North America Kombucha Market Size, Share, Trends & Growth Forecast Report By Product Type (Original/Regular, Flavored), Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of North America), Industry Analysis From 2025 to 2033

North America Kombucha Market Size

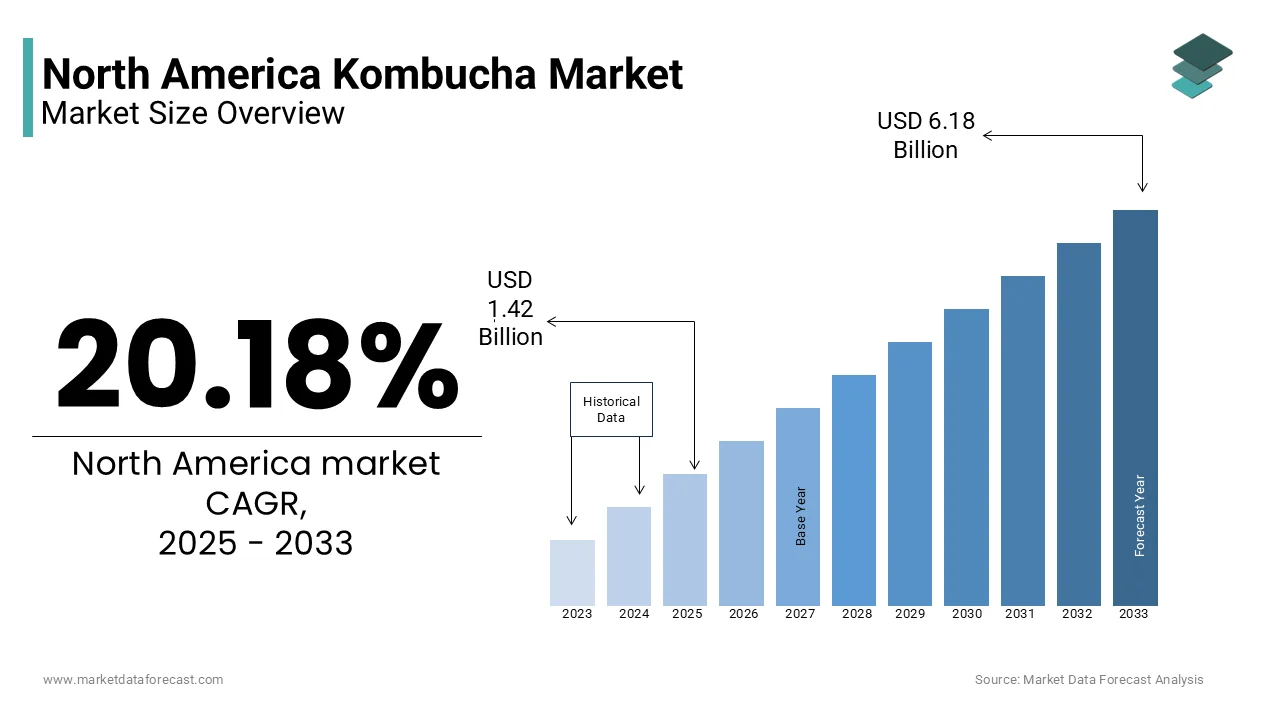

North America Kombucha Market size was valued at USD 1.18 billion in 2024, and the market size is expected to reach USD 6.18 billion by 2033 from USD 1.42 billion in 2025. The market's promising CAGR for the predicted period is 20.18%.

The North America kombucha market refers to the commercial production, distribution, and consumption of kombucha—a fermented tea beverage made from sweetened tea, a symbiotic culture of bacteria and yeast (SCOBY), and sometimes infused with fruits, herbs, or botanicals. Known for its probiotic content, organic acids, and antioxidants, kombucha has gained popularity as a functional beverage that supports gut health, digestion, and immune function. The product is typically sold in ready-to-drink bottles, concentrates, or powdered forms across retail stores, natural food outlets, and online platforms.

North America dominates the global kombucha industry due to rising consumer awareness about health benefits, increasing demand for natural beverages, and strong brand presence. According to Beverage Marketing Corporation, kombucha sales in the U.S. exceeded $1.6 billion in 2023, reflecting an annual growth rate of approximately 12% since 2020. Moreover, the growing trend of clean-label products and plant-based diets has further fueled consumer preference for unpasteurized, non-GMO, and organic variants.

