North America Smart Irrigation Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Irrigation Controller, Hardware And Network Component, Application, And By Country (The U.S, Canada), Industry Analysis From 2025 to 2033

North America Smart Irrigation Market Size

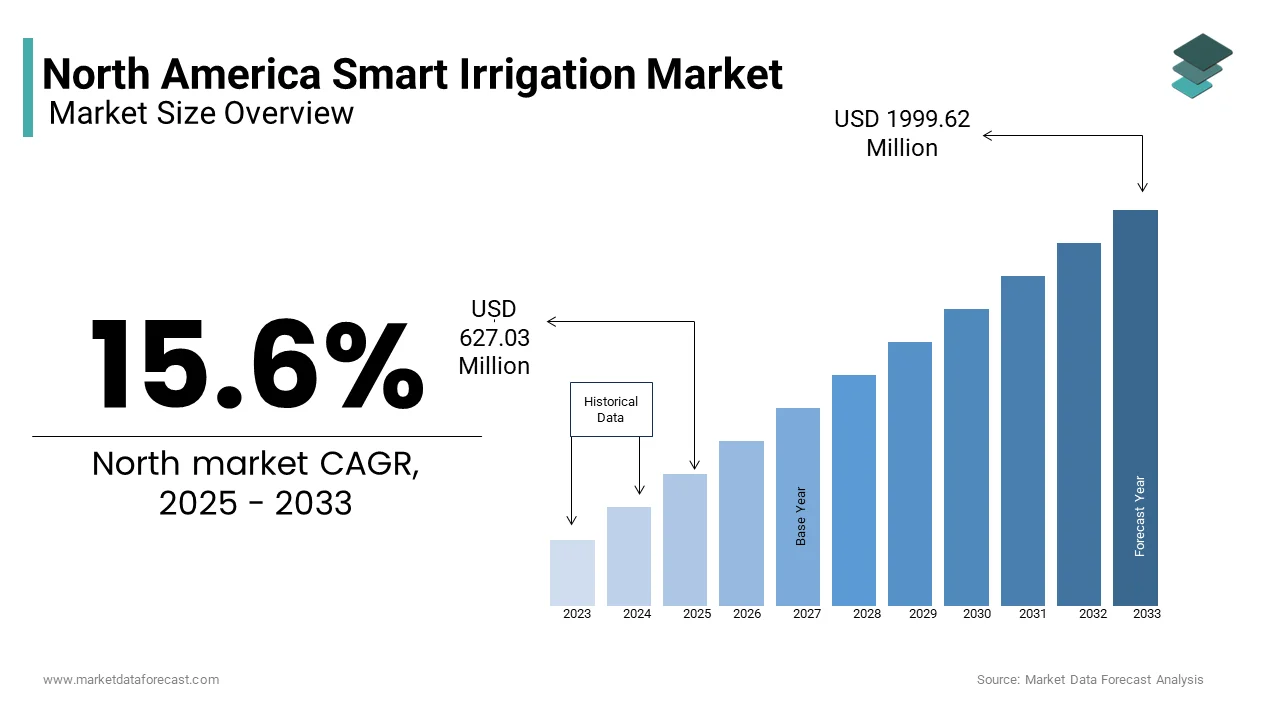

The North American smart irrigation market was valued at USD 542.41 million in 2024 and is anticipated to reach USD 627.03 million in 2025 from USD 1999.62 million by 2033, growing at a CAGR of 15.6% during the forecast period from 2025 to 2033.

Current Scenario Of The North American Smart Irrigation Market

Smart irrigation systems are designed to monitor weather conditions, soil moisture levels, and plant water requirements in real-time, ensuring efficient water usage while minimizing waste. The region’s growing emphasis on sustainability and resource conservation aligns perfectly with the adoption of smart irrigation technologies.

MARKET DRIVERS

Increasing Water Scarcity and Drought Conditions

Water scarcity and frequent droughts are significant drivers propelling the adoption of smart irrigation systems across North America. This has led to stringent water conservation policies, such as California’s Sustainable Groundwater Management Act, which mandates the implementation of water-efficient technologies in both the agricultural and residential sectors.

