Global Hotel and Other Travel Accommodation Market Size, Share, Trends & Growth Forecast Report By Type (Hotel and Motel, Casino Hotels, Bed and Breakfast Accommodations, All Other Traveler Accommodations), By Mode Of Booking (Online Bookings, Direct Bookings, Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Hotel and Other Travel Accommodation Market Size

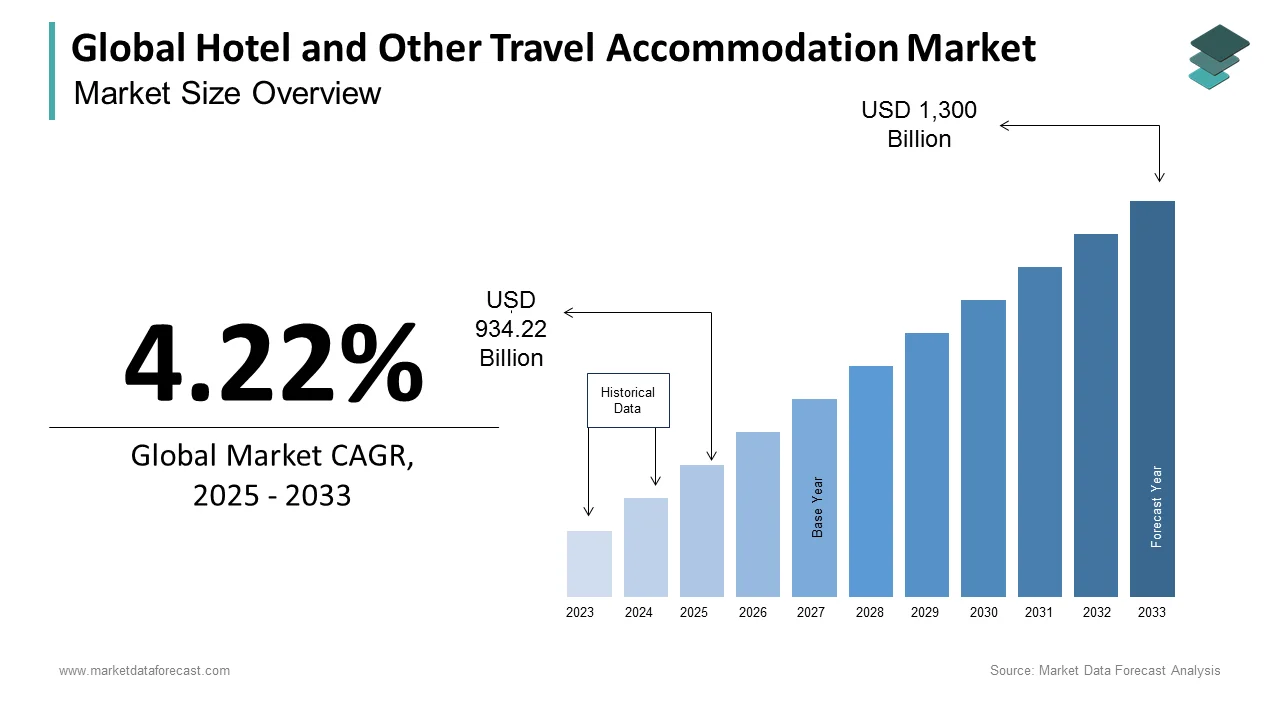

The global hotel and other travel accommodation market is expected to grow from US$ 896.39 billion in 2024 to reach a valuation of US$ 1,300 billion by 2033 from US$ 934.22 billion in 2025, at a compound annual growth rate (CAGR) of 4.22% between 2025 and 2033.

The hotel and other travel accommodation markets consist of the sale of short-term lodging services by entities (organizations, sole proprietorships, or partnerships). The hotel and other travel accommodation markets are segmented into hotels and motels, hotels with a casino, guest rooms, and all other accommodations for travelers.

