North America Compound Feed Market Size, Share, Trends & Growth Forecast Report, Segmented By Ingredients, Supplements, Animal, and Country (United States, Canada, Rest of North America), Industry Analysis From (2025 to 2033)

North America Compound Feed Market

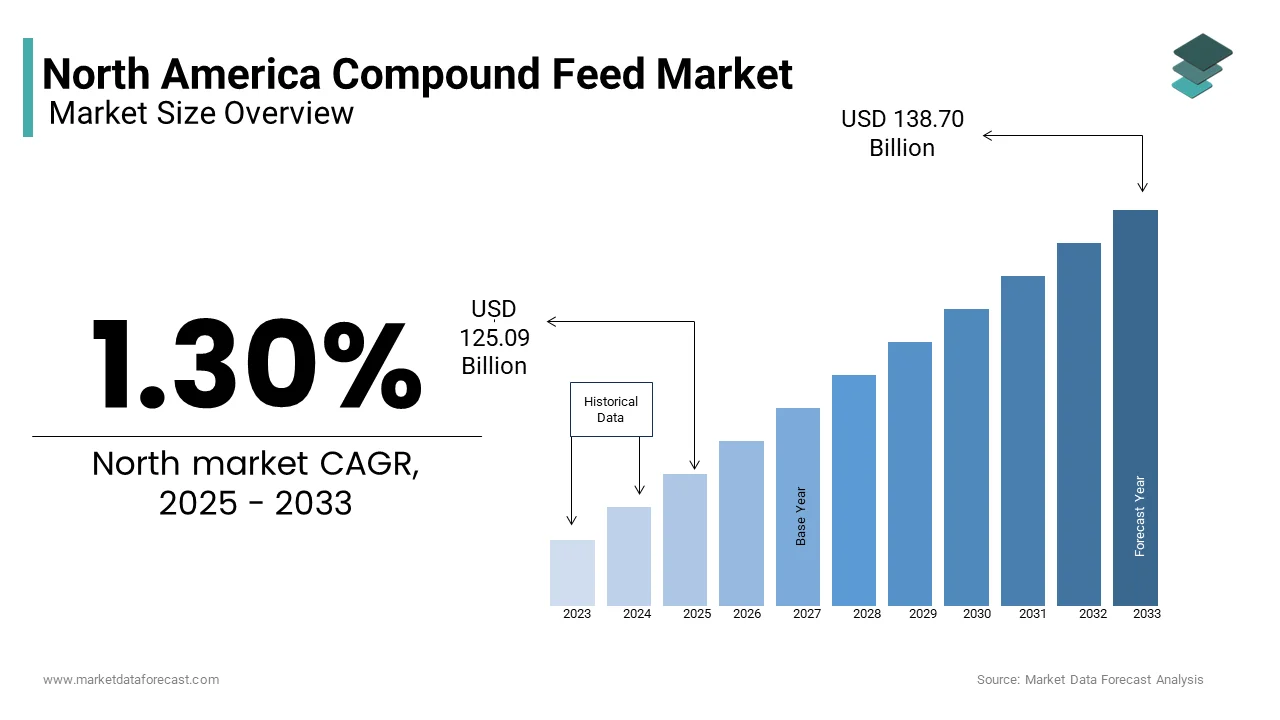

The North American compound feed market was valued at USD 123.48 billion in 2024 and is expected to reach USD 125.09 billion in 2025 from USD 138.70 billion by 2033, growing at a CAGR of 1.30% during the forecast period from 2025 to 2033.

Current Scenario of the North American Compound Feed Market

Compound feed is designed to optimize animal health, growth, and productivity while addressing specific nutritional requirements across different life stages.

MARKET DRIVERS

Rising Demand for High-Quality Animal Protein

The escalating demand for high-quality animal protein has emerged as a primary driver for the North American Compound Feed Market. This trend is mirrored in dairy and egg production, creating a pressing need for efficient livestock systems that rely heavily on compound feed. By providing precise nutrient blends, compound feed ensures optimal growth rates, improved feed conversion ratios (FCR), and consistent product quality, which are essential for meeting consumer expectations. Compound feed formulations, enriched with vitamins, amino acids, and probiotics, address specific nutritional gaps, enabling farmers to maximize yields while minimizing costs. For instance, broiler chickens fed with specialized compound feed exhibit faster weight gain and better immunity, directly impacting profitability.

