Global Mezcal Market Size, Share, Trends & Growth Forecast Report - Segmented by Product Type (Joven, Reposado, Añejo), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) - Industry Analysis 2025 to 2033

Global Mezcal Market Size

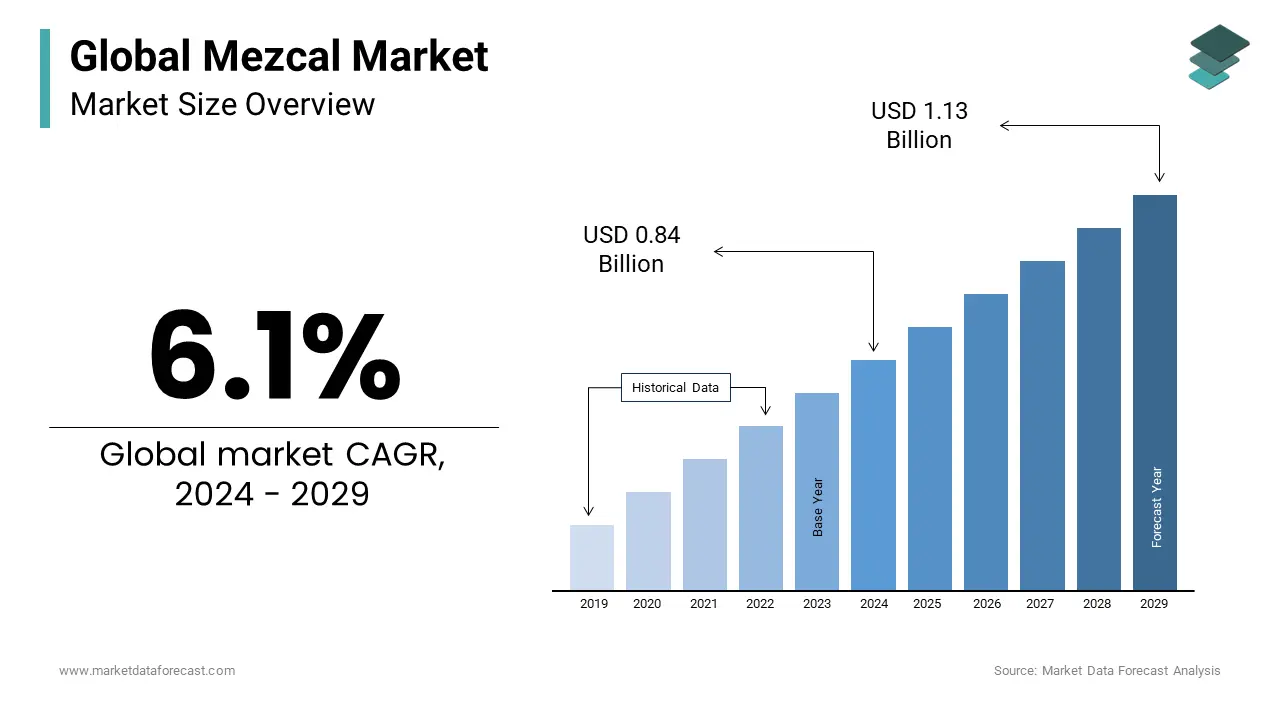

The global mezcal market size was valued at USD 0.84 billion in 2024, and the global market size is estimated to reach USD 1.43 billion by 2033 from USD 0.89 billion in 2025, growing at a CAGR of 6.1% from 2025 to 2033.

The Global Mezcal Market records a prominent growth in the demand for quality standards. The mezcal market is continuing its enhancing stage, which creates the industry further attractive and is the major object for growing investments in the global mescal market. Professionals in the mezcal market landscape have recommended a limit on harvesting wild agave, therefore reducing the pressure on natural manufacture. A moderately low number of market players who led a large market share controls the global mezcal market. The mezcal market is robust in the United States. The U.S Mezcal Market is projected to show the highest progress in the coming years. In 2024, the United States became the largest mezcal market globally, as imports increased by 50%, surpassing Mexico, which jumped to 10%. In 2016, the United States and Spain accounted for a greater mezcal export than the United Kingdom. The word "mezcal" has generally been used in Mexico for all agave spirits and continues to be used for many agave spirits, regardless of whether those spirits have been legally certified as "mezcal" or not. Agaves or magueys are endemic to Mexico and are present throughout the world. It is not known whether distilled beverages were produced in Mexico before the Spanish conquest. However, the Spanish knew the autochthonous fermented drinks such as pulque, made from the maguey plant. The result was Mezcal.

