Global Life Insurance Policy Administration System Market Size, Share, Trends & Growth Forecast Report By Deployment Type, Components and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Life Insurance Policy Administration System Market Size

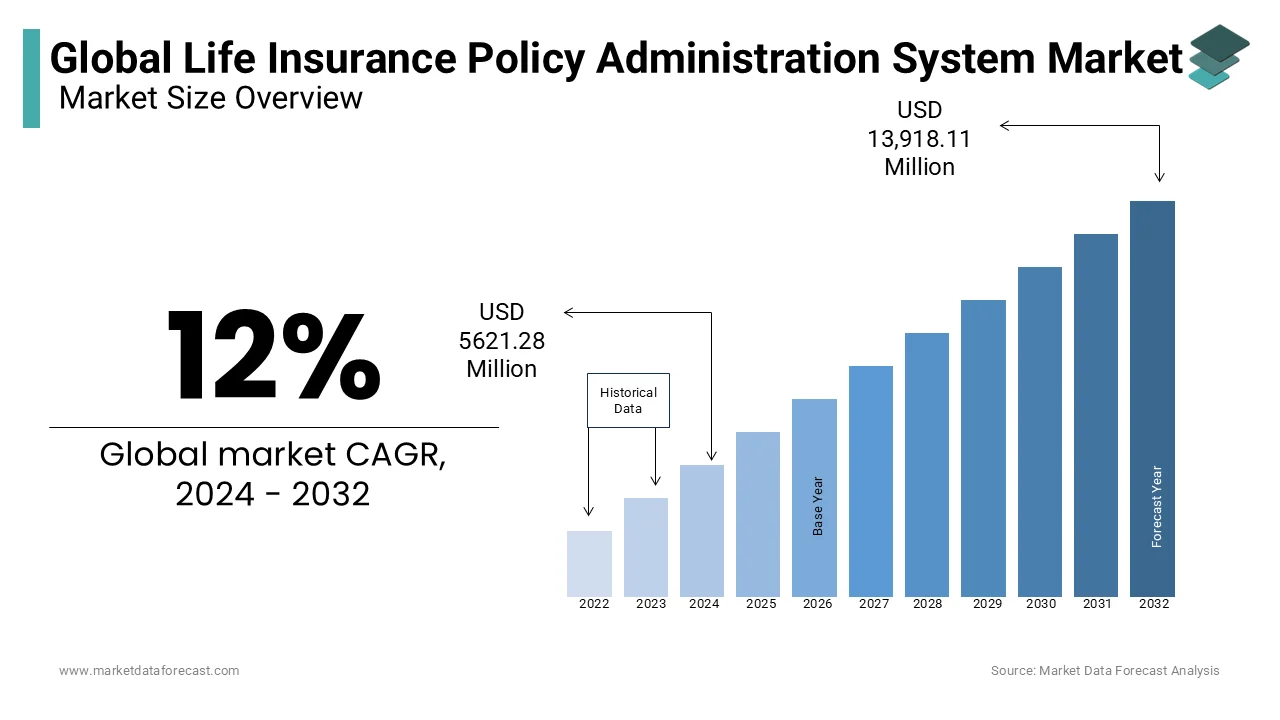

The global life insurance policy administration system market was valued at USD 5,621 million in 2024. The global market is projected to grow from USD 6,296 million in 2025 to reach USD 15,588 million by 2033, exhibiting a compound annual growth rate (CAGR) of 12% from 2025-2033.

The life insurance policy administration system is a system that helps to manage the end-to-end lifecycle of the group life, individual policies, and pension products. It allows insurers to manage life and annuity insurance policies and helps organizations track their strategies and calculate costs. The Life Insurance Policy Administration System can be executed as part of an independent solution or integrated guarantee package. This system can even improve the flexibility and administration of various insurance policies. Further, this system can be implemented as a part of a standalone solution or an integrated insurance suite.

In the recent years, the life insurance policy administration systems have experienced substantial growth, and this trend is likely to fuel further during the forecast period and propel the global market growth. The evolving needs of the insurance industry for more efficient and scalable solutions, increasing complexity of life insurance products, regulatory requirements and growing need for enhanced customer service have been continuously thriving the demand for life insurance policy administration systems. High demand for life insurance policy administration systems is clearly seen in the developed countries such as the U.S., Canada, the UK and emerging markets such as India and China. In countries such as the U.S. and Canada, the established insurance markets demand for modernization of legacy systems, which is paving the way for life insurance policy administration systems. Similarly in Europe, regulatory compliance such as Solvency II is boosting the adoption of such systems.

Companies that operate in the life insurance policy administration systems market have been focussing on developing comprehensive and flexible solutions that can handle various life insurance products and comply with changing regulatory landscapes to strengthen their position in the global market. The market participants have also been actively investing in technology, especially in cloud-based platforms, artificial intelligence, and automation to enhance operational efficiency, reduce costs and improve customer experience.