Increasing Focus on Sustainable Farming Practices

Sustainability has become a cornerstone of modern agriculture, propelling the adoption of compound feed as a tool for reducing the ecological footprint of livestock operations. Compound feed manufacturers are responding by developing formulations that incorporate alternative protein sources, such as insect meal and algae, which require fewer resources compared to traditional ingredients like soybean meal. Compound feed plays a vital role in this transition by optimizing resource utilization. For example, enzyme-treated feeds break down anti-nutritional factors, allowing farmers to utilize locally available raw materials without compromising animal performance. These innovations align closely with government initiatives promoting eco-friendly farming methods, making compound feed a strategic choice for compliance and long-term sustainability.

MARKET RESTRAINTS

Volatility in Raw Material Prices

One of the most significant restraints affecting the North American Compound Feed Market is the volatility in raw material prices, which impacts production costs and profitability. According to the USDA Economic Research Service, fluctuations in key ingredients like corn and soybean meal have surged in recent years due to supply chain disruptions and geopolitical tensions. This instability creates challenges for compound feed manufacturers, who must navigate rising input costs while maintaining competitive pricing for their products. Such price volatility disproportionately affects small-scale producers who operate on tight margins and lack the resources to absorb sudden cost increases. Larger enterprises, though more resilient, also face pressure to balance input expenses against market dynamics. In addition, the complexity of reformulating feed mixes to accommodate changing ingredient availability often requires additional R&D investments, further inflating operational costs.

Stringent Regulatory Frameworks

Another critical restraint stems from stringent regulatory frameworks governing the formulation and commercialization of compound feed. The Food and Drug Administration (FDA) mandates rigorous testing protocols to ensure safety and efficacy before any new feed product enters the market. However, the average time required to secure FDA approval for innovative feed formulations can be multiple years, accompanied by substantial R&D expenditures. This prolonged timeline poses significant challenges for manufacturers aiming to introduce groundbreaking solutions tailored to emerging industry needs. Moreover, discrepancies between federal and state-level regulations often lead to fragmented compliance requirements, complicating distribution efforts. For example, California’s Proposition 12 imposes strict welfare standards that necessitate reformulation of compound feed to meet its criteria, creating additional hurdles for companies operating nationwide.

MARKET OPPORTUNITIES

Expansion into Alternative Protein Sectors

A burgeoning opportunity lies in expanding the application of compound feed to alternative protein sectors, such as aquaculture and insect farming. Compound feed formulations specifically tailored for aquatic species, such as those enriched with marine-derived proteins and carotenoids, are essential for achieving optimal growth rates and vibrant coloration in farmed fish. Simultaneously, the emergence of insect-based feeds offers a novel avenue for innovation. Insects like black soldier flies are rich in essential nutrients and serve as sustainable alternatives to conventional protein sources.

Adoption of Precision Nutrition Technologies

The advent of precision nutrition technologies presents a transformative opportunity for the North American Compound Feed Market. This paradigm shift involves leveraging data analytics, sensors, and AI-driven tools to customize feed formulations based on individual animal requirements, thereby maximizing productivity and minimizing waste. Compound feed plays a central role in this evolution by enabling targeted interventions tailored to specific physiological stages or health conditions. For instance, omega-3 fatty acid supplements are increasingly being used to enhance reproductive efficiency in dairy cattle, resulting in improved fertility rates and milk quality. Similarly, probiotic blends designed to combat pathogenic bacteria in poultry demonstrate promising outcomes in reducing antibiotic usage, aligning with consumer preferences for drug-free meat products.

MARKET CHALLENGES

Resistance to Change Among Traditional Farmers

A persistent challenge facing the North American Compound Feed Market is the resistance to change exhibited by traditional farmers entrenched in conventional practices. This reluctance is particularly pronounced among older generations who prioritize tried-and-tested methods over experimental approaches. Consequently, educational outreach programs aimed at demonstrating tangible benefits often fall short, leaving many unaware of the long-term advantages offered by advanced compound feed formulations. Furthermore, cultural and regional disparities exacerbate this issue. For example, Southern states tend to have lower adoption rates compared to technologically progressive regions like the Midwest, where large-scale operations dominate. Also, addressing these gaps necessitates tailored communication strategies that resonate with local contexts and priorities. Without overcoming this barrier, the full potential of compound feed cannot be realized, limiting its contribution to enhanced productivity and sustainability across the agricultural value chain.

