Global Cider Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Still Cider, Sparkling Cider, Draft Cider, Apple Wine), Distribution Channels (Hypermarkets, Supermarkets, Departmental Stores, Convenience Stores, Online Stores), and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa, and Rest of the World) - Industry Analysis 2025 to 2033

Global Cider Market Size

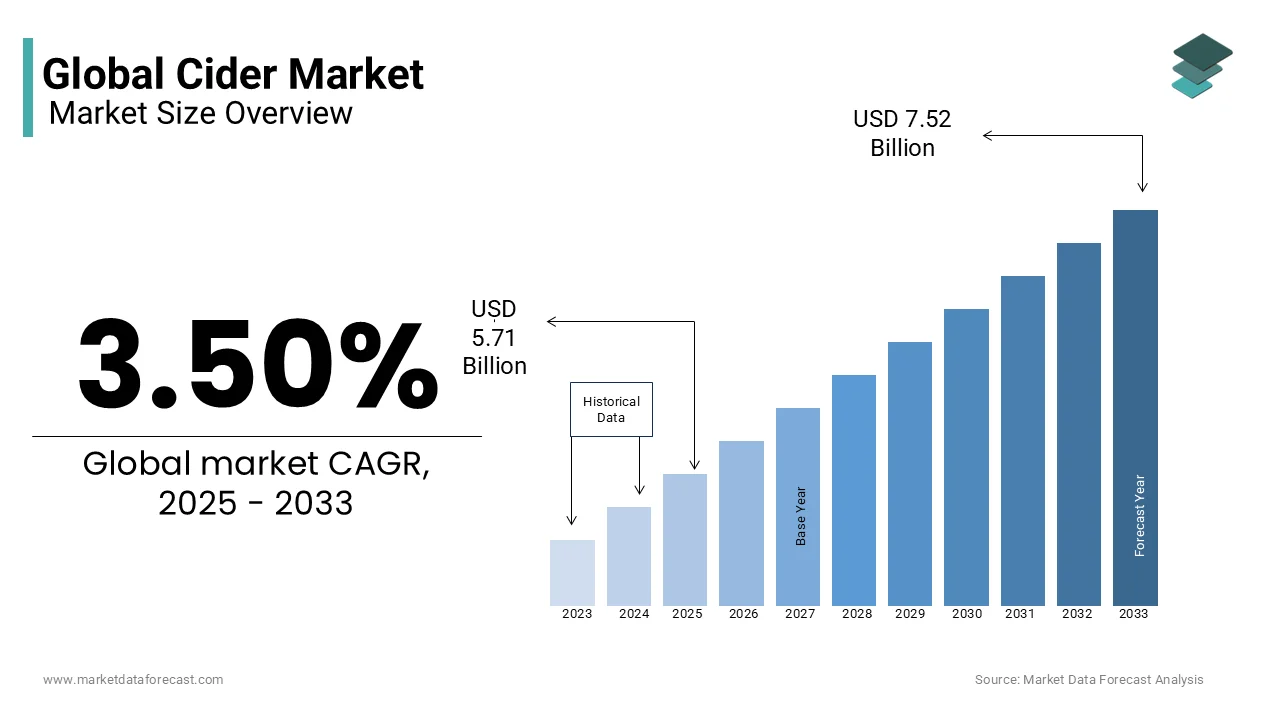

The global cider market size was valued at USD 5.52 billion in 2024. The market size is expected to reach USD 7.52 billion by 2033 from USD 5.71 billion in 2024. The market's promising CAGR for the predicted period is 3.5%.

Cider is usually considered an alcoholic beverage, or a beverage prepared from various apples, but recently, other fruits have been added to the mix to expand the variety. Like how wine is made, cider is also produced. The fruits are procured from the cultivars, and scratted, and pressed there. Using yeasts, the fermentation process enables ethanol production from simple carbohydrates. In contrast, in many popular cultures, cider is subtly used in place of beer or malt beverage. As a result, cider is most frequently also referred to as "fermented fruit juice." Additionally, it has antioxidant characteristics because the fruits chosen to make cider are typically astringent, and high in tannins. One of the main drivers propelling the cider market forward throughout the forecast period is the increased consumption of healthy alcoholic beverages by millennials in their daily routines, combined with the product makers' diverse product offerings.