MARKET DRIVERS

Rising Consumer Awareness Toward Gut Health Benefits

One of the primary drivers of the North America kombucha market is the increasing consumer awareness regarding the benefits of gut health and digestive wellness. Kombucha is rich in probiotics, organic acids, and polyphenols, which are scientifically linked to improved digestion, enhanced immunity, and better nutrient absorption. According to the International Scientific Association for Probiotics and Prebiotics (ISAPP), a significant share of American adults believe that probiotic-rich foods positively impact their overall health, directly influencing purchasing behavior toward fermented beverages like kombucha. This awareness is further amplified by healthcare professionals and nutritionists who frequently recommend probiotic-rich foods as part of a balanced diet. In response, kombucha brands have capitalized on this trend by highlighting digestive health benefits on packaging and marketing campaigns. For instance, GT’s Living Foods, one of the largest kombucha producers in the U.S., reported a 25% rise in sales in 2023 compared to the previous year, attributing much of this growth to increased consumer interest in gut-friendly beverages. Additionally, social media and digital health influencers have played a pivotal role in shaping public perception. Platforms like Instagram and TikTok have seen a surge in posts related to gut health.

Demand for Natural and Functional Beverages

Another key driver fueling the North America kombucha market is the growing consumer shift towards natural and functional beverages. With increasing scrutiny over artificial additives, preservatives, and excessive sugar content in soft drinks, consumers are opting for healthier alternatives that offer both taste and wellness benefits. Kombucha aligns well with this trend due to its minimal processing, naturally occurring fermentation byproducts, and absence of synthetic additives. Moreover, many brands now emphasize clean-label positioning by using USDA Organic certified teas, raw cane sugar, and naturally derived flavorings. Furthermore, kombucha is increasingly being marketed as a functional beverage with added benefits such as energy enhancement, detoxification, and immune support. Companies like Health-Ade and KeVita have introduced variants fortified with adaptogens, CBD, and electrolytes to cater to niche wellness segments. This evolving consumer mindset toward holistic health is reshaping beverage preferences, making kombucha a staple in the pantries of health-conscious individuals across North America.

MARKET RESTRAINTS

High Production Costs and Supply Chain Constraints

A major restraint affecting the North America kombucha market is the relatively high production costs associated with brewing, packaging, and maintaining quality standards. Unlike mass-produced soft drinks, kombucha requires a longer fermentation process, specialized equipment, and stringent hygiene controls to prevent contamination. Moreover, sourcing high-quality organic tea and raw sugar—key ingredients in premium kombucha—adds to the financial burden. These cost pressures are often passed on to consumers, resulting in higher retail prices that can limit accessibility for price-sensitive buyers. Also, the kombucha industry has faced logistical challenges, especially post-pandemic. Freight bottlenecks, container shortages, and labor issues have delayed shipments and inflated transportation costs. These constraints hinder market expansion and pose barriers for emerging players aiming to compete with established giants like GT’s and KeVita.

Regulatory Scrutiny and Labeling Challenges

Regulatory Scrutiny and Labeling Challenges

Regulatory scrutiny and labeling complexities also serve as a significant restraint in the North America kombucha market. Due to its fermented nature, kombucha contains trace amounts of alcohol, which has led to periodic regulatory actions by agencies such as the Alcohol and Tobacco Tax and Trade Bureau (TTB) and the Food and Drug Administration (FDA). In 2023, the TTB updated its guidelines requiring stricter testing and certification for products exceeding 0.5% alcohol by volume (ABV), compelling many small brewers to invest in advanced testing infrastructure or reformulate their products. Labeling requirements further complicate compliance. While kombucha brands often highlight probiotic content and health benefits, the FDA restricts specific health claims unless backed by substantial scientific evidence. Such regulatory hurdles create additional costs and administrative burdens, particularly for independent brands without dedicated legal or compliance teams. Moreover, inconsistent state-level regulations add complexity. For example, California’s Proposition 65 mandates warning labels for products containing certain levels of lead or cadmium, which some kombucha samples have triggered due to soil composition in tea farms.