Concerns Over Consumer Perception and Labeling Requirements

Consumer perception poses another formidable challenge for the North American Compound Feed Market, especially concerning labeling transparency and ingredient disclosure. This apprehension extends to genetically modified organisms (GMOs) and synthetic compounds, which some view as incompatible with natural or organic claims. Such sentiments place immense pressure on manufacturers to reformulate products while adhering to complex labeling regulations. For example, the Non-GMO Project Verified label requires rigorous documentation and traceability throughout the supply chain, adding layers of complexity to production workflows. Besides, misinformation spread via social media platforms amplifies public distrust, creating reputational risks for brands associated with controversial additives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

1.30% |

|

Segments Covered |

By Ingredients, Supplements, Animals, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

United States, Canada, Mexico |

|

Market Leaders Profiled |

Cargill Inc., Charoen Pokphand Foods, Archer Daniels Midland Company, Land o’ Lakes Inc., Nutreco, ALLTEC Inc., New Hope Group Co., Ltd, Wen’s Group, ForFarmers B.V, Agribusiness Holding Miratorg, Kyodo Shiryo Company, Sodrugestvo Group S.A, DeKalb Feeds, Inc, De Heus B.V, BallanceAgri-Nutrients Ltd, J.D. Heiskell & CO, Kent Feeds, Weston Milling Animal Nutrition, EWOS GROUP |

SEGMENTAL ANALYSIS

By Ingredients Insights

The cereals segment dominated the North America Compound Feed Market by holding a 40% share in 2024. This is propelled by their affordability, widespread availability, and versatility in feed formulations. Corn, wheat, and barley are among the most commonly used cereals, providing a rich source of carbohydrates essential for energy metabolism in livestock. A key factor driving this dominance is the efficiency of cereals in enhancing feed-to-meat conversion ratios. Also, advancements in milling technologies have enabled manufacturers to produce highly digestible cereal products that minimize waste. Another contributing factor is the region's robust agricultural infrastructure, which ensures a steady supply of high-quality cereals.

The supplements segment is quickly growing in the market, with a projected CAGR of 8.5%. This rapid growth is fueled by increasing demand for specialized feed additives that address specific nutritional needs and regulatory requirements. Vitamins, amino acids, and probiotics are gaining traction as farmers seek to enhance animal health and productivity while reducing reliance on antibiotics. A significant driver of this expansion is the shift toward antibiotic-free farming practices. Also, the growing emphasis on sustainability has spurred the use of enzyme-based supplements, which improve feed efficiency and reduce environmental impact. Like, enzyme-treated feeds can enhance nutrient absorption, making them an attractive option for modern livestock operations.

By Supplements Insights

The vitamins held the largest share in the supplements category by accounting for 30.6% in 2024. This prominence is attributed to their indispensable role in supporting animal health, immunity, and overall performance. Vitamin E, for example, is widely used in poultry diets to prevent oxidative stress and improve egg quality. According to the USDA, enriched eggs with higher omega-3 fatty acids have seen an annual increase in demand, further propelling the adoption of vitamin-rich compound feeds. A key factor driving this leadership is the versatility of vitamins across different livestock categories. Also, vitamins like B-complex and D3 are critical for optimizing growth rates and bone health in poultry. Additionally, the rise in antibiotic-free meat production has increased reliance on vitamins to support natural immune functions, reducing dependency on synthetic drugs.

The segment of feed enzymes is the fastest-growing within the supplements category, with a CAGR of 9.2%. This progress is propelled by their ability to break down anti-nutritional factors in feed, improving digestibility and nutrient absorption. Enzymes like phytases and proteases are particularly effective in enhancing feed efficiency, enabling farmers to utilize alternative ingredients without compromising animal performance. Another factor fueling this expansion is the increasing focus on sustainable farming practices. According to the Environmental Protection Agency, agriculture contributes notably to total greenhouse gas emissions in the U.S., prompting stricter measures to mitigate its ecological impact. Feed enzymes play a vital role in this transition by reducing waste and minimizing resource usage. For instance, enzyme-treated feeds can lower nitrogen excretion.

By Animal Insights

The poultry segment is exhibiting the biggest category in the North America Compound Feed Market by capturing a 35.5% of the total share. This dominance is rooted in the region's high per capita chicken consumption. Like, the U.S. alone produces significant billions of pounds of poultry meat each year, creating substantial demand for specialized compound feed formulations to ensure consistent quality and productivity. A major factor driving this place is the industry’s focus on optimizing feed-to-meat conversion ratios. Enzymes and amino acids are extensively used in poultry feed to break down anti-nutritional factors and enhance protein synthesis. These additives can improve weight gain, directly impacting profitability. Besides, the growing trend toward antibiotic-free poultry farming has spurred the adoption of probiotics and prebiotics, which support gut health and reduce disease incidence.

