Global Feed Carotenoid Market Size, Share, Trends, & Growth Forecast Report, Segmented By Type (Lutein, Canthaxanthin, Astaxanthin, Beta-Carotene, Lycopene, Zeaxanthin, And Others), Animal Type (Poultry, Aquaculture, Swine, Ruminant, And Others), And By Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa), Industry Analysis From 2025 to 2033

Global Feed Carotenoid Market Size

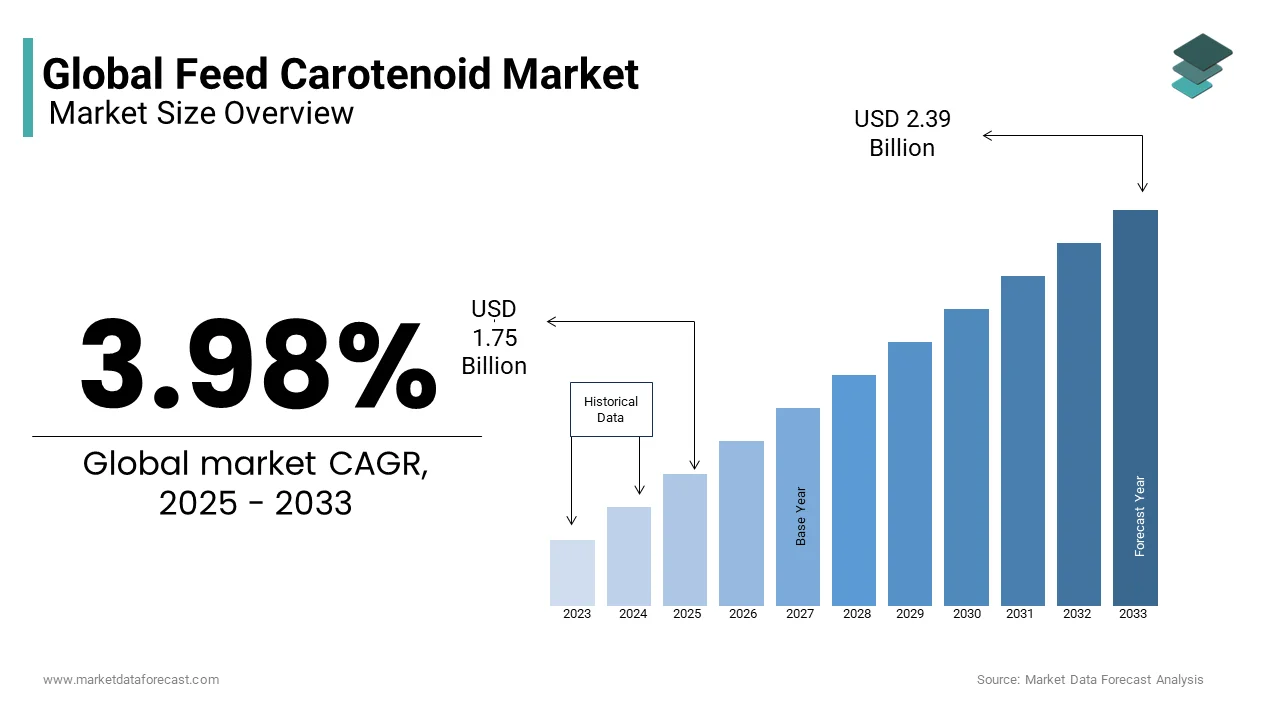

The global feed carotenoid market was valued at USD 1.68 billion in 2024 and is anticipated to reach USD 1.75 billion in 2025 from USD 2.39 billion by 2033, growing at a CAGR of 3.98% during the forecast period from 2025 to 2033.

Feed carotenoid plays an important role in enhancing animal nutrition, pigmentation, and overall health. The growing demand for high-quality meat, dairy, and poultry products with enhanced visual appeal is fueling the demand for feed carotenoids worldwide. Carotenoids such as astaxanthin, canthaxanthin, and lutein are widely used to improve the coloration of egg yolks, fish flesh, and poultry skin, aligning with consumer preferences for vibrant and visually appealing food products.

