Global PPE Market Size, Share, Trends & Growth Forecast Report By Product (Head, Eye & Face Protection, Hearing Protection, Protective Clothing, Respiratory Protection, Protective Footwear, Fall Protection, Hand Protection, Disposable Gloves and Others), End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global PPE Market Size

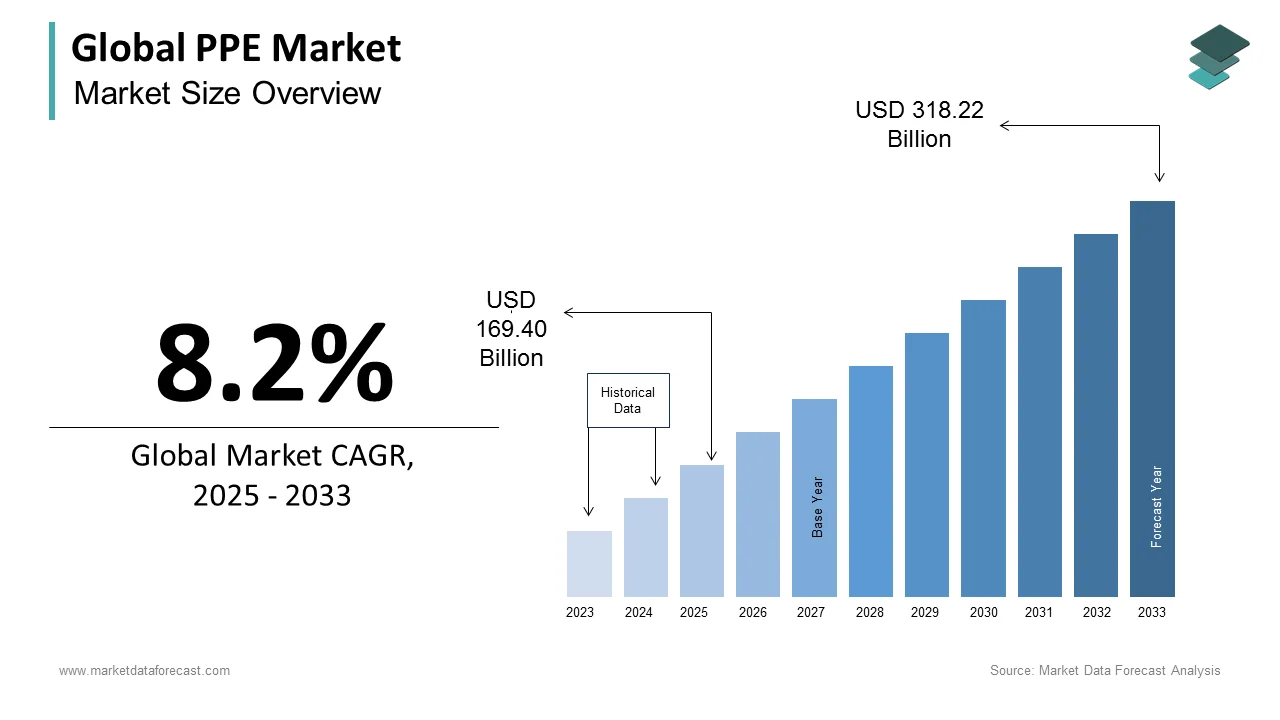

The size of the global PPE market was worth USD 156.56 billion in 2024. The global market is anticipated to grow at a CAGR of 8.2% from 2025 to 2033 and be worth USD 318.22 billion by 2033 from USD 169.40 billion in 2025.

According to the World Health Organization (WHO), personal protective equipment (PPE) consists of clothes placed to protect healthcare workers or other persons from contamination. Face protection, goggles and mask or face shield, gloves, gown or coverall, head cover, and rubber boots are all standard pieces of medical PPE. The Food and Drug Administration defines personal protective equipment (PPE) as garments, gloves, helmets, goggles, face shields, facemasks, respirators, and other items designed to protect the wearer from physical harm or the spread of infection or illness.

