Global Preimplantation Genetic Testing Market Size, Share, Trends & Growth Forecast Report By Procedure Type, Products & Services, Application, End User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Preimplantation Genetic Testing Market Size

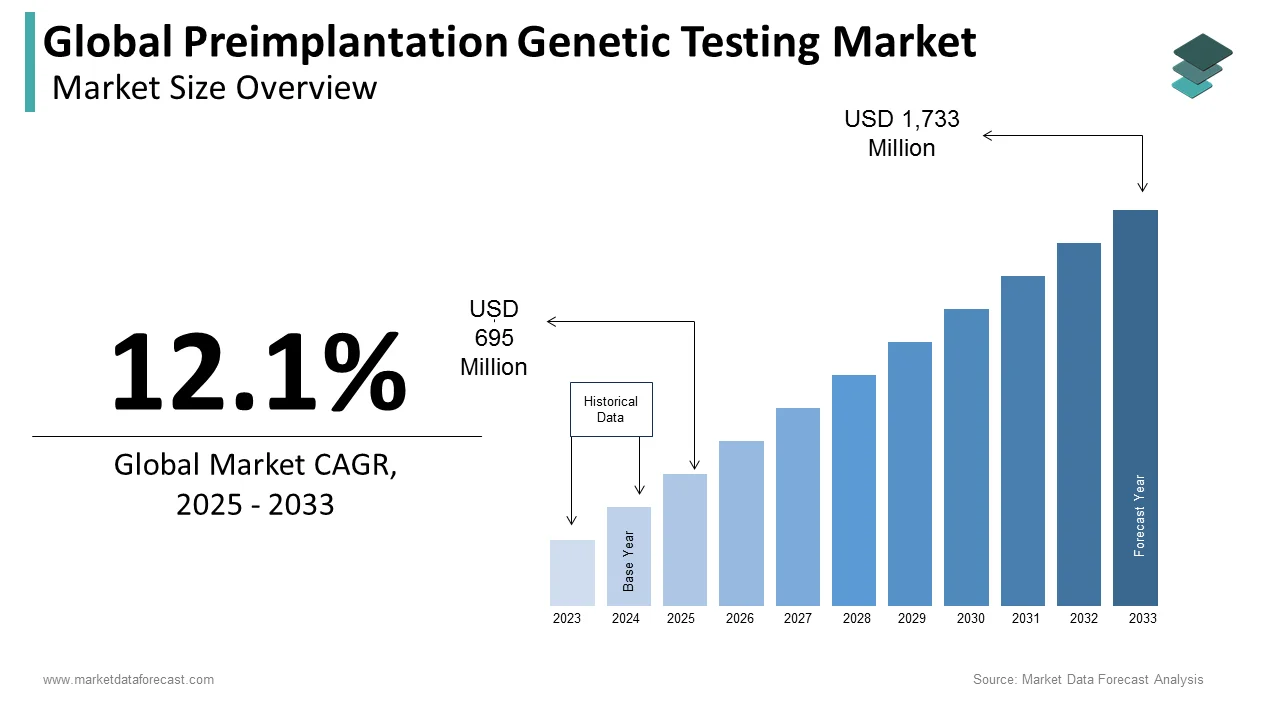

The global preimplantation genetic testing market was worth US$ 620 million in 2024 and is anticipated to reach a valuation of US$ 1,733 million by 2033 from US$ 695 million in 2025, and it is predicted to register a CAGR of 12.1% during the forecast period 2025-2033.

Preimplantation genetic detection is a method that examines the embryos created using the process of in vitro fertilization. This facilitates the implantation of only selected fit embryos into the uterus, ensuring a healthy baby is delivered. This prevents the carrying of genetic disorders into the family generations. A screening process does the testing wherein the healthy ones are frozen and stored. Due to the hectic, sedentary, and non-active modern life, many couples face difficulties conceiving naturally. The increasing pollution and chemicals in farming and animal husbandry sectors have greatly exacerbated infertility in the millennial generation. Some couples might also have genetic diseases they might not wish to be passed down to their offspring. In these cases, embryos fertilized in vitro have the option of being examined to see if they contain any harmful genetic matter or any disease that either of the parents has. This advancement in science has allowed many couples to have children who might have otherwise not tried.

MARKET DRIVERS

The global preimplantation genetic testing market is primarily driven by the rise in infertility rate in individuals, lifestyle changes, PCOD syndrome in women, hereditary genetic disorders in the couple, advancements in genetics, therapies to resolve chromosomal anomalies and an increase in fertilization treatment centers.

These are the drivers that are propelling the growth of the preimplantation genetic testing market. Apart from all these, the scientific advancements in developing countries and lifestyle changes, especially in women's lives, are making them exposed to hormonal changes. These aspects are propelling the market for further expansion.

