Global Endoscopy Devices Market Size, Share, Trends and Growth Forecast Report -Segmented By Product (Endoscopes, Visualization Systems and Others), Application (Laparoscopy, Bronchoscopy and GI Endoscopy) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Endoscopy Devices Market Size

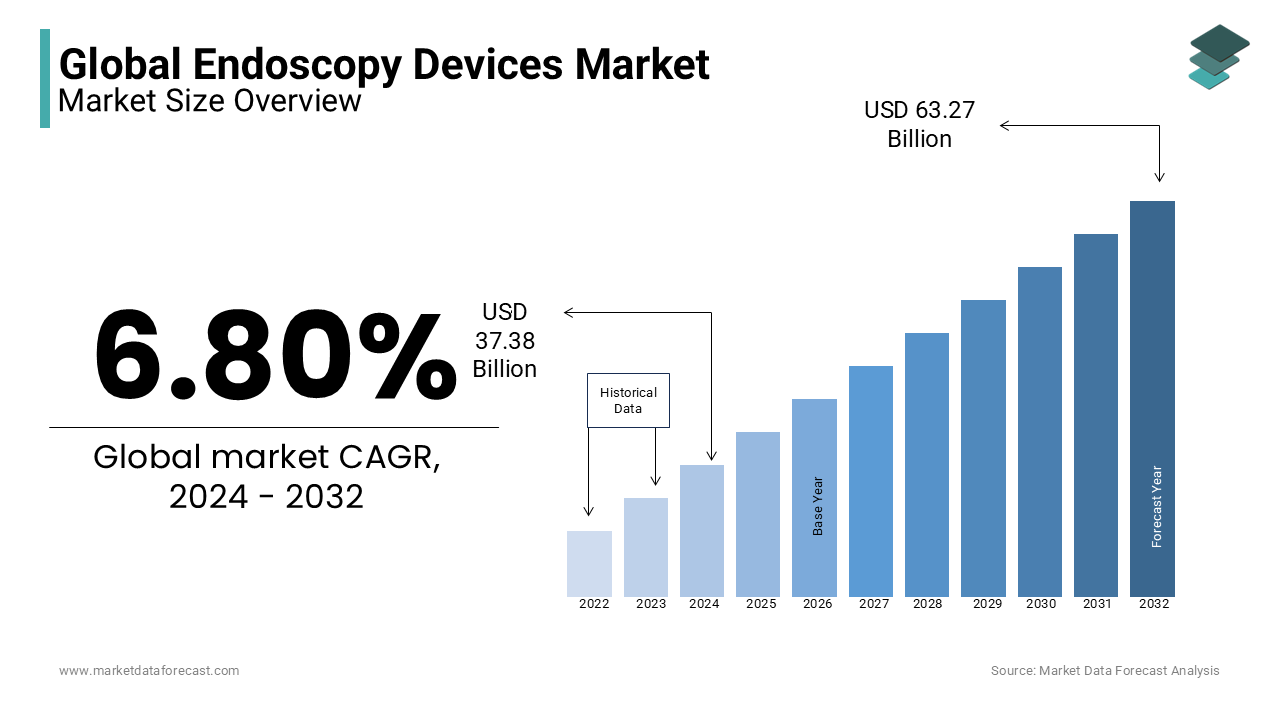

In 2024, the global endoscopy devices market was valued at USD 37.38 billion and it is expected to reach USD 65.57 billion by 2033 from USD 39.92 billion in 2025, growing at a CAGR of 6.80 % during the forecast period.

Endoscopy is a medical technological solution through which healthcare professionals can examine the inside parts of a human body. In this medical procedure, a long and flexible tube with a light and camera on the end is used to view the inside environment of a human body. Endoscopy helps identify the diseased organ's condition and aids in surgical procedures. Endoscopy is in the usage from across the world as these procedures are minimally invasive and cost-effective. The tube used in endoscopy procedures is inserted either from the mouth or through the anus and can be used to view the body organs such as the stomach, intestines, and other internal organs. Endoscopy diagnoses and treats various diseases such as GI problems, cancer, and others. In some countries, endoscopy procedures are covered by the health insurance provider; in such countries, the adoption of endoscopy is growing consistently. On the other hand, the preference for endoscopy from doctors and patients is increasing.

