Global Craft Beer Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type (Ale & Lager), Distribution Channel, Age Group & Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Craft Beer Market Size

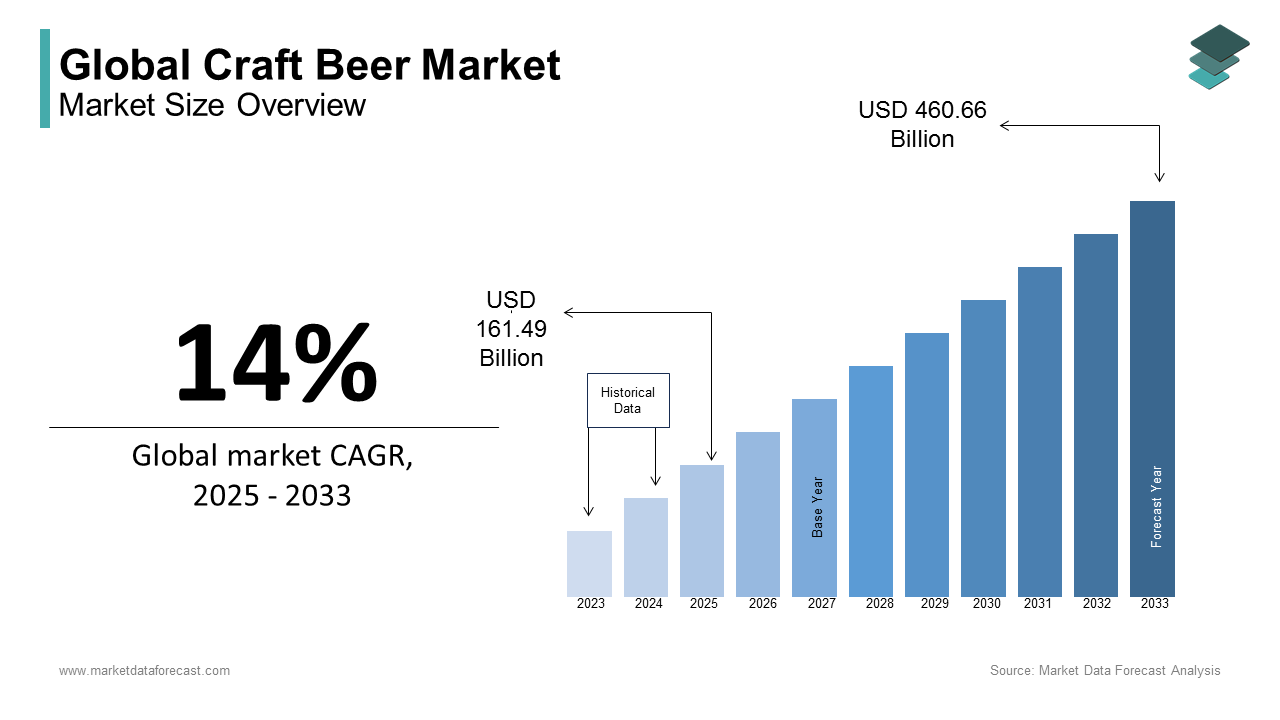

The global craft beer market was assessed to be USD 141.66 billion in 2024. The global market is further expected to grow at a CAGR of 14% from 2025 to 2033 and be valued at USD 460.66 billion by 2033 from USD 161.49 billion in 2025

The craft beer market represents a dynamic and rapidly evolving segment of the global alcoholic beverage industry. Craft beer is defined as beer produced by small, independent breweries that emphasize traditional brewing methods, high-quality ingredients, and innovative flavor profiles. Unlike mass-produced beers, craft beers are often characterized by their artisanal nature, limited production volumes, and a focus on creativity and experimentation. The Brewers Association, a leading industry body, defines a craft brewery as one that produces fewer than 6 million barrels annually and is less than 25% owned by a non-craft beverage alcohol industry member. Additionally, the craft beer movement has become a cultural phenomenon, with consumers seeking not just a beverage but an experiential connection to local breweries through tours, tastings, and community events.

MARKET DRIVERS

Growing Consumer Preference for Unique and Local Flavors

The craft beer market is driven by increasing consumer demand for unique, high-quality, and locally produced beverages. According to the Alcohol and Tobacco Tax and Trade Bureau, the number of active craft breweries in the U.S. grew from 8,884 in 2020 to over 9,000 in 2022 with a 1.3% annual increase. The Brewers Association reports that craft beer sales accounted for 13.1% of the total U.S. beer market by volume in 2022, generating $26.8 billion in revenue. Consumers are increasingly drawn to the diversity of flavors and styles offered by craft breweries, which cater to evolving tastes and preferences for artisanal products over mass-produced beers.