Smart irrigation systems play a pivotal role in addressing these challenges by reducing water wastage through precise monitoring and control. For example, according to a study conducted by the University of Florida, smart irrigation controllers can reduce outdoor water usage by up to 40% compared to traditional systems. These systems utilize real-time data from weather sensors and soil moisture detectors to optimize watering schedules, ensuring plants receive only the necessary amount of water. The increasing frequency of droughts, coupled with government incentives for adopting water-saving technologies, has significantly bolstered the demand for smart irrigation solutions in the region.

Rising Adoption of Smart Home Technologies

The growing popularity of smart home technologies is another major driver fueling the expansion of the North American smart irrigation market. Smart irrigation systems, which integrate seamlessly with other home automation platforms like Amazon Alexa and Google Home, have become an integral part of this trend.

For instance, homeowners can now remotely control their irrigation systems via smartphone apps, allowing them to adjust watering schedules based on real-time weather forecasts. Also, the aesthetic and economic benefits of maintaining lush lawns and gardens without excessive water usage further drive adoption.

MARKET RESTRAINTS

High Initial Costs of Installation

One of the primary restraints hindering the widespread adoption of smart irrigation systems is the high upfront cost associated with installation. This cost barrier often deters small-scale homeowners and agricultural producers, particularly in rural areas where financial resources may be limited.

Moreover, ongoing maintenance costs add to the financial burden. For instance, as per a report by the American Society of Agricultural and Biological Engineers, regular calibration of sensors and software updates are essential to ensure optimal performance, requiring additional expenditures. While some municipalities offer rebates or incentives to offset these costs, such programs are not universally available. This financial challenge limits the accessibility of smart irrigation systems, particularly among low-income households and small-scale farmers, thereby impeding broader market penetration.

Limited Awareness and Technical Expertise

Another significant restraint is the limited awareness and technical expertise surrounding smart irrigation systems. Despite their benefits, many consumers remain unfamiliar with how these systems function or their potential to conserve water. According to a survey conducted by the Alliance for Water Efficiency, over 60% of homeowners in the U.S. are unaware of the existence of smart irrigation technologies, let alone their advantages.

Besides, the complexity of installing and operating these systems requires a certain level of technical knowledge, which many users lack. As per the National Association of Landscape Professionals, improper installation or programming of smart irrigation controllers can lead to inefficiencies, negating the intended benefits. Educational gaps and insufficient outreach programs further exacerbate this issue, particularly among rural communities.

MARKET OPPORTUNITIES

Integration with Smart City Initiatives

The integration of smart irrigation systems into smart city initiatives presents a transformative opportunity for the North American smart irrigation market. As per the International Data Corporation, over 300 smart city projects are currently underway across North America, focusing on sustainable urban development and resource management. Smart irrigation systems, with their ability to optimize water usage in public parks, green roofs, and urban landscapes, align perfectly with these objectives.

For example, cities like Los Angeles and Toronto are investing heavily in green infrastructure projects to combat urban heat islands and improve air quality. Like, incorporating smart irrigation technologies into these projects can reduce municipal water consumption by up to 35%, creating significant cost savings. Besides, partnerships with local governments and private stakeholders can facilitate large-scale adoption, unlocking new revenue streams for manufacturers.

Expansion into Precision Agriculture

The growing adoption of precision agriculture offers another significant opportunity for the North American smart irrigation market. Similarly, precision agriculture technologies are projected to grow at a double-digit rate over the next decade, driven by the need to enhance crop yields while conserving resources. Smart irrigation systems, which provide real-time data on soil moisture and weather conditions, are becoming indispensable tools for modern farmers.

This dual benefit is particularly appealing to large-scale agricultural operations in states like Iowa and Nebraska, where water efficiency is critical. Furthermore, federal programs like the Environmental Quality Incentives Program (EQIP) offer subsidies for adopting precision technologies, encouraging farmers to invest in smart irrigation systems.

MARKET CHALLENGES

Dependence on Reliable Internet Connectivity

A significant challenge facing the North American smart irrigation market is the dependence on reliable internet connectivity for optimal system performance. As per the Federal Communications Commission (FCC), approximately 19 million Americans, primarily in rural areas, lack access to high-speed internet, which is essential for the seamless operation of IoT-enabled irrigation systems. This digital divide creates a barrier to adoption, particularly for farmers and homeowners in remote locations.