Part of the reason is that budget hotels are better able to take advantage of demand segments that remain relatively strong despite travel restrictions, including truck drivers and extended-stay guests. At all hotels, revenue is based on an average daily rate, number of rooms, and occupancy, as well as food and drink where applicable. For homeowners considering going out of business, variable and semi-fixed costs are factors, as fixed costs don't change no matter what. Better demand and lower operating costs suggest that budget hotels will recover faster. It would be consistent with what we have seen in past crises. But there are likely to be pockets of resilience and recovery in the market. Hotels that rely on revenue from meetings, incentives, conferences, and events (MICE) could face large deficits. Owners will need to carefully monitor reserves to distinguish between single peaks of growth and sustained recovery.

MARKET TRENDS

Technology Enhancing Guest Experience in Hotels

Hotels use technologies that transform the guest experience. Some technologies lead to big improvements and savings for hotels and other lodging markets. The most significant trend in the lodging industry is the use of near-field communication technology (NFC), infrared technologies, and robots. NFC gives users the ability to exchange data between devices, making mobile payments an instant and secure process. Infrared sensors are used in hotels to address guest complaints about service interruptions. Hotels also use robots to provide room amenities and for other functional purposes. Hoteliers invest in systems and technologies capable of automating processes, reducing costs, and personalizing the guest experience.

MARKET DRIVERS

Businesses Use Customer Data for Tailored Offers

Technological advances allow companies to provide personalized services by obtaining information from customers. Businesses offer personalized offers and promotions by collecting vital information about consumer likes, dislikes, and preferences through the use of social media and technologies such as mobile software applications that track customer behavior. Hotels now provide personalized menus, lighting, and other services on the basis of customer information present from past visits or information collected on social media. The Four Seasons Hotel has spent $ 18 million to revamp its website, which will offer personalized dynamic web pages to potential guests.

MARKET RESTRAINTS

Global Travel Restrictions Reduced Demand

The coronavirus pandemic acted as a massive strain on the market for hotels and other travel accommodations in 2024, with governments globally imposing restrictions on domestic and international travel that limit the need for the services offered by these establishments. Measures taken by national governments to contain transmission have led to a decrease in economic activity, with countries in a state of lockdown, and the outbreak is expected to continue to affect companies during 2024 and into 2033 negatively.

MARKET OPPORTUNITIES

Social Media Boosts Tourism Awareness

The increasing use of social media and access to the media is having a positive impact on the tourism and hospitality industries. With tourists sharing their travel information, photos, and videos on social media platforms, people are becoming more and more aware of the tourist destinations and leisure experiences that the different countries of the world offer. According to a WeSwap survey, 37% of millennials were inspired by social media content, and 61% of travelers want to share their experiences online. In addition, social media plays an important role in helping countries promote tourism by making people aware of their culture. This growing awareness is reflected in large numbers of people traveling abroad and is foreseen to drive growth in the hospitality and other tourist accommodation sectors during the outlook period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.22% |

|

Segments Covered |

By Type, Mode Of Booking, Application, Price Point, OwnerShip, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Marriott International, Hilton Worldwide, Wyndham Corporation, Hyatt Hotels Corporation, Four Seasons Hotels & Resorts, and Others. |

