Global Recycled Copper Market Size, Share, Trends & Growth Forecast Report By Application (Building and Construction, Transportation, Industrial Machinery and Equipment, Electricity and Electronics, and Others), By Copper Scrap Grade (Bright Bare Copper, Number 1 Copper, Number 2 Copper and Number 1 Insulated Wire) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Recycled Copper Market Size

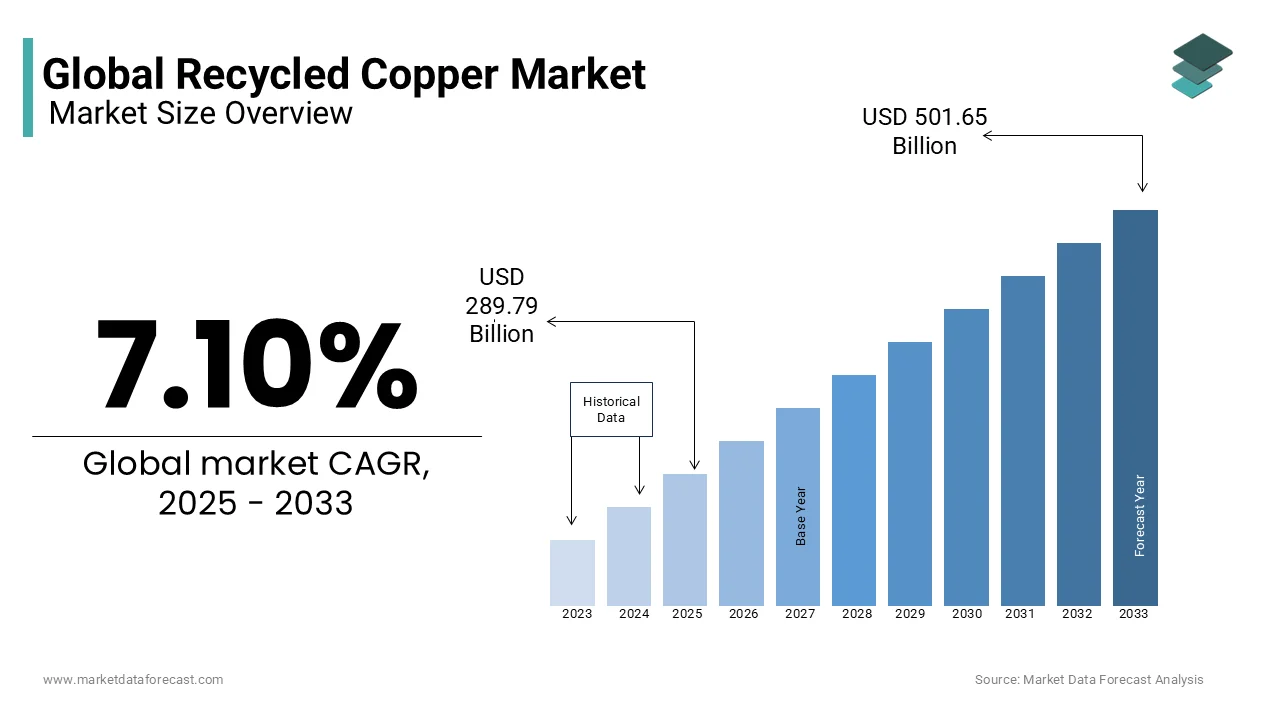

The size of the global recycled copper market was worth USD 270.58 billion in 2024. The global market is anticipated to grow at a CAGR of 7.10% from 2025 to 2033 and be worth USD 501.65 billion by 2033 from USD 289.79 billion in 2025.

