Global Sperm Bank Market Size, Share, Trends & Growth Forecast Report By Donor Type, Services Type, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Sperm Bank Market Size

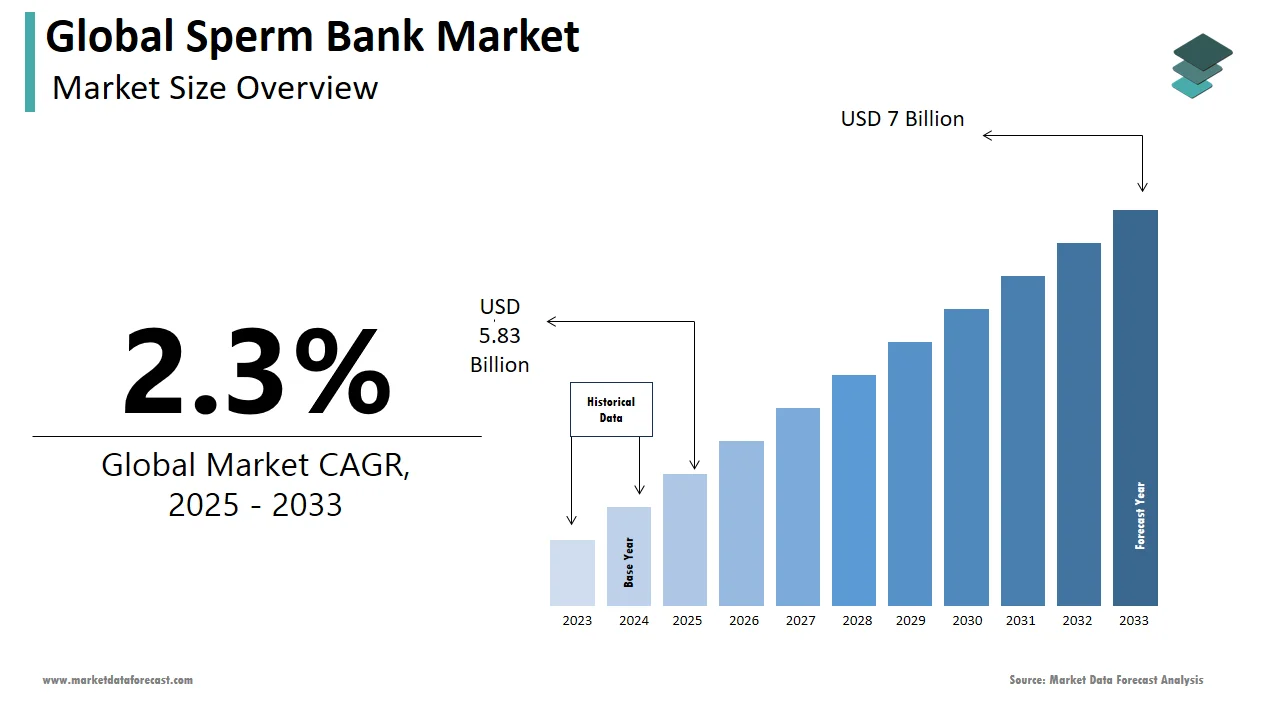

The global sperm bank market was worth US$ 5.7 billion in 2024 and is anticipated to reach a valuation of US$ 7 billion by 2033 from US$ 5.83 billion in 2025, and it is predicted to register a CAGR of 2.3% during the forecast period 2025-2033.

MARKET DRIVERS

The growing prevalence of infertility majorly propels the sperm bank market growth. The number of people suffering from infertility is growing worldwide due to factors such as lifestyle changes, environmental factors and age-related issues.

According to the data published by the World Health Organization (WHO), an estimated 48.5 million couples worldwide suffer from infertility. People who are suffering from infertility have been using assisted reproductive technologies (ART) such as in vitro fertilization (IVF) to increase their chances of conceiving. The sperm of the donor will be used in assisted reproductive technologies. Sperm Bank provides a solution to people who are suffering from infertility by providing high-quality donor sperm. The growing prevalence of infertility is resulting in the increasing demand for donor sperm. Sperm banks have been trying to meet this increasing demand from people by expanding their services.