MARKET DRIVERS

The growing patient population suffering from gastrointestinal diseases is one of the key factors propelling the endoscopy devices market growth.

The number of people suffering from gastrointestinal diseases such as cancer, ulcers, inflammatory bowel disease, and gastroesophageal reflux has been growing gradually over the last few years. An estimated 29.3 million new cancer cases worldwide were recorded in 2020. An estimated 6 million people every year in the United States suffer from peptic ulcers. As per the statistics published by the Centers for Disease Prevention and Control (CDC), an estimated 3.1 million adults have been diagnosed with inflammatory bowel disease (IBD). 20% of the U.S. population has issues with GERD. Using endoscopy, healthcare providers examine the gastrointestinal tract for abnormalities and perform various procedures such as biopsies, removal of polyps, and treatment of bleeding ulcers. The growing prevalence of gastrointestinal diseases is resulting in the rising number of endoscopy procedures and boosting the endoscopy devices market growth.

The rapid adoption of technological developments to develop advanced and effective endoscopy devices is further fuelling the growth rate of the endoscopy devices market.

With the help of technological advancements, endoscopy devices have seen several developments improved imaging capabilities, wireless endoscopy devices and greater maneuverability. These technological developments have further helped to improve the effectiveness, accuracy, and safety of endoscopic procedures and resulted in the growing demand for endoscopy devices. The growing aging population is accelerating the growth of the endoscopy devices market. The aging population is much more likely to be diagnosed with digestive diseases and other conditions that require endoscopic procedures and resulting in an increasing number of endoscopic procedures.

The growing demand for minimally invasive surgeries is another notable factor contributing to the endoscopy devices market growth.

Owing to the reduced trauma and pain to the patient, shorter recovery times, and lower healthcare costs, the number of minimally invasive surgeries is growing significantly. Endoscopic devices play a key role in minimally invasive surgeries as healthcare providers can visualize and access internal organs and tissues using these devices. The growing healthcare expenditure in several countries is boosting the growth of the endoscopy devices market. Several governments and healthcare organizations invest significant amounts in the healthcare industry and medical devices, including endoscopy devices. The rising awareness regarding digestive diseases and the increasing number of screening programs by several governments to detect these diseases early is accelerating the growth of the endoscopy devices market.

In addition, growing preference for outpatient procedures, rising demand for disposable devices, an increasing number of improvements in the healthcare infrastructure in developing countries, and rising adoption of capsule endoscopy are propelling the growth of the endoscopy devices market. Furthermore, rising demand for wireless endoscopy devices, an increasing number of technological advancements in endoscopic accessories and growing usage of endoscopy devices in veterinary medicine are further fuelling the growth rate of the endoscopy devices market.

MARKET RESTRAINTS

The high costs associated with endoscopic procedures are limiting the adoption of endoscopy devices and hampering the global market growth.

Poor reimbursement coverage by some insurance companies in certain countries for endoscopic surgeries is another notable factor hindering the market’s growth rate. The availability of alternative diagnostic and treatment options is impeding the market growth. The scarcity of skilled professionals who can operate the devices, interpret results and perform procedures safely is a notable obstacle to the growth of the endoscopy devices market. In addition, concerns about infection transmission, stringent regulatory environment and limited access to endoscopy devices in certain countries are inhibiting the growth rate of the endoscopy devices market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.80 % |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Ethicon, Stryker Corporation, Karl Storz GmbH, Boston Scientific Inc., Olympus Corporation, Covidien Plc, Smith and Nephew Inc., and Fujifilm Holding Corporation |

SEGMENTAL ANALYSIS

By Product Insights

The visualization systems segment had the leading share of the worldwide market in 2023 and is expected to showcase significant domination in the global endoscopy devices market during the forecast period owing to the advanced technologies and funds. In addition, investments from private & public organizations fuel the market growth over the forecast period.