MARKET OPPORTUNITIES

Expansion into Flavored and Functional Kombucha Variants

A significant opportunity in the North America kombucha market lies in the development and commercialization of flavored and functional kombucha variants tailored to evolving consumer tastes and wellness demands. Traditional kombucha flavors such as ginger, berry, and lemon remain popular; however, brands are now experimenting with exotic fruit infusions, herbal blends, and even savory profiles to attract new customer segments. Beyond flavor innovation, the integration of functional ingredients presents a lucrative avenue for growth. Adaptogens like ashwagandha and reishi mushroom, along with nootropics and CBD, are being incorporated into kombucha to target mental clarity, stress relief, and immune support. Moreover, partnerships with wellness influencers and fitness communities have enabled kombucha brands to tap into lifestyle-driven markets. For instance, brands like Humm Kombucha have launched limited-edition lines co-developed with yoga studios and meditation centers, enhancing brand visibility and loyalty.

Growth of E-commerce and Direct-to-Consumer Sales Channels

Growth of E-commerce and Direct-to-Consumer Sales Channels

The rapid expansion of e-commerce and direct-to-consumer (DTC) sales channels represents a transformative opportunity for the North America kombucha market. Traditionally reliant on brick-and-mortar retailers and natural food stores, kombucha brands are increasingly leveraging online platforms to reach wider audiences and offer customized shopping experiences. According to Digital Commerce 360, U.S. e-commerce sales grew by 9.4% in 2023, reaching $1.1 trillion, with health and wellness beverages witnessing above-average growth. DTC models allow kombucha producers to maintain greater control over branding, pricing, and customer engagement while bypassing intermediary markups. Brands such as Health-Ade and Remedy Kombucha have successfully scaled through subscription-based services, offering curated bundles and home delivery options. Additionally, digital platforms enable personalized marketing strategies and real-time feedback loops with consumers, fostering brand loyalty and repeat purchases. Social commerce features on platforms like Instagram and Shopify have further streamlined the buying process, contributing to increased trial rates. As e-commerce continues to evolve, kombucha brands that invest in robust digital infrastructures and omnichannel strategies stand to capture a larger share of the North American market, particularly among tech-savvy and convenience-oriented consumers.

MARKET CHALLENGES

Maintaining Product Consistency Amidst Fermentation Complexity

A critical challenge facing the North America kombucha market is ensuring consistent product quality and flavor due to the inherent variability of the fermentation process. Unlike standardized beverages, kombucha relies on live cultures and time-dependent microbial activity, which can be influenced by temperature fluctuations, pH levels, and ambient conditions. Even minor deviations in the fermentation cycle can alter taste profiles, carbonation levels, and microbial composition, potentially affecting consumer satisfaction. Larger brands have invested in controlled fermentation environments and proprietary SCOBY strains to mitigate these risks, but such measures require significant capital and technical expertise, limiting access for emerging players. Moreover, consumer expectations for uniformity in taste and texture have intensified pressure on producers to standardize their offerings without compromising the natural fermentation process. Some companies have resorted to pasteurization or filtration to stabilize batches, though these methods may reduce live probiotic content—an attribute highly valued by health-conscious consumers.

Increasing Competition from Alternative Functional Beverages

Intensifying competition from alternative functional beverages poses a formidable challenge to the North America kombucha market. Consumers seeking gut health benefits, hydration, or natural energy boosts are increasingly turning to substitutes such as kefir, cold brew coffee, apple cider vinegar tonics, and ready-to-drink (RTD) herbal infusions. Cold brew coffee has emerged as a strong competitor by combining caffeine with low acidity and natural flavor profiles, appealing to similar health-conscious demographics. Meanwhile, probiotic waters and coconut water blends have gained traction as lighter, lower-calorie alternatives to kombucha, especially among younger consumers prioritizing hydration and digestive wellness. Additionally, major beverage conglomerates are entering the functional space with proprietary brands or acquisitions, diluting market share for independent kombucha producers. Coca-Cola’s acquisition of Fairlife and PepsiCo’s investment in Olipop exemplify how corporate power is shifting consumer attention away from niche fermentations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

