Global Healthcare EDI Market Size, Share, Trends & Growth Forecast Report By Component, Delivery Mode, Transaction Type, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Healthcare EDI Market Size

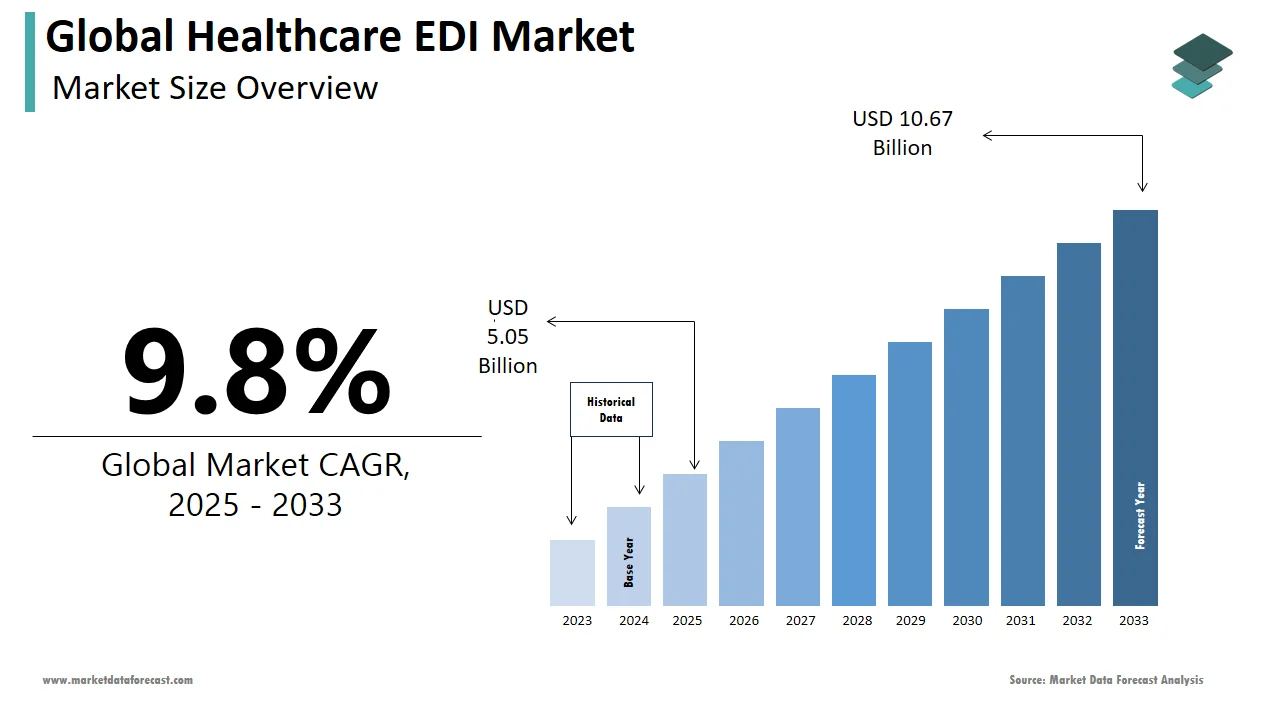

The global healthcare electronic data interchange (EDI) market was worth US$ 4.6 billion in 2024 and is anticipated to reach a valuation of US$ 10.67 billion by 2033 from US$ 5.05 billion in 2025, and it is predicted to register a CAGR of 9.8% during the forecast period 2025-2033.

Electronic Data Interchange (EDI) for healthcare purposes is an electronic remedy with its complexities extremely vital for managing healthcare payment issues, the government standards, being highly vital to medical claims. Ensured the safe and efficient transfer of Patient Health Information (PHI) using standardized formats, more digitalization of data leading to reduced document processing costs, a high level of data security ensured between authorized parties, providers, insurers, and patients, fewer human errors typos, incorrect entries, or lost fax/mail due to Improved accuracy and increased efficiency through the use of Snip Levels validating EDI files at seven different levels, and enabling of immediate data transactions by improving productivity to multiple parties by minimizing retouch requests and denials. Characteristics like helping medical organizations in enabling faster processing of information, securing data exchanges, and eliminating claims processing delays, when used in healthcare, make EDI a crucial part of delivering high-quality care since it has changed the old scenario of hospitals with tons of paper, massive amounts of documents, and hundreds of returned claims.