On the other hand, the endoscopes segment is predicted to have the fastest CAGR during the forecast period. The rise in the adoption of minimally invasive procedures, growing technological advancements in this domain, and disposable endoscopes are contributing factors for the endoscopes segment. It is also driven by manufacturers' invention of technologically innovative endoscopes and increased public awareness. Furthermore, factors like better ergonomics, safety, and efficacy over rigid endoscopes. Manufacturers' attention to providing optimal use of advanced flexible endoscopes is likely to surge the market growth over the forecast period.

By Application Insights

The GI endoscopy segment is anticipated to account for the market's most significant share of worldwide endoscopy devices market during the forecast period. The segmental growth is driven by the growing patient count suffering from GI diseases and the increasing aging population worldwide. In addition, the rising number of endoscopic procedures for the early diagnosis of GI cancer is another key factor contributing to the segment’s growth. Furthermore, an increasing number of developments in the healthcare infrastructure in emerging countries and a growing number of colonoscopy procedures are expected to aid the segment in growing further.

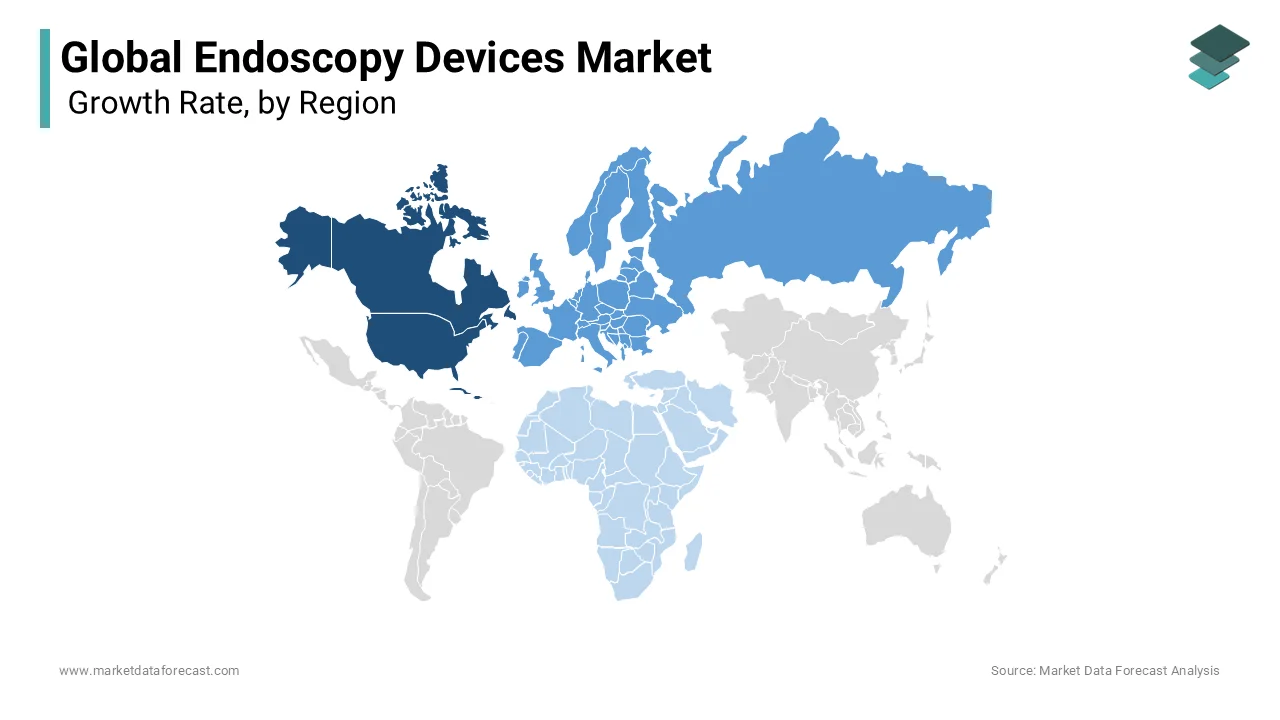

REGIONAL ANALYSIS

North America led the market in 2023 and accounted for a notable share. North America is expected to continue dominating the endoscopy devices market throughout the forecast period. The region’s dominance can be attributed to the growing prevalence of diseases such as bladder cancer and colon cancer, increasing preference for minimally invasive surgeries, and the growing aging population. In addition, the growing usage of robot-assisted endoscopes in diagnosis and surgical procedures favors the market growth in the North American region. The U.S. captured the most significant share of the North American region in 2023 and continues to hold a promising share during the forecast period. The growing number of laparoscopic and colonoscopy procedures and the growing prevalence of colorectal cancer are a few of the factors majorly contributing to the growth of the endoscopy devices market in the U.S. In addition, growing awareness regarding the advantages associated with the usage of endoscopy devices and the presence of key market participants are supporting the market growth in the U.S.

Europe is another promising region in the worldwide market and is anticipated to register a notable CAGR in the coming years. Factors such as growing preference from people towards minimally invasive procedures are one of the major factors propelling the regional market growth. Germany held the major share of the European market in 2023 and is expected to hold good occupancy in the European market during the forecast period, followed by UK and France.