The segment of aquaculture is the fastest advancing, with a CAGR of 10.3%, which is driven by the booming aquaculture industry in North America. Compound feed tailored for aquatic species, such as those enriched with marine-derived proteins and carotenoids, plays a vital role in achieving vibrant coloration and optimal growth rates in farmed fish. Another factor accelerating this growth is the rising demand for sustainable seafood. Compound feed helps reduce the ecological footprint of aquaculture by minimizing waste and improving nutrient absorption.

COUNTRY ANALYSIS

Top Leading Countries in the Market

The United States will spearhead the North America Compound Feed Market by commanding a substantial regional share in 2024. This is due to the country's robust livestock sector, which includes some of the world's largest poultry, dairy, and beef operations. A key driver of this leadership is the presence of advanced agricultural infrastructure. Apart from these, stringent food safety regulations enforced by the FDA have accelerated the adoption of sustainable and eco-friendly feed solutions, ensuring compliance with consumer expectations.

Canada is a key market. The country's strong emphasis on sustainable farming practices has positioned it as a hub for innovative feed solutions. Another factor driving Canada's prominence is its thriving aquaculture industry. Additionally, government incentives for adopting organic farming methods have spurred the use of natural additives, further bolstering the market's growth.

Mexico holds a smaller regional market share. The country's rapidly expanding livestock sector, particularly in poultry and swine farming, has created a fertile ground for compound feed innovation. A key driver of this growth is the increasing adoption of imported compound feed, facilitated by favorable trade agreements with the U.S. and Canada. In addition, efforts to modernize agricultural practices through government-funded programs have encouraged small-scale farmers to invest in premium feed solutions, contributing to Mexico's steady market expansion.

KEY MARKET PLAYERS

Cargill Inc, Charoen Pokphand Foods, Archer Daniels Midland Company, Land o’ Lakes, Inc, Nutreco, ALLTECH, INC, New Hope Group Co. Ltd, Wen’s Group, ForFarmers B.V, Agribusiness Holding Miratorg, Kyodo Shiryo Company, Sodrugestvo Group S.A, DeKalb Feeds, Inc, De Heus B.V, BallanceAgri-Nutrients Ltd, J.D. Heiskell & CO, Kent Feeds, Weston Milling Animal Nutrition, EWOS GROUP. are some of the major key players involved in the North America compound feed market.

Top Players in the Market

Cargill Incorporated

Cargill Incorporated is a global leader in the North American compound Feed Market, renowned for its innovative and sustainable feed solutions tailored to meet the diverse needs of livestock producers. The company’s extensive portfolio includes high-performance formulations enriched with vitamins, amino acids, and probiotics, designed to enhance animal health and productivity while addressing environmental concerns. Cargill’s commitment to research and development has positioned it as a pioneer in precision nutrition technologies, enabling farmers to optimize feed formulations based on specific nutritional requirements.

Archer Daniels Midland Company (ADM)

Archer Daniels Midland Company (ADM) is a key contributor to the North America Compound Feed Market, offering a wide range of specialized feed formulations that cater to poultry, swine, ruminants, and aquaculture. ADM’s focus on sustainability and food safety is evident in its development of eco-friendly additives and organic feed solutions. The company invests heavily in cutting-edge technologies to address emerging challenges such as antibiotic resistance and environmental impact.

Tyson Foods, Inc.

Tyson Foods, Inc. is a prominent player in the North American compound Feed Market, leveraging its expertise in poultry production to develop high-quality feed formulations that support optimal growth and performance. The company emphasizes sustainable sourcing practices, ensuring that its feed ingredients meet stringent quality and ethical standards. Tyson’s vertically integrated business model allows it to maintain control over the entire supply chain, from feed production to meat processing, ensuring consistency and traceability. By prioritizing customer-centric solutions and investing in advanced nutritional research, Tyson continues to strengthen its position as a trusted partner for livestock producers.

Top Strategies Used by Key Market Participants

Strategic Acquisitions and Partnerships

Key players in the North America Compound Feed Market have prioritized strategic acquisitions and partnerships to expand their product portfolios and strengthen their market presence. By acquiring smaller firms specializing in niche feed additives or forming alliances with research institutions, these companies gain access to cutting-edge technologies and innovative solutions. Such collaborations enable them to address unmet needs in the livestock sector while enhancing their competitive edge.