MARKET DRIVERS

Impact of Digital Transformation on the Life Insurance Policy Administration System Market

Y-o-Y growth in the demand for digital transformation in insurance is one of the factors driving the life insurance policy administration system market growth. Digital transformation has been playing an integral role in reshaping the insurance industry from the last few years, which is also driving the demand for advanced policy administration systems. The insurance service providers have been increasingly adopting digital technologies for various purposes that range from streamlining operations to enhancing customer experiences in order to remain competitive in the global market. Today, approximately 70% of the insurance customers likes to do digital interactions compared to traditional methods, which clearly showcases the importance of digital transformation in the insurance sector. The shift towards digital platforms is significantly favouring he market participants to improve data accuracy and facilitate real-time processing, which are further making policy administration more efficient.

Importance of Streamlined Policy Administration Processes

Y-o-Y growth in the need for streamlined policy administration processes to the insurance customers is favouring the global market growth. The policy administration must be efficient to maintain effectiveness in managing the lifecycle of policies in the insurance companies. Considering the importance that streamlining of policy administration holds, the insurance companies have been considerably investing to make the processes as smooth as possible. The streamlining of processes offers several benefits to the insurance companies such as reduction in the number of errors, improving compliance and leads to improved customer satisfaction.

Technological Advancements Driving Market Expansion

Furthermore, factors such as the rapid adoption of cloud-based solutions, increasing adoption of technological advancements such as AI and machine learning, growing demand for enhanced customer service capabilities and the integration with other insurance technologies are aiding the global market expansion. The growing importance of data analytics and business intelligence, Y-o-Y rise in the number of insurance policies issued, the expansion of the insurance industry in emerging markets and growing competition among insurance providers are boosting the growth of the life insurance policy administration system market.

Opportunities in the Life Insurance Policy Administration System Market

The active change in market conditions in the life insurance policy administration to grow and adapt quickly drives the market growth. The rise in policy management functions outsourcing and the need to be up to date in technology is fuelling the market. Moreover, the low price associated with the system is further forecasted to boost the global life insurance policy administration system market. The life insurance policy administration system saves the cost of setting up infrastructure and training people to handle tools are significant opportunities for the market. Besides, the system can easily collaborate with the existing system. These are the opportunities of the life insurance policy administration system market.

MARKET RESTRAINTS

Challenges Hindering the Life Insurance Policy Administration System Market

The growing competition for the life insurance policy administration system is restraining the market. The quick rise in product updates is hampering the market. Moreover, the lack of professionally skilled people to handle the system in developing areas is dragging the market down. The Life Insurance Policy Administration System saves the cost of setting up infrastructure and training people to handle tools are significant opportunities for the market. Besides, the system can easily collaborate with the existing system. These are the opportunities of the life insurance policy administration system market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Deployment Type, Component, Policy Administration, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Analysed |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Infosys Limited, SAP SE, Capgemini SE, Concentrix Corporation, DXC Technology Company, Mphasis Wyde |

SEGMENTAL ANALYSIS

By Deployment Type Insights

The SaaS segment's revenue contribution is expected to expand at a CAGR of 13.0% during the forecast period based on the deployment type. The segment is expected to retain its dominance during the forecast period. Wide usage of the segment is caused by growth in the handle option of cloud-based services, superior security, and developments.

By Component Insights

The services segment accounted for the major share of the worldwide market in 2024 and is estimated to grow at a notable CAGR during the forecast period. The service segment is further divided into Managed Services and Professional Services. The Software segment is anticipated to gain higher market share and CAGR in the upcoming years. These are the factors that propel the Life Insurance Policy Administration System Market.

By Policy Administration Insights

The user experience segment's revenue contribution is expected to expand at a CAGR of 13.7% during the forecast period. Policy lifecycle is broadening, outsourcing policy administration functions, and fast changes in the market are some of the prime factors driving the market growth.