The availability and proper use of personal protective equipment (PPE) are among the most important safety aspects of working in a factory, workshop, job site, or other environments. Unfortunately, medical guidelines do not always use personal protective equipment. Non-use was attributed to various factors, such as a lack of necessity, availability, or technical difficulties. Non-compliance has serious public health consequences. During the current coronavirus (COVID-19) epidemic, personal protective equipment has become an important and concerning topic.

MARKET DRIVERS

The rapid adoption of the stringent regulatory framework for worker safety is propelling the global PPE market.

The FDA has issued EUAs for certain PPE products, including face shields, other barriers, and respiratory protective devices such as respirators, to help address concerns about availability during the COVID-19 pandemic. The FDA has issued personal protective equipment (PPE) recommendations and policies, which can be found here Final Medical Device Guidance Documents that have recently been issued. Regulations for Personal Protective Equipment (PPE) in Healthcare Settings During the COVID-19 Response. Healthcare employers must provide PPE to protect their employees; however, keeping an adequate stockpile of PPE is becoming increasingly complex; during the COVID-19 outbreak, healthcare facilities across the country were short on personal protective equipment and disinfectants. Healthcare facilities should continue to use regulated PPE whenever possible. OSHA standards for general industry, maritime, and construction all address personal protective equipment. OSHA requires that many personal protective types of equipment meet or be equivalent to American National Standards Institute (ANSI) standards.

The rising prevalence of infectious diseases is expected to accelerate the global PPE market growth.

PPE refers to employees' specialized clothing or equipment to protect themselves from infectious materials. PPE prevents contact with an infectious agent or body fluid containing an infectious agent by forming a barrier between the potential infectious material and the healthcare worker. Only airborne precautions include a fitted high-filtration mask, which should only be used during aerosol-generating procedures. Certain aspects of personal protective equipment, such as the mask type, use of hoods, and the possibility of reusing equipment, remain unknown.

Growing spending on global healthcare facilities is a big plus to the global PPE market growth.

Global healthcare spending as a share of global income has steadily increased over the last two decades. According to the World Health Organization, global health investment has increased two years into the Sustainable Development Goals period. Between 2000 and 2017, global health spending increased by 3.9% per year, while the economy expanded by 3% per year. Investment in health facilities increased 2.37 times, or 137 percent, year on year in the Union Budget 2021; the total health sector allocation for FY22 was Rs. 223,846 crores (US$ 30.70 billion). Between 2000 and 2017, the global economy grew 1.6 times in GDP per capita. Canada is one of many countries with excellent healthcare systems. The government has established facilities for its residents.

MARKET RESTRAINTS

The shortage of raw materials, such as nonwoven fabric, melt-blown fabric, and synthetic rubber, among others, is one of the key factors hampering the growth of the PPE market.

Poor awareness regarding the importance of PPE in developing countries and increasing competition between the market participants are imposing a negative impact on the PPE market growth. Furthermore, supply chain disruptions, lack of innovation, environmental concerns, and social attitudes are predicted to have a negative impact on the growth of the PPE market during the forecast period. Government policies and regulations, such as changes in import/export policies or tariffs, can affect the supply chain and the pricing of PPE products is another significant challenge to the PPE market growth. The presence of alternative products to PPE products in several countries and the growing costs of personal protective equipment products are negatively affecting the growth rate of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2034 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

3M, Honeywell International, Inc., DuPont, Cardinal Health, Medline Industries, Inc., Kimberly-Clark Corporation, Ansell Ltd., MSA Safety Inc., and O&M Halyard, Inc. |

SEGMENTAL ANALYSIS

By Product Insights

In 2024, the hand protection product segment accounted for the largest revenue share of the global market and is predicted to expand at a healthy CAGR during the forecast period. In the construction, food processing, oil & gas, healthcare, and metal fabrication industries, risks connected with toxic materials, handling heated items, and heavy-duty equipment are projected to drive demand for protective gloves.