MARKET DRIVERS

Rising Demand for High-Quality Animal Products

The escalating consumer preference for visually appealing animal products is primarily driving the growth of the feed carotenoid market. According to the International Egg Commission, eggs with deep yellow yolks are perceived as healthier and more nutritious, driving poultry farmers to incorporate carotenoids like canthaxanthin into feed formulations. This trend has resulted in a 20% increase in carotenoid usage in poultry feed since 2019. In aquaculture, astaxanthin is indispensable for achieving the desired pinkish-red hue in salmon and trout. The Norwegian Seafood Council reports that Norway exported over 1.1 million metric tons of salmon in 2022, valued at USD 8.7 billion, with astaxanthin playing a pivotal role in maintaining product quality. Consumers’ willingness to pay premium prices for visually enhanced seafood further boosts demand for carotenoids.

Focus on Animal Health and Immunity

Carotenoids not only enhance pigmentation but also contribute to animal health by acting as antioxidants. According to a study published in Poultry Science, dietary supplementation with lutein improves immune responses in broilers, reducing mortality rates by 15%. This dual functionality makes carotenoids a cost-effective solution for livestock and aquaculture producers. Additionally, the growing awareness of antibiotic-free farming has increased reliance on natural additives like carotenoids. For instance, the demand for organic poultry in the U.S. grew by 12% annually between 2020 and 2022, which is creating opportunities for bio-based carotenoid formulations that align with sustainable practices.

MARKET RESTRAINTS

High Production Costs

The high cost of producing synthetic carotenoids that limits accessibility for small-scale farmers is significantly hampering the growth of the feed carotenoid market. According to sources, producing astaxanthin synthetically costs up to USD 2,000 per kilogram, compared to natural sources, which are even more expensive. These costs are passed on to farmers, making carotenoid-enriched feed less affordable in developing regions like Africa and Southeast Asia. For instance, the African Development Bank highlights that smallholder farmers in sub-Saharan Africa spend 30% of their income on feed, leaving little room for premium additives like carotenoids. This economic barrier restricts widespread adoption, particularly in low-income agricultural communities.

Stringent Regulatory Frameworks

Regulatory restrictions pose another major challenge, particularly in Europe and North America. The European Food Safety Authority mandates rigorous testing for residues and toxicity, delaying product approvals and increasing compliance costs. For instance, these regulations have led to a 10% reduction in synthetic carotenoid usage in the EU since 2018. In the United States, the FDA’s approval process for new feed additives can take up to three years, hindering innovation. Smaller manufacturers often struggle to meet these regulatory requirements, creating barriers to entry and limiting market diversity.

MARKET OPPORTUNITIES

Development of Natural Carotenoid Sources

The shift toward natural and sustainable feed additives is providing significant opportunities for the feed carotenoid market. Manufacturers are increasingly focusing on extracting carotenoids from algae, marigold flowers, and microorganisms, aligning with consumer demand for eco-friendly solutions. For instance, the demand for natural carotenoid is growing significantly due to the rising awareness of environmental sustainability. For example, companies like DSM have launched algae-derived astaxanthin products tailored for aquaculture, gaining traction in markets like Europe and North America. For instance, the organic aquaculture in the U.S. grew by 18% annually between 2020 and 2022, creating a niche for natural carotenoids that comply with organic certification standards.