Copper is one of the few materials that can be recycled repeatedly without losing performance. Recycling copper helps meet the annual demand for copper and conserves valuable natural resources by saving energy and reducing carbon dioxide emissions. The global recycled copper market accounted for significant growth in the past years and is anticipated to grow remarkably during the forecast period. The growing demand for copper due to population growth, product innovations, and economic development creates opportunities for the recycled copper market growth. According to the reports, about 32 percent of annual copper use in the last decade came from recycled sources. On average, 26.7 million tonnes of copper were used globally. The growing innovations and technological advancements are accelerating growth opportunities.

MARKET DRIVERS

The growing emphasis on secondary metal production due to environmental concerns such as energy consumption and waste disposal is majorly driving the growth of the recycled copper market worldwide. Copper is ubiquitous in the equipment that modern life increasingly depends on, including high-tech products, electrical installations, motors, solar systems, and smart buildings. Cabling and electrical infrastructure are key revenue-generating sectors for recycled copper, as copper is widely recycled without losing its chemical and physical properties. The high rate of urbanization and industrialization in the Asia Pacific and the Middle East is expected to boost the construction industry, which will have a greater impact on metal demand in the coming years.

Constant technological updates and increased focus on metal recycling due to strict legislation are likely to improve the metal recycling rate, helping to achieve big gains for the entire market over the course of the forecast period. Recycled copper has been found to help increase the energy efficiency of many electrical systems. The copper recycling process uses much less energy than primary copper production. Therefore, outside of electronics, manufacturers in the recycled copper market are exploring value recovery opportunities in the industrial machinery and equipment sector to expand their revenue streams. Technical advances in design with better performance have led to greater acceptance of electric vehicles. This is expected to boost the transportation segment of the Asia-Pacific recycled copper market in the near future.

MARKET RESTRAINTS

An inefficient recycling process is a significant factor hampering the growth of the recycled copper market for years to come. For Instance, the recycling of ferrous metals constitutes more than 40% of its total production. This is attributed to an inefficient recycling process and machines that cannot obtain scrap from the total waste generated. One of the major challenging factors restricting the expansion of the recycled copper market is ensuring the quality of the recycled products, which is mainly the contamination concern. Recycling involves the collection of copper scrap from various sources, such as plumbing, wiring, and electronic circuits, which are of different quality, and the risk of contamination is high, which affects the quality and purity of the copper. This is hindering the global market growth. Another factor is the limited supply and availability of copper scrap, which is expected to restrain market growth. The rising demand for copper from various industries is creating a burden on the manufacturers. However, the availability of copper scrap for recycling is limited. It could be more consistent on factors like the lifespan of copper-containing products and demolition and renovation activities, limiting market growth opportunities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.10% |

|

Segments Covered |

By Application, Copper Scrap Grade, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Aurubis AG, Commercial Metals Company, Schnitzer Steel Industries, Inc., Umicore N.V., Kuusakoski Group Oy, Sims Metal Management Ltd., OmniSource, LLC, Elgin Recycling, Pacific Metal Pty Ltd, Aaron Metals, Universal Recycling, Wilton Recycling, SA Recycling LLC, European Recycled Metal and LKM Recycling and Others. |

SEGMENTAL ANALYSIS

By Copper Insights

The scrap grade segment had 36.6% of the global recycled copper market in 2024 and emerged as the most dominating segment based on copper type. Scrap-grade copper is majorly sourced from post-consumer and industrial scrap materials and is recognized as the environmentally friendly alternative to virgin copper. The growth of the scrap-grade segment is primarily attributed to the availability of industrial scrap from the manufacturing and construction industries and stringent environmental regulations that promote recycling and sustainable practices.

The bright bare copper segment is anticipated to register a healthy CAGR during the forecast period. Bright bare copper is a premium-grade recycled copper mostly used in the electrical and telecommunications industries. The demand for high-quality conductive materials in these industries is on the rise, which is primarily contributing to the growth of the bright bare copper segment in the global market.