Technological advancements are further contributing to sperm bank market growth. In recent years, technological advancements have improved the quality of the services that sperm banks provide, increased the success rate of fertility treatments and expanded their reach to more customers. Sperm banks have been using advanced screening methods that are developed using recent technological developments to ensure the quality and safety of donor sperm. Recently, technological developments improved the cryopreservation techniques that sperm banks use to freeze and store donor sperm for future use. Sperm banks have increasingly used online platforms and mobile applications to connect with customers, offer their services, and facilitate the selection and purchase of donor sperm.

Shift in social attitudes towards sperm donation and assisted reproduction in recent years, growing acceptance of the LGBTQ+ community, increasing disposable income to undergo fertility treatments such as IVF and greater awareness among people about the benefits of sperm banking, such as the ability to preserve fertility for future use fuel the growth rate of the sperm banks market. The growing number of initiatives from the governments in favor of sperm banks such as providing financial support for fertility treatments such as IVF and donor sperm usage, shortage of sperm donors in many countries, the success rates of sperm donation and ART, rising prevalence of lifestyle diseases such as obesity and diabetes and rising popularity of fertility tourism contribute to the growth of the sperm bank market.

MARKET RESTRAINTS

The social stigma attached to the concept of sperm donation is one of the major factors hampering the growth of the sperm bank market. Legal and regulatory requirements associated with the sperm banks, high costs of sperm bank services, limited availability, rigorous screening that donors must undergo to ensure that they are healthy and do not carry any genetic diseases and competition from alternative methods for conception such as adoption or surrogacy further hinder the market growth. Furthermore, religious and cultural beliefs about using sperm bank services and poor awareness among potential customers about the availability and benefits of sperm bank services impede the market growth.

Impact Of COVID-19 on The Global Sperm Bank Market

The COVID-19 pandemic has shown an unfavorable impact on the growth of the sperm bank market. During the COVID-19 pandemic, several sperm banks have stopped or limited their operations due to the measures imposed by governments such as government-mandated lockdowns, travel restrictions and social distancing protocols. This has resulted in the reduced demand for the services of sperm banks and affected the market growth negatively. In addition, fertility treatments were postponed or put on hold during the COVID-19 pandemic and this has resulted in the reduced demand for sperm donations due to the health risks associated with it and hampered the growth rate of the market. Furthermore, sperm ranks have had to implement safety measures to continue with the operations during the COVID-19 pandemic such as screening potential donors for COVID-19 and ensuring the safety of staff and recipients during the donation and collection process and this has added to the operating costs and this has affected the revenues of the sperm bank operators and impacted the market growth negatively. Likewise, the sperm bank market has experienced a negative impact from the COVID-19 pandemic. However, the market is expected to recover quickly and pose a healthy CAGR during the forecast period due to the relaxation from the restrictions imposed by the governments and the increasing usage of these services by needy people.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.3% |

|

Segments Covered |

By Donor Type, Services Type, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Fairfax Cryobank, Inc., Xytex Corporation, Andocryos, Cryo-Save AG, Indian Spermtech, New England Cryogenic Center, Seattle Sperm Bank, and London Sperm Bank., and Others. |

SEGMENTAL ANALYSIS

By Donor Type Insights

Based on the donor type, the known donor segment dominated the sperm bank market in 2024 and is expected to continue playing the dominating role during the forecast period. The growing social acceptance and an increasing number of single women and same-sex couples who are looking to start a family majorly drive segmental growth. The rising demand for more personalized and customized donor options is another key factor contributing to the segmental growth.The anonymous donor segment had a considerable share of the worldwide market in 2024 and is anticipated to register a healthy CAGR during the forecast period. The growing demand for assisted reproductive technologies (ART) such as in-vitro fertilization (IVF) and intrauterine insemination (IUI) is one of the major factors propelling segmental growth. The availability and acceptability are further contributing to the segmental growth.

