Latin America Food Colors Market Size, Share, Trends & Growth Forecast Report By Type (Synthetic, Natural, Nature-Identical), Application (Processed Food, Beverages, Bakery & Confectionery Products, Dairy Products, Oils & Fats, Poultry, Meat and Seafood), Form (Gel, Powder, Liquid and Paste), And Country (Brazil, Mexico, Argentina, Chile and Rest of Latin America), Industry Analysis From 2025 To 2033

Latin America Food Colors Market Size

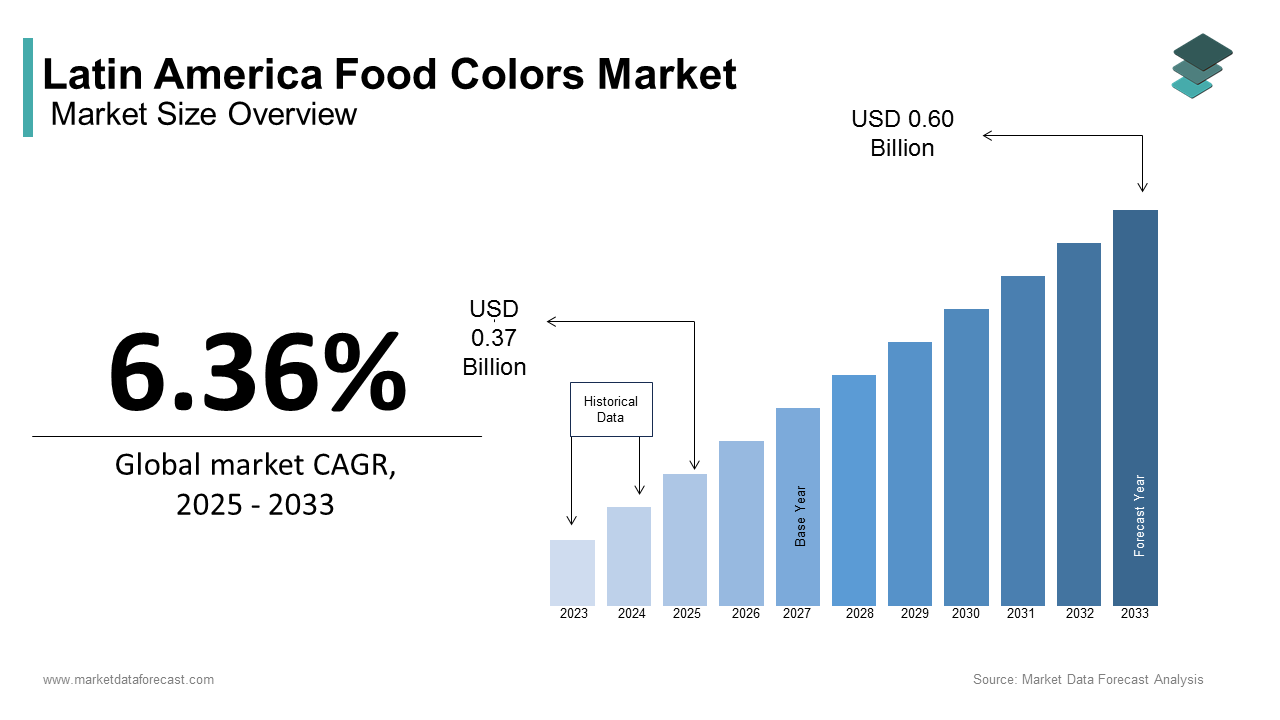

The Latin America food colors market was worth USD 0.34 billion in 2024. The Latin American market is anticipated to be worth USD 0.60 billion by 2033 from USD 0.37 billion in 2025, exhibiting a CAGR of 6.36% from 2025 to 2033.

Food colors refer to chemicals made to improve the appearance of food by giving it artificial shine and color. They are even used in various brands of salad dressings, smoked salmon colorings, and pickles, as well as in some medications. The bright colors of baked goods, sports drinks, and candy are due to the application of artificial food coloring. Food coloring is classified into natural food coloring, synthetic food coloring, and mixed food coloring. It is widespread in everyday life and is also included in foods and drinks that we did not expect. These substances are added to food or drinks that change color to make them soluble in water. Natural food coloring is derived from a variety of vegetables, fruits, plants, minerals, and other natural food sources. Artificial colors are compounds that are used to add flavor and improve the appearance of foods or to improve the flavoring properties of foods.

