Global Proteomics Market Size, Share, Trends & Growth Analysis Report – Segmented By Instrument Type (Protein Microarrays, Spectroscopy, X-Ray Crystallography, Chromatography, Electrophoresis, Surface Plasmon Resonance and Protein Fractionation), Reagents, Software & Service, Application and Region – Industry Forecast From 2025 to 2033

Global Proteomics Market Size

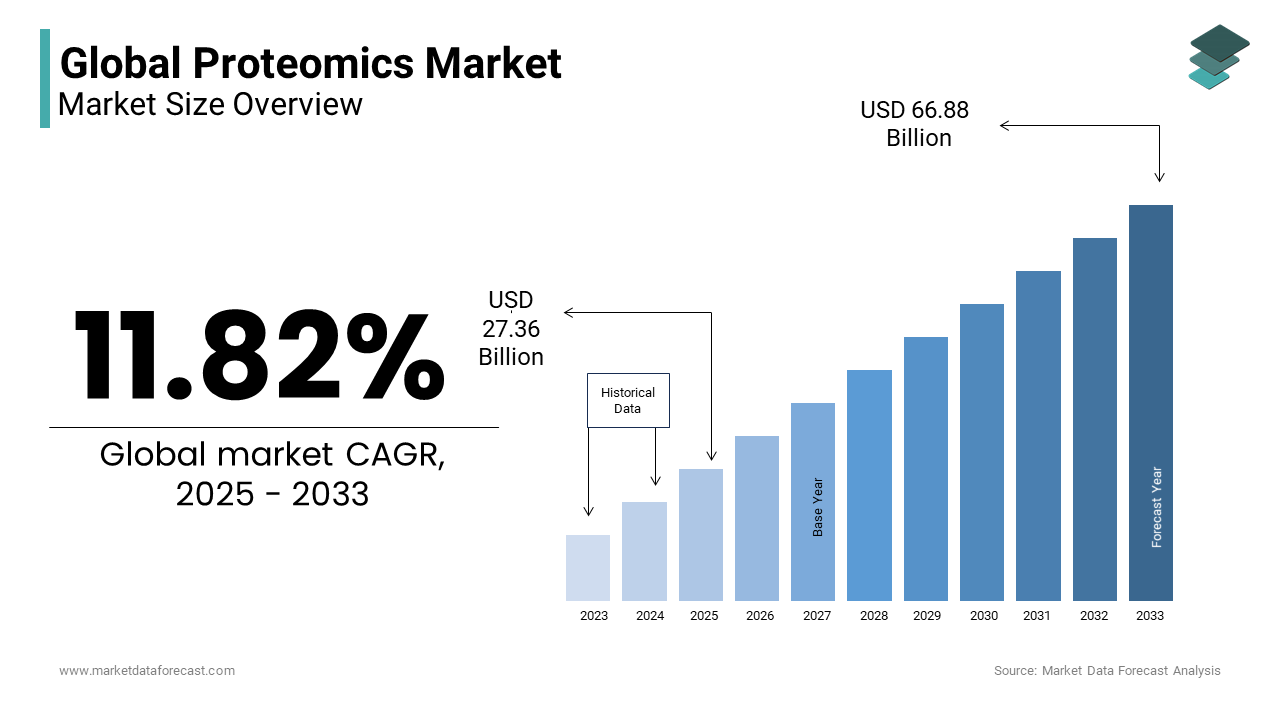

In 2024,the global proteomics market was valued at USD 24.47 billion and it is expected to reach USD 66.88 billion by 2033 from USD 27.36 billion in 2025, growing at a CAGR of 11.82 % during the forecast period 2025 to 2033.

MARKET DRIVERS

The growing adoption of and demand for personalized medicine is one of the key factors driving the proteomics market growth.

Proteomics helps with the understanding of proteins and pathways that are involved in diseases and assists in the identification of appropriate biomarkers that can be used in the diagnosis and monitoring of diseases. The data shared by proteomics research is further used to develop targeted therapies that can be more effective in curing diseases and gives fewer side effects than traditional diseases. In recent years, the adoption of personalized medicine has grown significantly due to its benefits such as better patient outcomes and improved healthcare efficiency, and the trend is expected to continue in the coming years, which is predicted to result in the growing usage of proteomics and accelerate the growth rate of the market.The growing number of investments in the R&D of proteomics is another significant factor in boosting the growth rate of the proteomics market.

In recent years, the proteomics market has experienced several investments by market participants considering the rising demand for new drug targets and personalized medicine. The need for early detection and treatment of diseases is growing significantly due to the benefits associated such as improving patient outcomes, reducing healthcare costs, and minimizing the burden of chronic diseases and this requires the development of more precise and efficient diagnostic tools, in which proteomics can potentially help.

Technological advancements in proteomics are further fuelling the growth rate of the market.

