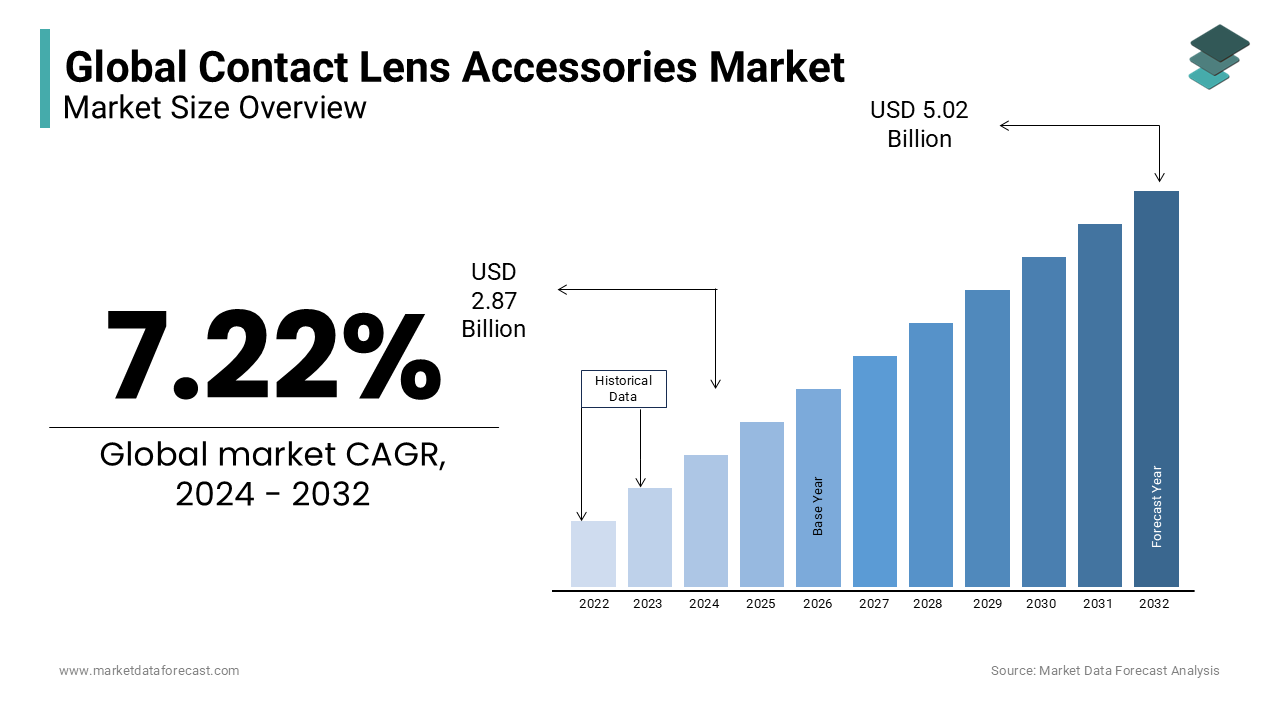

Global Contact Lens Accessories Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type (Lens Cases, Cleaning Solutions, Eye Drops, Lens Inserters and Removers, and Others), Material Type, Distribution Channel, End-User and Region (North America, Europe, Asia Pacific, Latin America and Middle East & Africa) - Industry Analysis (2024 to 2032)

Global Contact Lens Accessories Market Size

The global contact lens accessories market size was worth USD 2.68 billion in 2023 and is expected to be valued at USD 5.02 billion by 2032 from USD 2.87 billion in 2024, exhibiting a CAGR of 7.22% from 2024 to 2032.

The contact lens accessories market is experiencing robust growth, driven by an increasing global adoption of contact lenses for both vision correction and aesthetic purposes. As the eyewear industry expands, there is a parallel surge in demand for supporting products such as lens cases, cleaning solutions, and other comfort-enhancing accessories. This rising use of contact lenses has heightened the need for specialized accessories that prioritize cleanliness, comfort, and prolonged lens life. The market’s growth trajectory is closely linked to the broader contact lens market, which is itself witnessing expansion due to factors like an aging population, a growing incidence of myopia among younger demographics, and heightened awareness of eye care hygiene. The proliferation of disposable lenses, which necessitate regular use of complementary products, further amplifies this demand. Additionally, the rise of e-commerce platforms has improved accessibility to these products, driving higher global adoption.