MARKET DRIVERS

Changes in lifestyles and globalization have led to increased use of Latin American food colors in a growing market. The Latin American market for food colors is driven primarily by increasing demand from the beverage industry and the bakery and confectionery industries. For commercial adoption, synthetic food colors are in high demand due to their high light stability, low cost, and low microbial contamination. The high demand for flavored drinks, fruit juices, and nutritional drinks drives the Latin American market for food colors. Growing consumer awareness of clean-label products, the health risks associated with synthetic colors, and the health benefits of using natural food colors are driving the demand for food colors over synthetic colors. Due to food safety concerns due to chemical contamination of food and the adverse effects of synthetic additives, consumers are increasingly demanding products with clean labels. Growing health awareness, rising consumer purchasing power, and increasing instances of food contamination are driving the demand for clean-labeled natural foods in Latin America. This growing demand has led to the launch of several new products with claims such as "natural". As a result, food manufacturers are investing in clean labels, which in turn incorporate clean-labeled food colors to introduce new products or modify existing product portfolios. Changing preferences for color products due to taste perception will drive the growth of the Latin American food color industry. Along with favorable government regulations, the high adoption of products in gourmet cooking will expand product coverage. Using edible colors to enhance an item's visual appeal and texture is a key factor in increasing product penetration.

Synthetic pigments can cause allergic disorders among consumers. Using chemicals that contain heavy metals like lead or arsenic to make synthetic food coloring can cause life-threatening illnesses. Food colors are attracting market attention because they attract consumers who see them as "safe to use" products due to their natural origin. Natural colors reduce the consumer's risk of allergies and intolerances. These factors are driving the demand for natural colors in food and beverage applications. The growing world population is expected to increase demand for food and beverages, which is likely to increase demand for the product further during the forecast period. As consumer awareness of exotic and traditional flavored products increases, the growing demand for fast food is expected to drive further market growth in the coming years.

MARKET RESTRAINTS

Consumers face many challenges regarding the cost, process, application, and quality of natural ingredients. The extraction process for natural ingredients is complex and time-consuming, and although natural ingredients are somewhat consumed, the yield of high-purity products is poor. This factor is expected to hamper the growth of the Latin American food colors market in the coming years.

IMPACT OF COVID 19 ON THE LATIN AMERICA FOOD COLORS MARKET

Global concerns about the coronavirus pandemic have had a negative impact on the functioning of the global food and beverage industry. While this pandemic is expected to have a negative impact on the market in the short term, food coloring prices are expected to rise in 2020 to overcome economic instability. The world has stalled with the arrival of COVID-19. Weakening consumer demand for lifestyle and wellness products due to social restrictions and lockdown policies negatively affects demand patterns in the food color market. However, restrictions on the resumption of economic activity in the consumer goods market and the ease of public discourse suggest that a recovery in market demand for food coloring is imminent.

SEGMENTAL ANALYSIS

By Type Insights

By type, nature-identical colors accounted for the highest proportion in 2023, followed by synthetic. In the food industry, syrups, jams/preserves, and candies are mainly used by food and beverage manufacturers due to their wide range of applications. Recent trends in the food industry have consumers turning towards natural colors due to their health benefits.

By Application Insights

By application, the processed foods segment accounted for the largest share in 2023, followed by bakery and confectionery products.

By Form Insights

In terms of form, the liquid sector accounted for the largest share in 2023. Liquid dyes are the most common form applied to almost all food products.

REGIONAL ANALYSIS

The Latin American regions are expected to contribute to the global food color market. This, coupled with increasing disposable income and lifestyle changes in Brazil, the GCC countries, and South Africa, promotes the consumption of processed foods, increasing the demand for food colors.

KET MARKET PLAYERS

Companies playing a leading role in the Latin American food colors market include Naturex S.A., Sensient Technology Corporation, D.D. Williamson & Co. Inc.., MC Corporation, Chr. Hansen S/A, Fiorio Colori, Archer Daniels Midland Company, Koninklijke DSM N.V., Döhler Group and Kalsec Inc.

RECENT HAPPENINGS IN THE MARKET

- In March 2018, Sensient Technologies acquired GlobeNatural (Peru). The acquired company is called Sensient Natural Colors Peru S.A.C. (Peru).

MARKET SEGMENTATION

This research report on Latin American food colors market is segmented and sub-segmented into the following categories.

By Type

- Natural

- Synthetic

- Natural-Identical

By Application

- Beverages

- Processed Food

- Bakery & Confectionery Products

- Oils & Fats

- Dairy Products

- Meat

- Poultry

- Seafood

By Form

- Gel

- Powder

- Liquid

- Paste

By Country

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com