The research of proteins has experienced several technological developments over the last few years and improved accuracy and efficiency. Technological developments such as mass spectrometry, protein microarrays, and next-generation sequencing have helped to improve the sensitivity, speed, and accuracy of proteomic analysis. For instance, mass spectrometry has gained recognition as one of the effective tools to analyze proteins and identify biomarkers for diseases. During the forecast period, technological developments are predicted to further boost the capabilities of proteomics and contribute to the market growth as more and more companies and researchers are willing to use the proteomics technology for the development of new drugs, diagnostics, and personalized medicine solutions.

In addition, the growing prevalence of chronic diseases is boosting the proteomics market growth. The increasing patient population suffering from chronic diseases has resulted in the increasing demand for proteomics research disease diagnosis, treatment, and monitoring. The growing demand for bioinformatics tools and an increasing number of favorable initiatives and growing funding by the governments are propelling the proteomics market growth. The rising number of collaboration activities between pharmaceutical and biotechnology companies and an increasing number of advancements in protein expression technologies are favoring the growth of the proteomics market.

Furthermore, rising emphasis on drug discovery and development, increasing usage of proteomics in agriculture and food industries, rising adoption of personalized nutrition and the increasing importance of biomarker discovery in diagnostics are contributing to the proteomics market growth. Factors such as the growing demand for quality control in pharmaceuticals and biologics, rising usage of proteomics in veterinary medicine and the growing number of advancements in proteomics research for infectious diseases and vaccine development support the growth of the proteomics market.

MARKET RESTRAINTS

The complexities associated with the data analysis of proteomics are one of the notable factors impacting the market growth negatively. High costs associated with the equipment used for proteomics research and the scarcity of skilled professionals are further hindering market growth. The stringent regulatory environment for proteomics technologies and poor awareness among healthcare professionals regarding the potential benefits of proteomics are impeding market growth. Increasing competition from other technologies is another notable obstacle to the growth of the proteomics market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Instrument Type, Reagents, Software & Service , Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Leader Profiled |

Agilent Technologies Inc., Bio-Rad Laboratories, Inc., Bruker Corporation, Danaher Corporation |

SEGMENTAL ANALYSIS

By Instrument Type Insights

Based on instrument type, the protein microarrays segment was the biggest segment in 2024 and is expected to continue holding a substantial share of the global market during the forecast period. Protein microarrays have the ability to simultaneously measure multiple proteins in a single experiment which is not possible with the traditional methods is one of the major factors for the growing adoption of protein microarrays and the same is contributing to the growth of the segment. In addition, the growing usage of protein microarrays in drug discovery, biomarker discovery, and diagnostics is propelling the growth rate of the segment. Furthermore, rising demand for personalized medicine and increasing need for high-throughput technologies are predicted to fuel the growth of the protein microarrays segment during the forecast period.The spectroscopy segment is predicted to account for a considerable share of the global proteomics market during the forecast period. Infrared spectroscopy, nuclear magnetic resonance (NMR) spectroscopy, and mass spectrometry are some of the spectroscopy techniques and the usage of these techniques is growing rapidly in proteomics research. The rising demand for spectroscopy techniques in drug discovery and research and an increasing number of laboratories performing proteomics research globally are further contributing to the growth of the spectroscopy segment in the worldwide proteomics market.

By Reagents Insights

Based on reagents, the immunoassay reagents segment had the major share of the global proteomics market in 2024 and is expected to account for the highest share of the global market during the forecast period. The growing usage of immunoassays in proteomics due to their high sensitivity and specificity is one of the key factors propelling segmental growth. The growing number of applications of immunoassays including clinical diagnostics, drug discovery and development, and biomarker identification is another major factor contributing to the segment’s growth rate. Recent technological advancements such as multiplex immunoassays have made it possible to measure multiple proteins simultaneously and are more efficient and cost-effective. Furthermore, increasing demand for personalized medicine and rising usage of proteomics in drug discovery are predicted to boost the segment’s growth rate during the forecast period.

By Software & Service Insights

Based on software and service, the data analysis and maintenance segment is predicted to witness a healthy CAGR during the forecast period. The growth of the segment is primarily driven by the increasing need for the effective management and interpretation of the data generated by proteomics research. The growing adoption of advanced data analysis technologies such as AI, ML, and big data analytics to improve the efficacy and accuracy of proteomics research is contributing to segmental growth.

By Application

Based on application, the clinical diagnostics segment accounted for the largest share of the global proteomics market in 2024 and the domination of the segment is predicted to continue during the forecast period. Factors such as the rising demand for personalized medicine and the increasing need for early and accurate disease diagnosis are propelling segmental growth.On the other hand, the drug discovery segment is expected to grow at the highest CAGR during the forecast period. The growing demand for new and innovative drugs is primarily driving the growth of the segment.

REGIONAL ANALYSIS

Geographically, the North American region had the largest share of the global market in 2024 and is expected to grow at a promising CAGR during the forecast period. The growth of the North American market is primarily driven by the growing patient population suffering from chronic diseases and the rising demand for personalized medicine. In addition, the presence of well-established healthcare infrastructure and rapid adoption of advanced medical technologies by North American countries are contributing to the proteomics market growth in North America. The growing adoption of advanced proteomics technologies in academic and research institutions in the North American region is fuelling the growth rate of the regional market. Increasing healthcare expenditure and favorable reimbursement policies are favoring the North American proteomics market growth. The growing demand for companion diagnostics and the increasing number of pharmaceutical and biotechnology companies in the North American region is further supporting the North American proteomics market growth. The U.S. proteomics market accounted for 74% of the North American market in 2024.