Expansion into Emerging Markets

Emerging markets offer lucrative growth opportunities due to rising protein consumption and intensifying livestock farming activities. For instance, India’s poultry industry is expected to grow at a CAGR of 10% through 2030, creating robust demand for carotenoids to enhance egg and meat quality. The Indian government allocated USD 500 million in 2022 to promote commercial poultry farming, indirectly boosting carotenoid adoption. Similarly, the Brazilian aquaculture sector is valued at USD 1.5 billion and relies heavily on astaxanthin for shrimp farming. Government initiatives, such as subsidies for sustainable feed additives, further support market expansion in Latin America and Asia-Pacific.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions have emerged as a major challenge, particularly during the post-pandemic recovery phase. For instance, global trade bottlenecks caused raw material costs for feed additives to rise by 25% in 2022, impacting carotenoid production. Key ingredients like marigold extracts, essential for lutein production, faced shortages due to logistical delays and geopolitical tensions. For instance, China, a leading producer of synthetic carotenoids, imposed export restrictions during the pandemic, affecting global supply chains. These disruptions forced manufacturers to raise prices, reducing affordability for small-scale farmers in developing regions. Addressing these vulnerabilities requires investment in localized production facilities and diversified sourcing strategies.

Consumer Skepticism and Awareness Gaps

Consumer skepticism about synthetic additives poses another challenge, particularly in developed markets. A survey conducted by the Organic Trade Association reveals that 65% of consumers prefer naturally derived feed additives, creating pressure on manufacturers to innovate safer alternatives. However, limited awareness among farmers in emerging markets about the benefits of carotenoids hinders adoption rates. For example, in sub-Saharan Africa, only 30% of poultry farmers use carotenoid-enriched feed, as per the African Agricultural Technology Foundation. Bridging this awareness gap requires targeted education campaigns and financial incentives to encourage wider acceptance of carotenoid-based solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.98% |

|

Segments Covered |

By Type, By Animal Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE, Chr. Hansen A/S, FMC Corporation, Kemin Industries Inc., Royal DSM N.V., and Behn Meyer Group. |

