Global Endoscope Reprocessing Market Size, Share, Trends & Growth Forecast Report By Product (High-Level Disinfectants & Test Strips, Detergents & Wipes, Automated Endoscope Reprocessors, Endoscope Tracking Systems and Other Products), End-User (Ambulatory Surgery Centers, Hospitals and Other End Users) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033.

Global Endoscope Reprocessing Market Size

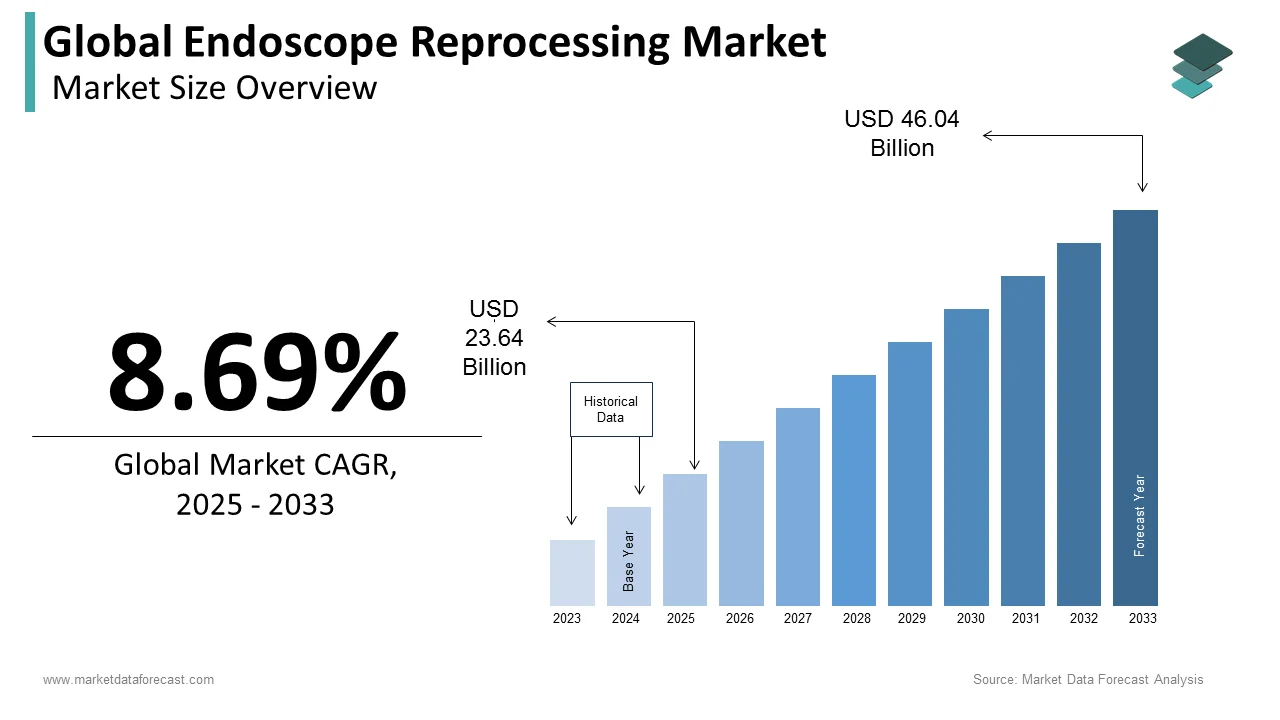

The global endoscope reprocessing market size was valued at USD 21.75 billion in 2024. The global market is predicted to be valued at USD 23.64 billion in 2025. This figure is forecasted to grow at a CAGR of 8.69% to reach USD 46.04 billion by 2033.

An endoscope is a tubular instrument used to examine the hollow viscera's interior. Reprocessing involves the cleaning and sterilization of the devices. Here, it refers only to flexible gastrointestinal endoscopes, like Automated Endoscope Reprocessor (AER), a machine designed for cleaning and disinfecting purposes for endoscopes and their accessories, along with a preceding meticulous manual cleaning. It is used regularly in various procedures, and the device must be cleaned to avoid infections. Also, endoscope reprocessing improves performance levels along with high accuracy and reliability. The cleaning process undergoes enzymatic detergents and has to be done at appropriate temperatures.