There is a plethora of opportunities for the market to expand as the prevalence of infertility in almost all women and genetic disorders due to chemically processed food consumption. Due to this, there is a need for preimplantation genetic therapy, and it will reduce the exposure to genetic disorders and other defects in the embryo and helps in delivering a healthy baby. Hence, preimplantation genetic testing provides ample scope for pre-decided genetically modified babies. This is an opportunity of using preimplantation genetic testing. This triggers the market in a very optimistic way.

MARKET RESTRAINTS

High costs associated with preimplantation genetic testing are one of the major factors hampering the market growth. The healthcare costs of preimplantation genetic testing have no covered by insurance in some countries and the adoption of this testing is poor in such countries, which is diluting the growth rate of the overall market. The ethical concerns surrounding the use of PGT, such as the selection of embryos based on their genetic makeup is another notable factor hindering the market growth. The limited availability of PGT in some countries further impedes market growth. The scarcity of professionals with specialized expertise to handle PGT, accuracy issues and the invasive nature of PGT further inhibit the market’s growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.1% |

|

Segments Covered |

By Procedure Type, Technology, Product and Service, Application, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Illumina Inc., Yikon Genomics, CooperSurgical, Oxford Gene Technology, Inc., Thermo Fisher Scientific, Inc., Rubicon Genomics, Inc., Agilent Technologies, Inc., Natera, Inc., Abbott Laboratories, PerkinElmer, Inc. and SciGene Corporation, and Others. |

SEGMENTAL ANALYSIS

By Procedure Type Insights

Based on procedure type, the preimplantation genetic diagnosis segment held the leading share of the global market in 2024 and is expected to grow at a healthy CAGR during the forecast period. Rising The growing of genetic disorders, increasing interest in family balancing and gender selection using PGD and technological advancements expanding the test capabilities of PGD, detecting a wider range of genetic conditions majorly drive segmental growth.

On the other hand, the preimplantation genetic screening segment is estimated to hold a substantial share of the global market during the forecast period. It is majorly driven by the growing maternal age and associated higher risk of chromosomal abnormalities, rising awareness and acceptance of PGS and technological advancements, such as next-generation sequencing, making PGS more accurate and cost-effective.

By Technology Insights

Based on technology, the next-generation sequencing segment led the market in 2024, followed by the fluorescent in situ hybridization segment. High accuracy, efficiency and comprehensive genetic information offered by NGS drives its adoption in PGT and is one of the major factors propelling the segmental growth. Improved success rates of assisted reproductive techniques due to the detailed genetic analysis provided by NGS further boost the segment’s growth rate. The growth of fluorescent in situ hybridization (FISH) segment is primarily driven by the wide adoption to detect specific DNA sequences or chromosomal abnormalities in embryos before implantation. FISH offers rapid results and is commonly used for screening a limited number of chromosomes and these are contributing to segmental growth.

By Application Insights

Based on application, the HLA typing segment is the most lucrative segment and accounted for the major share of the global market in 2024. The compatibility for stem cell transplantation, the prevention of HLA-associated disorders, enhanced donor selection and improved success rates of HLA typing majorly propel the segmental growth.

The structural chromosome anomalies segment is estimated to grow at a healthy CAGR during the forecast period. The prevalence of structural chromosomal abnormalities in couples with a history of genetic disorders or recurrent pregnancy loss is one of the key factors driving segmental growth. The growing awareness among healthcare professionals about the potential of PGT in detecting structural chromosomal abnormalities and technological advancements in PGT techniques, such as comparative genomic hybridization (CGH) further promote the segment’s growth rate.

By End-users Insights

Based on the end-users, the fertility clinics and maternity centers segment accounted for the major share of the global market in 2024. The trend is predicted to continue throughout the forecast period. The growing demand for assisted reproductive technologies (ART), rising awareness of PGT's role in improving pregnancy outcomes, increasing prevalence of infertility and the desire of couples to increase their chances of successful pregnancies, the availability of comprehensive PGT services, including genetic screening and testing, at specialized fertility clinics and technological advancements in PGT techniques, making it more accessible and reliable for maternity centers and fertility clinics primarily drive the segmental growth.