SEGMENT ANALYSIS

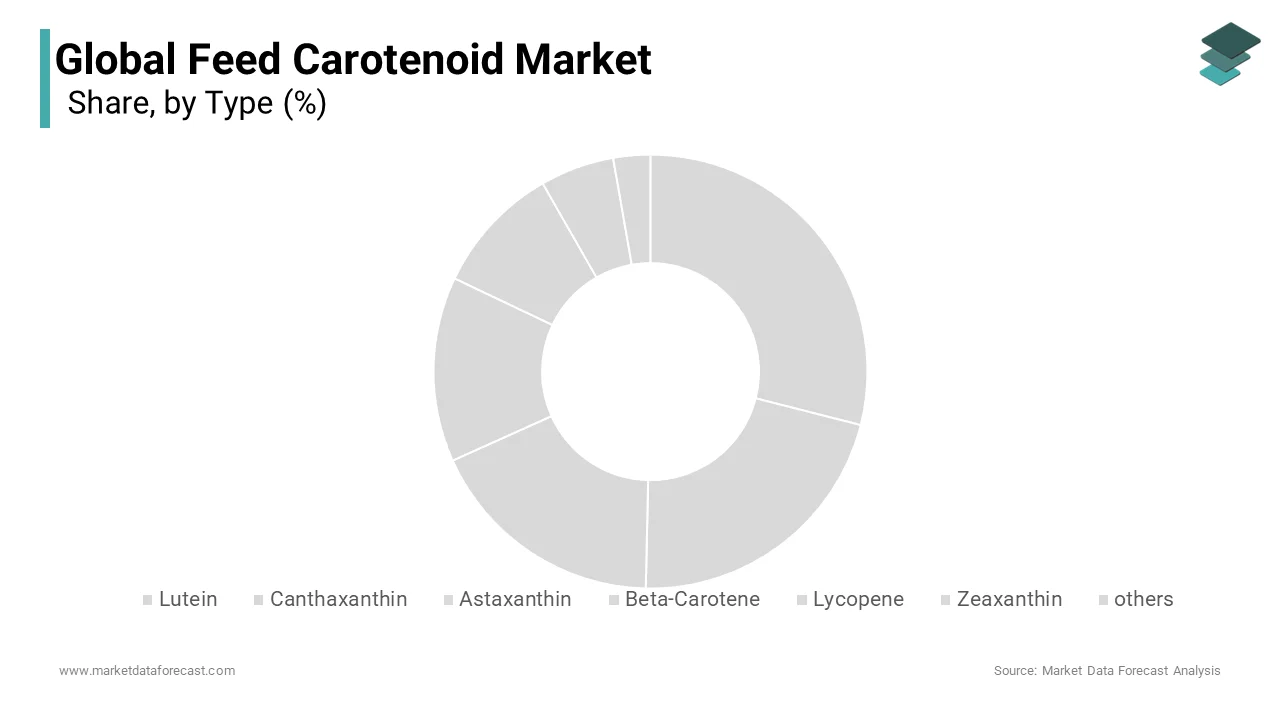

By Type Insights

Largest Segment: Astaxanthin

The astaxanthin segment occupied the leading share of 36.1% of the global market in 2024. The growth of the astaxanthin segment in the global market is attributed to its critical role in aquaculture, particularly in enhancing the pigmentation of salmon, trout and shrimp. According to the Norwegian Seafood Council, Norway exported over 1.1 million metric tons of salmon in 2022 and was valued at USD 8.7 billion, with astaxanthin being essential for achieving the desired pinkish-red flesh color that consumers associate with premium quality. The growing aquaculture industry is further contributing to the growth of the astaxanthin segment in the global market. The Food and Agriculture Organization (FAO) states that global aquaculture production exceeded 120 million metric tons in 2022, with astaxanthin accounting for nearly 40% of all carotenoids used in fish farming. Additionally, advancements in synthetic and natural astaxanthin production have reduced costs, making it more accessible for large-scale applications. For instance, DSM’s algae-derived astaxanthin has gained traction in Europe, where organic aquaculture is projected to grow at a prominent CAGR. The growing consumer preference for visually appealing seafood is also aiding the expansion of astaxanthin segment in the global market. For instance, 70% of consumers prioritize color when purchasing salmon, underscoring the importance of astaxanthin in meeting market demands.

The lutein segment is anticipated to grow at a CAGR of 8.2% over the forecast period owing to its increasing use in poultry feed to enhance egg yolk pigmentation and improve animal health. The International Egg Commission reports that eggs with deep yellow yolks are perceived as healthier, driving poultry farmers to incorporate lutein into feed formulations. This trend has resulted in a 20% increase in lutein usage in poultry feed since 2019. The rising demand for organic and free-range eggs is also driving the growth of the lutein segment in the global market. For instance, the demand for organic poultry in the U.S. has been consistently growing from the last few years and creating opportunities for natural lutein derived from marigold flowers.

By Animal Type Insights

The poultry segment accounted for the major share of 40.9% of the global market in 2024. The domination of poultry segment in the global market is attributed to the widespread use of carotenoids like canthaxanthin and lutein to enhance egg yolk coloration and poultry skin pigmentation. According to the International Egg Commission, global egg production exceeded 85 million metric tons in 2022, with carotenoids playing a vital role in meeting consumer expectations for visually appealing products. The growing demand for high-quality eggs is also contributing to the domination of poultry segment in the global market. As per a survey conducted by the Organic Trade Association reveals that 65% of consumers prefer eggs with deep yellow yolks, creating robust demand for carotenoid-enriched feed. Additionally, the rise of antibiotic-free farming has increased reliance on natural additives like lutein, which not only enhances pigmentation but also boosts immunity. An increasing number of favorable initiatives from the governments of various countries is further boosting the expansion of the poultry segment in the global market. For instance, India allocated USD 500 million in 2022 to promote commercial poultry farming, indirectly boosting carotenoid usage.