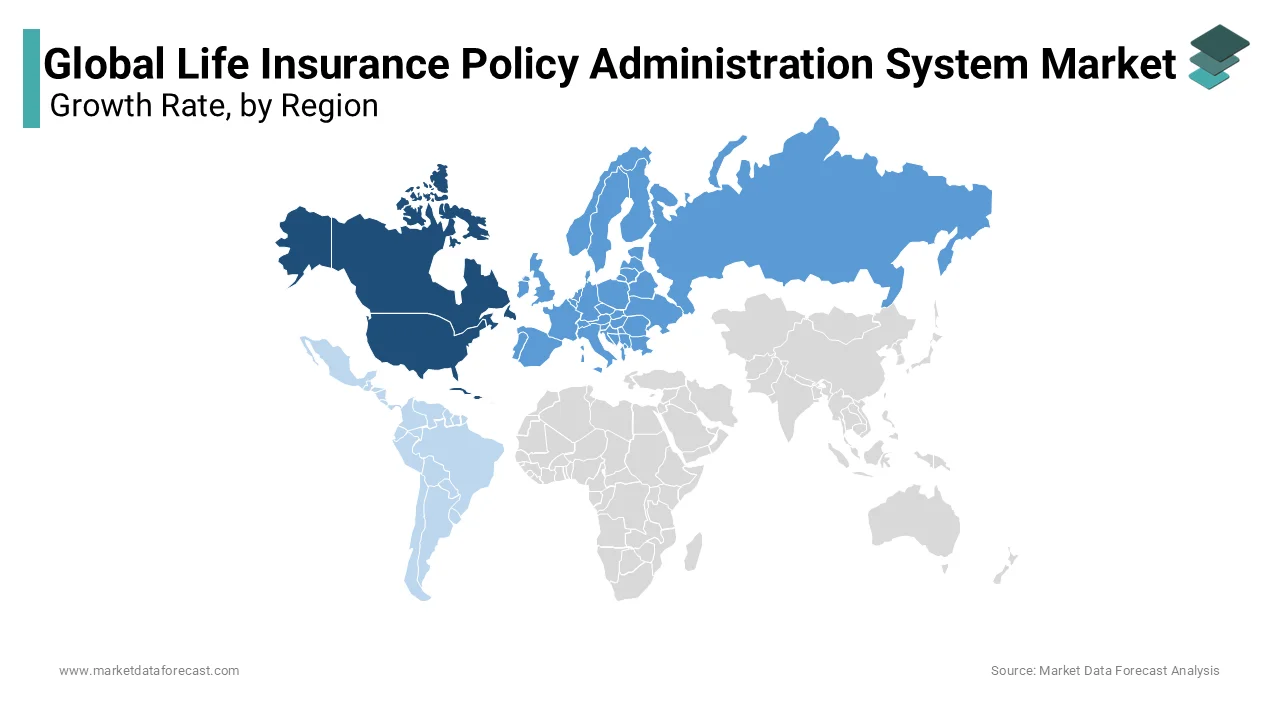

REGIONAL ANALYSIS

North America played the dominating role in the global market in 2024 and accounted for 36.1% of the global market share. The domination of the North American market is likely to continue in the global market during the forecast period. North America has an advanced insurance sector, which is one of the major factors propelling the regional market growth. Rapid adoption of technological advancements and the presence of leading insurance companies in North America are further boosting the growth rate of the North American market. For instance, as per Insurance Information Institute, more than 50% of the top global insurance companies are headquartered in North America. The U.S. and Canada are the large contributors to the North American market and this trend will continue in the North American market during the forecast period. The U.S. emerged as the most dominating country-level segment in the global market in 2024 and the supremacy of the U.S. in the worldwide market looks evident. The lead of the U.S. market is majorly due to the high penetration of life insurance products, strong regulatory frameworks, advanced IT infrastructure that support the integration and deployment of administration systems and continuous innovation and adoption of advanced technologies such as AI and big data analytics in insurance.

Europe was second largest regional segment for life insurance policy administration system market in 2024 and held 24.2% of the global market share. Strong regulatory frameworks such as Solvency II, Y-o-Y growth in the demand for customized life insurance products and efficient policy management solutions, growing focus on customer experience and increasing number of digital transformation initiatives are fuelling the European market growth. UK and Germany are contributing majorly towards the life insurance policy administration system market growth. Enhancements in the flexibility and administration of various insurance schemes are responsible for the region’s market growth.

The life insurance policy administration system market in Asia-Pacific is believed to have quick growth. China and India are emerging nations in the market. The upsurge in the rising focus on economic management across the globe is escalating market growth. Existing artificial intelligence and the rising adoption of cloud-based solutions are likely to surge the growing market demand.

Latin America and the Middle East & Africa are projected to have constant growth in the upcoming years.

KEY MARKET PLAYERS

Some of the companies dominating the global life insurance policy administration system market profiled in this report are Infosys Limited, SAP SE, Capgemini SE, Concentrix Corporation, DXC Technology Company, Mphasis Wyde, Oracle Corporation, Accenture Plc, InsPro Technologies LLC, EXL Service Holdings, Inc., Sapiens International Corporation, Majesco and others.

MARKET SEGMENTATION

This research report on the global life insurance policy administration system market has been segmented and sub-segmented based on the deployment type, component, policy administration, and region.

By Deployment Type

- SaaS

- On-Premises

By Component

- Software

- Services

- Managed Services

- Professional Services

By Policy Administration

- Policy Life Cycle

- Underwriting

- Contract Changes

- Claim Settlement

- User Experience

- others

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- UK

- France

- Spain

- Germany

- Italy

- Rest of EU

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia & New Zealand

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

- Middle East

- Africa

Frequently Asked Questions

What are the major factors driving the growth of the life insurance policy administration market?

The growth of the life insurance policy administration market is primarily driven by factors such as the increasing demand for digital insurance solutions, the growing need for process automation, and advancements in artificial intelligence and machine learning technologies.

Who are the key players in the life insurance policy administration market?

Some of the key players in the life insurance policy administration market include Accenture, DXC Technology, Majesco, Oracle Corporation, and Sapiens International Corporation.

What are the challenges faced by the life insurance policy administration market?

The life insurance policy administration market faces several challenges, including the complexity of legacy systems, data security concerns, and the need for skilled professionals to implement and maintain the software solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com