REGIONAL ANALYSIS

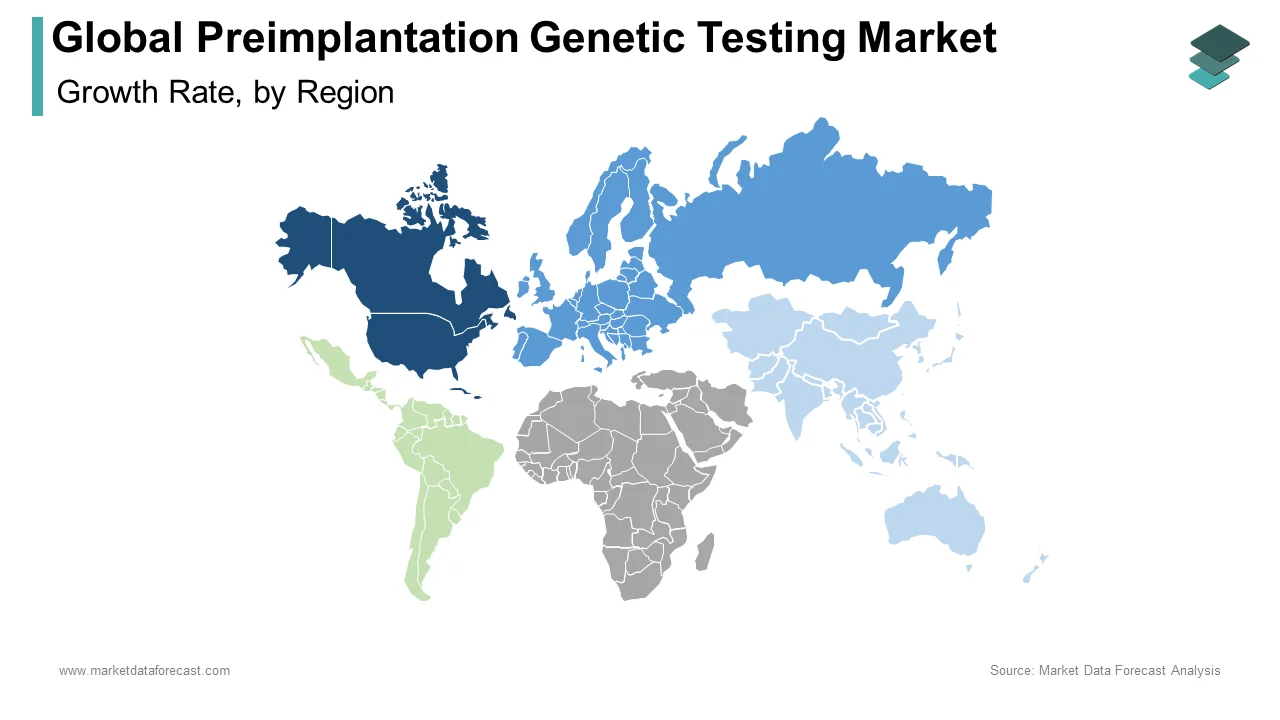

Geographically, the North American preimplantation genetic testing market had the largest share of the global market in 2024 and the same trend is predicted to repeat throughout the forecast period. The presence of advanced healthcare infrastructure, high awareness and acceptance of PGT majorly drive the PGT market growth in North America. The rising disposable income, growing prevalence of genetic disorders and increasing demand for advanced reproductive technologies further boost the North American market growth.

The Europe preimplantation genetic testing market had a noteworthy share of the global market in 2024 and is estimated to grow at a noteworthy CAGR during the forecast period. Stringent regulatory frameworks and favorable reimbursement policies primarily drive the growth of the PGT market in Europe. The rising emphasis on reducing the burden of genetic diseases and increasing availability of PGT services in Europe further boosts the regional market growth. The UK led the market in Europe in 2024 followed by Germany and Spain due to the high infertility rates.

The APAC preimplantation genetic testing market is a lucrative regional market worldwide and is predicted to showcase the fastest CAGR during the forecast period. The growing population, increasing disposable income and rising awareness of PGT in the Asia-Pacific countries majorly drive market growth in the Asia-Pacific region. The growing number of advancements in healthcare infrastructure, increasing number of fertility clinics and rapid adoption of novel genetic testing technologies further fuel the growth rate of the APAC market. In the APAC region, China, India, and Japan are the leading markets; this can be attributed to the huge population and high fertility rates associated with the change in lifestyles, triggering the demand for the usage of preimplantation genetic testing methods.

Latin America is predicted to witness a healthy CAGR during the forecast period due to factors such as the growing adoption of assisted reproductive technologies, increasing awareness of genetic testing, rising number of improvements in healthcare infrastructure, rising healthcare expenditure and government initiatives to promote reproductive health majorly boost the Latin American PGT market growth.

MEA held a moderate share of the worldwide market in 2024 and is predicted to grow steadily during the forecast period. Factors such as the increasing infertility rates, growing awareness about genetic disorders, improved access to healthcare services, rising medical tourism for fertility treatments and increasing number of advancements in reproductive medicine support the PGT market in MEA.

