Global Carotenoids Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Astaxanthin, Canthaxanthin, Lutein, Beta-Carotene, Lycopene, & Zeaxanthin), Application (Food & Beverages, Dietary Supplements, Animal Feed And Pharmaceuticals And Others), Sources (Natural And Synthetic), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Global Industry Analysis, Size, Share, Growth, Trends And Forecast 2025 To 2033

Global Carotenoids Market Size

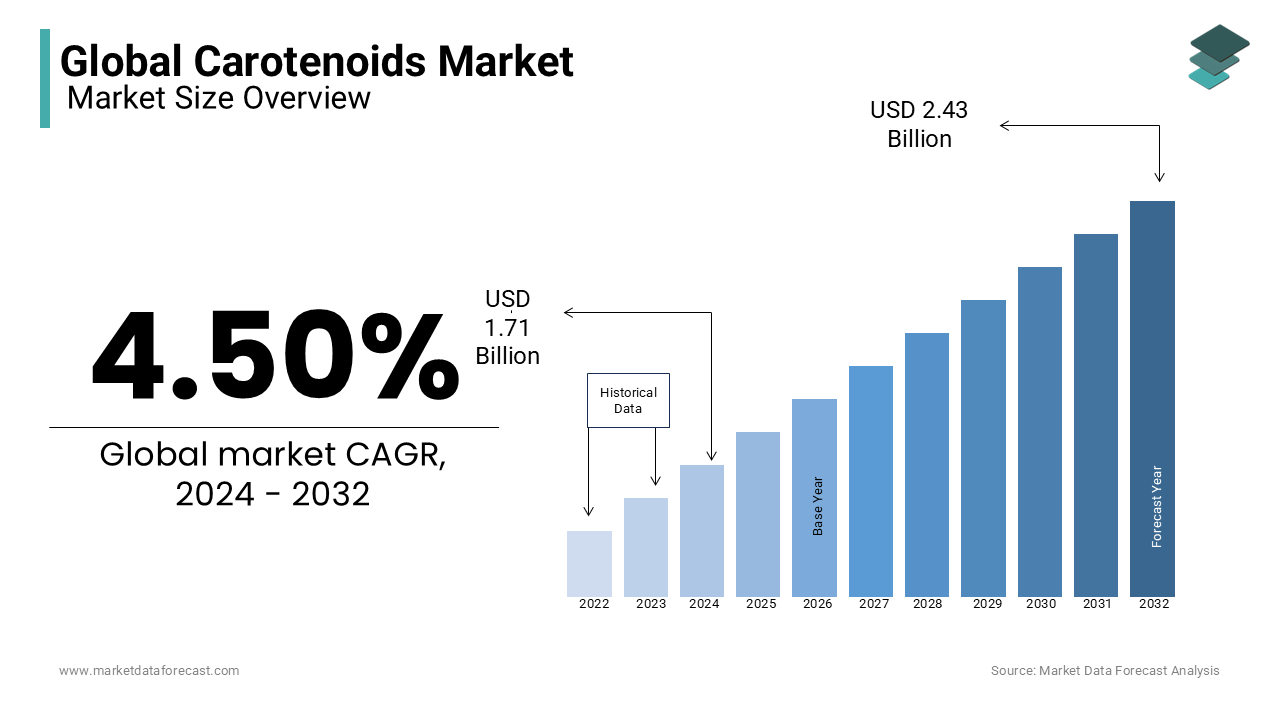

The size of the global carotenoids market was expected to be worth USD 1.71 billion in 2024 and is anticipated to be worth USD 2.55 billion by 2033 from USD 1.79 billion In 2025, growing at a CAGR of 4.50% during the forecast period.Greater use of natural carotenoids as a food coloring and innovation in the technology used to extract carotenoids.

Carotenoids are plant pigments that exhibit red, yellow, and orange color in many fruits and vegetables. This pigment plays a vital role in plant health. Also, people who eat foods that contain carotenoids protect their health. Carotenoids are also found in plant chloroplasts and chromosomes and other photosynthetic organisms such as some bacteria and fungi. They act as antioxidants in the body, preventing cell damage, the effects of aging, and some chronic diseases. They can assemble into the fat and other basic organic metabolic building blocks of these organisms. Carotenoids are essential for properties like color of carrots, corn, egg yolks, buttercups, canaries, daffodils, and bananas. As an antioxidant, carotenoids are useful for protecting eyesight and fighting cell damage. The carotenoids found in tomatoes help keep the liver, prostate, breast, colon, and lungs healthy. The growing demand for antioxidants, micronutrients, and vitamins will accelerate product adoption in countless end-use applications.

MARKET DRIVERS

Increased health problems are expected to lead to increased demand for healthy foods and natural foods and increased consumption of supplements.