MARKET DRIVERS

The rising number of hospitals and the growing number of investments in endoscopic instruments are expected to drive the growth of the global endoscope reprocessing market. In almost all the facilities using gastrointestinal endoscopy (hospital, clinic, ambulatory care center, and practice), all personnel adhere to infection control principles to maintain a safe, infection-free environment and avoid the possibility of transmitting the disease to patients and colleagues, as result of strict government policies, which is compiling on every person to follow the advice on infection control and competence in reprocessing, thereby driving the growth of the market. Furthermore, the increased threat of infections associated with inappropriate purification of endoscopes increases the endoscope reprocessing market. Also, due to rising awareness among manufacturers, quality assurance is given the highest priority in settings where gastrointestinal endoscopy is performed, focusing on cleaning and high-level disinfection of hoses. Furthermore, advanced technologies developed for endoscopic surgical instruments are expected to boost the market. In addition, increasing demand for minimally invasive surgeries increases the risk of infections due to improper sterilization processes, which is one of the major factors driving the global endoscope processing market.

Furthermore, growing support from government and non-government institutes in healthcare centers also propels market growth. Moreover, the analysis of data from validation studies for cleaning and high-level disinfection is being helped by the FDA, and a record of outbreaks of infections in hospitals is being kept to understand AER infections. Factors such as the rising prevalence of launching innovative products concerned with patient safety and increasing incidences of infectious diseases worldwide are pushing the growth forward. Moreover, the growing tendency to improve the quality of treatment procedures in hospitals, increase the elderly population and increase chronic disease incidences further fuel the market growth for endoscope r processing. Staff monitoring for high-level disinfectants and reusable sterilants is expected to have a minimum effective concentration. To avoid cross-contamination, most areas of the endoscopy room are designated as clean areas; separating contaminated areas from clean counter areas is expected to drive the market.

MARKET RESTRAINTS

The shortage of skilled technicians to monitor the systems more accurately and the high costs associated with installing and maintaining the devices are significant market growth restraints. Adverse complications that arise after endoscopic treatment are one of the factors that obstruct maket growth. In addition, recycling instrumentation and reimbursement policies are restricted in developing countries, and the issues associated with the security of the reprocessed instruments further limit the market growth. Also, Reprocessing of flexible endoscopes has a narrow margin of security, due to which even the slightest deviation from the recommended protocol may increase the risk of infection. Furthermore, the rise in the complications during real-time due to system failures and the lack of awareness of some diagnostic procedures in rural areas also hamper the demand for the endoscope reprocessing market since for the reprocessing of these instruments, only persons capable of reading and understanding and implementing the instructions for high-level disinfection of gastrointestinal endoscopes and their accessories need to be appointed which meet the competency standards for endoscope reprocessing, and not just temporary staff.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges PESTLE Analysis; Porter's Five Forces Analysis; competitive Landscape, Analyst Overview of Investment Opportunities. |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Laboratories Anios (France), Olympus (Japan), Wassenburg Medical (The Netherlands) |

SEGMENTAL ANALYSIS

By Product Insights

The high-level disinfectants & test strips segment accounted for the majority of the market share in the global endoscope reprocessing market in 2024. The growth is attributed to the growing eruption related to insufficient cleaning or disinfecting during the high-level disinfectants and increasing affixation to the rules and guidelines of endoscope reprocessing by health re-centers. In addition, this might be due to the increased prevalence of infections like pneumonia and bacteremia as after-use effects of endoscopic procedures.

A saturated dialdehyde, Glutaraldehyde, is widely used for high-level disinfection of endoscopes by activating the acidic Glutaraldehyde to become sporicidal. Moreover, escalating attention on health conditions among the sole and fascination towards a quick recognition of having a permanent cure for the diseases are soaring the market growth. Likewise, the adoption of test strips is also increasing for faster disinfection reaction time, helping detect carbohydrates, residual proteins, and hemoglobin in flexible and rigid endoscopes and providing effective measurement through the use of minimum effective concentration (MEC) for high-level disinfection.