SEGMENTAL ANALYSIS

By Type Insights

REGIONAL ANALYSIS

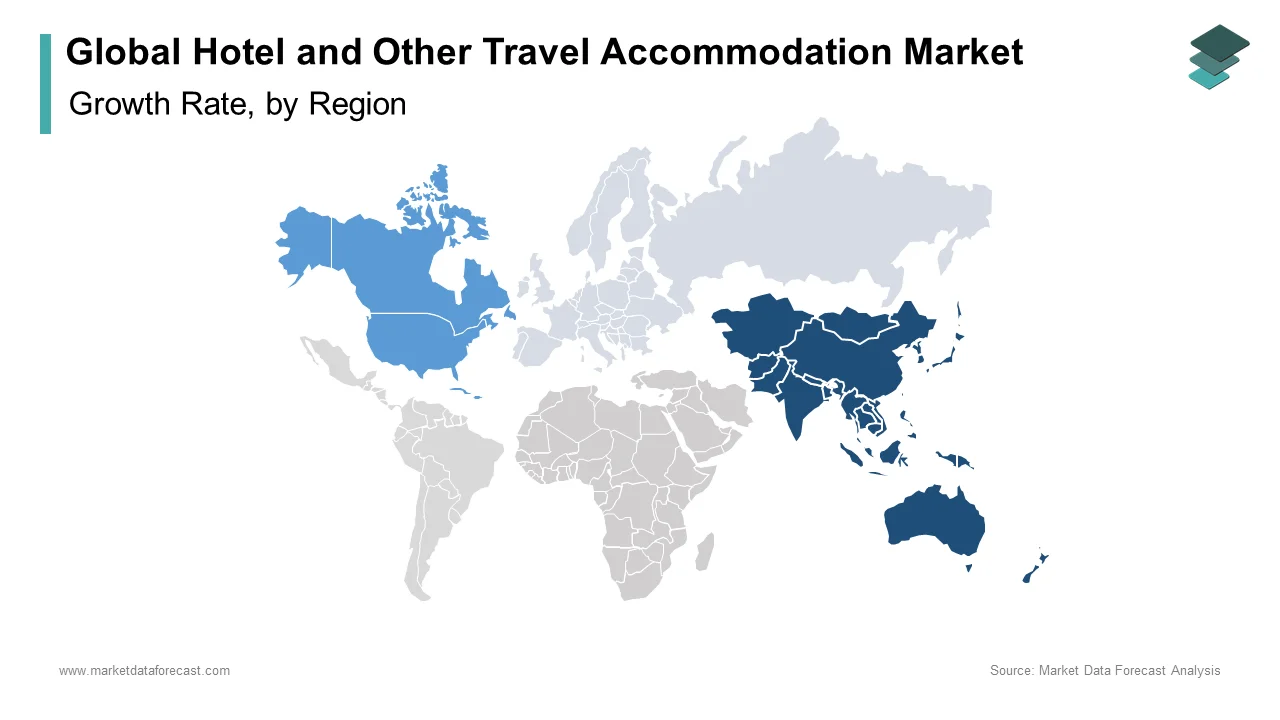

Asia-Pacific was the biggest region in the worldwide industry for hotels and other travel accommodations, accounting for 36% of the industry in 2021. North America was the second-largest region with 27% of the global market. Africa was the smallest region in the world that is estimated to offer promising opportunities in the coming years.

KEY MARKET PLAYERS

Companies playing a prominent role in the global hotel and other travel accommodation market include Marriott International, Hilton Worldwide, Wyndham Corporation, Hyatt Hotels Corporation, Four Seasons Hotels & Resorts, and Others.

RECENT HAPPENINGS MARKET

- Travel agencies and hotels are launching new offers to boost their sales. From special bubble vacations that promise personalized services from start to finish to 72-hour flash sales that offer free nights and up to 40% off select five-star hotels, chains, and travel agents implement other promotions during the holidays getting closer.

- As the travel industry recovers during the Christmas season following the pandemic, Leisure Hotels Group, a leading chain of experimental resorts with a presence in scenic destinations in North India and Goa announced the opening of The Hideaway Bedzzz in Rishikesh, the first property in this alternative accommodation segment.

MARKET SEGMENTATION

This global hotel and other travel accommodation market research report has been segmented and sub-segmented based on type, mode of booking, application, price point, ownership, and region.

By Type

- Hotel and Motel

- Casino Hotels

- Bed and Breakfast Accommodations

- All Other Traveller Accommodations

By Mode of Booking

- Online Bookings

- Direct Bookings

- Others

By Application

- Tourist Accommodation (Leisure)

- Official Business (Professional)

By Price Point

- Economy

- Mid-range

- Luxury

By Ownership

- Chained

- Standalone

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]