The aquaculture segment is set to expand at a CAGR of 9.1% over the forecast period owing to the increasing demand for visually appealing seafood and the booming aquaculture industry. The Food and Agriculture Organization (FAO) states that global aquaculture production exceeded 120 million metric tons in 2022, with carotenoids like astaxanthin being indispensable for achieving vibrant flesh coloration in salmon and shrimp. The rising consumption of seafood is also propelling the growth of the aquaculture segment in the global market. According to the FAO, per capita seafood consumption reached 20.5 kilograms annually in 2022, with consumers willing to pay premium prices for visually enhanced products. Additionally, advancements in natural astaxanthin production, such as algae-derived formulations, align with sustainability trends. Government subsidies further support this growth.

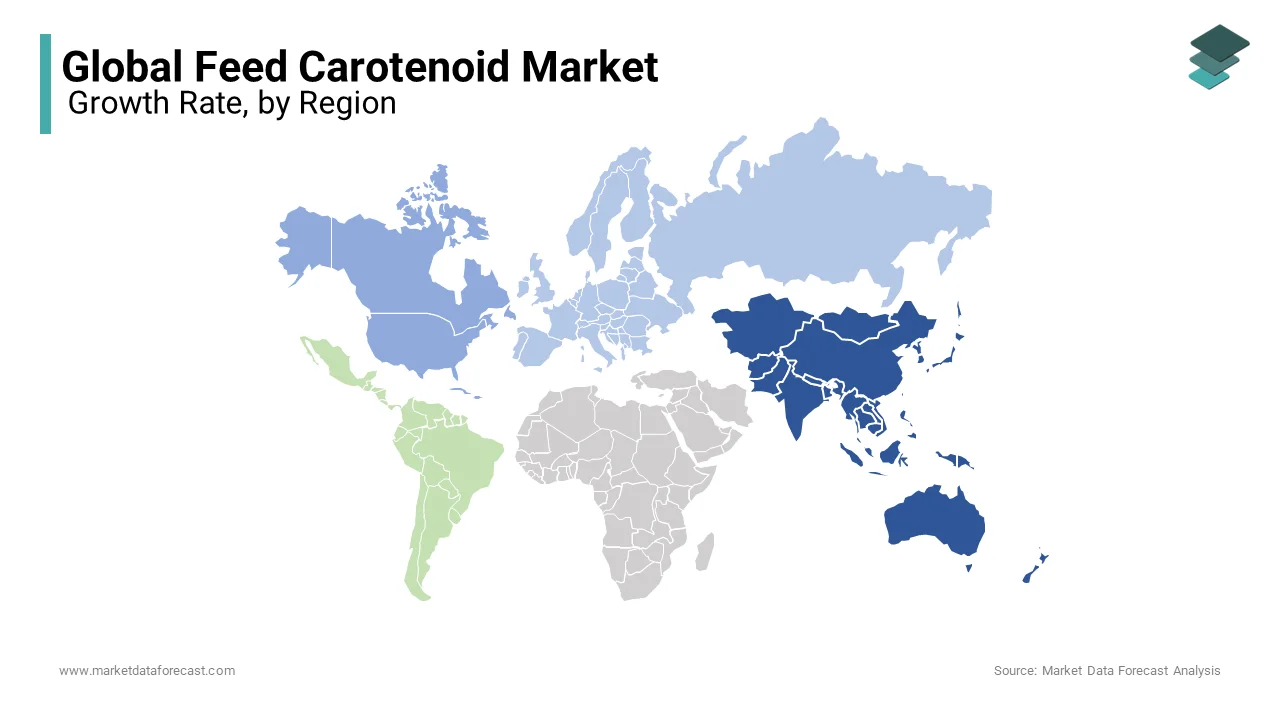

REGIONAL ANALYSIS

Asia-Pacific emerges as the largest and fastest-growing region in the feed carotenoid market by holding 39.4% of the global market share in 2024. China is dominating the market in Asia-pacific, producing more than 60% of the world’s synthetic carotenoids due to the intensive farming practices. For instance, shrimp farming alone accounts for 30% of the country’s aquaculture production, which is making astaxanthin indispensable. India follows closely, with its poultry and dairy sectors driving demand. Lutein and canthaxanthin are widely used in India, where egg production exceeded 100 billion units in 2022, as per the Indian Poultry Federation. Government initiatives, such as the USD 500 million poultry promotion scheme, encourage farmers to adopt modern feed additives. Southeast Asia’s tropical climate creates ideal conditions for aquaculture, further propelling carotenoid usage. Vietnam’s shrimp exports reached USD 3.2 billion in 2022, underscoring the importance of astaxanthin in maintaining product quality.

North America captured a significant position of the global feed carotenoid market in 2024 and is estimated to showcase a healthy CAGR over the forecast period. The United States the leading the market in North America, with its advanced agricultural practices and strong emphasis on high-quality animal products. According to the USDA, the U.S. poultry industry produced over 9 billion broilers in 2022, driving demand for carotenoids like canthaxanthin and lutein to enhance egg yolk pigmentation and poultry skin color. The growing consumer preference for organic and premium animal products in North America is further boosting the market expansion in North America. For instance, the Organic Trade Association reports that the U.S. organic poultry market grew by 12% annually between 2020 and 2022, creating opportunities for natural carotenoids derived from algae and marigold flowers. Additionally, advancements in precision nutrition tools have enabled farmers to optimize carotenoid usage, reducing costs while improving product quality. Government initiatives, such as subsidies for sustainable farming practices, further bolster adoption rates. Canada complements this growth with its focus on aquaculture, particularly salmon farming. The Canadian Aquaculture Industry Alliance states that Atlantic salmon exports reached CAD 1.2 billion in 2022, underscoring the importance of astaxanthin in maintaining product appeal.