The automated endoscope reprocessors segment is estimated to grow at a healthy CAGR during the forecast period. However, it is projected to stand the second line leading the majority of the market share owing to various efforts by government organizations to support the adoption of ARE, increasing adoption of AERs in hospitals and medical facilities like ambulatory surgery centers, the active indulgence of companies for innovative and advanced AERs, as a result of an increasing number of endoscopic surgeries.

By End-User Insights

By the end-user, the hospital's segment is ruling with the highest shares of the market. The construction activities of hospitals and clinics are rising with the latest equipment to bolster the market demand. Hospitals' high numbers can be attributed to the establishment of funds and investments provided by government agencies, accessibility, and presence of professional staff available, and a growing number of endoscope cases reprocessing turning to hospitals are majorly driving growth to this market.

Ambulatory surgery centers are likely to have a quick growth rate during the period, followed by the hospital segment. The growth attributed to the growing number of endoscopic processes executed in ambulatory surgery centers and the increasing preference of ASCs over hospitals is majorly surging growth.

REGIONAL ANALYSIS

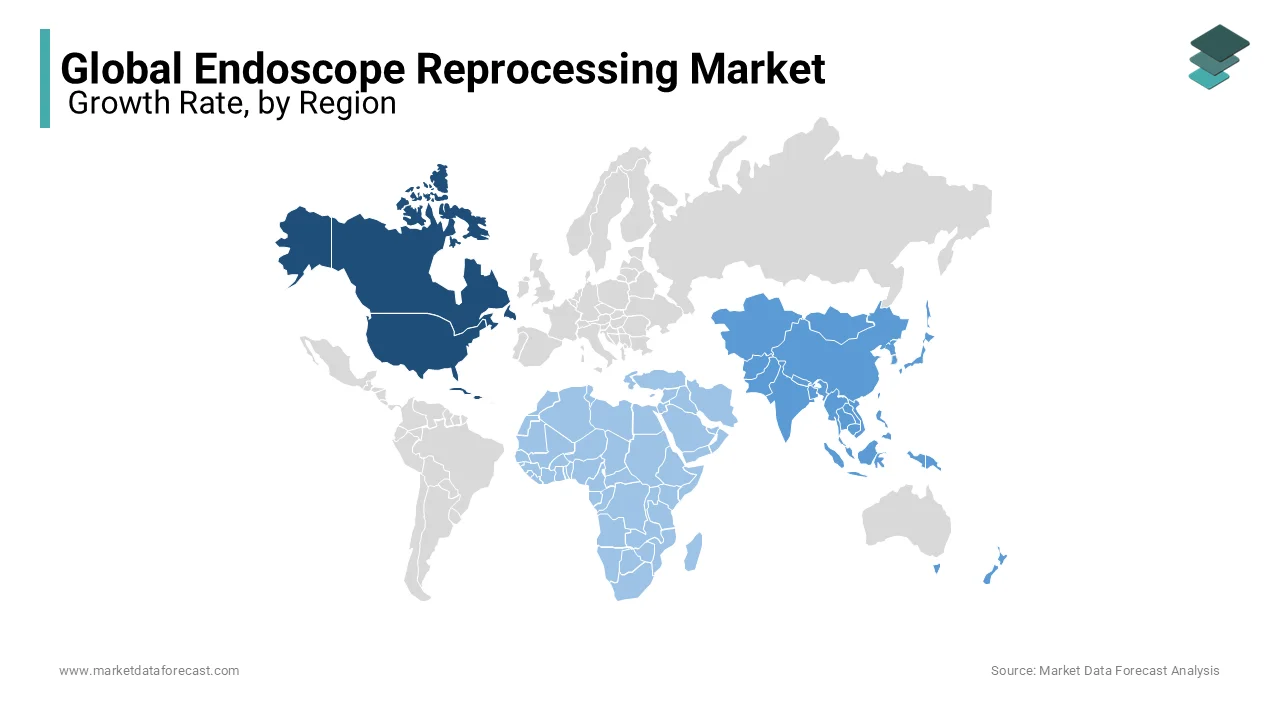

The North American market is predicted to dominate the global endoscope reprocessing market due to the quick acceptance of the latest technological d velopments. It is further driven by recognizing new advanced technologies that come into the market, increasing the commonness of diseases that need endoscopy procedures and a better healthcare foundation. In addition, this region is attributed due to supportable repayable policies mainly due to the presence of a large number of high-level disinfectant and test strip manufacturers, high health care costs, an increase in the number of hospitals, strict government regulations to maintain endoscopes sterilized after each use, increased preference for minimally invasive procedures, favorable reimbursement scenarios in the region, and the presence of giant medical device manufacturers which facilitates the availability of only endoscopes and OEM repair services.