Rising Popularity of Low-Alcohol and Non-Alcoholic Craft Beers

Health-conscious consumers are fueling demand for low-alcohol and non-alcoholic craft beers. The National Institute on Alcohol Abuse and Alcoholism highlights that 42% of U.S. adults are actively trying to reduce alcohol consumption. The Brewers Association notes that non-alcoholic craft beer sales grew by 38% in 2021 with $290 million in revenue. This trend is supported by innovations in brewing techniques, allowing craft breweries to produce flavorful, low-alcohol options without compromising taste. This shift aligns with broader health and wellness trends by making craft beer accessible to a wider audience seeking moderation without sacrificing quality.

MARKET RESTRAINTS

High Production Costs

The craft beer market faces significant challenges due to high production costs, which include raw materials, labor, and equipment. According to the Brewers Association, the cost of malted barley, a key ingredient, increased by 10-15% in 2022 due to supply chain disruptions and climate-related issues. Additionally, the U.S. Bureau of Labor Statistics reported a 6.5% rise in wages for brewery workers in 2021, further straining budgets. Small breweries often lack economies of scale, making it difficult to compete with larger beer producers. These rising costs can lead to higher retail prices, potentially alienating price-sensitive consumers and limiting market growth.

Regulatory Hurdles

Craft breweries must navigate complex regulatory environments, which can hinder growth. The Alcohol and Tobacco Tax and Trade Bureau (TTB) requires extensive permits and compliance checks, often delaying product launches. A 2021 report by the TTB revealed that 30% of craft breweries faced delays of over six months in obtaining necessary approvals. Additionally, state-level regulations vary widely, creating further complications. For example, in Pennsylvania, breweries must sell through state-run stores, limiting direct-to-consumer sales. These regulatory barriers increase operational costs and reduce market agility, making it harder for small breweries to expand and innovate.

MARKET OPPORTUNITIES

Growing Consumer Preference for Local Products

The craft beer market benefits from increasing consumer demand for locally sourced and artisanal products. According to the U.S. Department of Agriculture, local food sales, including beverages, reached $11.8 billion in 2020, reflecting a 15% growth from 2015. Craft breweries, often seen as community-focused businesses, align with this trend. The Brewers Association reported that over 9,000 craft breweries operated in the U.S. in 2022, up from 6,000 in 2018, showcasing the sector's rapid expansion. This preference for local products allows craft breweries to build strong customer loyalty and tap into niche markets, driving sustained growth.

Expansion into E-Commerce and Direct-to-Consumer Sales

The rise of e-commerce presents a significant opportunity for craft breweries. The U.S. Census Bureau noted that e-commerce sales grew by 43% in 2020, accelerated by the COVID-19 pandemic. Many states have relaxed regulations to allow direct-to-consumer beer shipments, enabling breweries to reach wider audiences. For instance, the Brewers Association highlighted that 16 states now permit direct shipping, up from 10 in 2018. This shift allows craft breweries to bypass traditional distribution channels, increase profit margins, and connect directly with consumers, fostering brand loyalty and expanding their market reach.

MARKET CHALLENGES

Intense Competition from Large Brewers

The craft beer market faces fierce competition from large-scale breweries that dominate market share. According to the Alcohol and Tobacco Tax and Trade Bureau, the top five beer producers in the U.S. accounted for over 70% of total beer sales in 2021. These large breweries benefit from economies of scale, allowing them to offer lower prices and invest heavily in marketing. Additionally, they have begun acquiring smaller craft breweries, further consolidating their dominance. This competitive landscape makes it challenging for independent craft breweries to maintain visibility and market share, particularly in saturated markets where consumer choices are abundant.

Fluctuating Raw Material Availability and Costs

Craft breweries are vulnerable to fluctuations in the availability and cost of raw materials like hops and barley. The U.S. Department of Agriculture reported that barley prices increased by 20% in 2022 due to drought conditions in major producing regions. Similarly, the cost of hops, a critical ingredient for flavor, rose by 12% in the same period. These price hikes strain profit margins for small breweries, which often lack the financial resilience of larger competitors. Additionally, climate change poses a long-term threat to crop yields, potentially exacerbating supply chain challenges and increasing operational costs for craft brewers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14% |

|

Segments Covered |

By Product Type, Distribution Channel, Age Group, & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Anheuser-Busch InBev, Heineken NV, The Boston Beer Company Inc., D.G. Yuengling& Son Inc., Sam Adams, Constellation Brands, Sierra Nevada, The Gambrinus Company, Chimay Beers and Cheeses, Stone & Wood Brewing Co. and Vagabund |