Europe held a considerable share of the feed carotenoid market in 2024 and is estimated to continue to play a key role in the global market along with North America and Asia-pacific. In Europe, Germany leads the market, with its advanced livestock farming practices and strict adherence to environmental regulations. The European Food Safety Authority mandates rigorous testing for feed additives, encouraging manufacturers to innovate safer formulations. The rising demand for visually appealing animal products is one of the factors driving the European market growth. For instance, eggs with deep yellow yolks are preferred by 70% of European consumers, boosting the use of lutein and canthaxanthin in poultry feed. Additionally, Europe’s booming aquaculture sector relies heavily on astaxanthin, with Norway exporting over 1.1 million metric tons of salmon in 2022 and valued at USD 8.7 billion, as per the Norwegian Seafood Council. France and Spain also contribute significantly, with their dairy and poultry industries driving carotenoid adoption. Government subsidies, such as France’s EUR 500 million pesticide innovation fund, further support market expansion.

Latin America held a notable position in the feed carotenoid market in 2024. Brazil leads the market in Latin America, with its vast agricultural landscape and high reliance on aquaculture and poultry farming. The Brazilian Aquaculture Association states that shrimp farming alone generated USD 1.5 billion in 2022, driven by effective use of astaxanthin to enhance flesh coloration. Mexico complements this growth with its focus on poultry farming, which relies heavily on lutein and canthaxanthin to meet consumer preferences for vibrant egg yolks. Government programs, such as Mexico’s USD 200 million initiative to promote sustainable aquaculture, further support carotenoid adoption. Argentina also plays a critical role, with its beef and dairy industries driving demand for beta-carotene and lycopene. These additives not only improve animal health but also align with sustainability trends, ensuring long-term market growth.

The Middle East and Africa represent an emerging segment in the feed carotenoid market, capturing a moderate share of the global market. South Africa dominates this region, with its poultry and aquaculture industries driving demand. The South African Poultry Association reports that egg production exceeded 2.5 billion units in 2022, creating steady demand for lutein and canthaxanthin. Egypt’s agricultural sector also plays a critical role, particularly in fish farming. Astaxanthin is extensively used in tilapia farming, which contributes USD 1.5 billion annually to Egypt’s economy. Additionally, public health applications are gaining prominence, with carotenoids being used to fortify animal products with antioxidants. However, limited awareness and financial constraints hinder widespread adoption. To address these challenges, Kenya launched a USD 10 million initiative in 2022 to train farmers on safe feed additive usage, promoting sustainable practices while enhancing market penetration.