For example, smart irrigation controllers rely on real-time data from cloud-based platforms to adjust watering schedules based on weather forecasts and soil conditions.

Competition from Conventional Irrigation Systems

Competition from conventional irrigation systems represents another major challenge for the smart irrigation market in North America. Traditional systems, such as sprinklers and drip irrigation, dominate the market due to their lower upfront costs and ease of installation. As per the Irrigation Association, conventional systems account for a significant portion of all irrigation installations, making them a formidable competitor for smart irrigation manufacturers.

Apart from these, misconceptions about the complexity of smart irrigation systems deter adoption. This perception gap, combined with the entrenched market presence of conventional systems, creates a challenging environment for smart irrigation providers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.6% |

|

Segments Covered |

By Irrigation Controller, Hardware, Application, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The U.S, Mexico, Brazil, Rest of North America |

|

Market Leaders Profiled |

Hunter Industries, Rain Bird Corporation, Netafim, HydroPoint Data Systems, Inc., Rachio Inc., The Toro Company, Calsense, Galcon, Bloss, and Green Electronics LLC (RainMachine). |

SEGMENTAL ANALYSIS

By Irrigation Controller Insights

The weather-based controllers segment dominated the North America smart irrigation market by accounting for 60.4% of the total market share in 2024. This dominance is driven by their ability to integrate real-time weather data with irrigation schedules, ensuring optimal water usage. For instance, according to the U.S. Environmental Protection Agency (EPA), weather-based controllers can reduce outdoor water consumption, making them highly appealing to both residential and commercial users.

A key driving factor is the increasing prevalence of droughts in regions like California and Texas. As per the National Oceanic and Atmospheric Administration (NOAA), these states experienced prolonged drought conditions between 2012 and 2021, prompting governments to incentivize the adoption of water-efficient technologies. Programs such as California’s WaterSense certification have further bolstered the demand for weather-based controllers. Besides, advancements in IoT and cloud computing have enhanced the accuracy and reliability of these systems, enabling them to adjust watering schedules dynamically based on hyper-local weather forecasts.

The sensor-based controllers segment is the fastest-growing category in the North America smart irrigation market, with a projected CAGR of 14.5% through 2033. This is fueled by their precision in monitoring soil moisture levels and plant water requirements, offering a more granular approach to irrigation management. A significant driver is the rising adoption of precision agriculture. According to the U.S. Department of Agriculture (USDA), over 30% of large-scale farms now use sensor-based technologies to optimize resource allocation, with smart irrigation systems playing a pivotal role. Furthermore, government subsidies and incentives, such as those offered under the Environmental Quality Incentives Program (EQIP), encourage farmers to invest in advanced irrigation technologies. The emphasis on sustainability and resource conservation further amplifies the adoption of sensor-based controllers across both agricultural and non-agricultural applications.

By Hardware Insights

The sensors segment held the largest market share in the North America smart irrigation hardware segment by capturing 35.3% of the market in 2024. This prominence stems from their critical role in enabling real-time data collection and analysis, which forms the backbone of smart irrigation systems. The ability of sensors to monitor soil moisture, temperature, and humidity ensures precise irrigation scheduling, enhancing water efficiency.

A primary driving factor is the increasing focus on sustainable water management. According to the EPA, over 9 billion gallons of water are used daily for landscape irrigation in the U.S., with a significant portion wasted due to inefficiencies. Sensors help mitigate this issue by providing actionable insights to optimize water usage. Also, advancements in wireless communication technologies have improved the connectivity and reliability of sensors, making them more accessible and cost-effective.

The smart detection systems segment is the fastest expanding in the North America smart irrigation market, with a CAGR of 15.8%. This is driven by their ability to detect leaks, blockages, and system malfunctions in real-time, ensuring uninterrupted operation and minimizing water wastage. A key driver is the rising awareness of water conservation and system efficiency. According to the Alliance for Water Efficiency, over 10% of water used in irrigation systems is lost due to leaks and inefficiencies, showcasing the need for advanced detection technologies. For example, smart detection systems equipped with AI algorithms can identify anomalies within seconds, enabling prompt corrective actions. Additionally, government mandates, such as California’s SB 606 and AB 1668, require the implementation of water-saving technologies, further accelerating adoption.