SEGMENTAL ANALYSIS

By Product Type Insights

The ale segment dominated the craft beer market by accounting for 60.3% of the global market share in 2024. Its popularity stems from its diverse flavor profiles, ranging from hoppy IPAs to rich stouts, appealing to a broad consumer base. The U.S. Department of Agriculture highlights that ale production has grown steadily due to its alignment with consumer preferences for bold and innovative flavors. Additionally, ale’s shorter fermentation process allows breweries to produce it more quickly, meeting high demand. The Brewers Association also reports that IPAs alone account for over 30% of craft beer sales with their significance. This segment’s versatility and ability to cater to evolving tastes make it the leading product type in the craft beer market.

The lagers segment is growing rapidly and is estimated to showcase the fastest CAGR of 7.5% during the forecast period due to their crisp, clean taste, which appeals to both traditional beer drinkers and new consumers. The Brewers Association notes that craft lagers have gained traction due to their refreshing quality and lower bitterness compared to ales. Innovations like craft pilsners and IPLs (India Pale Lagers) have expanded their appeal, with IPL sales growing by 12% in 2021. Additionally, the U.S. Department of Agriculture highlights that lagers are increasingly popular in warmer climates, where their light and refreshing qualities are preferred. This resurgence underscores lagers’ importance in attracting a wider audience and diversifying the craft beer market.

By Distribution Channel Insights

The on-trade distribution channel, which includes bars, restaurants, and pubs is projected to hold the largest share of the craft beer market during the forecast period. This dominance is driven by the experiential aspect of consuming craft beer in social settings, where consumers can explore unique flavors and styles. The U.S. Census Bureau forecasts that food and drinking place sales will grow by 6% annually from 2025 to 2033, reaching $1.4 trillion by 2033. On-trade channels also allow breweries to build brand loyalty through direct consumer engagement, making them a critical component of the craft beer market.

The off-trade distribution channel, including retail stores, supermarkets, and e-commerce platforms, is expected to be the fastest-growing segment over the forecast period owing to the convenience of purchasing craft beer for home consumption, a trend accelerated by the COVID-19 pandemic. The U.S. Department of Commerce notes that e-commerce sales for alcoholic beverages are expected to grow by 35% annually from 2025 to 2033, with craft beer being a significant contributor. Additionally, the expansion of direct-to-consumer shipping laws in states like California and New York has further boosted off-trade sales. This channel’s accessibility and convenience make it increasingly important for market expansion.

By Age Group Insights

The 21–35 age group captured 48.6% of the global market share in 2024 due to growing preference from consumers for unique, flavorful, and locally produced beverages. The U.S. Census Bureau highlights that millennials (born 1981–1996) and Gen Z (born 1997–2012) are increasingly prioritizing experiential and artisanal products, with 65% of millennials willing to pay a premium for craft beer. Additionally, this age group’s active engagement on social media platforms amplifies brand visibility and fosters trends by making them a key driver of market growth. Their influence is expected to sustain the segment’s dominance through 2033.

The 40–54 age group segment is estimated to witness a CAGR of 6.8% from 2025 to 2033. This growth is attributed to increasing disposable income and a shift in preferences toward premium and craft beverages. The U.S. Department of Labor notes that this demographic’s spending on alcoholic beverages grew by 12% in 2022, with craft beer being a significant contributor. Additionally, this age group’s willingness to explore new flavors and support local breweries has fueled demand. Their growing influence underscores their importance in expanding the craft beer market.

REGIONAL ANALYSIS

North America dominated the craft beer market by accounting for 39.6% of the global market share in 2024. This dominance is attributed to a well-established craft beer culture, a high number of microbreweries, and strong consumer demand for diverse and innovative beer flavors. According to the Brewers Association, the United States alone had over 9,000 craft breweries operating in 2021, reflecting the region's significant contribution to the craft beer industry. Consumer preferences in North America have shifted towards more robust and flavorful beers, driving the demand for craft varieties. Additionally, there's a growing interest in low-calorie and innovative flavored beers, prompting breweries to diversify their offerings.

The Asia-Pacific region is experiencing the fastest growth in the global craft beer market and is likely to exhibit a CAGR of 24.41% during the forecast period. This rapid expansion is driven by increasing urbanization, rising disposable incomes, and a growing consumer preference for premium and unique beer flavors. In countries like India, the emergence of microbreweries and favorable government policies have further propelled market growth.