KEY MARKET PLAYERS

The major companies dominating the global Feed Carotenoid market are BASF SE, Chr. Hansen A/S, FMC Corporation, Kemin Industries Inc., Royal DSM N.V., and Behn Meyer Group.

Top Players in the Market

DSM (Royal DSM)

DSM is a global leader in the feed carotenoid market, renowned for its innovative solutions and sustainable practices. The company specializes in producing high-quality astaxanthin, lutein, and canthaxanthin, widely used in aquaculture and poultry farming. DSM’s algae-derived astaxanthin has gained traction in Europe, aligning with organic certification standards. Its commitment to sustainability is evident in its development of bio-based formulations that comply with stringent environmental regulations. DSM also invests heavily in R&D to address emerging challenges like pest resistance and consumer preferences for natural additives.

BASF SE

BASF SE plays a pivotal role in the feed carotenoid market, offering advanced formulations like beta-carotene and lycopene. The company focuses on precision nutrition, integrating digital tools to optimize carotenoid application and reduce costs. BASF’s global presence allows it to cater to diverse agricultural needs, from poultry in North America to aquaculture in Asia-Pacific. Its partnership with local governments and NGOs promotes sustainable farming practices, ensuring long-term adoption of its products. BASF’s emphasis on innovation ensures its position as a trusted name in animal nutrition.

FMC Corporation

FMC Corporation contributes significantly to the feed carotenoid market through its focus on eco-friendly solutions. The company produces active ingredients like lutein and astaxanthin, which are highly effective in enhancing pigmentation while maintaining low toxicity levels. FMC’s strategic investments in research enable it to develop formulations that meet evolving regulatory standards. Its strong distribution network ensures widespread availability of products, particularly in emerging markets like Latin America and Asia-Pacific. By prioritizing sustainability and customer-centric solutions, FMC has established itself as a key player in the global feed carotenoid industry.

Top Strategies Used By Key Market Participants

Development of Natural and Bio-Based Formulations

Key players are increasingly focusing on developing natural carotenoids derived from algae, marigold flowers, and microorganisms to meet consumer demand for eco-friendly solutions. For example, DSM launched algae-derived astaxanthin tailored for organic aquaculture, gaining traction in Europe. According to Meticulous Research, the global natural carotenoid market is projected to grow at a CAGR of 6.5% from 2023 to 2030, underscoring the potential of this strategy. These formulations not only comply with stringent environmental regulations but also appeal to environmentally conscious consumers.

Expansion into Emerging Markets

Emerging markets present lucrative opportunities for growth due to rising protein consumption and intensifying livestock farming activities. Companies like BASF have partnered with governments in India and Brazil to promote carotenoid usage in poultry and aquaculture. For instance, BASF collaborated with the Indian government to provide affordable lutein formulations for egg farmers, driving adoption rates. According to the FAO, India’s poultry industry is expected to grow at a CAGR of 10% through 2030, creating robust demand for carotenoid-based solutions.

Strategic Collaborations and Acquisitions

Collaborations and acquisitions are instrumental in strengthening market position. For example, FMC Corporation acquired a biotech startup specializing in sustainable feed additives, enabling it to integrate carotenoid applications with genetic engineering solutions. Such partnerships foster innovation while addressing challenges like regulatory compliance and supply chain disruptions. Additionally, joint ventures with regional distributors ensure wider product accessibility, particularly in underserved markets like sub-Saharan Africa.