By Application Insights

The non-agriculture segment dominated the North America smart irrigation market by accounting for 65.8% of the total market share in 2024. This leading position is attributed to the widespread adoption of smart irrigation systems in residential, commercial, and municipal landscapes. A major driving factor is the growing trend of smart homes and urban landscaping. These systems integrate seamlessly with platforms like Amazon Alexa and Google Home, allowing users to control irrigation remotely. Apart from these, municipalities are investing in green infrastructure projects, such as parks and green roofs, to combat urban heat islands. For example, the Urban Land Institute reports that incorporating smart irrigation into these projects can reduce water usage.

The agriculture segment is the rapidly accelerating application area in the North American smart irrigation market, with a projected CAGR of 13.2%. This progress is propelled by the increasing adoption of precision farming practices aimed at enhancing crop yields while conserving resources.

A key driver is the rising demand for food security amid population growth. As per the Food and Agriculture Organization, global food production must increase by 70% by 2050 to meet the needs of a growing population. Smart irrigation systems play a crucial role in achieving this goal by optimizing water usage and reducing waste. Also, federal programs like EQIP offer subsidies for adopting advanced irrigation technologies, encouraging farmers to invest in smart irrigation systems.

COUNTRY ANALYSIS

Top Leading Countries in the Market

The U.S. led the North American smart irrigation market by holding a substantial market share in 2024. This influence is propelled by stringent water conservation policies and the widespread adoption of smart home technologies. For instance, California’s WaterSense program mandates the use of water-efficient systems, fostering demand for smart irrigation solutions. Apart from these, the prevalence of droughts in western states has accelerated adoption, with NOAA reporting prolonged dry spells between 2012 and 2021.

Canada is exhibiting positive development. The country’s leadership is fueled by its commitment to sustainable urban development, particularly in cities like Toronto and Vancouver. Government initiatives promoting green infrastructure, such as the Green Municipal Fund, have spurred investments in smart irrigation systems for public parks and urban landscapes.

Mexico holds a smaller market. The country’s growth is driven by the rising adoption of precision agriculture, particularly among large-scale producers. Programs like PROAGRO allocate $100 million annually to support modern farming practices, including smart irrigation.

The remaining countries are expected to grow. These nations leverage smart irrigation to address localized challenges, such as water scarcity and urban heat islands. For instance, Caribbean islands like Jamaica are adopting smart irrigation to combat drought-induced agricultural losses. Government partnerships and international funding further support market growth in these regions.

KEY MARKET PLAYERS

Some of the prominent vendors in the smart irrigation market include Hunter Industries, Rain Bird Corporation, Netafim, HydroPoint Data Systems, Inc., Rachio Inc., The Toro Company, Calsense, Galcon, Blossom, and Green Electronics LLC (RainMachine). These market players are dominating the North American smart irrigation market.

Top Players In The Market

Rain Bird Corporation

Rain Bird Corporation is a pioneer in irrigation technology, renowned for its innovative smart irrigation solutions that cater to both residential and agricultural sectors. The company’s contribution to the global market lies in its ability to integrate advanced IoT-enabled controllers with user-friendly interfaces, ensuring efficient water management. Rain Bird actively collaborates with governments and municipalities to promote sustainable water practices, particularly in drought-prone regions.

Hunter Industries

Hunter Industries is a key player in the North American smart irrigation market, offering a wide range of smart irrigation controllers and hardware tailored to diverse applications. The company’s focus on sustainability is evident in its development of energy-efficient systems that reduce water wastage while enhancing landscape health. Hunter Industries partners with homeowners, landscapers, and agricultural producers to demonstrate the long-term benefits of smart irrigation.

Toro Company

Toro Company specializes in providing cutting-edge smart irrigation solutions that combine advanced sensors, weather data, and automation to optimize water usage. The company’s innovative approach addresses both residential and commercial needs, making it a preferred choice for urban landscaping and precision agriculture. Toro actively invests in expanding its product portfolio to include AI-driven technologies, enabling real-time monitoring and control.