In Europe, the craft beer market continues to grow steadily, supported by a rich brewing heritage and a strong emphasis on artisanal products. The region has seen a surge in microbreweries, particularly in countries like the United Kingdom and Germany. Latin America is also witnessing growth, albeit at a slower pace, with increasing consumer interest in craft beers in countries such as Brazil and Mexico. The Middle East and Africa region remains nascent in the craft beer market due to cultural and regulatory factors, but there is potential for growth as consumer preferences evolve and regulations become more accommodating.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major players of the global craft beer market include Anheuser-Busch InBev, Heineken NV, The Boston Beer Company Inc., D.G. Yuengling& Son Inc., Sam Adams, Constellation Brands, Sierra Nevada, The Gambrinus Company, Chimay Beers and Cheeses, Stone & Wood Brewing Co. and Vagabund are some of the major players in the global craft beer market. Some prominent names in the industry dominating revenues with their innovative flavors and packaging are A.B. In Bev, Heineken NV, The Boston Beer Company, Constellation Brands, Sierra Nevada, and others. In the earlier days, low-ABV beers used to be tasteless, but they are now replaced with craft beers.

The craft beer market is highly competitive, with independent breweries, microbreweries, and big beer companies all fighting for market share. The U.S. leads the industry, with over 9,000 craft breweries as of 2022 (Brewers Association). Well-known brands like Sierra Nevada and Samuel Adams face competition from major companies like AB InBev and Molson Coors, which have acquired smaller craft breweries to expand their offerings.

Europe also has a strong craft beer scene, especially in countries like Germany, the UK, and Belgium. In Asia-Pacific, demand is rising quickly, with China and Australia seeing a surge in new breweries. Latin America and Africa are still developing markets but have growing potential.

Competition is increasing as more breweries enter the market, and new beverage trends like hard seltzers and non-alcoholic craft beers gain popularity. Companies like Athletic Brewing are capitalizing on this shift (The Times). To stay ahead, breweries focus on creative flavors, sustainable production, and strong branding. Many are also turning to online sales and direct-to-consumer models. While challenges exist, those that continue to innovate and adapt to changing consumer tastes will remain strong in the growing craft beer industry.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Acquisitions and Partnerships

Key players like Anheuser-Busch InBev (AB InBev) and Heineken N.V. have aggressively pursued acquisitions of successful craft breweries to expand their portfolios and tap into the growing craft beer market. For example, AB InBev acquired Goose Island, Elysian Brewing, and 10 Barrel Brewing Co., while Heineken acquired Lagunitas Brewing Company. These acquisitions allow large breweries to leverage the authenticity and innovation of craft brands while utilizing their extensive distribution networks to reach global markets. Partnerships with local breweries also help these players cater to regional tastes and preferences, strengthening their market presence.

Product Innovation and Diversification

Innovation is a cornerstone strategy for craft beer market leaders. Companies like Boston Beer Company continuously introduce new flavors, styles, and formats to meet evolving consumer demands. For instance, Boston Beer’s expansion into hard seltzers with Truly Hard Seltzer and ciders with Angry Orchard has allowed it to capture a broader audience. Similarly, AB InBev and Heineken have introduced limited-edition and seasonal craft beers to keep their offerings fresh and exciting. This focus on innovation helps key players stay relevant in a highly competitive market.

Expanding Distribution Networks

Global distribution is a critical strategy for key players to strengthen their position in the craft beer market. AB InBev and Heineken leverage their established distribution networks to introduce craft beers to new regions, particularly in emerging markets like Asia-Pacific and Latin America. For example, Heineken has successfully marketed Lagunitas in Europe and Asia, while AB InBev has expanded its craft beer portfolio to over 50 countries. By making craft beer more accessible, these companies drive market growth and increase their global footprint.

TOP 3 PLAYERS IN THE MARKET

Anheuser-Busch InBev (AB InBev)

Anheuser-Busch InBev, the world’s largest beer company, has a significant presence in the craft beer market through its subsidiary, The High End. AB InBev owns several prominent craft beer brands, including Goose Island, Elysian Brewing, and 10 Barrel Brewing Co. These brands contribute to the global craft beer market by combining the scale and distribution power of a multinational corporation with the authenticity and innovation of craft brewing. AB InBev’s craft beer portfolio accounts for approximately 15% of the global craft beer market share, as reported by the Brewers Association. The company’s ability to market craft beers globally has helped expand the reach of craft beer to new markets, particularly in Asia-Pacific and Latin America.