COMPETITION OVERVIEW

The feed carotenoid market is highly competitive, characterized by the presence of multinational giants like DSM, BASF, and FMC Corporation, alongside numerous regional players. These companies leverage their R&D capabilities, global reach, and technological advancements to maintain dominance. However, the market is witnessing increased fragmentation due to the entry of smaller firms offering cost-effective and specialized solutions. Regulatory pressures, particularly in Europe and North America, have forced companies to innovate and adopt sustainable practices, intensifying rivalry.

Key players differentiate themselves through product quality, technological integration, and customer support. For instance, DSM’s focus on bio-based formulations and BASF’s emphasis on precision agriculture set them apart from competitors. Meanwhile, emerging markets in Asia-Pacific and Latin America present lucrative opportunities, prompting companies to expand their geographic footprint. Strategic acquisitions, partnerships, and investments in alternative chemistries are common tactics to strengthen market position. Overall, the feed carotenoid market remains dynamic, with innovation and sustainability serving as critical success factors.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, DSM launched its new algae-derived astaxanthin formulation designed for organic aquaculture. This move aims to address the growing demand for sustainable feed additives and strengthen DSM’s leadership in eco-friendly innovations.

- In June 2023, BASF partnered with the Indian government to establish a training program for poultry farmers on safe carotenoid usage. This initiative focuses on promoting lutein and canthaxanthin adoption while enhancing egg quality, reinforcing BASF’s presence in South Asia.

- In September 2022, FMC Corporation acquired a Brazilian agtech startup specializing in sustainable feed additives. This acquisition enables FMC to integrate carotenoid applications with genetic engineering solutions, addressing challenges like pest resistance and regulatory compliance.

- In December 2021, DSM introduced its digital platform, CaroNutri+, which uses AI to analyze animal health metrics and recommend optimal carotenoid applications. This tool improves efficiency and reduces costs, positioning DSM as a tech-driven innovator.

- In July 2020, BASF launched a joint venture with an Indian distributor to expand its reach in South Asia. This collaboration focuses on providing affordable carotenoid-based solutions to small-scale farmers, driving adoption in emerging markets.

MARKET SEGMENTATION

This research report on the global feed carotenoid market has been segmented and sub-segmented into the following categories.

By Type

- Lutein

- Canthaxanthin

- Astaxanthin

- Beta-Carotene

- Lycopene

- Zeaxanthin

- others

By Animal Type

- Poultry

- Aquaculture

- Swine

- Ruminant

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle-East & Africa

Frequently Asked Questions

What role do carotenoids play in animal nutrition, and why are they essential in feed?

Carotenoids, such as astaxanthin, beta-carotene, lutein, and canthaxanthin, enhance pigmentation in poultry, fish, and livestock while also acting as powerful antioxidants that improve immune function, reproduction, and overall animal health.

What are the primary drivers fueling the growth of the global feed carotenoid market?

Increasing demand for high-quality, visually appealing animal products (especially poultry meat, eggs, and aquaculture), rising consumer preference for natural feed additives, and advancements in biotechnology for carotenoid extraction are key growth factors.

How do synthetic and natural carotenoids differ in the feed industry, and which is gaining traction?

Synthetic carotenoids are cost-effective and widely used, but natural carotenoids, derived from sources like algae, marigold flowers, and paprika, are gaining popularity due to rising concerns over synthetic additives and regulatory shifts favoring natural alternatives.

Which regions are leading the global feed carotenoid market, and why?

Europe and North America dominate due to stringent feed quality regulations and high awareness of animal nutrition. Meanwhile, Asia-Pacific is witnessing the fastest growth, driven by expanding livestock and aquaculture industries, particularly in China, India, and Southeast Asia.

Who are the major players in the feed carotenoid industry, and what innovations are they bringing?

Key players such as DSM, BASF, Kemin Industries, Novus International, and Allied Biotech Corporation are focusing on sustainable extraction methods, microencapsulation for better stability, and customized carotenoid blends to enhance feed efficiency and bioavailability.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]