Global Intraocular Lens Market Size, Share, Trends & Growth Forecast Report By Material (Polymethylmethacrylate (PMMA), Silicone and Hydrophobic Acrylic), Type (Monofocal and Premium), End-User (Hospitals, Ophthalmology Clinics, Eye Research Institutes and Ambulatory Surgical Centers) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Intraocular Lens Market Size

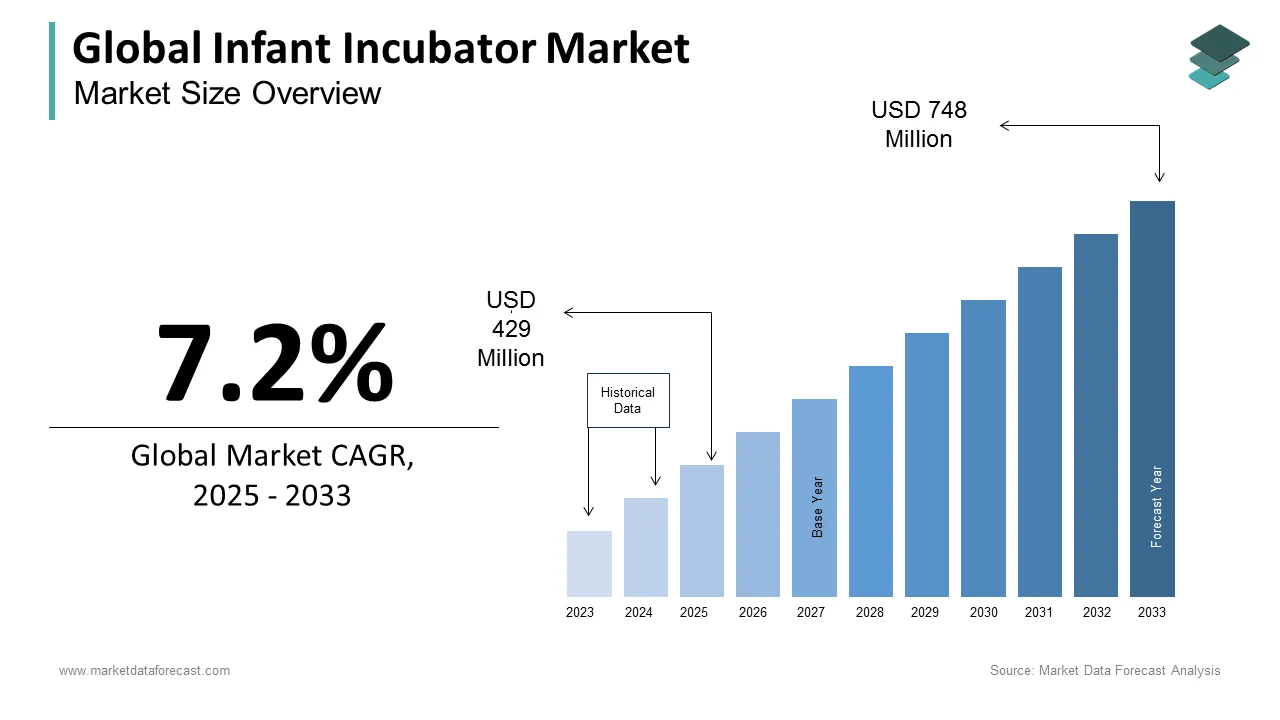

The size of the global intraocular lens market was worth USD 4.72 billion in 2024. The global market is anticipated to grow at a CAGR of 4.9% from 2025 to 2033 and be worth USD 7.26 billion by 2033 from USD 4.95 billion in 2025.

MARKET DRIVERS

The rising prevalence of eye diseases and diabetes worldwide is majorly driving the growth of the intraocular lens market.

The growing cases of cataracts in the diabetic population, and technological advancements in intraocular lenses are further boosting the intraocular lens market growth. Furthermore, the market's growth is aided by an increase in the use of premium lenses, which have benefits such as improved visual performance and decreased astigmatism. Companies' increasing emphasis on developing markets in Europe and a steady transition toward advanced technology are providing substantial growth opportunities for intraocular lens manufacturers. Increased government initiatives to eliminate avoidable blindness are expected to propel the global intraocular lens market forward. Moreover, market growth is encouraged by favorable reimbursement policies and increasing investment and funding by the government. Besides, the high demand for intraocular contact lenses has prompted manufacturers to perform research and development efforts in order to provide innovative lenses that can aid patients in both close and far vision. Over the projected period, an increase in ophthalmic conditions around the world is expected to accelerate the development of the IOL market.