Top Strategies Used by Key Market Participants

Strategic Partnerships with Municipalities and Governments

Key players in the North American smart irrigation market frequently collaborate with local governments and municipalities to promote water conservation initiatives. These partnerships enable companies to integrate their technologies into public projects, such as parks, sports fields, and urban green spaces. For instance, joint ventures with city councils allow firms to demonstrate the effectiveness of smart irrigation systems in reducing municipal water consumption.

Investment in R&D for Technological Advancements

Innovation remains a cornerstone for maintaining competitiveness in the smart irrigation market. Leading companies are investing heavily in research and development to improve system efficiency and user experience. By focusing on advancements such as AI-driven analytics and IoT integration, these firms can differentiate themselves while addressing emerging trends like smart cities and precision agriculture. This emphasis on technological leadership ensures they stay ahead of regulatory requirements and consumer expectations, reinforcing their position as industry pioneers.

Expansion into Emerging Applications

To diversify their revenue streams, key players are exploring new applications for smart irrigation systems beyond traditional landscaping. For example, smart irrigation is increasingly being used in vertical farming, rooftop gardens, and even recreational facilities. By targeting these emerging markets, companies can tap into untapped opportunities and reduce reliance on conventional sectors.

COMPETITION OVERVIEW

The North American smart irrigation market is characterized by intense competition, driven by the presence of established players and emerging startups striving to capture market share. Leading companies leverage their expertise in technology and innovation to offer superior products that comply with stringent environmental standards. The competitive landscape is further shaped by the increasing demand for sustainable solutions, prompting firms to adopt strategies such as mergers, acquisitions, and partnerships. Additionally, the push for water conservation and smart city initiatives has intensified rivalry, as companies vie to integrate advanced technologies into their offerings. Smaller players, on the other hand, focus on niche markets, targeting specific applications like urban gardening or precision agriculture.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Rain Bird Corporation launched a partnership with California’s Department of Water Resources to implement smart irrigation systems in public parks. This collaboration aims to reduce water usage while promoting sustainable urban landscapes.

- In June 2023, Hunter Industries introduced a new line of AI-driven irrigation controllers designed for precision agriculture. This innovation aligns with the growing demand for resource-efficient farming practices and strengthens the company’s position in the agricultural sector.

- In February 2024, Toro Company acquired a regional IoT solutions provider specializing in smart water management technologies. This acquisition enhances Toro’s capabilities in integrating real-time data analytics into its irrigation systems.

- In September 2023, Rain Bird Corporation signed an agreement with a major U.S. homebuilder to incorporate smart irrigation systems into newly constructed residential properties. This move positions the company as a leader in smart home water management solutions.

- In November 2023, Hunter Industries launched a pilot program in Texas to demonstrate the use of smart irrigation systems in urban heat island mitigation projects. The initiative targets municipalities seeking to reduce energy consumption and improve air quality through sustainable landscaping practices.

MARKET SEGMENTATION

This research report on the North American smart irrigation market is segmented and sub-segmented into the following categories.

By Irrigation Controller

- Weather-based controllers

- Sensor-based controllers

By Hardware

- Sensor

- Water/flow meter

- Smart detection system

- Network

- Component

By Application

- Agriculture

- Non-agriculture

By Country

- U.S.A

- Canada

- Mexico

Frequently Asked Questions

What is the Smart Irrigation Market in North America?

The smart irrigation market in North America involves technology-driven irrigation systems that use sensors, weather data, and automation to optimize water usage for agriculture, landscaping, and residential purposes.

What factors are driving the growth of this market?

Key drivers include water scarcity concerns, government incentives, increased adoption of precision agriculture, and the rising need for efficient water management in commercial and residential sectors.

Which technologies are commonly used in smart irrigation?

Popular technologies include soil moisture sensors, weather-based controllers, drip irrigation, and remote monitoring systems integrated with IoT and AI.

Who are the key players in the North American smart irrigation market?

Leading companies include The Toro Company, Rain Bird Corporation, Hunter Industries, Netafim, and HydroPoint Data Systems.

What is the outlook for the market in the coming years?

The market is expected to grow steadily due to increasing environmental awareness, tech advancements, and expanding smart city initiatives across the region.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com