth.

REGIONAL ANALYSIS

The North American region was rapidly growing due to the high malnutrition rate and increased population affected by various diseases. North America was the leading revenue contributor to the global clinical nutrition market in 2020 and is anticipated to dominate the market during the forecast period due to an upsurge in several chronic diseases such as coronary artery disease, ischemic stroke, diabetes, and a few cancer indications, and increase in the geriatric population. Besides, the initiative taken by the U.S. government to promote complete nutrition care for cancer patients is anticipated to drive the market further. However, Asia-Pacific is expected to experience the fastest CAGR during the forecast period due to increased metabolic disorders, high disposable incomes, and patient awareness regarding adopting clinical nutrition products.

The size of the European market is anticipated to register a promising CAGR during the forecast period owing to the growing aging population and increased disease diagnoses.

The Asia Pacific region is estimated to hold the largest share of the worldwide market during the forecast period due to increased birth rates, a rise in the geriatric population, increasing chronic conditions in patients, and unhealthy food habits. In the forecast period, Asia-Pacific has the highest growth compared to the other regions. The significant factors contributing to the development of the Asia Pacific clinical nutrition market include an increase in the prevalence of metabolic disorders, a rise in the geriatric population in the Asia Pacific Region, and high healthcare. In addition, hits. The incidence of diabetes in China is proliferating rapidly, a significant factor for obesity. As per the International Diabetes Federation (IDF) data, there were over 114,394,800 cases of diabetes in China in 2017, and the rate of prevalence of diabetes in adults is 10.9%. In addition, the number of patients undergoing diagnosis of metabolic disorders has increased over the decade; hence, there is an increase in the number of patients diagnosed in the Asia Pacific region. Japan's market is estimated to expand with a CAGR of 7.9% over the forecast period, owing to a large geriatric population base and increasing incidences of chronic conditions, including diabetes mellitus and cancer, due to dietary shifts. In addition, the presence of associations such as the Japan Society of Nutrition and Food Science (JSNFS), working towards promoting public health and creating awareness about clinical nutrition, will favor the growth of the Japanese market over the forecast timeframe.

The Latin American region is anticipated to hold a steady CAGR during the forecast period. Brazil's market dominated Latin America and was valued at around USD 1,586.6 million. However, the increasing obese population and the growing incidences of chronic diseases will drive the market growth cease. In addition, the high prevalence of preterm births leading to a rise in demand for clinical nutrition will favor Brazil's market growth. Moreover, a strong association with the American Society of Parenteral and Enteral Nutrition helps develop the clinical nutrition market in the country.

The MEA market is predicted to capture a moderate share of the worldwide market during the forecast period. The presence of associations such as the South African Society for Enteral and Parenteral Nutrition, creating awareness about clinical nutrition in the country, and the growing burden of enfeebling diseases will drive the South African market over the forecast timeframe. In addition, health infrastructure development and the increasing public and private player initiatives to boost sales of nutritional formulae in the country will propel market growth.

KEY PLAYERS IN THE GLOBAL CLINICAL NUTRITION MARKET

Some of the key market participants in the global clinical nutrition market profiled in this report are Nestle Nutrition, Abbott Laboratories Inc., Gentiva Health Services Inc., Mead Johnson & Company, Kendall, Ajinomoto Co. Inc., Hospira Inc., Hero Nutritionals Inc., Lonza Ltd, Baxter International Inc., B. Braun Melsungen AG, H., J. Heinz Company, American Home Patient Inc. and Fresenius Kabi.

RECENT HAPPENINGS IN THE MARKET

- In 2019, Nestle acquired Persona to expand its product portfolio in personalized nutrition.

- In 2019, Fresenius Medical care completed the acquisition of NxStage Medical.

- In 2018, Nestle bought the rights to distribute food service products and consumer packaged goods from Starbucks Corporation.

DETAILED SEGMENTATION OF THE GLOBAL CLINICAL NUTRITION MARKET INCLUDED IN THIS REPORT

This market research report on the global clinical nutrition market has been segmented based on the route of administration, therapeutic areas, ingredients type, and region.

By Route of Administration

- Oral Nutrition

- Enteral Nutrition

- Parenteral Nutrition

By Therapeutic Areas

- Malabsorption

- Diarrhea

- Cancer

- Food Allergies

- Maldigestion

- Diabetes

- Short-Bowel Syndrome

- Acute Lung Injury

- Acute Respiratory Distress

By Ingredients Type

- Vitamins

- Minerals

- Carbohydrates

- Amino Acids

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How big is the global clinical nutrition market?

The global clinical nutrition market size is forecasted to be worth USD 15.18 Billion in 2023 and USD 18.58 Billion by 2028.

Does this report include the impact of COVID-19 on the clinical nutrition market?

Yes, we have studied and included the COVID-19 impact on the global clinical nutrition market in this report.

Which region led the clinical nutrition market in 2023?

Geographically, the North American regional market dominated the clinical nutrition market in 2023.

Which are the major players operating in the clinical nutrition market?

Nestle Nutrition, Abbott Laboratories Inc., Gentiva Health Services Inc., Mead Johnson & Company, Kendall, Ajinomoto Co. Inc., Hospira Inc., Hero Nutritionals Inc., Lonza Ltd, Baxter International Inc., B. Braun Melsungen AG, H., J. Heinz Company, American Home Patient Inc. and Fresenius Kabi are a few of the noteworthy players in the global clinical nutrition market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1800

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]