However, APAC is projected to grow at the highest CAGR during the forecast period owing to increasing demand for minimally invasive surgeries. Emerging economies such as China and India are aiding market growth in the Asia-Pacific region. In addition, the growing number of people with cancer and consistent improvements in the healthcare infrastructure are supporting the endoscopy devices market in the Asia-Pacific region. China, followed by India, is currently leading the APAC market. The Indian market is anticipated to showcase a healthy CAGR in the coming years owing to the growing adoption of technological developments to manufacture well-advanced endoscopy devices. On the other hand, the increasingly advanced diagnostic procedures and regular healthcare infrastructure advancements favor the Chinese market.

Latin America is predicted to witness a steady CAGR during the forecast period owing to the unmet medical needs to diagnose various diseases such as cancer. Therefore, Mexico and Brazil are potential regional markets in Latin America.

MEA is predicted to hold a moderate share of the worldwide market during the forecast period due to the growing awareness regarding the early detection of diseases and the increasing number of people diagnosed with various diseases that need endoscopy devices.

KEY MARKET PLAYERS

Ethicon, Stryker Corporation, Karl Storz GmbH, Boston Scientific Inc., Olympus Corporation, Covidien Plc, Smith and Nephew Inc., and Fujifilm Holding Corporation are a few of the notable players in the worldwide endoscopy devices market.

RECENT HAPPENINGS IN THIS MARKET

- In 2019, "PowerSpiral," a small intestine endoscopy system, was launched by Olympus in Europe and Asia, including Hong Kong and India.

- In 2018, ENF-VT3 was launched by Olympus, the world's first rhino-laryngo video scope, to incorporate 4-direction angulation capability.

- In 2018, to enhance minimally invasive neurosurgery, a 4mm Endoscopic NIR/ICG Fluorescence imaging system was launched by KarlStroz.

MARKET SEGMENTATION

This market research report on the global endoscopy devices market has been segmented based on the product, application, and region.

By Product

- Endoscopes

- Flexible Endoscopes

- Rigid Endoscopes

- Capsule Endoscopes

- Visualization Systems

- Other Endoscopy Equipment

- Electrical Endoscopy Equipment

- Mechanical Endoscopy Equipment

By Application

- Laparoscopy

- Bronchoscopy

- GI Endoscopy

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the growth rate of the global endoscopic devices market?

Yes, we have studied and included the COVID-19 impact on the global endoscopic devices market in this report.

Which segment by type held the major share in the endoscopic devices market?

Based on type, the endoscopes segment led the market in 2025.

Who are the major players in the endoscopic devices market?

Ethicon, Stryker Corporation, Karl Storz GmbH, Boston Scientific Inc., Olympus Corporation, Covidien Plc, Smith and Nephew Inc., Fujifilm Holding Corporation are some of the key players in the endoscopic devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com