Contact lens accessories play a critical role in maintaining eye health. Essential products like cleaning solutions and disinfectants are vital in preventing serious infections such as Acanthamoeba keratitis, often caused by poor lens hygiene. Moreover, accessories like lens inserters and removers enhance the lens-wearing experience, especially for new users or those with dexterity challenges. Beyond functionality, these accessories are evolving to cater to modern consumer preferences, with growing interest in eco-friendly, travel-friendly, and aesthetically pleasing products. This shift is encouraging innovation, with companies now introducing biodegradable lens cases and travel kits, aligning with the increasing demand from environmentally conscious consumers.

CONTACT LENS ACCESSORIES MARKET TRENDS

Personalization in Lens Accessories

Customization has emerged as a significant trend in the contact lens accessories market, with consumers seeking products tailored to their specific needs. This trend is reflected in the demand for personalized lens storage cases and cleaning kits, which cater to individual preferences such as compact, travel-friendly designs or aesthetic appeal. Brands like Cooper Vision are leading the way by offering customized care kits that target specific user segments.

Sustainability Leading Consumer Demand

Sustainability is at the forefront of consumer preferences, with increasing concern over the environmental impact of single-use plastics commonly found in lens cases and solution bottles. Brands are responding by offering biodegradable cases and recyclable packaging, with studies showing that 60% of global consumers are willing to pay a premium for sustainable products. Companies like Bausch + Lomb and Alcon are launching eco-friendly accessories, further driving the market's growth.

Digital Transformation in Sales

The rise of e-commerce has revolutionized how consumers purchase contact lens accessories. Online sales of eyewear products have surged, offering consumers convenience, a wider range of options, and competitive pricing. Companies like Warby Parker and 1-800 Contacts have tapped into this trend by offering subscription models and automatic reordering services for lens accessories, simplifying the purchasing process for consumers.

MARKET DRIVERS

Increasing Contact Lens Usage

The growth of the contact lens accessories market is closely tied to the increasing global adoption of contact lenses. As contact lens wearers grow in number, so does the demand for complementary accessories that ensure hygiene and comfort. The rising popularity of daily disposables, which require more frequent use of cleaning and care products, is further accelerating market expansion.

Rising Awareness of Eye Health

There is a growing awareness among consumers about the importance of eye health, driving increased demand for accessories that prevent infections and ensure proper lens hygiene. Eye care professionals are emphasizing the importance of high-quality disinfectants, cleaning kits, and storage solutions, encouraging consumers to invest in these products and contributing to market growth.

Technological Innovations

Technological advancements in contact lens accessories, such as the development of anti-microbial cases and biodegradable storage solutions, are appealing to eco-conscious and health-focused consumers. Innovations like UV-C sterilization technology is revolutionizing the market, offering consumers enhanced hygiene solutions. For instance, LumiLens’ smart lens case with UV-C disinfection technology reduces bacterial contamination, catering to the growing demand for efficient, tech-driven products.

MARKET RESTRAINTS

High Costs of Premium Accessories

Despite growing demand, the market faces challenges related to the high costs of premium accessories, such as advanced cleaning solutions and specialized lens cases. These higher prices can be a barrier for price-sensitive consumers, particularly in developing regions, limiting the overall growth potential.

Environmental Concerns

While sustainability is a growing trend, the market continues to face scrutiny over the environmental impact of traditional disposable plastic cases and cleaning products. Companies that fail to adapt to these concerns may lose market share to competitors offering more eco-friendly alternatives.

Regulatory Hurdles

Stringent regulatory requirements in markets like the United States and Europe pose challenges for manufacturers. Products must meet safety standards, which increases production costs and can delay product launches. Smaller companies may struggle to navigate these complex regulatory landscapes, restricting market entry and slowing innovation.

Impact of COVID-19 on the Contact Lens Accessories Market

Initial Decline in Sales Due to Lockdowns

At the onset of the pandemic, the global contact lens accessories market experienced a notable decline as widespread lockdowns and restricted mobility limited access to optical stores. Many consumers postponed the purchase of new contact lenses and related accessories amid concerns over income stability and reduced availability of professional eye care services.

Increased Focus on Hygiene and Eye Health

As the pandemic unfolded, heightened awareness around hygiene practices positively impacted certain contact lens accessories market segments, particularly those related to cleaning and disinfecting solutions. Fears surrounding viral transmission through contact lenses prompted many users to adopt more rigorous cleaning routines. This surge in demand was supported by guidelines issued by organizations such as the American Academy of Ophthalmology (AAO), which emphasized the importance of proper lens hygiene. According to Statista, sales of disinfecting solutions increased by 15% by mid-2020 as consumers prioritized eye health.