MARKET DRIVERS

Governments ' growing support for the implementation of HCIT and the rise of the need for healthcare costs are the key factors driving the healthcare EDI market. Various benefits and advantages offered by EDI systems are other major factors promoting the growth of the healthcare EDI market. These include Standardization, reduced administrative costs, a high level of security, improved accuracy and improved productivity. In addition, the management of reimbursement transactions efficiency is also propelling the global healthcare EDI market expansion.

In 1996, HIPAA (Healthcare Insurance Portability and Accountability Act) was established as a standard for transmitted data. Regulations for the transaction processes are the primary factor driving the healthcare EDI market. More than 400 medical forms differ by providing difficulties for the providers and payers to claim the process by introducing errors in many ways, which is made to implement the standards for the claim's management. The EDI makes the ease of claims management. In 2010, the Patient Protection and Affordability Care Act was also recognized as the Obamacare Act in the US. This act mainly focused on incrementing the affordability and health insurance quality and mandated the EDI transactions of 834 for the healthcare providers and payers. Adopting the EDI in the healthcare industry, making the purpose of the electronically transmitted enrolment, and the dis-enrolment information drives the global healthcare EDI market.

MARKET RESTRAINTS

High costs associated with EDI software are one of the major factors hampering the healthcare EDI market growth. Most healthcare providers adopt the EDI software in the high range, but installing this software may cause high spending, which terrifies the providers. The involvement of third-party solutions, clearing houses, and indecent internal systems are the primary reasons for adding high-cost transactions. Due to the increased investments, the healthcare EDI market is becoming low in regions like Europe and North America by the small and medium providers, affecting the total cost of the ownership.

Limitations of the End-User and the hospitals requirements are the challenges facing the healthcare EDI market. The EDI witnesses limited success due to the care centers atmosphere, like hospitals using the EDI and required organizations. Small Users have limited IT resources, which is limiting their financial growth and strength, preventing the adoption of EDI. However, the prominent vendors have the resources and sufficient budget to deploy and use the healthcare EDI. Adoption of the EDI is a process that consumes time. The major challenge is more resources and mandates to implement the EDI.

Impact of COVID-19 on the Global Healthcare EDI Market

Due to the latest COVID-19 pandemic, many people attend healthcare services regularly; as of November 30, 2020, WHO reports showed 62.3 million confirmed COVID-19 cases and 1.4 million deaths worldwide. The number of patient data has risen worldwide due to the COVID-19 epidemic. With the COVID-19 pandemic, several nations, including the entire European Union, the United States, India, and Australia, have implemented nationwide lockdowns. The use of healthcare EDI solutions, which help healthcare providers and payers exchange patient data, has increased due to these lockdowns and restrictions related to social distancing. The advantages of this technology have been shown even further during the current COVID-19 pandemic when EDI is assisting healthcare providers in providing treatment to patients who are not infected with COVID-19. For example, in April 2020, India's Cloudnine Group of Hospitals collaborated with Dunzo, a 24/7 online portal, to provide vital medicines to expectant mothers and their babies at their doorstep. Due to the global health crisis, the use of EDI solutions is expected to increase.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.8% |

|

Segments Covered |

By Component, Delivery Mode, Transaction Type, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

GE Healthcare, Optum, Inc., Mckesson Corporation, Cerner Corporation, Experian PLC, Cognizant Technology Solutions Corporation, and Others. |

SEGMENTAL ANALYSIS

By Component Insights

Based on the component, the services segment is predicted to register the fastest CAGR in the global healthcare EDI market during the forecast period. The growing demand for consulting and implementation services for EDI solutions, the increasing need for support and maintenance services to ensure seamless operation of EDI systems and the growing demand for outsourcing services to manage healthcare data efficiently drive the segmental growth. The rapid adoption of managed services for healthcare data management and the rising need for training and education services to help healthcare providers effectively use EDI solutions further contribute to segmental growth.