By Services Type Insights

Based on services type, the semen analysis segment led the market in 2024 and is expected to grow promisingly during the forecast period. The growing demand for accurate and reliable sperm testing services majorly propels segmental growth. The rising awareness of male fertility issues, the increasing need for early detection and treatment, and the availability of advanced laboratory techniques and equipment have made it easier to perform semen analysis tests accurately and efficiently further contributing to the growth rate of the segment.The sperm storage segment is expected to show a lucrative CAGR during the forecast period. Factors such as the rising awareness about fertility preservation and the growing number of individuals who want to delay having children primarily boost segmental growth. The rising acceptance and availability of sperm-freezing technologies that can increase the chances of successful conception later in life, and advances in cryopreservation techniques have made it possible to store sperm for long periods without significant loss of viability further fuel the growth rate of the segment.

By End-User Insights

Based on the end-user, the in-vitro fertilization segment is expected to grow rapidly during the forecast period. The growing demand for ART treatments is one of the key factors boosting segmental growth. The rising prevalence of infertility issues that have led to greater demand for advanced fertility treatments like IVF is further driving segmental growth. In addition, improvements in IVF success rates and the availability of pre-implantation genetic testing (PGT) have made IVF a more attractive option for couples and individuals struggling with infertility contributing to the growth rate of the IVF segment.The donor Insemination segment is predicted to account for a notable share of the global sperm bank market during the forecast period. The growing number of single women and same-sex couples who are looking to start a family, increasing social acceptance of non-traditional family structures, and advances in assisted reproductive technologies (ART) and cryopreservation techniques have made it easier to store and use donor sperm are majorly contributing to the segmental growth.