The Asia Pacific is estimated to be the fastest-growing regional market globally due to the rise in the elderly population and growing revenue in most countries. The increase in the number of endoscopic surgeries, high incidence of gastrointestinal cancers, and improved healthcare infrastructure, primarily in developing and highly populated countries like Japan and China, which might collectively account for approximately 50% of the regional market.

The European market is forecasted to register a substantial share in the global market during the forecast period. Furthermore, it is likely to have a high CAGR due to the growing demand for endoscopy instruments with different features that stimulate market growth in this region.

The Latin American region is likely to grow with a CAGR of 8.5% and be worth 0.23 billion by 2025. The growth is also due to the building of hospitals, the increasing incidence of stomach cancer due to the rapid adoption of sedentary lifestyles by the population, and the high risk of infections are the factors that help the growth in this region.

The Middle East and Africa are anticipated to have an inclined growth rate shortly. Moreover, Saudi Arabia is anticipated to show the highest growth rate among these regions owing to the growing demand for minimally invasive devices due to the rising incidence of stomach diseases.

KEY MARKET PLAYERS

Noteworthy companies dominating the global endoscope reprocessing market profiled in this report are Advanced Sterilization Products (ASP) (U.S.), Cantel Medical (U.S.), Laboratories Anios (France), Olympus (Japan), Wassenburg Medical (The Netherlands), Custom Ultrasonics (U.S.), STERIS (U.S.), Steelco (Italy), Getinge (Sweden), ENDO-TECHNIK (Germany), BES Decon (U.K.), ARC Healthcare Solutions (Canada) and Metrex Research (U.S.).

RECENT DEVELOPMENTS IN THE MARKET

- In October 2022, one of the world's leading developers of semiconductor solutions, OmniVision, and AdaptivEndo, the leader in advancing single-use endoscopy technology, partnered to provide the medical industry with a unified platform of single-use and hybrid endoscopes that could be used for hepatology, gastroenterology, urology, gynecology and advanced endoscopic surgeries like cardiac and spinal electrophysiology, which can be used both inside and outside the operating room.

- In October 2022, PENTAX Medical, a healthcare industry leader in diagnostic and therapeutic endoscopy solutions, launched the Canadian CryoBalloon C2 Ablation System, a new effective way to treat Barrett's esophagus, which has a reduced 50% duration of pain over conventional radiofrequency ablation (RFA).

MARKET SEGMENTATION

This research report on the global endoscope reprocessing market has been segmented and sub-segmented based on the product, end-user, and region.

By Product

- High-Level Disinfectants & Test Strips

- Detergents & Wipes

- Automated Endoscope Reprocessors

- Single-Basin Automated Endoscope Reprocessors

- Double-Basin Automated Endoscope Reprocessors

- Endoscope Tracking Systems

- Advantages of Endoscope Tracking Systems

- Endoscope Drying, Storage, & Transport Systems

- Other Products

By End-User

- Ambulatory Surgery Centers

- Hospitals

- Other End Users

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much is the global Endoscope Reprocessing Market going to be worth by 2033?

As per our research report, the Endoscope Reprocessing Market size is projected to be USD 46.04 billion by 2033.

Which region is growing the fastest in the Endoscope Reprocessing Market ?

Geographically, the APAC Endoscope Reprocessing Market is predicted to have the fastest growth rate in the global market from 2025 to 2033.

Does this report include the impact of COVID-19 on the Endoscope Reprocessing Market?

We have studied and included the COVID-19 impact on the global Endoscope Reprocessing Market in this report.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com