MARKET RESTRAINTS

However, an adverse reimbursement situation for premium lenses and postoperative complications such as refractive errors restrain the market growth. Also, the lack of awareness among the people in the emerging countries and unfavorable reimbursement policies in the APAC are expected to slightly reduce the global intraocular lens market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Material, Type, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Johnson & Johnson, Valeant, Carl Zeiss Meditec AG, Rayner, Alcon, Inc. (a division of Novartis AG), EyeKon Medical, Inc., Lenstec, Inc., HumanOptics AG, STAAR Surgical, Physiol s.a., Calhoun Vision Center, and Oculentis GmBH. |

SEGMENTAL ANALYSIS

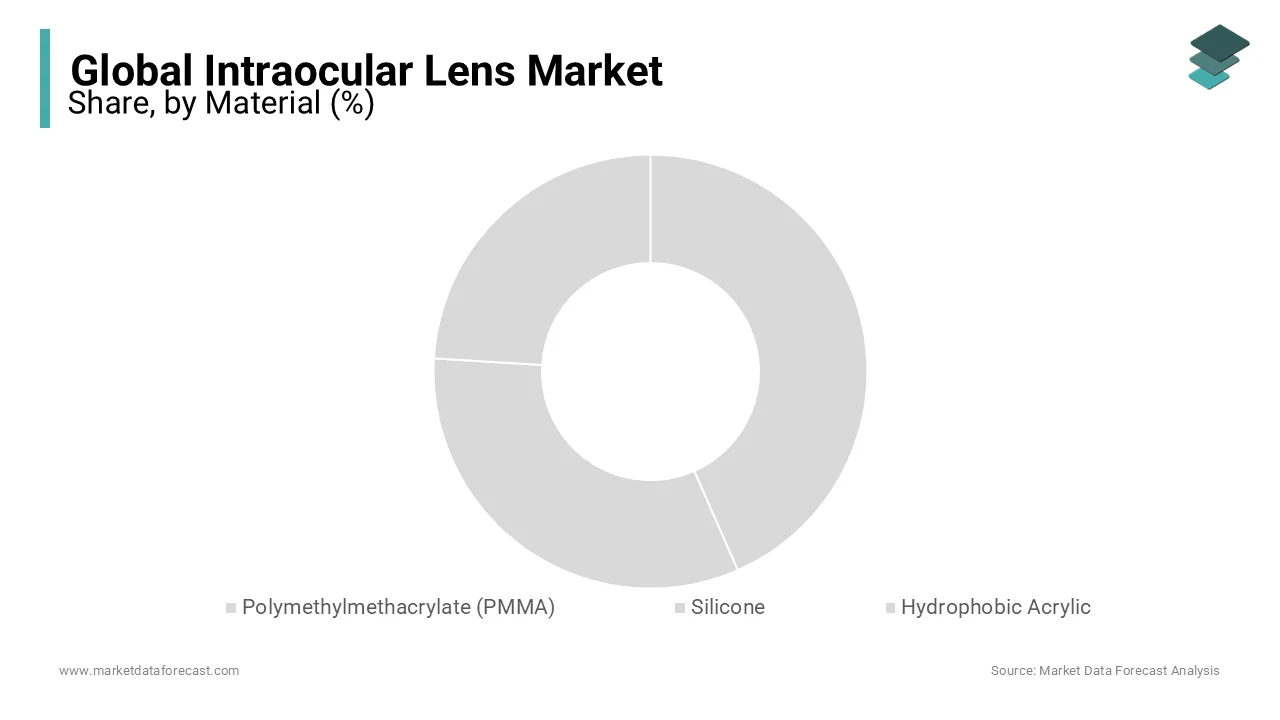

By Material Insights

The silicone and hydrophobic acrylic segments together are likely to occupy a major share of the global market during the forecast period. These intraocular lenses are made from silicone and hydrophobic acrylic which can be inserted through small openings or cuts.