The solutions segment is estimated to hold a substantial share of the global market during the forecast period. The growing need for advanced healthcare IT solutions to manage large volumes of patient data, rising demand for electronic health records (EHR) and electronic medical records (EMR) for efficient patient data management and rapid adoption of cloud-based solutions for healthcare data management primarily drive the segmental growth. The rising awareness among healthcare providers about the benefits of using EDI solutions for managing healthcare data and the increasing number of initiatives from various governments and regulations mandating the use of EDI solutions for healthcare data management propel segmental growth.

By Delivery Mode Insights

Based on delivery mode, the mobile EDI segment is estimated to grow at a promising CAGR during the forecast period. The growing adoption of mobile devices among healthcare providers for patient data management, the rising need for real-time access to patient data from any location and the increasing demand for mobile applications that support healthcare data management majorly drive the segmental growth. The rising adoption of telemedicine and remote patient monitoring solutions and the growing availability of high-speed internet and mobile networks further boost the growth rate of the segment.

The web & cloud-based EDI segment is anticipated to capture a considerable share of the global market during the forecast period. The rising adoption of cloud-based solutions for healthcare data management, growing demand for web-based portals for patient data access and increasing need for remote access to patient data majorly favor segmental growth. The growing adoption of telemedicine and remote patient monitoring solutions and the rising availability of high-speed internet and mobile networks further support the growth rate of the segment.

By Transaction Type Insights

Based on the transaction type, the claims management segment accounted for the largest share of the global healthcare EDI market in 2024 and is expected to grow at a healthy CAGR during the forecast period owing to the increasing volume of healthcare claims due to the growing aging population and prevalence of chronic diseases. The growing need for efficient and accurate claims processing to reduce costs and improve patient satisfaction and regulatory requirements for electronic claims submission and processing propel the segmental growth. The rising adoption of electronic health records (EHR) and electronic medical records (EMR) and the growing demand for real-time access to patient data for claims processing favour segmental growth.

The healthcare supply chain segment is predicted to register a healthy CAGR during the forecast period due to factors such as the rising need for efficient management of healthcare supply chain operations, growing demand for transparency and traceability in the healthcare supply chain and increasing need for accurate and timely inventory management to reduce waste and improve cost-effectiveness. The rising adoption of electronic health records (EHR) and electronic medical records (EMR) and regulatory requirements for electronic tracking and reporting of healthcare supplies further contribute to the segment’s growth rate.

By End User Insights

Based on end-user, the healthcare payers segment is anticipated to hold the major share of the global market during the forecast period. Factors such as the growing demand for efficient claims processing and payment management, the increasing need for real-time access to patient data for claims processing and the rising need for accurate and timely eligibility verification to reduce claim denials primarily contribute to the segmental growth.

On the other hand, the pharmacies segment is predicted to account for a considerable share of the worldwide market during the forecast period due to the rising demand for efficient pharmacy management systems to improve patient care and reduce costs, increase in the need for accurate and timely prescription processing and medication dispensing and growing demand for real-time access to patient data for medication management.