By Application Insights

Due to copper's excellent electrical conductivity and corrosion resistance, the electricity and electronics segment held the most significant share of the global recycled copper market. The wide usage of copper in various electrical and electronic devices, including wires, cables, connectors, and motors, propels the segment's growth rate. The increased demand for copper in consumer electronics such as smartphones, laptops, and televisions fuels the segment revenue. The increasing number of electronic devices and escalating technology are enhancing the rise in global e-waste generation, contributing to the significant recycled copper market opportunities. The rise in demand for electronic devices is anticipated to fuel the importance of recycling copper from e-waste, leading to segment growth.

The building and construction segment is expected to grow prominently in the coming years. The construction industry is the largest producer of waste, and sustainable materials like copper are becoming valuable as they replace plastic building materials, which are rarely recycled. This enhances the demand for recycled copper in the industry, expanding the segment revenue.

REGIONAL ANALYSIS

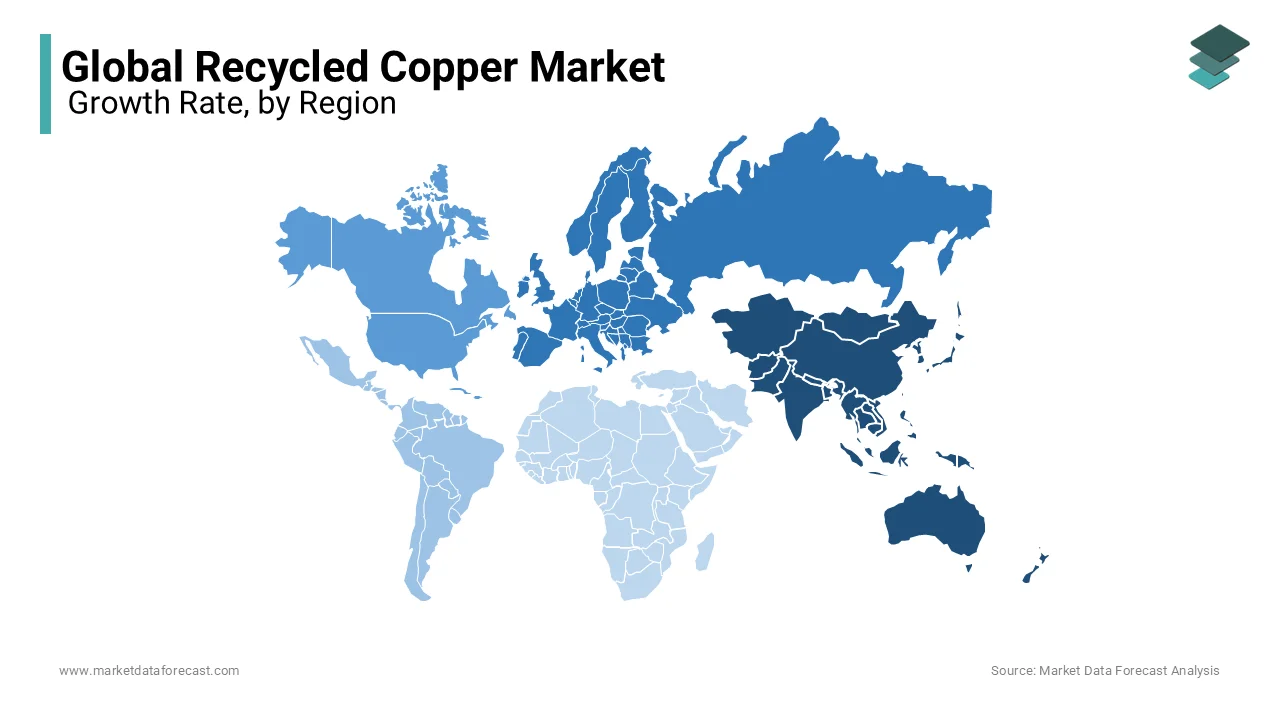

Asia-Pacific dominated the recycled copper market worldwide in 2024. The lead of the Asia-Pacific region in the global market is primarily due to the rapidly growing manufacturing industry, increasing number of infrastructure development projects, and rising awareness of the benefits of recycled materials. China is a critical country in the manufacture of electronic products. The increasing demand for recycled copper in the global electronics market due to rapid urbanization and improved lifestyle has increased the electronics market in China. China plans to make significant investments worth USD 2.7 trillion in the transport and infrastructure sector, which will have a subsequent positive impact on the demand for metals and is, therefore, likely to contribute significantly. China, India, and Japan are the largest producers and consumers of copper worldwide.