By Type Insights

The mono-focal Intraocular lens segment is expected to dominate the intraocular lens market during the forecast period. Due to the low cost compared with premium ones and government policies that are supportable are the factors that increase the market.

By End User Insights

The hospital segment is expected to continue its dominance during the forecast period. Hospitals' advanced technology facilities, which use retinal and corneal procedures, are propelling the segmental growth.

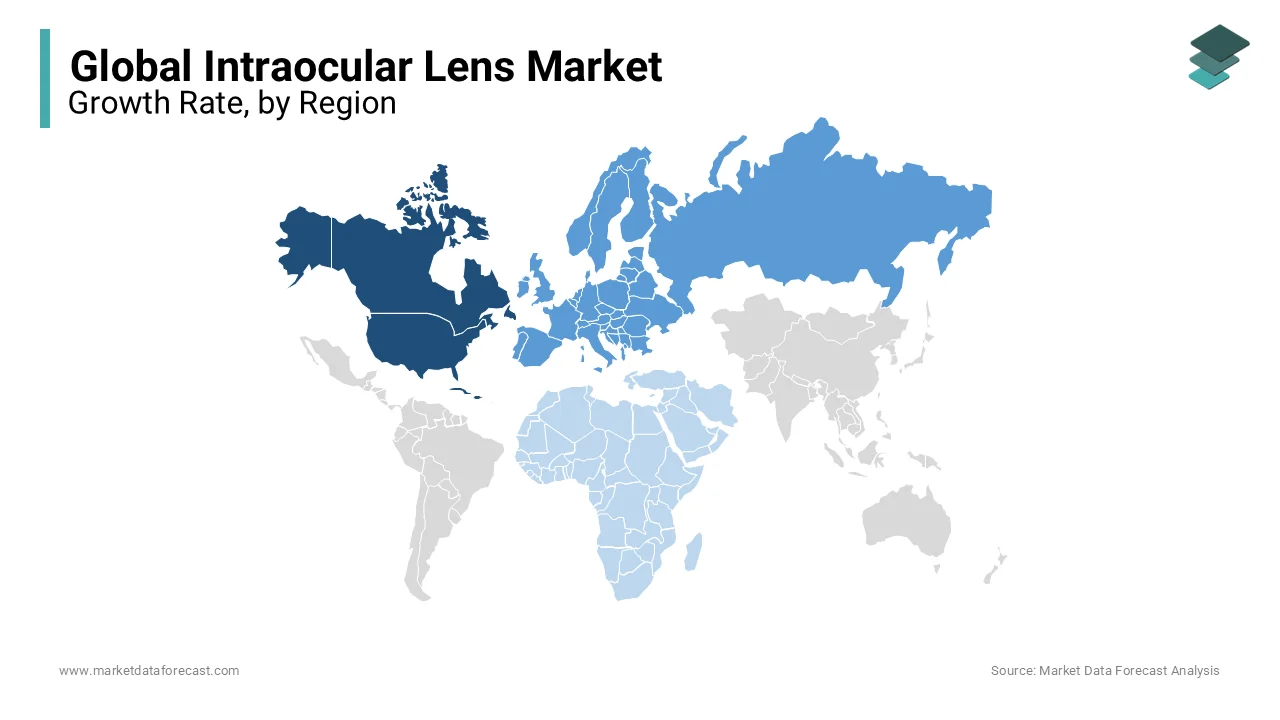

REGIONAL ANALYSIS

The North American market is predicted to dominate the global intraocular lens market and is expected to retain its dominance during the forecast period. Y-O-Y growth in the incidence of cataracts and other eye-related disorders propel the North American market growth. On August 17, 2020, BVI launched its first intraocular lens in the United States with pure. It is the first and only pre-loaded aspheric monofocal IOL available in both a 1-piece and 3-piece design for cataract surgery patients. As per the American Academy of Ophthalmology, 50 million people are predicted to have a cataract in the U.S. by 2050. The Canadian IOL market is next to the United States in accounting majority of the share in the North American market. On August 27, 2019, Alcon introduced AcrySof IQ PanOptrix Trifocal IOL in the U.S. It is the first and only approved trifocal lens.

