Global Liquid Fertilizers Market Size, Share, Trends, & Growth Forecast Report, Segmented By Nutrient Type (Potassium, Micronutrients, Phosphate and Nitrogen), Ingredient Type (Organic and Synthetic), Compound (Potassium Nitrate, Calcium Ammonium Nitrate, Urea-Ammonium Nitrate, Phosphorous Pentoxide, and Others), Application (Soil, Fertigation, Foliar and Others), Crop Type (Oil Seeds, Fruits & Vegetables, Grains & Cereals and Others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Liquid Fertilizers Market Size

The global liquid fertilizers market was valued at USD 14.88 billion in 2024 and is anticipated to reach USD 15.49 billion in 2025 from USD 21.36 billion by 2033, growing at a CAGR of 4.1% from 2025 to 2033.

Liquid fertilizers are an integral part of the agricultural sector and are used to increase the absorbability of nutrients in plants and deliver quick growth.

MARKET DRIVERS

The primary factor attributing to the growth of the global liquid fertilizers market is the rising population and the need for more food production to meet daily intake requirements. Liquid fertilizers enhance overall crop yield due to the targeted method of offering essential nutrients directly to the roots. The surge in the implementation of precision farming practices and the use of advanced technologies like GPS-guided equipment and drones also propelled the demand for liquid fertilizers. Environmental concerns also play a crucial role in the market's dynamics, with liquid fertilizers being considered more eco-friendly than traditional alternatives.

Moreover, the ease of handling and application, coupled with the ability to customize nutrient formulations based on specific crop and soil needs, makes liquid fertilizers an attractive choice for modern farmers. The focus of governments across the world on sustainable agricultural practices also drives the growth of the global liquid fertilizers market. Besides, the surge in global warming and deforestation is hindering the pattern of seasons and resulting in uncertain rain conditions. Therefore, there is a huge emphasis on effective solutions to ensure more crop production and high-quality foods, which is promoting the liquid fertilizers market. Moreover, the flourishing adoption of greenhouse practices and demand for seasonal crops are supposed to create promising opportunities for the liquid fertilizers market in the coming years.

MARKET RESTRAINTS

The primary restraint to the global liquid fertilizers market is the issues concerning the initial setup costs of these fertilizers along with the infrastructure needed for the supply of these liquids. The environmental impact because of the leaching of nutrients from root to soil is also creating a negative influence on the rapid development of this business. Also, the chances of pollution due to the supply of more nitrogen and other components through water, along with the lack of proper training in farmers, are influencing the market demand. In addition, the difficulty in liquid formulations to include different types of nutrients is a challenge for farmers to create the ideal solution for specific crops and soils. Besides, the volatility of the market due to changing commodity prices is also limiting the sales and accessibility of products in the global liquid fertilizers market. The strict government regulations and compliances related to environmental safety also present a challenge to both manufacturers and end users. Moreover, the lack of flexible payment options, coupled with limited farmer awareness about the advantages, is further restricting the global liquid fertilizer market.

Impact Of COVID-19 On The Liquid Fertilizers Market

The COVID-19 pandemic had an initial negative impact on the agriculture sector and liquid fertilizers market due to disruptions to the supply chain and restricted logistics across the globe. The worldwide lockdown scenario changed priorities towards essentials, limiting the production and development of new liquid fertilizers. In addition, the temporary shutdown of industries and social distancing measures led to a shortage of workforce in the manufacturing units. The market instability, along with the uncertainty in the adoption of new processes, had limited most of the companies to slow down their investments, which affected the liquid fertilizers market. In addition, several governments have shifted funds towards essentials during COVID-19, which impacted developments in the agriculture sector. On the contrary, COVID-19 also emphasized the need for more food products and increased the scope of greenhouse implementations to handle any kind of future challenges.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.1% |

|

Segments Covered |

By Nutrient Type, Ingredient Type, Compound, Application, Crop Type, and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Yara International ASA, IFFCO, SQM, EuroChem Group, Israel Chemical Limited, Nutrien Limited, The Mosaic Company, K+S Aktiengesellschaft, Nortox, Haifa Chemical Limited, GrupaAzoty, Plant Food Company, Inc., Agrium Inc., Kugler Company, AgroLiquid, Rural Liquid Fertilizers, and Compo Expert GmbH. |

SEGMENT ANALYSIS

By Nutrient Type

Nitrogenous fertilizers recorded the highest share and are likely to have more demand in the global liquid fertilizers market in the forecast period due to their role in the making of amino acids and providing proteins needed for crop growth. In addition, nitrogen is also crucial for the development of compounds like urea, ammonium nitrate, and calcium nitrate, which promote crop yield and address soil issues. Similarly, micronutrients are also expected to witness considerable growth with the surging need for these components in crop cultivation.