Heineken N.V.

Heineken N.V. has made significant strides in the craft beer market through its acquisition of Lagunitas Brewing Company and investments in other craft breweries like Brixton Brewery and Beavertown Brewery. Lagunitas, one of the largest craft breweries in the U.S., has a strong international presence, contributing to Heineken’s 10% share of the global craft beer market, according to the International Trade Administration. Heineken leverages its global distribution network to introduce craft beers to regions like Europe, Asia-Pacific, and Africa, where demand for premium and artisanal beers is growing. The company’s focus on innovation and sustainability has also strengthened its position in the craft beer segment.

Boston Beer Company

The Boston Beer Company, known for its flagship brand Samuel Adams, is a pioneer in the U.S. craft beer movement and a major player globally. The company has expanded its portfolio to include popular brands like Angry Orchard, Twisted Tea, and Truly Hard Seltzer, catering to evolving consumer preferences. Boston Beer Company holds approximately 8% of the global craft beer market share, as reported by the Brewers Association. Its emphasis on quality, innovation, and community engagement has made it a trusted name in the craft beer industry. The company’s international distribution efforts have also introduced craft beer to new markets, particularly in Europe and Latin America.

RECENT MARKET DEVELOPMENTS

- In April 2023, Anheuser-Busch InBev launched a new line of non-alcoholic beers, including Budweiser Zero and Stella Artois Liberte. This move is anticipated to allow AB InBev to tap into the growing demand for non-alcoholic beverages, increasing its market share and diversifying its product portfolio.

- In September 2022, Heineken NV announced a $1 billion investment in sustainable brewing practices, including carbon-neutral breweries and renewable energy usage. This initiative is expected to strengthen Heineken's brand image as an environmentally responsible company, appealing to eco-conscious consumers and investors.

- In June 2022, The Boston Beer Company introduced new flavors and low-calorie options for its Truly Hard Seltzer line. This innovation is anticipated to help the company maintain its position as a leader in the hard seltzer market, attracting younger consumers.

- In March 2023, D.G. Yuengling & Son Inc. expanded its distribution to the West Coast of the United States. This expansion is expected to significantly increase Yuengling's market reach and brand visibility, boosting sales and revenue.

- In November 2022, Sam Adams partnered with several craft breweries, including Stone & Wood Brewing Co., to create limited-edition beers. This collaboration is anticipated to enhance Sam Adams' reputation as a leader in the craft beer industry and attract craft beer enthusiasts.

- In January 2024, Constellation Brands focused on premium beer offerings, including Modelo Especial and Corona Premier. This strategy is expected to increase profit margins and solidify Constellation's position in the premium beer segment.

- In August 2023, Sierra Nevada launched a new line of organic beers, emphasizing natural ingredients and sustainable farming practices. This move is anticipated to appeal to health-conscious and environmentally aware consumers, differentiating Sierra Nevada from competitors.

- In May 2024, The Gambrinus Company reintroduced and modernized its iconic Shiner Bock beer with new marketing campaigns and packaging. This revitalization is expected to attract both loyal customers and new audiences, boosting brand relevance.

- In October 2022, Chimay Beers and Cheeses expanded its export operations to Asia and South America. This expansion is anticipated to increase Chimay's global footprint and introduce its products to new markets.

- In July 2023, Vagabund, a Berlin-based craft brewery, opened new taprooms in major European cities, including Amsterdam and Vienna. This expansion is expected to increase Vagabund's brand presence and allow it to directly engage with consumers, fostering loyalty.

MARKET SEGMENTATION

This research report on the global craft beer market has been segmented and sub-segmented based on product type, distribution channel, age group, and region.

By Product Type

- Ale

- Lagers

By Distribution Channel

- On-Trade

- Off-Trade

By Age Group

- 21–35 years

- 40–54 years

- 55 years and above

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Who are the key consumers driving the craft beer market?

Millennials, Gen Z, and beer enthusiasts seeking unique flavors and premium-quality brews are the primary consumers.

2. What factors are fueling the growth of the craft beer industry?

The rise in consumer preference for unique flavors, demand for locally brewed beer, and increasing interest in premium alcoholic beverages.

3. How is the craft beer market expected to grow in the coming years?

The market is projected to expand due to increasing consumer demand, innovations in brewing, and the rise of low-alcohol and non-alcoholic craft beers.

4. Which trends are shaping the future of the craft beer market?

Key trends include the rise of hard seltzers, CBD-infused beers, sustainable brewing practices, and AI-driven recipe development.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com