20.18% |

|

Segments Covered |

By Product, Distribution channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of North America |

|

Market Leaders Profiled |

PepsiCo, Inc., Revive Kombucha, GT's Living Foods, Health-Ade Kombucha, Brew Dr. Kombucha, NessAlla Kombucha, The Bu Kombucha, Humm Kombucha, The Hain Celestial Group, Inc., Wonder Drink, and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The original or regular kombucha segment holds the largest share of the North America kombucha market by accounting for 52.7% of total sales volume in 2024. This dominance is primarily attributed to consumer preference for traditional formulations that emphasize natural fermentation and minimal ingredient lists. Unlike flavored variants that may contain added sugars or artificial flavoring agents, original kombucha appeals to health-conscious consumers seeking purity in their functional beverages. A main aspect behind this segment’s continued leadership is the growing emphasis on clean-label products. Moreover, original kombucha is often marketed as a base for home customization, allowing consumers to infuse it with personal additions such as fresh fruits or herbs, thereby enhancing its appeal among DIY wellness enthusiasts. Additionally, original kombucha maintains a strong presence across mainstream retail channels due to its shelf stability and ease of mass production compared to more volatile flavored versions.

Flavored kombucha is the booming segment within the North America kombucha market, predicted to advance at a CAGR of 13.8%. This quick progress is due to shifting consumer preferences toward diverse taste profiles and innovative beverage experiences without compromising health benefits. A different factor driving this segment is the increasing experimentation with exotic and seasonal flavors. Brands are leveraging botanical extracts, adaptogens, and fruit purees to create unique flavor combinations that cater to evolving palates. Moreover, younger demographics—particularly Gen Z and millennials—are gravitating toward bold and distinctive flavors as part of their lifestyle-driven consumption habits. Additionally, social media trends on platforms like Instagram and TikTok have amplified brand visibility through visually engaging content centered around limited-edition releases and influencer collaborations.

By Distribution Channel Insights

Supermarkets and hypermarkets constituted the predominent distribution channel in the North America kombucha market, capturing an estimated 43% of total sales in 2024 . This dominance is largely driven by the widespread availability of kombucha in major retail chains such as Walmart, Kroger, and Albertsons, which offer broad geographic coverage and high foot traffic. A critical point underpinning this segment's leadership is the increasing integration of kombucha into mainstream beverage aisles rather than being confined to specialty health sections. Retailers have expanded chilled beverage sections to accommodate growing demand, enabling greater visibility and accessibility. Also, large-scale promotions and in-store sampling campaigns conducted by leading brands like GT’s Living Foods and KeVita have significantly boosted trial rates.

Online retail stores symbolised the quickes-growing distribution channel in the North America kombucha market, anticipated to grow at a CAGR of 16.4%. This rapid expansion is fueled by changing consumer shopping behaviors, particularly among urban professionals and health-focused millennials who prioritize convenience and product diversity. A main drivers of online kombucha sales is the rise of direct-to-consumer (DTC) models adopted by niche and regional brands. Companies like Health-Ade and Remedy Kombucha have leveraged e-commerce platforms to bypass traditional retail intermediaries, offering subscription-based delivery services that ensure regular consumption. Moreover, digital marketing and influencer partnerships have played a pivotal role in boosting brand awareness and customer acquisition. Platforms like Shopify, Amazon Fresh, and Thrive Market have introduced curated health drink categories, making it easier for consumers to discover premium and organic kombucha variants.

REGIONAL ANALYSIS

The United States occupied the dominant position in the North America kombucha market, accounting for approximately 86% of the regional market share in 2024. The country’s progress is because of robust consumer adoption, a well-established retail infrastructure, and a thriving ecosystem of domestic kombucha producers. Another propellent of the U.S. market is the heightened awareness of gut health and digestive wellness. Additionally, the presence of major players such as GT’s Living Foods, KeVita, and Health-Ade has facilitated product innovation and widespread availability. Moreover, the U.S. kombucha sector benefits from strong support from natural and organic retail channels. The integration of kombucha into mainstream grocery chains and expanding DTC e-commerce models further reinforce its entrenched market position across the country.