By Crop Type

The cereals & grains crop type accounts for a significant portion of the liquid nitrogen market owing to the increased demand from people around the world to meet the daily food requirements. These are staple foods in most countries, which supports the demand in this segment. However, the fruits and vegetables segment is estimated to thrive in the coming years because of changing consumer priorities and improving global exports of these products.

By Ingredient Type

Organic liquid fertilizers hold the lion’s share in the international market and are predicted to continue their dominion in the foreseen period. Developed majorly from plant residues and animal wastes, organic fertilizers are eco-friendly and offer rich nutrients to both plants and soil for long-term benefits to farmers.

By Compound

Calcium ammonium nitrate registered a majority share in the global liquid fertilizers market because of its advantages, like quick absorption and availability of more nutrients. The ability to reduce nitrogen loss and supply calcium nitrate to enhance absorbability also encourages more farmers to use this compound. CAN is primarily used in the cultivation of crops like wheat, barley, vegetables, and fruits.

By Application

Fertigation, which is an amalgam of fertilizers and irrigation, is predicted to witness more demand in the following years. The benefits of this technique, like fewer water requirements, a smaller workforce, and high yield, are promoting the overall segment growth. The augmented use of drip irrigation and implementation in field crops are foreseen to boost the fertigation segment in the future.

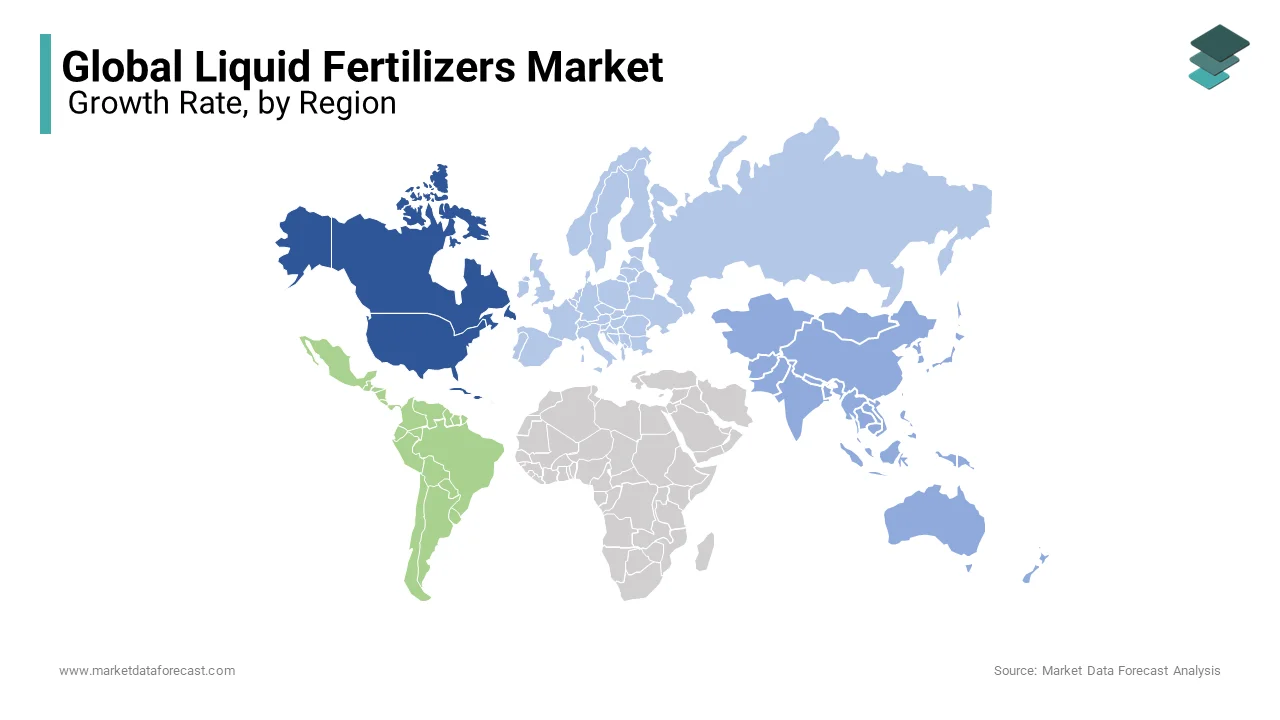

REGIONAL ANALYSIS

North America is predicted to record significant growth in the global liquid fertilizers market in the forecast period. The United States is the leading contributor to this regional market because of the presence of key market players and the surging need for various food products. In addition, the benefits of liquid fertilizers to maintain the pH levels of soil and to overcome issues like nutrient leaching are majorly driving their adoption in the North American market.