Mezcal producers have responded to the growing interest in this once-overlooked category with exciting innovations and a constant stream of products and new brand launches along the way. Growing consumer interest in ethically sourced products offers opportunities for ethically exported soft drinks. Companies operating in the beverage market are expected to take advantage of this opportunity during the forecast period. Leading beverage companies are significantly focusing on research and development (R&D) activities to promote the multi-functional profiles of non-alcoholic beverages that provide great health benefits. With current trends continuing, even more, new entrants to the agave market could be seen. In addition, distillers worldwide have experimented with various varieties of agave, and some distillers have implemented new techniques. However, concern for the environment is a critical threat to growth. First, agave plants take many years to mature. Thus, the overexploitation of agaves is a permanent threat.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.1% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Rey Campero, Davide Campari-Milano S.p.A., William Grant & Sons Ltd, Pernod Ricard, Diageo Plc., Brown-Forman Corporation, Familia Camarena Tequila, Craft Distillers and Bacardi. |

SEGMENTAL ANALYSIS

By Product Type Insights

This segment accounted for the largest market share in 2019 and is expected to experience the fastest growth during the forecast period. Joven Mezcal is more popular due to its easy availability. In addition, it is clear and has a maximum aging of two months, unlike Reposado and Anejo that do it for a minimum of nine months and one year, respectively.

By Distribution Channel Insights

Most mezcal is sold through in-store retailers. This segment has been divided into supermarkets and hypermarkets, specialized stores, and others.

REGIONAL ANALYSIS

The Market for Mezcal has been categorized based on geography to offer a clear understanding of the global market; the world Market for Mezcal has been studied in four regions: North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa. The main players in the United States are investing in installing production plants due to the growing popularity of mezcal in the country. In addition, in 2019, the United States became the largest mezcal market globally, as imports increased by 50%, surpassing Mexico, which jumped to 10%. In 2024, the United States and Spain accounted for a greater mezcal export than the United Kingdom.

In September 2024, it was reported that mezcal could be found in many London bars. That same month the first London Mezcal Festival took place to celebrate the spirit. However, in 2024, a GQ UK article reported a sharp increase in mezcal availability in recent years in the UK.

single malts are currently leading the growth of spirits consumption in China. Mezcal has many similar characteristics, putting it in a good position to replicate the growth of single malts. Mezcal is an artisan drink with many flavors and grades to explore. Mezcal is also produced in many regions, so consumers wanting to learn more about mezcal have many places to visit. Lately, wealthy Chinese consumers between the ages of 25 and 34 have been considering authentic and natural drinks offered by Mezcal. As a result, China could overtake the United States as the top tequila consumer by 2024.

KEY MARKET PLAYERS

Key Players in the Global Mezcal Market are Rey Campero, Davide Campari-Milano S.p.A., William Grant & Sons Ltd, Pernod Ricard, Diageo Plc., Brown-Forman Corporation, Familia Camarena Tequila, Craft Distillers and Bacardi.

RECENT HAPPENINGS IN THE MARKET

- The long-awaited news has finally arrived of the acquisition by Pernod Ricard of a mezcal company; perhaps the biggest surprise of all is that of Del Maguey. Pernod will take a majority stake in America's number one mezcal. According to the press release and what we heard from the company, the current management team and staff remain in place, and all operations in Mexico remain intact. Given the movements of Diageo and Bacardi in the world of mezcal, Mezcal Union, and Ilegal Mezcal, respectively, it was rumored that Pernod was looking to choose a brand for his wallet.

MARKET SEGMENTATION

This research report on the global mezcal market has been segmented and sub-segmented based on product type, distribution channel & region.

Product Type

- Joven

- Reposado

- Añejo

By Distribution Channel

- Store-Based

- Non-Store-Based

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- the Middle East and Africa

Frequently Asked Questions

1. What is Mezcal?

United States region is expected have the largest market share of the global Mezcal Market.

2.How is Mezcal different from Tequila?

While both Mezcal and Tequila are distilled from agave, they are made from different varieties of the plant and are produced in different regions of Mexico. Mezcal has a smokier flavor profile compared to Tequila, which tends to be smoother and more floral

3.What are the different types of Mezcal?

There are several types of Mezcal categorized based on the type of agave used, production methods, and aging process. Some common types include joven (young or unaged), reposado (rested), añejo (aged), and pechuga (distilled with additional ingredients such as fruits or spices).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com