KEY MARKET PLAYERS

Some of the promising companies operating in the global preimplantation genetic testing market profiled in the report are Illumina Inc., Yikon Genomics, CooperSurgical, Oxford Gene Technology, Inc., Thermo Fisher Scientific, Inc., Rubicon Genomics, Inc., Agilent Technologies, Inc., Natera, Inc., Abbott Laboratories, PerkinElmer, Inc. and SciGene Corporation.

Illumina Inc., one of the key market participants in the global preimplantation genetic testing market, was founded by David Walt, Larry Bock, John Stuelpnagel, Anthony Czarnik and, Mark Chee in the year 1998. The company mainly develops, manufactures, and markets integrated systems to analyze genetic variation and testing. It was headed by Francis deSouza, who acted as its CEO and President. As of 2017, it had 5,500 employees and reported net revenue of USD 2.752 billion.

RECENT MARKET DEVELOPMENTS

- India recently reported its first case of a savior sibling and a baby conceived to save a sibling suffering from a chronic disease. In this case, Preimplantation genetic testing was used to identify the embryo with the requisite characteristics of human leukocyte antigen (HLA) so that the sibling could donate stem cells from her bone marrow to her brother suffering from Thalassaemia Major.

- Agilent Technologies Inc. announced the introduction of Agilent OnePGT, a genome-wide, next-generation sequencing (NGS) solution for preimplantation genetic testing (PGT). OnePGT allows the parallel detection of multiple monogenic disorders (PGT-M), translocations (PGT-SR), and aneuploidies (PGT-A) on a single biopsy. This is further expected to increase the options couples have when they try preimplantation genetic testing.

- A new polygenic test has been developed in the USA, which can screen embryos based on their intelligence should they grow to term. Testing for a limited number of diseases via preimplantation genetic testing is currently allowed by law in many countries. Still, these developments further raise many uncomfortable questions about the potential role of doctors in deciding who should live and which embryo should not be born.

KEY HIGHLIGHTS OF THE REPORT

- This report briefly describes the preimplantation genetic testing market and provides a glimpse into what would be covered in the full report.

- Growth, drivers & restrictions, market segmentation, and key players are covered in this report description.

- This report description provides a rough estimate of what the complete report contains, and the final report can be customized according to the client's needs and specifications.

- This could be potentially useful for companies operating in biochemical, pharmaceutical, healthcare, and other allied industries due to its wide scope and coverage.

- The complete report, if purchased, will contain the analysis of various aspects of the industry using Porter’s five forces analysis.

MARKET SEGMENTATION

This research report on the global preimplantation genetic testing market has been segmented and sub-segmented into the following categories and calculated market size and forecast for each segment until 2033.

By Procedure Type

- Preimplantation Genetic Screening

- Preimplantation Genetic Diagnosis

By Technology

- Next-Generation Sequencing

- Polymerase Chain Reaction

- Validation Biomarkers

- Fluorescence in Situ Hybridization

- Comparative Genomic Hybridization

- Single-Nucleotide Polymorphism

By Product and Service

- Reagents and Consumables

- Instruments

- Software and Services

By Application

- Aneuploidy

- Structural Chromosomal Abnormalities

- Single Gene Disorders

- X-Linked Disorders

- HLA Typing

By End-users

- Maternity Centres & Fertility Clinics

- Hospitals, Diagnostic Labs, and Service Providers

- Research Laboratories & Academic Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the key factors driving the growth of the preimplantation genetic testing market?

The growing prevalence of genetic disorders, rising awareness of PGT as a means to prevent genetic diseases, advancements in genetic testing technologies, growing demand for assisted reproductive technologies, and supportive reimbursement policies majorly drive the PGT market growth.

Which segment of the preimplantation genetic testing market is currently leading in terms of procedure type?

The leading segment in the preimplantation genetic testing market in terms of procedure type depends on the specific market dynamics and trends. However, both preimplantation genetic screening (PGS) and preimplantation genetic diagnosis (PGD) are widely adopted procedures, with their respective importance based on patient needs and the indication for testing.

What are the driving factors for each technology segment in the preimplantation genetic testing market?

The driving factors for each technology segment in the preimplantation genetic testing market can include technological advancements, improved accuracy and efficiency, expanded testing capabilities, cost-effectiveness, and compatibility with different genetic testing objectives.

Which regions exhibit significant growth potential in the preimplantation genetic testing market?

Regions such as North America, Europe, and Asia-Pacific exhibit significant growth potential in the preimplantation genetic testing market due to factors such as advanced healthcare infrastructure, rising prevalence of genetic disorders, increasing awareness and acceptance of PGT, supportive reimbursement policies, and expanding fertility clinics.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]