The Asia Pacific region dominated the global liquid fertilizers market and is expected to register the highest growth rate in this market with the increasing agricultural practices in nations like India, China, Vietnam, South Korea, and Japan. The surge in the local population, along with the challenges of using conventional fertilizers, is acting positively for the liquid fertilizers business in this locale. China and India are the leading players in the Asia Pacific due to the spike in food consumption, the implementation of technological processes in farming, the need for increased productivity, and the adoption of automated irrigation systems in crop cultivation. Further, the supportive initiatives from local governments and economic certainty are supposed to drive the market demand in nations like Australia, Vietnam, and others in this region.

Europe is also a considerable player in this market, with the availability of well-maintained micro-irrigation systems in nations like the United Kingdom, Germany, France, Russia, and Spain. The increasing government reforms like irrigation subsidies and public water rights, along with the need for environmentally friendly practices, are promoting the adoption of liquid fertilizers in this area.

Latin America, with nations like Brazil and Argentina, is also a promising player in the global liquid fertilizers market. Government-regulated cultivation and the increasing demand for sustainable agriculture are driving the business in this locale. In addition, the large plantations of corn and soybean that need constant care and supply of nutrients are likely to boost the growth potential in this region.

Middle East and Africa are comparatively smaller markets for liquid fertilizers. However, there is a huge untapped opportunity in these nations because of the improved government spending and augmented need for high-valued foods among the local population.

KEY MARKET PLAYERS

Yara International ASA, IFFCO, SQM, EuroChem Group, Israel Chemical Limited, Nutrien Limited, The Mosaic Company, K+S Aktiengesellschaft, Nortox, Haifa Chemical Limited, GrupaAzoty, Plant Food Company, Inc., Agrium Inc., Kugler Company, AgroLiquid, Rural Liquid Fertilizers, and Compo Expert GmbH. Some of the major key players dominate the global liquid fertilizers market.

RECENT HAPPENINGS IN THIS MARKET

- In April 2023, Indian Farmers Fertilizer Cooperative (IFFCO) launched its Nano Di-Ammonium Phosphate (DAP) liquid fertilizer to enhance crop yield and profits for the farmers. With the benefits of addressing nitrogen and phosphorus deficiencies, this is the world’s first Nano DAP liquid fertilizer.

- In February 2023, Vantage AG introduced its first product based on the company’s nanotechnology platform. This newly launched liquid fertilizer comprises sulfur particles that are less than a nanometer and offers quick absorption and metabolism for plants.

- In October 2023, China’s BiOWiSH Technologies and Syngenta Group’s Modern Agricultural Program (MAP) signed an agreement to increase the availability of the former’s Enhanced Efficiency Fertilizer (EEF) crop liquid that combines microbial cultures coated onto dry fertilizer or mixed with liquid fertilizers.

MARKET SEGMENTATION

This research report on the global liquid fertilizers market has been segmented and sub-segmented into the following categories.

By Nutrient Type

- Nitrogen

- Potash

- Phosphorus

- Micronutrients

By Crop Type

- Oilseeds & Pulses

- Cereals & Grains

- Fruits & Vegetables

- Commercial Crops

- Others

By Ingredient Type

- Organic

- Synthetic

By Compound

- Potassium Nitrate

- Calcium Ammonium Nitrate (CAN)

- Urea-ammonium Nitrate (UAN)

- Phosphorous Pentoxide (P2O5)

- Others (Iron, Boron, Chloride)

By Application

- Fertigation (Hydroponics & Agricultural Fields)

- Soil

- Foliar

- Others (Aerial Applications & Starter Solutions)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

Which regions are leading in terms of market share for liquid fertilizers?

North America and Europe currently hold the largest market share for liquid fertilizers, driven by the adoption of precision agriculture practices and increasing demand for high-efficiency fertilizers.

What are the key trends driving growth in the liquid fertilizers market in Asia Pacific?

In Asia Pacific, the increasing adoption of intensive farming practices, growing population, and government initiatives to promote agricultural productivity are driving the growth of the liquid fertilizers market.

What factors are hindering the growth of the liquid fertilizers market in Latin America?

In Latin America, factors such as fluctuations in commodity prices, limited access to credit for farmers, and political instability are hindering the growth of the liquid fertilizers market.

How is the adoption of precision agriculture influencing the liquid fertilizers market in Europe?

The adoption of precision agriculture technologies such as variable rate application (VRA) and soil testing is driving the demand for liquid fertilizers customized to specific crop nutrient requirements in Europe.

How is the liquid fertilizers market in Canada responding to changing agricultural practices and crop rotation patterns?

In Canada, the liquid fertilizers market is witnessing increased demand for custom-blended fertilizers tailored to specific crop rotation patterns and soil nutrient requirements to optimize yields and sustainability.

How is the liquid fertilizers market in China adapting to changing consumer preferences for organic produce?

In China, the liquid fertilizers market is witnessing increased demand for organic and bio-based fertilizers derived from natural sources to meet consumer preferences for organic produce and sustainable agriculture practices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com