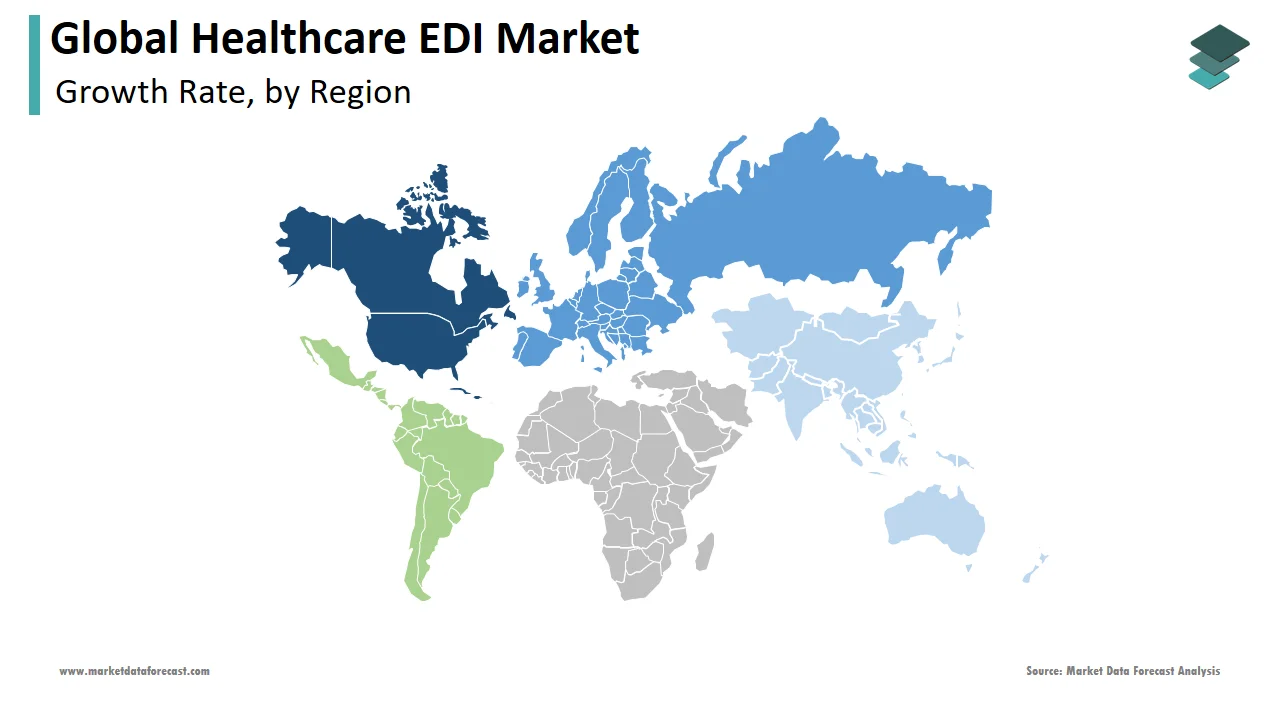

REGIONAL ANALYSIS

The North American region had the largest share of the global market in 2024, followed by the European region and this pattern is likely to continue throughout the forecast period. The presence of established healthcare IT infrastructure, increasing adoption of advanced healthcare technologies, rising emphasis on healthcare cost reduction and improved patient outcomes and increasing demand for efficient claims processing and payment management primarily propel the North American market growth. The rising demand for healthcare data analytics and population health management, the increasing trend towards value-based healthcare and patient-centered care models, high healthcare expenditure and advanced healthcare infrastructure, and the rising trend towards telemedicine and remote patient monitoring further boost the growth rate of the North American market. The U.S. accounted for the major share of the North American market in 2024 and is expected to witness a healthy CAGR during the forecast period due to the rising adoption of healthcare IT solutions, growing demand for efficient claims processing and payment management, and regulatory requirements for electronic claims submission and processing.

Europe is another noteworthy regional market for healthcare EDI and is anticipated to grow at a healthy CAGR during the forecast period. Strong emphasis on patient privacy and data security, increasing demand for healthcare interoperability and data sharing between different healthcare organizations and rapid adoption of mobile health (mHealth) technologies and patient engagement solutions in Europe majorly drive the regional market growth. The rising trend towards personalized medicine and precision healthcare and the growing focus on healthcare innovation and research and development further contribute to the European market growth. The UK had the leading share of the European market in 2024, followed by Germany, France, Italy, and Spain. The rising need for efficient healthcare data management and interoperability between different healthcare IT systems, increasing demand for healthcare cost reduction and improved patient outcomes and regulatory requirements for secure and efficient data exchange in the healthcare industry support the market growth in the UK.