Current Scenario of the Global Cider Market

The cider market is growing rapidly worldwide but is especially expanding in the Asia Pacific, and Latin America region. Countries like India, China, and Vietnam are on the priority list of the prominent companies worldwide. Moreover, in the past few years, the demand for flavoured cider has risen considerably with additions like lemon, strawberry, rose, blood oranges blueberry, and dark fruits to create an authentic rainbow. Also, the evolving customer tastes towards the real apple variants from the sweeter choices. This has positioned it almost on par with the RTD segment. As per a 2024 report, the market share of crafted apple ciders has raised to slightly more than 64 percent from 5.6 percent against the RTD which is at 31 percent while the flavoured cider has declined to 2 percent. However, the performance of fruit ciders has taken a significant hit. Still, the changes in the alcohol duty on 1st August are being seen as the accelerator for the in-house draught fruit ciders with 10p less for 4 percent above pint.

Despite the world’s ongoing volatile market situation, reducing the effects of inflation, enhancing functional efficiency, corporate streamlining, and securing the confidence of consumers remain the top priorities for companies in the medium period.

MARKET DRIVERS

According to a survey, European nations constitute more than half i.e. 56 percent of cider consumption worldwide in 2023. The growth of the market is also propelled by the growing awareness of its health benefits. A large section of the European population is consuming due to the presence of antioxidants, Vitamin C,, and heart health,, and globally around 2.6 billion litres of this was drunk in 2023. Also, a major propellant of the market growth is extensive consumption. Moreover, the rise in the consumption of gluten-free beverages is another contributor to the expansion of the market. The food producers were quick enough to pick up this customer pattern of shifting towards gluten-free for the purpose of diet, medical reasons or weight loss. This is due to the widespread prevalence of celiac in which the absorption of gluten causes harm to the small intestine, and probably about 78 million people worldwide suffer from this autoimmune disease.

The growth of the cider market is affected by the rising impact of climate change which is obstructing its cultivation. Moreover, the market expansion is also hindered by the increasing production costs. The expenditure in setting up, and running a cidery is significant because of the involvement of higher-value fruit, labour wages, regulatory charges, distribution, and operational costs. In addition, the market also struggles due to several challenges in the production of cider apples, especially for European varieties. As of now, cultivators have not stated the harvests for the cider fruit that are achievable for fresh industry apples, and those lower productions are affected furthermore by the biennialism inborn in various such types. Several such diversities also are prone to bacterial canker,, and administration of that disease via elimination of infected wood, and possible tree death surges costs, and may lower precocity. Ultimately, industry prices for European-produced cider apples are currently equivalent to few fresh market types, but the restricted supply, and inadequate purchasers for this fruit recommend that such rates could readily decline should supply decrease or increase need if clients leave the Industry.

MARKET RESTRAINTS

Cider's sugar level poses a major global cider market challenge. First off, compared to wine, cider has a lower glycemic index rating since grapes contain more sugar than most apples. In any case, the fermented product has a lot of sugar. According to recent research, a 470 ml "natural cider" can include 20.5 grams of sugar, which is the only amount that adults are advised to consume daily. Additionally, depending on whether the cider is consumed with lager or ale, the sugar amounts may increase by 5 or 10 times. Given that diabetes is one of the most common cardiovascular diseases, and that people's food preferences have altered in response to these statistics, the cider market faces a significant challenge.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.50% |

|

Segments Covered |

By Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Asahi Premium Beverages, Aston Manor, C&C Group plc, Carlsberg Breweries A/S, Carlton & United Breweries (CUB), Heineken UK Limited, The Boston Beer Company, Anheuser-Busch Companies LLC, and Distell Group. |

SEGMENTAL ANALYSIS

By Type Insights

The Apple segment continues to hold the bigger portion of the cider market. This can be attributed to the wide popularity of its health benefits, and surging consumption of carbonated apple cider. Also, the segment’s growth is due to its application in making apple cider vinegar. According to research, around 50 percent of US people state they presently i.e. 21 percent utilise apple cider vinegar for well-being, and health purposes or had before but no longer which is at 29%.

By Distribution Channel Insights

The sparkling cider segment continues to lead the category due to growing investment in carbonated soft drinks in Europe, and Asia Pacific countries. Likewise, the Cremant, Cava, and Prosecco suppliers will remain focused on their investments in the sparkling sector. Moreover, as per a study, 49 per of the overall cider is consumed by the West Europe region which is 1.28 billion litres. In monetary terms, customers in the West European countries purchased cider worth 7.46 billion dollars in 2023 in contrast to 2.42 billion dollars in North America which is the second biggest industry based on both volume, and value. Customers in Canada, and the United States consumed 250 million litres. Furthermore, the segment’s market share also elevated owing to the growing consumer inclination for its versatility as a festive beverage, and is usually considered as a less calorie substitute for beer, and other alcoholic drinks.