The second-largest product segment is protective clothing, which includes heat and flame protection, chemical defense, cleanroom clothing, and mechanical protective clothing. These products' high-performance features have led to greater penetration, boosting demand in various end-use industries. In addition, employees are protected from dangerous gases and vapors, particulates, chemical agents, radioactive particles, and biological pollutants using respiratory protective equipment. Over the projected period, the segment will likely rise due to rising demand for unpowered respirators, especially from the petrochemical, mining, cement, construction, coal, fertilizers, and oil & gas sectors.

By End-User Insights

The healthcare segment held the major share of the global PPE market in 2024, owing to the COVID-19 pandemic. In addition to the spread of the coronavirus in hospital settings, medical staff wore PPE kits throughout working hours, which has resulted in the growing use of PPE kits and promoted the segment's growth.

On the other hand, the oil and gas segment is anticipated to grow at a healthy CAGR during the forecast period owing to the high accident risk in upstream and midstream activities.

The food segment is anticipated to showcase a promising CAGR during the forecast period. The global growth in the food and beverage sector majorly fuels the usage of PPE kits in the food industry. In addition, various industry procedures, such as mixing, weighing, cutting, cleaning, in-house transportation, dispensing, and storage, might offer significant dangers driving the food segment's product demand.

The construction segment is also estimated to register a healthy CAGR in the coming years owing to the rising consumer spending and new construction projects in developing nations such as India, China, and Brazil. In addition, this end-use segment is also driven by employees' increased usage of personal protection equipment in bridge buildings, residential buildings, roadway paving, demolitions, and excavations.