Canada is rapidly expanding market with rising wellness awareness. While smaller in scale compared to the U.S., the Canadian kombucha industry is experiencing notable growth driven by increasing consumer interest in natural, functional beverages and a shift away from sugary soft drinks. A main growth aspect is the rising prevalence of health-conscious lifestyles, particularly in urban centers like Toronto, Vancouver, and Montreal. Also, the proliferation of local craft kombucha breweries has enhanced product variety and regional sourcing, appealing to eco-conscious consumers. Furthermore, regulatory support for organic and probiotic labeling has bolstered consumer trust. The Canadian Food Inspection Agency (CFIA) has maintained clear guidelines on fermented beverage standards, facilitating transparency and encouraging new market entrants.

The Rest of North America, encompassing Mexico and smaller Caribbean markets, accounts for small share of the regional kombucha market share. Though currently a minor contributor, this segment exhibits early-stage growth potential driven by evolving consumer preferences and increasing exposure to global wellness trends. Mexico, in particular, is witnessing gradual penetration of kombucha due to rising disposable incomes and growing interest in alternative health beverages. Local entrepreneurs have begun launching small-batch kombucha brands, capitalizing on the region’s rich tradition of fermented foods. In the Caribbean, countries such as Jamaica and Puerto Rico are exploring kombucha as a novel health drink, supported by tourism-driven demand and wellness retreats promoting detox and probiotic diets. However, challenges such as limited cold-chain infrastructure and higher import costs continue to restrict large-scale commercialization.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The major key players in the North America Kombucha market are PepsiCo, Inc., Revive Kombucha, GT's Living Foods, Health-Ade Kombucha, Brew Dr. Kombucha, NessAlla Kombucha, The Bu Kombucha, Humm Kombucha, The Hain Celestial Group, Inc., and Wonder Drink.

The North America kombucha market is highly dynamic and characterized by a mix of established national brands and emerging regional players. While legacy companies like GT’s Living Foods, KeVita, and Health-Ade dominate due to their extensive distribution networks and brand recognition, a growing number of independent craft brewers are entering the space with niche offerings and localized appeal. The competition is intensifying as companies strive to capture consumer attention through unique flavor development, clean-label positioning, and functional enhancements. Retailers are also launching private-label kombucha lines, further fragmenting the market and increasing pressure on smaller brands to differentiate themselves. Additionally, consolidation activity has picked up pace, with larger beverage corporations acquiring or partnering with successful kombucha startups to tap into the functional beverage trend. As consumer demand continues to evolve, innovation, brand authenticity, and sustainable business practices have become critical differentiators in maintaining a competitive edge in this rapidly maturing market.

TOP PLAYERS IN THE MARKET

GT’s Living Foods

GT’s Living Foods is a pioneering brand in the kombucha industry and holds a dominant presence in the North America market. Founded in the early 1990s, it has built a strong reputation for its raw, unpasteurized kombucha that retains live probiotics. The company has played a crucial role in mainstreaming kombucha by making it accessible across major retail chains and natural food stores. GT’s commitment to organic ingredients and traditional brewing methods has influenced industry standards globally.

KeVita Master Brew

KeVita, now part of PepsiCo, has been instrumental in expanding the reach of kombucha beyond niche health markets. Known for its innovative flavor profiles and functional beverage offerings, KeVita introduced many consumers to kombucha through its sparkling probiotic drinks. The brand’s strategic marketing and distribution network have helped integrate kombucha into everyday beverage choices, significantly contributing to the global growth of the category.

Health-Ade Kombucha

Health-Ade has emerged as a key player by focusing on small-batch, handcrafted kombucha with clean-label ingredients. Its success lies in combining premium quality with modern branding that appeals to millennials and Gen Z. Health-Ade’s direct-to-consumer approach and subscription-based models have set new benchmarks in customer engagement within the kombucha sector, influencing how brands interact with consumers worldwide.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Diversification

Key players in the North America Kombucha Market are heavily investing in product innovation to cater to evolving consumer preferences. Companies like Health-Ade Kombucha and GT's Living Foods frequently introduce new flavors and functional variants, such as adaptogen-infused or low-sugar options, to appeal to health-conscious and adventurous consumers. This strategy not only helps them differentiate their offerings but also attracts diverse demographics, including younger audiences seeking novelty. Additionally, brands like PepsiCo’s KeVita have expanded into related categories, such as probiotic sparkling waters, to diversify their portfolios and capture a broader segment of the functional beverage market.