Carotenoids are, in general, organic pigments that are available in several plants and organisms. This product acts as an antioxidant and protects the body from the effects of chronic disease, cell damage, and aging. Due to the increase in health problems and increasing use of dietary supplements, increases the market demand. The main driver of the industry is the importance of carotenoids in the treatment of diabetes, cancer and eye disorders. The health benefits of carotenoids in human food have become increasingly misleading in recent years and are frequently preventing many major health disorders. The higher the carotenoid awareness intake, the more it helps the body rejuvenate by promoting the growth of healthy cells and preventing the growth of unhealthy cells. This has resulted in the growth of the market by increasing the consumption of carotenoids in human food.

The increased demand for animal protein and dairy products will support the growth of the carotenoid market during the forecast period. Carotenoids are included in animal feed to improve the skin color of broilers, such as poultry, fish and shrimp, fish, egg yolks, and crustaceans. Furthermore, the ability of carotenoids to improve fertility and support healthy body functions will further increase penetration into the animal feed sector. As the prevalence of cancer, obesity, and diabetes increased, a paradigm shift toward carotenoid use began. Positive impact due to the application of this product in various end-use sectors like food and beverages, pharmaceuticals, feed, cosmetics, and dietary supplements, is likely to fuel this market boom. Additionally, government efforts to promote a healthy diet to reduce the side effects of diseases caused by obesity will support industrial expansion. As the demand for skincare products increases due to various weather conditions, the use of carotenoids such as phytoene and phytofluene is recommended due to their ultraviolet absorbing properties.

Exposure to UV light is an essential factor in making skin cells cancerous. As awareness of the adverse effects of UV light increases, the demand for carotenoid-enhanced skincare products is supported, accelerating market growth, and the market is driven by substantial investment in research and development of new products. This prompted an investigation of microbial products as a means of obtaining better yields. Overall industrial growth is accelerating with the expansion of production facilities and product innovation. Technological advances in synthetic engineering will support market growth because it can reduce the cost of producing synthetic derivatives.

MARKET RESTRAINTS

Strict regulatory and approval standards are expected to disrupt demand for products in the coming years. The expensive unregulated utilization costs and related health risks are suspected of challenging demand for carotenoids in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2023 |

|

CAGR |

4.5% |

|

Segments Covered |

By Type, Application, Source, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC; PESTLE Analysis. Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE, Brenntag, Kemin Industries, Cyanotech Corp, ExcelVite Sdn. Bhd, Chr. Hansen, D.D. Williamson, Allied Biotech, Divis Laboratories, DSM Nutritional Products, Naturex SA, Lycored and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The beta-carotene segment held the major share of the global carotenoids market in 2024. Beta-carotene is a widely used carotenoid due to its strong antioxidant properties and its role as a precursor to vitamin A. It is commonly found in products such as dietary supplements, functional foods, beverages, and cosmetics. The high demand for beta-carotene is driven by its health benefits, including eye health, immune system support, and skin care applications. The growing consumer awareness of the importance of antioxidants in health and wellness further boosts the demand for beta-carotene, making it the dominant segment in the carotenoids market.

The astaxanthin segment is predicted to showcase a notable CAGR in the global carotenoids market during the forecast period. Astaxanthin is a powerful antioxidant derived from microalgae, and it is increasingly used in dietary supplements, cosmetics, and functional foods due to its anti-inflammatory and skin-protective properties. This carotenoid is gaining popularity in the wellness industry, especially for its potential in improving skin health, reducing oxidative stress, and supporting joint health. The rising consumer interest in natural and sustainable ingredients, along with the growing demand for anti-aging and wellness products, is driving the rapid growth of the astaxanthin segment in the carotenoids market.

By Application Insights

The food & beverages segment led the carotenoids market by application in 2024. Carotenoids are commonly used as natural colorants and nutritional additives in food and beverage products, such as juices, dairy products, and processed foods. Beta-carotene, lutein, and other carotenoids are valued for their ability to enhance color, flavor, and health benefits, such as antioxidant properties and promoting eye health. The increasing demand for natural food colorants and the growing consumer preference for functional foods are key drivers of the segment's dominance in the carotenoids market.

The dietary supplements segment is on the rise and is anticipated to register the fastest growth in the global market during the forecast period. Carotenoids, especially astaxanthin, lutein, and beta-carotene, are widely used in supplements due to their health benefits, including antioxidant properties, eye health support, and skin protection. As consumer awareness of the importance of preventive healthcare rises, demand for carotenoid-based supplements is increasing. The growing focus on wellness, aging populations seeking anti-aging benefits, and the rise in demand for natural, plant-based supplements are fueling the rapid growth of this segment in the carotenoids market.