Shift to E-commerce and Digital Channels

The pandemic also accelerated the shift towards e-commerce, a trend that has had a profound impact on the contact lens accessories market. As physical retail stores faced closures, consumers increasingly turned to online platforms to purchase contact lenses and related accessories. In 2020, online sales of optical products, including contact lens accessories, grew by 34%, according to Forbes. This transition to digital channels is expected to have lasting effects as consumers continue to value the convenience and safety of online shopping. Leading brands such as Warby Parker and 1-800 Contacts capitalized on this shift by expanding their e-commerce offerings and introducing subscription models to ensure consistent delivery of lenses and accessories.

Supply Chain Disruptions

Global supply chains faced considerable disruptions during the pandemic, which impacted the availability of contact lens accessories, including cleaning solutions, storage cases, and eye drops. Euromonitor International reported that by mid-2020, 30% of optical retailers experienced delayed shipments due to production halts and logistics challenges. Manufacturers encountered difficulties in sourcing raw materials, particularly for plastic and silicone-based products, resulting in temporary shortages and delays in product availability.

Long-term Changes in Consumer Behavior

COVID-19 has driven lasting changes in consumer attitudes toward contact lens care. Increased awareness of the risks associated with infections, particularly those linked to eye-touching behaviors, has elevated the importance of hygiene for lens wearers. A 2021 survey conducted by the Contact Lens Institute revealed that over 60% of respondents reported adopting more diligent cleaning habits during the pandemic, with plans to maintain these practices moving forward. This heightened emphasis on hygiene is expected to sustain long-term demand for premium cleaning solutions, antimicrobial lens cases, and other accessories designed to ensure optimal lens care.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

7.22% |

|

Segments Covered |

Product Type, Material Type, Distribution Channel, End-User and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Hydron Contact Lens Co., Ltd., Visioneering Technologies, Inc., Essilor International S.A., Blanchard Contact Lenses, Bausch + Lomb, Clearlab International, Paragon Vision Sciences, Hoya Corporation, Alcon Vision LLC, Seed Co., Ltd., X-Cel Specialty Contacts, Carl Zeiss Meditec AG, Johnson & Johnson Vision Care, Inc., Contamac Ltd., UltraVision CLPL, SynergEyes, Inc., Opti-Free, CooperVision, Inc., Menicon Co., Ltd and Abbott Medical Optics |

SEGMENTAL INSIGHTS

Contact Lens Accessories Market By Product Type

The lens cases segment held the largest share of the contact lens accessories market, accounting for approximately 31.8% of the global market share in 2023. The increasing use of disposable contact lenses and the growing awareness of the importance of proper lens storage are driving this segment. Innovations such as anti-microbial lens cases and biodegradable options are further propelling demand.

The cleaning solutions segment is another major segment and is projected to grow at a CAGR of 5.5% during the forecast period. The growth of the cleaning solutions segment is majorly driven by rising concerns over eye infections like Keratitis and growing demand for preservative-free and eco-friendly cleaning products. As consumers become more aware of the health risks associated with improper lens care, the demand for high-quality cleaning solutions is increasing. A 2022 survey by the American Academy of Ophthalmology found that over 60% of contact lens users are willing to invest more in premium cleaning solutions to avoid infections.

The eye drops and lubricants segment is expected to witness a healthy CAGR during the forecast period as more users experience dry eye syndrome due to increased screen time and environmental factors. These products are vital for ensuring comfort, especially for wearers in dry or polluted environments. According to Market Watch, there has been a 15% increase in the sale of lubricating eye drops since 2020, largely attributed to more time spent on digital devices.

Contact Lens Accessories Market By Material Type

Plastic-based accessories, particularly lens cases and cleaning solution bottles, dominated the market in 2023 with a 40.5% share. While plastic remains the most commonly used material, environmental concerns over plastic waste have led to innovations in biodegradable and recycled plastics. Despite these challenges, plastic accessories are expected to grow at a CAGR of 4.5% through 2028 due to their affordability and widespread availability. According to Euromonitor, the demand for eco-friendly plastics in the eyewear market has risen by 12% annually since 2020.

However, the silicone segment is expected to register the fastest CAGR of 5.8% during the forecast period owing to increasing consumer preference for more hygienic, long-lasting materials. Silicone-based accessories, primarily used for lens cases and inserters. Silicone offers durability and is less prone to bacterial growth, making it a preferred choice for premium products. A study published by the Journal of Optometry in 2022 found that silicone lens cases reduce the risk of infection by 20% compared to traditional plastic cases.