REGIONAL ANALYSIS

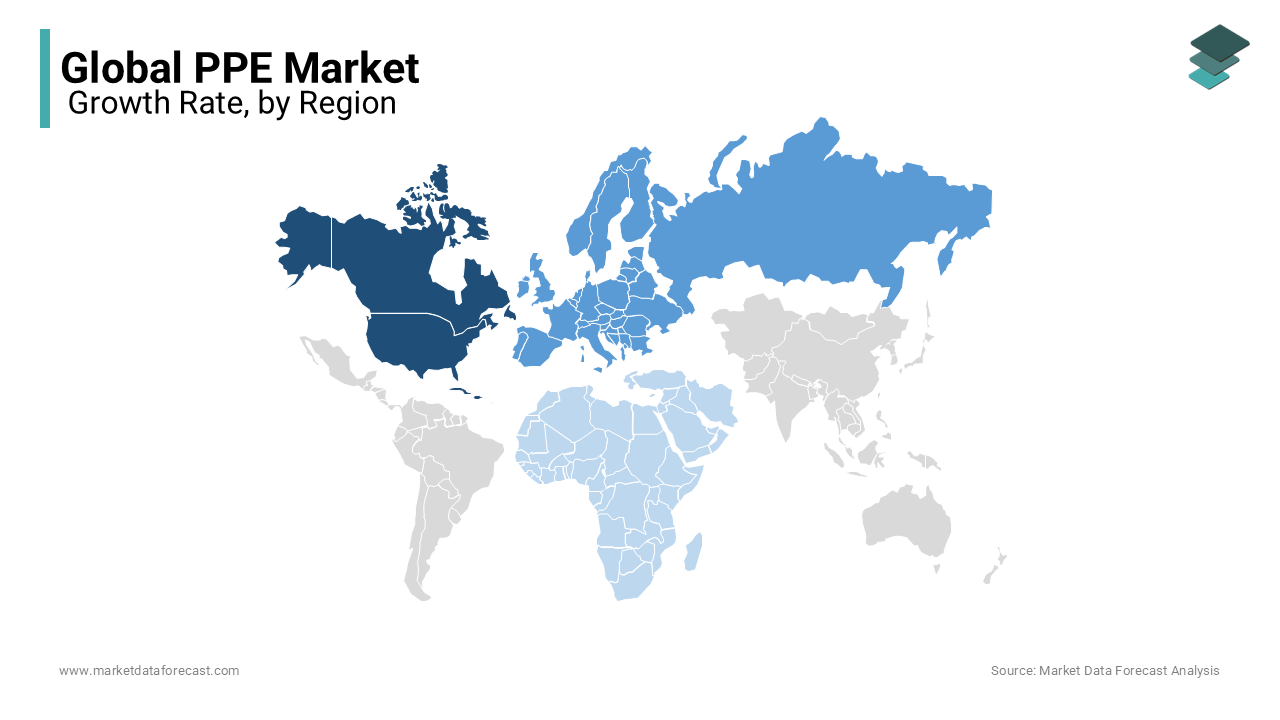

Geographically, North America accounted for the largest share of the global market in 2024, and the region's domination is expected to continue during the forecast period owing to the growing usage of PPE kits from the end-user industries and increasing adoption of PPE kits from hospitals across the North American region. Furthermore, the U.S. PPE market led the North American region in 2024 owing to the rapid adoption of PPE kits due to the strict regulatory environment coupled with severe penalties for non-compliance with the requirements. In addition, the growing number of workplace accidents and OSHA's robust regulatory framework to maintain employee safety propel the PPE market in the North American region.

Europe held a substantial share of the global market in 2024 and is expected to showcase a healthy CAGR during the forecast period owing to the growing expenditure from the European countries on renewable energy sources. In addition, a growing number of government regulations around safety standards are anticipated to result in the growth of the PPE market in the European region.

During the forecast period, Asia-Pacific is expected to grow at the highest CAGR owing to the growing investments in developing infrastructure and industrialization, particularly from countries such as India, Vietnam, and China. In addition, government policy developments targeting smart and energy-efficient construction promote the use of PPE kits in the construction industry.

The Latin American PPE market is anticipated to occupy a considerable share of the global market during the forecast period.

The PPE market in MEA is forecasted to showcase a healthy CAGR in the coming years.

KEY MARKET PLAYERS

3M, Honeywell International, Inc., DuPont, Cardinal Health, Medline Industries, Inc., Kimberly-Clark Corporation, Ansell Ltd., MSA Safety Inc., and O&M Halyard, Inc. are some of the noteworthy companies in the global PPE market and profiled in this report.

MARKET SEGMENTATION

This research report on the global PPE market has been segmented and sub-segmented based on product, end-user, and region.

By Product

- Head, Eye & Face Protection

- Hearing Protection

- Protective Clothing

- Heat & Flame Protection

- Chemical Defending

- Cleanroom Clothing

- Mechanical Protective Clothing

- Limited General Use

- Others

- Respiratory Protection

- Air-purifying Respirators

- Supplied Air Respirators

- Protective Footwear

- Leather

- Rubber

- PVC

- Polyurethane

- Others

- Fall Protection

- Hand Protection

- Disposable Gloves

- By Type

- General Purpose

- Chemical Handling

- Sterile Gloves

- Surgical

- Others

- By Material

- Natural Rubber

- Nitrile

- Neoprene

- Vinyl

- Others

- Durable Gloves

- Mechanical Gloves

- Chemical Handling

- Thermal/Flame Retardant

- Others

- By Type

- Others

By End-User

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Healthcare

- Transportation

- Mining

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the market size of PPE?

As per our research report, the global personal protective equipment (PPE) market is estimated to be worth USD 318.22 billion by 2033.

Which geographical region is dominating the PPE market?

Geographically, the North American PPE market accounted for the largest share of the global market in 2024.

Who are the leading players in the PPE market?

3M, Honeywell International, Inc., DuPont, Cardinal Health, Medline Industries, Inc., Kimberly-Clark Corporation, Ansell Ltd., MSA Safety Inc., and O&M Halyard, Inc. are some of the major companies operating in the global PPE market.

Which segment by product is expected to lead the PPE market in the coming years?

Based on product, the hand product segment is estimated to show dominance over the other segments in the PPE market during the forecast period.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com