REGIONAL ANALYSIS

The world's largest producer of apples is thought to be in Europe, and holds around 39 percent share of the cider market. Also, the region has the strongest aggregation grip over apple juice that hasn't been fermented. Additionally, 800 million liters of cider were consumed at their highest level each year in the UK. In addition, countries like Poland, and the Czech Republic are some of the emerging markets in the region. The revenue from the cider is expected to sharply rise in the coming due to the increasing number of new breweries in the region, and the heightened consumption of drinks. The regional market is evolving with the launch of in-house, unique, and inventive cider with various flavors. As a result, this will expand the customer base significantly, and ultimately benefit the regional market. Moreover, culinary, and dessert apples are utilised in huge quantities in some areas for making ciders. Besides this, cider wine manufacturers along with specialized research centers have come together to invent several new types or to enhance productivity. Therefore, all these factors are driving the Europe cider market.

North America is one of the prospective industries providing significant opportunities for domestic, and international players. It is also the largest market for cider among others, and is projected to continue growing during the forecast period. The region is known for its culture, and inclination towards foods, and beverages which driving the market expansion. In addition, after heavy suffering from the pandemic the shift in lifestyle, awareness of consuming healthy foods, and the rise in spending power of middle-class people in this region is pushing the industry forward. Moreover, it accounts for more than 33 percent market share which is because of the presence of a large number of cider producers, and suppliers, greater yield capacity in the USA, and Canada, and big requirements in the area.

Asia Pacific is a growing marketplace, and it presents a huge opportunity for expansion for the cider companies. This is due to the millennial generation's growing preference for non-alcoholic drinks like cider or even healthy alcoholic beverages. Additionally, the region has changing preferences that can be met by modifying apple cider with various fruits. Other factors fuelling the APAC market are the high rate of acceptance of plant-based lifestyles, increased adoption of technological advancements for developing, and mass production, and the rising popularity of fusion cuisine. Also, the rise in intensity of plant-oriented movement is transforming the region’s Food, and beverage industry. So, this is providing customers with a viable substitute for the traditional dietary options. Besides this, it is further supported by technological developments for streamlining operations, improving efficiency, and customer satisfaction.

Latin America is anticipated to experience sustained growth during the forecast period. This can be attributed to the area’s diverse agricultural background. But, other elements surging the cider demand for alcohol-, and gluten-free drinks, and the rising cognizance towards health. Also, it is a net food exporter, and holds about 13 percent of the world’s agriculture, and farming trade. This places the region in an advantageous situation against the United Kingdom, and Europe which are among the biggest consumers of ciders in the world. Furthermore, Brazil, and Argentina are dominating the regional market.

KEY PLAYERS IN THE CIDER MARKET

Asahi Premium Beverages, Aston Manor, C&C Group plc, Carlsberg Breweries A/S, Carlton & United Breweries (CUB), Heineken UK Limited, The Boston Beer Company, Anheuser-Busch Companies LLC, and Distell Group are a few of the leading players in the global cider market.

RECENT DEVELOPMENTS IN THE MARKET

-

In March 2024, Carlton & United Breweries (CUB) entered into a 5 year partnership deal with ASM Global for its APCA, and the Middle East operations. This will result in making the CUSB the only cider, and beer provider to 9 of Australia’s largest entertainment places with an overall visitor count of around 5.2 million customers years.

-

In January 2024, Aston Manor Cider made this declaration that its Kingstone Press will be ready, and accessible on draught for on-the-line in both wild berry, and conventional apple flavours from 1st March. It is prepared with a mixture of semisweet Dabinett, and Michelin apples which are yielded in Worcestershire, and Herefordshire, and produced at its mill on River Severn bank.

-

In January 2024, Aston Manor became a member of SmartView Convenience. It is an independent convenience market read by the TWC group. Their database comprises 12 thousand stores, and out of that, it has specially selected 5500 major stores. This will help the company to grow in the convenience, and wholesale sectors.

MARKET SEGMENTATION

This research report on the global cider market has been segmented, and sub-segmented based on source, product, and region.

By Type

- Still Cider

- Sparkling Cider

- Draft Cider

- Apple Wine

By Distribution Channels

- Hypermarkets

- Supermarkets

- Departmental Stores

- Convenience Stores

- Online Stores

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East, and Africa

Frequently Asked Questions

1.How is Cider Different from Apple Juice?

Cider is made through a fermentation process, which gives it its alcoholic content, while apple juice is simply the extracted liquid from pressed apples without fermentation

2.What Are the Different Types of Cider?

Cider can be categorized into various types based on factors such as sweetness, carbonation, and alcohol content. Common types include sweet cider, dry cider, sparkling cider, and hard cider (which contains alcohol).

3.What Factors Influence the Flavor of Cider?

The flavor of cider can be influenced by several factors, including the types of apples used, fermentation techniques, addition of other fruits or spices, and aging processes.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]