Contact Lens Accessories Market By Distribution Channel

The online stores led the market in 2023, holding 45.6% of the global market share. The COVID-19 pandemic accelerated e-commerce adoption, and now more consumers prefer purchasing contact lens accessories online due to the convenience and availability of a wider variety of products. According to Statista, online optical sales grew by 34% in 2022, with the trend expected to continue.

The optical stores segment holds a substantial share of the worldwide market and is a trusted source for purchasing contact lens accessories, especially for first-time buyers and those seeking professional advice. This segment is projected to grow at a CAGR of 4.5%. As consumer trust in in-person consultation for eye care remains strong, many prefer purchasing accessories directly from their optometrists or specialized retailers.

Contact Lens Accessories Market By End-User

Individuals form the largest segment, accounting for 70% of the global market share. As more consumers seek personalized eye care solutions for their daily needs, the demand for individual-use products such as cleaning solutions, cases, and eye drops has grown. The CAGR for this segment is expected to be 5.4%, supported by the increasing adoption of contact lenses worldwide, particularly among younger and middle-aged populations.

The CAGR for clinics is projected to be 4.3%, driven by the increasing number of contact lens prescriptions. These include eye care clinics that offer bundled services and products to patients. Clinics often recommend high-quality accessories, which boosts the sales of premium products.

Contact Lens Accessories Market By Region

North America is the largest market for contact lens accessories.

North America had 35% of the global market share in 2023. The high adoption rate of contact lenses in the U.S. and Canada, driven by both medical and cosmetic demand, is a key factor. The American Optometric Association notes that about 45 million Americans wear contact lenses, contributing to strong sales of cleaning solutions, storage cases, and other accessories. Moreover, the presence of major market players such as Alcon and Bausch + Lomb in the region further drives growth through continuous product innovations.

Europe holds a significant portion of the market.

The market in this region is expected to expand at a CAGR of 5.1% over the next five years, driven by increasing awareness about eye health and the rising prevalence of myopia. Countries like Germany, France, and the UK are leading in market growth due to robust healthcare systems and a focus on eye care. Europe also has a strong regulatory framework, ensuring the availability of high-quality products, which enhances consumer confidence. Moreover, the growing trend toward eco-friendly products has led to the introduction of biodegradable lens cases and cleaning solutions, contributing to market expansion.

The Asia-Pacific region is witnessing the fastest growth in the contact lens accessories market.

With a CAGR of 7.3% from 2024 to 2029, the Asia-Pacific regional market is set to become the fastest-growing regional segment in the worldwide market. Countries like Japan, China, and India are leading this surge due to a growing middle-class population and increasing demand for contact lenses. According to the Asia Optometric Council, myopia affects more than 50% of the population in urban regions, leading to a higher need for vision correction products. Additionally, the rising popularity of cosmetic lenses in countries like South Korea and Japan is driving demand for related accessories, especially as online sales platforms continue to grow in the region.

Regions such as Latin America, the Middle East, and Africa hold a smaller share of the market. The growth is primarily driven by an increase in disposable income and improving access to healthcare in these regions. For example, Brazil and South Africa have seen a surge in contact lens use, supported by rising awareness of eye care and expanding e-commerce platforms that make these accessories more accessible. While these markets are still emerging, they hold significant potential for future growth, particularly as local manufacturers enter the scene with affordable options.

COMPETITIVE LANDSCAPE AND KEY PLAYERS IN THE MARKET

The contact lens accessories market is highly competitive, with a mix of established global players and emerging brands. These companies are driving innovation through product diversification and eco-friendly solutions, helping to expand the market.

List of key participants in the global contact lens accessories market include

- Hydron Contact Lens Co., Ltd.

- Visioneering Technologies, Inc.

- Essilor International S.A.

- Blanchard Contact Lenses

- Bausch + Lomb

- Clearlab International

- Paragon Vision Sciences

- Hoya Corporation

- Alcon Vision LLC

- Seed Co., Ltd.

- X-Cel Specialty Contacts

- Carl Zeiss Meditec AG

- Johnson & Johnson Vision Care, Inc.

- Contamac Ltd.

- UltraVision CLPL

- SynergEyes, Inc.

- Opti-Free

- CooperVision, Inc.

- Menicon Co., Ltd.