REGIONAL ANALYSIS

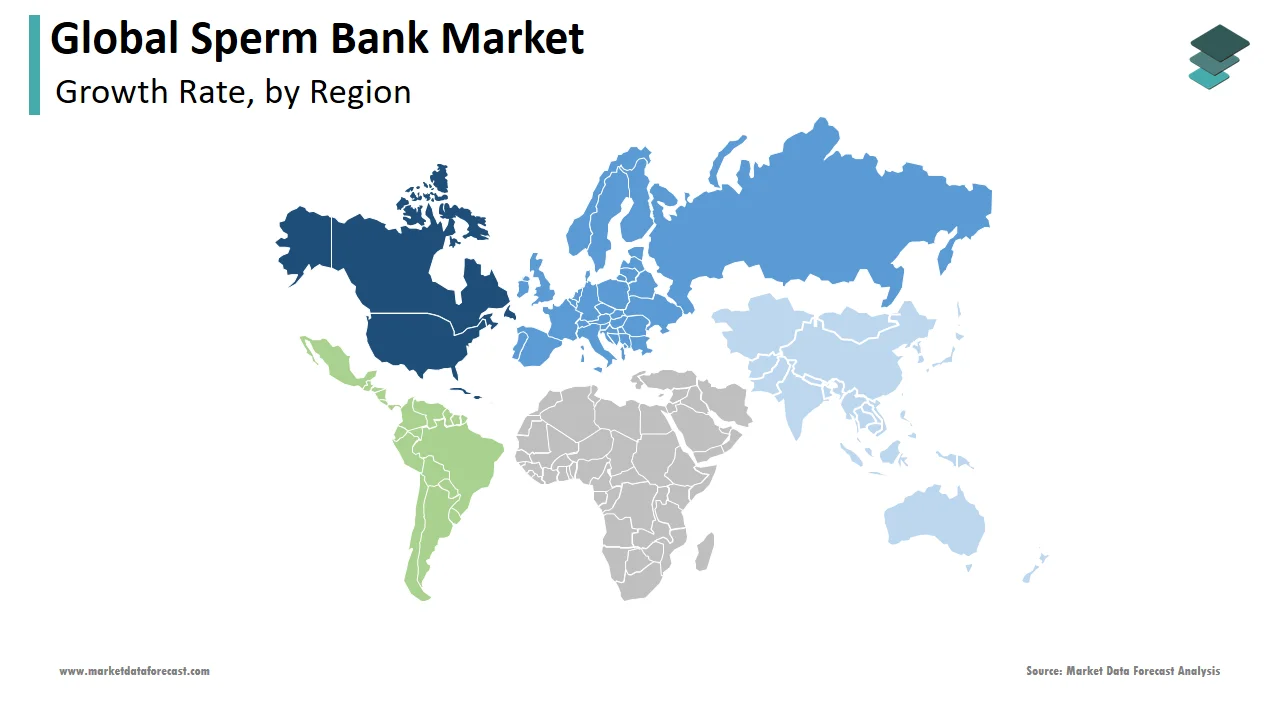

North America was the biggest regional segment in the worldwide market in 2024 and is expected to grow at a promising CAGR during the forecast period. The growing healthcare expenditure, the availability of advanced medical facilities and treatments such as sperm banks, rising social acceptance of non-traditional family structures such as same-sex couples and single mothers and the high prevalence of infertility primarily drive the North American market. In addition, a strong focus on R&D, the presence of key market participants such as California Cryobank and Fairfax Cryobank, the availability of advanced technologies for sperm cryopreservation, analysis, and genetic testing and a favorable regulatory environment contribute to the growth rate of the North American market. The U.S. occupied the largest share of the North American market in 2024, followed by Canada and the same trend is anticipated to repeat throughout the forecast period. The growth of the U.S. market is primarily driven by the presence of notable market participants and an increasing number of sperm donors.

Europe is another major regional segment in the worldwide market and is anticipated to hold a substantial share of the global market during the forecast period. Factors such as the liberal legal frameworks that support sperm donation, the rising prevalence of infertility, growing demand for ART treatments like sperm donation and IVF and the availability of advanced technologies for sperm cryopreservation, analysis and genetic testing boost the regional market growth. Cultural openness towards non-traditional family structures, the presence of key market players such as Cryos International, European Sperm Bank, and Androcryos, rising medical tourism and the presence of well-developed healthcare infrastructure further promote the regional market growth. Denmark had the major share of the European market in 2024. During the forecast period, countries like the UK and France are anticipated to hold a considerable share of the European market.

APAC is anticipated to hold a considerable share of the worldwide market during the forecast period. The growing patient population of infertility in APAC, increasing demand for ART treatments like sperm donation and IVF, cultural attitudes towards sperm donation and non-traditional family structures vary widely in Asia and growing awareness of infertility issues and ART treatments in many Asian countries drive the sperm bank market in the Asia-Pacific region. Global Doctor, Reproductive Health Science Pvt. Ltd., and Cryo-Save are some of the notable players in the APAC market. The growing disposable income and an increasing number of initiatives by several APAC countries to promote ART treatments like sperm donation and IVF to address the issue of low fertility rates favor the growth rate of the APAC market. China led the APAC sperm bank market in 2024.

Latin America had a considerable share in the worldwide market in 2024 and is expected to grow at a healthy CAGR during the forecast period.

MEA held a moderate share of the global market in 2024 and is predicted to progress at a steady CAGR in the coming years.

KEY MARKET PLAYERS

Companies playing a notable role in the global sperm bank market are Fairfax Cryobank, Inc., Xytex Corporation, Andocryos, Cryo-Save AG, Indian Spermtech, New England Cryogenic Center, Seattle Sperm Bank, and London Sperm Bank.

RECENT MARKET DEVELOPMENTS

- In 2022, Legacy, a top digital fertility clinic for people with sperm, announced that it had raised a USD 25M Series B funding round led by Bain Capital Ventures with participation from existing investors FirstMark Capital.

- European Sperm Bank ("ESB") has taken by Perwyn in 2022. Perwyn supports the ESB management in growing the donor bank and technology.

- In 2022, Dadi, a fertility company of sperm testing, analysis, and storage, is taken by DTC healthcare company Ro.

MARKET SEGMENTATION

This market research report on the global sperm bank market has been segmented based on the donor type, services type, end-user, and Region.

By Donor Type

- Known Donor

- Anonymous Donor

By Services Type

- Sperm Storage

- Semen Analysis

- Genetic Consultation

By End-User

- Doner insemination

- In-vitro Fertilization

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global sperm bank market worth in 2024?

The global sperm bank market size was valued at USD 5.7 billion in 2024.

Which segment by end-user held the major share in the sperm bank market?

Based on the end-user, the IVF segment led the sperm bank market in 2024.

Which region led the sperm bank market in 2024?

Geographically, the North American region accounted for the major share of the sperm bank market worldwide in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com