Strategic Partnerships and Acquisitions

Acquisitions and partnerships have been pivotal for major players aiming to scale their operations and enhance distribution capabilities. For instance, PepsiCo’s acquisition of KeVita and Coca-Cola’s investment in Health-Ade Kombucha showcased how large beverage corporations are leveraging smaller kombucha brands to enter the health-focused beverage space. These collaborations provide smaller brands with access to extensive distribution networks and resources while enabling larger companies to tap into niche markets. Furthermore, partnerships with fitness influencers and wellness platforms have helped brands like Humm Kombucha strengthen their positioning in the lifestyle and wellness sectors.

Sustainability and Eco-Friendly Practices

Sustainability has become a cornerstone strategy for key players seeking to align with environmentally conscious consumers. Brew Dr. Kombucha, for example, emphasizes its zero-waste brewing process, while Revive Kombucha focuses on using locally sourced ingredients to reduce its carbon footprint. These initiatives resonate with eco-aware buyers and help build brand loyalty. Additionally, companies are adopting sustainable packaging solutions, such as biodegradable or recyclable materials, to address growing concerns about plastic waste. By prioritizing sustainability, these brands not only enhance their reputation but also comply with regulatory trends favoring green practices.

Digital Marketing and E-Commerce Expansion

To strengthen their market position, kombucha brands are increasingly leveraging digital marketing and e-commerce platforms. Social media campaigns, influencer collaborations, and educational content about kombucha’s health benefits have proven effective in engaging consumers and driving brand awareness. Online retail channels, including subscription-based models, have allowed brands like Health-Ade and NessAlla Kombucha to bypass shelf-life constraints and reach remote or underserved areas. By focusing on direct-to-consumer strategies, these companies can foster stronger customer relationships and gather valuable insights into consumer preferences.

Focus on Premiumization and Brand Authenticity

Premiumization remains a key strategy for brands like GT's Living Foods, which emphasize artisanal brewing methods and high-quality ingredients to maintain their status as a premium kombucha provider. By positioning themselves as authentic and trustworthy, these brands command higher price points and cultivate loyal customer bases. Smaller players, such as The Bu Kombucha and NessAlla Kombucha, focus on storytelling and local sourcing to connect emotionally with consumers, reinforcing their unique value propositions in a competitive market. This approach helps them stand out amidst larger competitors and retain their niche appeal.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Health-Ade launched a limited-edition line of kombucha infused with adaptogenic herbs, targeting consumers seeking stress relief and immune support. This move reinforced its positioning as a leader in functional beverages and attracted a wellness-oriented demographic.

- In May 2023, GT’s Living Foods expanded its production capacity by opening a new bottling facility in the Midwest, allowing for faster distribution and improved supply chain efficiency across the U.S. This expansion supported its continued dominance in the market.

- In September 2024, KeVita introduced a revamped packaging design emphasizing recyclable materials and sustainability, aligning with consumer expectations for environmentally responsible brands and reinforcing its corporate responsibility commitments.

- In January 2023, Remedy Kombucha entered into a strategic partnership with a leading fitness app platform to co-develop kombucha-infused hydration programs, integrating its products into digital wellness ecosystems and reaching tech-savvy health enthusiasts.

- In November 2024, a consortium of independent kombucha producers formed an industry alliance aimed at advocating for regulatory clarity, shared logistics solutions, and collective marketing initiatives to enhance competitiveness against large-scale commercial brands in the North America market.

MARKET SEGMENTATION

This research report on the North America kombucha market is segmented and sub-segmented into the following categories.

By Product Type

- Original/Regular

- Flavored

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores/Grocery Stores

- Specialist Stores

- Online Retail Stores

- Other Distribution Channels

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What was the market size of the North America Kombucha market in 2024?

The North America Kombucha market size was valued at USD 1.18 billion in 2024.

2. What factors are driving the growth of the North America Kombucha market?

Key drivers include increasing consumer demand for health-conscious beverages, rising awareness of probiotic benefits, and innovative flavor offerings that attract a broader audience.

3. Which distribution channels are primarily used for kombucha in North America?

Kombucha is primarily distributed through supermarkets and hypermarkets, health food stores, convenience stores, online retail, and specialty stores.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com