Europe captured a substantial share of the global market in 2024. During the forecast period, the European market is predicted to witness a noteworthy CAGR owing to the increased funding for the R&D of proteomics by the European governments, rising preference towards personalized medicine, and growing demand for advanced diagnostic tools. Rising emphasis on drug discovery and development, an increasing number of collaborations between academic institutions and biotechnology companies, favorable regulatory policies by governmental organizations for the R&D of proteomics, and rising awareness of genetic testing are further promoting the growth rate of the European proteomics market. The UK, Germany, and France held the major share of the European market in 2024.

The APAC regional market is predicted to witness the highest CAGR during the forecast period. The growth of the APAC market is majorly driven by the growing cancer patient population and increasing efforts by the biotechnological and pharmaceutical companies for the development of innovative proteomics products and services. In addition, a growing number of initiatives by the governments of Asia-Pacific in favor of proteomics research, increasing patient population suffering from various diseases, and rising healthcare expenditure are fuelling the proteomics market growth in the Asia-Pacific region. The growing demand for high-quality diagnostic tools and technologies is another notable attribute contributing to the growth of the proteomics market in the Asia-Pacific region. During the forecast period, China and Japan are predicted to occupy the leading share of the APAC market.

Latin America is projected to grow at a healthy CAGR in the coming years. The growth of the Latin American proteomics market can be attributed to the growing number of investments to upgrade the healthcare infrastructure and medical technologies in Latin American countries and the rising adoption of genetic testing and personalized medicine. An increasing number of collaborations between local and international players in the biotechnology industry is further favoring the growth rate of the Latin American market. Brazil, Mexico, and Argentina captured a major share of the Latin American market in 2024 and the same trend is estimated to continue throughout the forecast period.

The Middle East and African regional market is anticipated to hold a moderate share of the global market during the forecast period. The growing focus on improving healthcare infrastructure and services is boosting the proteomics market growth in MEA. Saudi Arabia, UAE, and South Africa are predicted to capture a major share of the MEA market during the forecast period.

KEY MARKET PLAYERS

Companies leading the global proteomics market profiled in the report are Agilent Technologies Inc., Bio-Rad Laboratories, Inc., Bruker Corporation, Danaher Corporation, GE Healthcare, Luminex Corporation, Merck KGaA, PerkinElmer Inc., Thermo Fisher Scientific, Inc. and Waters Corporation.Agilent Technologies Inc. is an American company that was established in 1999 as a spin-off of Hewlett-Packard. It’s a public research, development, and manufacturing company. When the IPO for the company was released, it was the largest in Silicon Valley at that time. It is headquartered in Santa Clara, California, has more than 13,500 employees as of 2017, and reported net revenue of USD 4.5 billion in that year.

RECENT HAPPENINGS IN THIS MARKET

- Proteomics succeeded where genomics had failed in this case. German doctors used a new neutrophil proteome database to diagnose two children with severe congenital neutropenia whose typical sequencing had failed.

- Researchers from the University of Copenhagen have studied large amounts of data from tissue samples of the skin to map its molecules and functions. As a result, they have been able to create skin atlas using the data. This will help scientists understand the differences between dead skin and living skin in greater detail, allowing for better diagnosis and various diseases.

- A group of scientists from the Centre for Genomic Regulation (CRG) in Barcelona, led by the ICREA Research Professor Luciano di Croce, Sergio Aranda, lead author and co-leader of the study, and Eduard Sabidó, head of the CRG/UPF Proteomics Unit, have identified a molecular mechanism that regulates stem cell division speed. Furthermore, this study found that AHCY protein plays an essential and irreplaceable role in human fertility.

MARKET SEGMENTATION

This research report on the global proteomics market has been segmented and sub-segmented based on the Instrument Type, Reagents, Software & Service , Application and Region.

By Instrument Type

- Protein Microarrays

- Spectroscopy

- X-Ray Crystallography

- Chromatography

- Electrophoresis

- Surface Plasmon Resonance

- Protein Fractionation

By Reagents

- Protein Microarray Reagents

- X-Ray Crystallography Reagents

- Spectroscopy Reagents

- Chromatography Reagents

- Electrophoresis Reagents

- Immunoassay Reagents

By Software & Service

- Analytical Laboratory Services

- Data Analysis & Maintenance

- Quantitation Services

By Application

- Diagnostics

- Drug Discovery

- Other Proteomic Application

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the key drivers of the proteomics market?

The major growth factors include advancements in mass spectrometry, rising demand for personalized medicine, increasing government funding, and growing research in drug discovery.

Which region is growing the fastest in the global proteomics market?

Geographically, the North American proteomics market accounted for the largest share of the global market in 2024.

At What CAGR, the global proteomics market is expected to grow from 2024 to 2033 ?

The global proteomics market is estimated to grow at a CAGR of 11.82% from 2024 to 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]