- Abbott Medical Optics

Top Manufacturers and Brands

- Bausch + Lomb Bausch + Lomb is a leading player in the contact lens and accessories market, with a wide range of products, including lens cases, cleaning solutions, and eye drops. Their Biotrue® multipurpose solution is a top-selling product, known for its pH-balanced formula that mimics natural tears. In 2022, the company launched Biotrue® Hydration Boost, a preservative-free eye drop designed for contact lens users experiencing dryness. Bausch + Lomb's focus on research and development enhances its authoritative position in the market. According to the company’s 2023 Q2 report, it experienced a 7% growth in sales for contact lens accessories, driven by increased awareness of eye health and hygiene.

- Johnson & Johnson Vision Johnson & Johnson Vision, known for its Acuvue® line of contact lenses, is also a significant player in the accessories market. The company offers solutions such as Acuvue RevitaLens, a multi-purpose disinfecting solution with a dual-disinfecting formula designed to enhance comfort and cleanliness. According to a 2023 report by GlobalData, Johnson & Johnson Vision holds approximately 18% of the global contact lens accessories market. Their consistent investment in R&D and their commitment to consumer education on eye health solidify their trustworthiness in the industry.

- Alcon Alcon, another giant in the eye care industry, offers a variety of cleaning solutions, lens cases, and eye drops. Their Opti-Free® PureMoist® cleaning solution is widely popular for providing moisture retention and lens hydration. Alcon has also expanded its portfolio with eco-friendly lens care products, aligning with the increasing consumer demand for sustainability. The company’s 2023 financial report indicates that Alcon’s contact lens care division grew by 6.5% compared to the previous year, largely due to the rising demand for multipurpose solutions and lens cases.

Emerging Brands

- Dimple Contact Lenses Based in Australia, Dimple Contact Lenses has quickly gained a foothold in the market with its subscription model for lenses and accessories. They offer convenience by delivering lenses along with all necessary accessories, such as cleaning solutions and cases, directly to consumers’ doors. In 2023, Dimple reported a 30% growth in revenue, driven largely by its convenient subscription-based services and rising demand for home delivery in the wake of the COVID-19 pandemic.

RECENT HAPPENINGS IN THE GLOBAL MARKET

- In October 2023, Alcon launched the TOTAL30 Multifocal contact lenses in 2023, designed specifically for individuals with presbyopia, enhancing vision at all distances with a focus on comfort and clarity. Alcon also reported solid growth in contact lens sales, supported by innovations like their Opti-Free PureMoist cleaning solution, which is gaining traction globally.

- In 2023, Essilor continued to enhance its lens care portfolio by rolling out new cleaning solutions aimed at providing better hydration and prolonged comfort for lens wearers. Their multi-purpose solutions were updated to cater to the needs of daily disposable lens users, further increasing their market share

- In July 2021, Bausch + Lomb focused on sustainability with their Biotrue® Hydration Boost eye drops, a product aimed at addressing dry eye issues that are prevalent among contact lens users. This launch aligns with the growing consumer demand for eco-friendly and preservative-free products.

DETAILED SEGMENTATION OF THE MARKET INCLUDED IN THIS REPORT

This research report is segmented and sub-segmented based on product type, material type, distribution channel and region.

By Product Type

- Lens Cases

- Cleaning Solutions

- Eye Drops

- Lens Inserters and Removers

- Others

By Material Type

- Plastic

- Silicone

- Glass

- Others

By Distribution Channel

- Online Stores

- Optical Stores

- Supermarkets/Hypermarkets

- Others

By End-User

- Individuals

- Clinics

- Hospitals

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

How big is the contact lens accessories market?

The global contact lens accessories market was valued at USD 2.68 billion in 2023.

What are the factors driving the contact lens accessories market?

Technological advancements, increasing usage of contact lens and rising awareness among people of eye health are driving the market growth.

Which region held the leading share of the contact lens accessories market?

With 35% of the global market share in 2023, North America took the top position among all the regions.

Who are the key players in the market?

Hydron Contact Lens Co., Ltd., Visioneering Technologies, Inc., Essilor International S.A., Blanchard Contact Lenses, Bausch + Lomb, Clearlab International, Paragon Vision Sciences, Hoya Corporation, Alcon Vision LLC, Seed Co., Ltd., X-Cel Specialty Contacts, Carl Zeiss Meditec AG, Johnson & Johnson Vision Care, Inc., Contamac Ltd., UltraVision CLPL, SynergEyes, Inc., Opti-Free, CooperVision, Inc., Menicon Co., Ltd and Abbott Medical Optics are some of the notable players in the global market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]