The European market is forecasted to account for a significant share of the global market during the forecast period. On February 04, 2019, J&J Vision launched its TECNIS Eyhance intraocular lens in patients suffering from cataracts in Europe. The growing number of cataract surgeries, increasing adoption of femtosecond lasers for cataract surgery, and urging toric lenses' importance are some of the factors accelerating the growth rate of the European market. Nearly 34 million people in the EU are affected by age-related macular degeneration, as stated by EURETINA in 2017. In the European market, the German intraocular lens market is predicted to account majority of the share during the forecast period. Cataracts are one of the frequent surgeries as the government has taken initiatives in erasing the blindness and regular surge of cataracts, especially in aged people stimulate the market demand. According to the European Society of Retinal Specialists, in 2017, rate age-related macular degeneration accounted for around 32.8% in Germany.

Globally, the Asia-Pacific market is expected to be one of the fastest-growing regional markets during the forecast period due to the Y-O-Y growth in the diabetic population. Growing patient count drives the intraocular lens market in India and China. Growth in the number of ophthalmologists and rapid adoption of teleophthalmology are expected to develop the scope for the APAC market to grow further. Growing efforts from the APAC governments to develop the cataract surgical rate, awareness campaigns from the governments and other organizations to increase the awareness among people regarding the eye-related disorder are further expected to support the APAC intraocular lens market. According to the National Programme for Control of Blindness and Visual Impairment, nearly 6.4 million surgeries were implemented in India during 2016-2017.

The Latin American market is estimated to grow at a steady rate during the forecast period. The growing focus of key market participants to increase their market share is one of the significant factors accelerating the market growth. Growth in cataract surgical rates and the rising number of ophthalmologists in the Latin American regions perform surgery to boost regional market growth. In Latin America, the Brazilian IOL Market is forecasted to lead during the forecast period.

The IOL market in the Middle East & Africa is anticipated to have a sluggish growth rate during the forecast period. Factors such as the growing high demand for the ocular lens and the rising frequency of the lens boost the market growth. Good government support and acceptable reimbursement policies surge the market demand. Countries like UAE, Africa, and the rest of the MEA are to have impressive market growth in the upcoming years.

KEY MARKET PARTICIPANTS

Some of the prominent companies dominating the global intraocular lens market profiled in the report are Johnson & Johnson, Valeant, Carl Zeiss Meditec AG, Rayner, Alcon, Inc. (a division of Novartis AG), EyeKon Medical, Lenstec, Inc, HumanOptics AG, STAAR Surgical, Physiol s.a, Calhoun Vision Center, Oculentis GmBH.

RECENT HAPPENINGS IN THE MARKET

- In March 2020, Alcon stated that the launch of the new AcrySof IQ Vivity intraocular lens is available in European country markets. This new launch has some features like the usage of non-diffractive design X-WAVE technology to decrease the dependency on glasses when a patient undergoes cataracts.

- In December 2019, Johnson & Johnson stated that has received the FDA acceptance and has introduced the Tecnis Toris II one-piece intraocular lens to treat astigmatism in patients with cataracts. This is designed to deliver optical development for various optical conditions and lifestyles.

MARKET SEGMENTATION

This research report on the global intraocular lens market has been segmented and sub-segmented based on material, type, end-user, and region.

By Material

- Polymethylmethacrylate (PMMA)

- Silicone

- Hydrophobic Acrylic

By Type

- Monofocal Intraocular Lens

- Premium Intraocular Lens

- Toric Intraocular Lens

- Multifocal Intraocular Lens

- Accommodating Intraocular Lens

By End User

- Hospitals

- Ophthalmology Clinics

- Eye Research Institutes

- Ambulatory Surgical Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How is technological innovation impacting the Intraocular Lens market?

Technological advancements have led to the development of premium IOLs with enhanced features, such as extended depth of focus and improved optical designs. Additionally, innovations in materials, such as accommodating IOLs, aim to provide better outcomes for patients.

How are reimbursement policies affecting the Intraocular Lens market?

Reimbursement policies vary by region and can impact the adoption of premium IOLs. In some cases, patients may need to pay out-of-pocket for advanced lens options, influencing their choice and the market dynamics. It's essential to monitor reimbursement trends for market analysis.

What challenges does the Intraocular Lens market face?

Challenges may include regulatory hurdles, the high cost of advanced IOLs, and the need for skilled ophthalmic surgeons. Additionally, market competition and reimbursement issues can impact the growth of the IOL market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com