APAC is expected to register the fastest CAGR in the global market during the forecast period. The rapidly growing population, rising prevalence of chronic diseases, rapidly developing healthcare infrastructure and adoption of advanced healthcare technologies and growing demand for affordable and accessible healthcare solutions primarily fuel the growth rate of the APAC market. The rising trend towards digital health and telemedicine and the presence of emerging healthcare IT markets and innovative healthcare start-ups further propel regional market growth. China, Japan, India, South Korea and Australia controlled the major share of the APAC market in 2024.

The Latin American region is anticipated to register a healthy CAGR during the forecast period due to the rising demand for healthcare solutions that can address healthcare disparities and improve healthcare access for underserved populations, increasing number of investments to develop the healthcare infrastructure and healthcare workforce development and rising trend towards value-based healthcare and accountable care organizations in the Latin American countries. Brazil followed by Mexico led the market in Latin America in 2024.

MEA captured a moderate share of the worldwide market in 2024 and is estimated to grow at a steady CAGR during the forecast period. The growing focus on healthcare digitization and adoption of advanced healthcare technologies, rising demand for healthcare solutions that can address specific healthcare challenges in the region, such as communicable diseases and maternal and child health and the growing number of investments in healthcare IT infrastructure and telemedicine.

KEY MARKET PLAYERS

This report covers GE Healthcare, Optum, Inc., Mckesson Corporation, Cerner Corporation, Experian PLC, Cognizant Technology Solutions Corporation, and companies that play a promising role in the global healthcare EDI market Allscripts Healthcare Solutions, Inc., Synnex Corporation, Quality Systems Inc., and Dell Technologies Inc.

RECENT MARKET HAPPENINGS

- In October 2022, a $3.7 million grant was awarded to organizations by the Illinois Department of Public Health, funded by the Center for Disease Control, to address inequities in health services and communities.

- In October 2022, Data Dimensions completed the acquisition of a healthcare technology provider leader, Providerflow, focusing solely on improving supplier workflow efficiency for the P&C insurance industry.

- In September 2022, Prodigo Solutions launched Xchange, a next-generation EDI platform for reduced memory footprint, faster processing times for a high volume of EDI documents transmitted between trading partners, and to automate more transactions by driving deeper into their supplier communities.

- In November 2022, Vyne Dental, a leading healthcare technology, achieved full accreditation with the Commission's Electronic Health Networks (EHN) Accreditation Program, strategically developing solutions for dental practices and facilitating the optimization of optimizing cash flow and reducing associated costs.

MARKET SEGMENTATION

This research report on the global healthcare EDI market has been segmented and sub-segmented based on the component, delivery mode, transaction type, end-user, and region.

By Component

- Services

- Solutions

By Delivery Mode

-

Web & Cloud-based EDI

-

EDI VAN

- Point-to-Point EDI

- Mobile EDI

By Transaction Type

-

Claims Management

- Claims Submission

- Claim Status

- Eligibility Verification

- Payment Remittance

- Referral Certification & Authorization

- Claim Payments

- Others

- Healthcare Supply Chain

By End User

-

Healthcare Providers

-

Healthcare Payers

- Medical Device & Pharmaceutical Industries

- Pharmacies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the global healthcare EDI market?

The size of the global healthcare EDI market is predicted to reach USD 10.67 billion by 2033.

Which region is accounted for the largest market share in the global healthcare EDI market?

North America region is accounted for the largest market share in the healthcare EDI market.

Which segment by end user is accounting for the largest market share during the forecast period?

Based on the end user, the healthcare payers are accounting for the largest market share during the forecast period.

Who are the keyplayers of the global healthcare edi market?

Prominent companies dominating the global healthcare EDI market profiled in this report are GE Healthcare, Optum, Inc., Mckesson Corporation, Cerner Corporation, Experian PLC, Cognizant Technology Solutions Corporation, Allscripts Healthcare Solutions, Inc., Synnex Corporation, Quality Systems Inc., and Dell Technologies Inc.,

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com