Investment in Sustainable Solutions

Sustainability has emerged as a cornerstone of competitive strategy in the compound feed market. Leading companies are investing heavily in the development of eco-friendly feed formulations that reduce greenhouse gas emissions, minimize waste, and promote antibiotic-free farming. By focusing on reducing the ecological footprint of livestock operations, these players position themselves as champions of sustainable agriculture. Their commitment to environmental stewardship not only enhances brand loyalty but also ensures compliance with evolving industry standards, reinforcing their leadership in the market.

Emphasis on Research and Development

R&D is a critical driver of innovation in the North American Compound Feed Market. Key players are channeling significant resources into exploring novel formulations and advanced delivery systems that improve feed efficiency and animal health. By staying at the forefront of technological advancements, these companies can introduce groundbreaking solutions tailored to specific livestock categories.

COMPETITION OVERVIEW

The North American Compound Feed Market is characterized by intense competition, driven by the presence of established multinational corporations and emerging niche players. Companies strive to differentiate themselves through innovation, sustainability, and customer-centric strategies, creating a dynamic and rapidly evolving landscape. Leaders like Cargill, ADM, and Tyson Foods dominate the market by leveraging their extensive R&D capabilities and global reach to deliver high-performance solutions. At the same time, smaller firms focus on specialized products that cater to specific livestock segments or address unique challenges such as antibiotic resistance. Regulatory pressures and shifting consumer preferences further intensify competition, compelling companies to adopt sustainable practices and transparent labeling. Collaborations, mergers, and acquisitions are common strategies used to consolidate market share and expand product portfolios.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Cargill Incorporated launched a new line of enzyme-based compound feed designed to enhance nutrient absorption in poultry. This move aims to address the growing demand for efficient feed solutions in the North American market.

- In June 2023, Archer Daniels Midland Company (ADM) partnered with a leading agricultural research institute to develop sustainable feed formulations. This collaboration underscores ADM’s commitment to eco-friendly innovations in animal nutrition.

- In January 2023, Tyson Foods, Inc. acquired a startup specializing in precision nutrition technologies. This acquisition strengthens Tyson’s ability to offer tailored feed formulations for livestock producers.

- In September 2022, BASF SE introduced a range of natural antioxidants aimed at extending the shelf life of feed ingredients. This initiative aligns with consumer preferences for organic and sustainable products.

- In November 2022, Evonik Industries expanded its production facility in the U.S. to increase the supply of amino acids and other essential additives. This expansion supports the company’s goal of meeting rising demand in the North American Compound Feed Market.

MARKET SEGMENTATION

This market research report on the North American compound feed market is segmented and sub-segmented into the following categories.

By Ingredients

- Cereals

- Cereals by-Product

- Oilseed Meal

- Oil

- Molasses

- Supplements

- Others

By Supplements

- Vitamins

- Antibiotics

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

By Animal

- Ruminant

- Swine

- Poultry

- Aquaculture

- Others

By Country

- The U.S.

- Canada

- Rest of North America

Frequently Asked Questions

What Is The Current Size Of The North America Compound Feed Market?

The Current size of the compound feed market is to be valued at USD 125.09 billion in 2025.

What Is The Expected Growth Value Of The North America Compound Feed Market?

The compound feed market is expected to grow to USD 138.70 billion by 2033.

What Are The Dominating Factors in North America Compound Feed Market?

Poultry, pork, and cattle are the largest consumers of compound feed in this region, accounting for the major share of the overall compound feed market. Cereals are the most widely used ingredients in compound feed, whereas Vitamins are the most widely used additives, accounting for around 25% of the total feed additives market.

What Are The Key Market Involved In North America Compound Feed Market?

Cargill Inc, Charoen Pokphand Foods, Archer Daniels Midland Company, Land o’ Lakes, Inc, Nutreco, ALLTECH, INC, New Hope Group Co. Ltd, Wen’s Group, ForFarmers B.V, Agribusiness Holding Miratorg, Kyodo Shiryo Company, Sodrugestvo Group S.A, DeKalb Feeds, Inc, De Heus B.V, BallanceAgri-Nutrients Ltd, J.D. Heiskell & CO, Kent Feeds, Weston Milling Animal Nutrition, EWOS GROUP, Are some of the major key players involved in the North America compound feed market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com