By Source Insights

The natural source segment captured the major share of the global carotenoids market in 2024. Natural carotenoids, derived from plant sources like carrots, spinach, and algae, are increasingly preferred by consumers due to the growing demand for clean-label and natural ingredients. These carotenoids are seen as safer, more sustainable, and more beneficial for health compared to synthetic alternatives. As consumers become more health-conscious and aware of the potential risks of synthetic additives, the demand for natural carotenoids in food, beverages, supplements, and cosmetics continues to dominate the market.

The synthetic source segment is projected to witness the highest CAGR in the global market over the forecast period. Synthetic carotenoids are often more cost-effective to produce and can meet the high demand for mass-produced food colorants, supplements, and animal feed. While natural carotenoids are preferred for health reasons, synthetic alternatives offer a more affordable option for manufacturers in large-scale applications. This is particularly important in industries like food and beverages, where cost efficiency is a key factor. The growth in the synthetic carotenoid segment is fueled by technological advancements that allow for better production methods and greater consistency in supply.

REGIONAL ANALYSIS

As demand for clean-label food and health awareness increases, there is the largest carotenoid market in North America and Europe. In addition, in the UK, concerns about food safety are on the rise, pushing manufacturers to adopt clean labels, creating a demand for natural colors. Europe was the leading regional market and is expected to experience steady sales growth as demand for dietary supplements and animal feed increases. The well-established cosmetic industry due to the presence of major manufacturers such as L'Oréal, Unilever, Beiersdorf and Henkel is assumed to be an essential factor influencing growth in the region. The Asia Pacific region is an emerging market, and more and more consumers are taking preventative measures in the form of dietary supplements to prevent disease.

The Asia Pacific region is expected to benefit from the increased use of these additives in the food, supplement, food, pharmaceutical and cosmetic sectors. The business is foreseen to be driven by technological advances, industrial growth, economic growth, and low production costs in countries like China, Japan, and India. Recent changes in consumer lifestyles around the world and food intake have resulted in the development of the carotenoid business in the Asia Pacific area. The growth of the pharmaceutical and energy industries has also experienced substantial growth in South America. The rise in the middle-class population, educational sector growth and surge in disposable income in the area, have improved consumer awareness towards health and advantages of dietary supplements.

KEY PLAYERS IN THE GLOBAL CAROTENOIDS MARKET

Major Key Players in the Global Carotenoids Market are BASF SE, Brenntag, Kemin Industries, Cyanotech Corp, ExcelVite Sdn. Bhd, Chr. Hansen, D.D. Williamson, Allied Biotech, Divis Laboratories, DSM Nutritional Products, Naturex SA, Lycored and Others.

RECENT HAPPENINGS IN THE MARKET

- In March 2019, Kemin Industries launched Organic KEM GLO, and a USDA certified organic carotenoid that helps organic egg producers improve the color of egg yolks. This will help the company take the lead in the carotenoid market.

- In April 2019, the Döhler Group was headquartered at Zumos Catalano Aragoneses S.A., based in Spain. (ZUCASA) has acquired the majority of its shares. This will help companies increase their presence in the fruit and carotenoid sectors.

- In April 2019, Zhejiang NHU Co. Ltd partnered with LJ Ingredients (Denmark). Through this collaboration, LJ Ingredients is now considered as the exclusive sales agent for the firm's beta-carotene products in Europe.

- DDW The Color House took over Du Pont Natural Colors (Denmark) in June 2019, strengthening the company's presence in the global market. This acquisition will help expand your portfolio with new products.

- April 2019 ExcelVite Sdn. Bhd., In collaboration with the United States Pharmacopeia, published an original article on plant carotene. It was developed based on the EVTene mixed carotene complex.

DETAILED SEGMENTATION OF THE GLOBAL CAROTENOIDS MARKET INCLUDED IN THIS REPORT

This research report on the global carotenoids market has been segmented and sub-segmented based on type, application, source, and region.

By Type

- Astaxanthin

- Canthaxanthin

- Lutein

- Beta-Carotene

- Lycopene

- Zeaxanthin

By Application

- Food & Beverages

- Dietary Supplements

- Cosmetics

- Animal Feed

- Pharmaceuticals

By Source

- Natural

- Synthetic

By Region

- North America

- Europe

- Asia and Pacific

- Middle East and Africa

- Latin America

Frequently Asked Questions

1. What are the challenges facing the carotenoids market?

Some challenges include High production costs i.e., extracting carotenoids can be expensive, and Regulatory hurdles Different countries have varying regulations regarding the use of carotenoids in food and supplements.

2. What is the future outlook for the carotenoids market?

The future outlook for the carotenoids market is positive, with expected growth due to increasing health awareness, advancements in extraction technologies, and expanding applications in various industries.

3. What technological advancements are influencing the carotenoids market?

Technological advancements such as improved extraction techniques, microencapsulation for better stability and bioavailability, and innovations in fermentation processes are significantly influencing the carotenoids market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com