Europe is a promising regional segment for recycled copper worldwide and is predicted to account for a substantial global market share during the forecast period. At the total size of the market for recycled metals on time, Europe has a vital share of the global recycled copper market, where Germany accounted for a significant part of the recycled copper market in Europe in 2023. It is expected to be the largest copper-consuming country in Europe during the forecast period. The initiatives from the governments of European countries to promote recycling and increase awareness among industries regarding the environmental benefits of using recycled copper in Europe are propelling the European market growth.

North America is anticipated to play a vital role in the global market during the forecast period. The demand for and usage of recycled copper in industries such as construction, electronics, and automotive across the North American region is primarily boosting regional market expansion. The rapid adoption of electric vehicles (EVs) and renewable energy technologies in North America further promotes the growth of the North American market.

The Latin American recycled copper market is estimated to grow considerably during the forecast period. The growing government initiatives implementing regulations and policies encouraging recycling and e-waste management propel regional market growth. The governments are actively involved in the growth of public awareness campaigns and educational initiatives among the people, increasing the growth opportunities.

The Middle East and African recycled copper market is estimated to have steady growth during this period. The growing demand for copper in the construction and electronics industries is propelling the regional market growth. Most industries are focusing on sustainability due to concerns regarding the environmental effect, enhancing the demand for recycled copper in various industries and fueling regional growth.

KEY MARKET PARTICIPANTS

Companies playing a prominent role in the global recycled copper market include Aurubis AG, Commercial Metals Company, Schnitzer Steel Industries, Inc., Umicore N.V., Kuusakoski Group Oy, Sims Metal Management Ltd, OmniSource, LLC., Elgin Recycling, Pacific Metal Pty Ltd, Aaron Metals, Universal Recycling, Wilton Recycling, SA Recycling LLC, European Recycled Metal and LKM Recycling.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, AMTE Power, a prominent UK firm specializing in developing and producing lithium-ion and sodium-ion battery cells for specific applications, announced its sign of memorandum of understanding with CalPac Resources Limited. CalPac Resources is engaged in pioneering technology stemming from green hydrogen manufacturing, designed explicitly for refining copper sourced from industrial scrap materials.

- In February 2023, Toyo Seikan entered into a business alliance agreement with UACJ to promote the horizontal recycling of aluminum cans.

- In January 2022, a Switzerland-based metals and commodities trading firm announced a plan to focus on its electronics recycling efforts to recover copper. According to the Climate Report, the company recovered approximately 27,000 metric tons of copper for recycling last year.

- In October 2022, Wieland announced its plans to invest 80 million Euros in a new copper recycling facility at its primary production site in Germany.

MARKET SEGMENTATION

This global recycled copper market research report has been segmented and sub-segmented based on type, application, and region.

By Copper

- Scarp Grade

- Bright Bare Copper

- Number 1 Copper

- Number 2 Copper

- Number 1 Insulated Wire

By Application

- Building and Construction

- Transportation

- Industrial Machinery and Equipment

- Electricity and Electronics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the major drivers of the recycled copper market?

The market is driven by factors like rising demand for sustainable materials, the growing emphasis on energy-efficient processes, stringent environmental regulations, and the increasing need for copper in sectors such as construction, electronics, and renewable energy.

What technologies are commonly used in copper recycling?

Technologies include mechanical separation, hydrometallurgical processes, pyrometallurgy, and advanced sorting systems using AI and robotics to improve efficiency and purity.

What role does government regulation play in the recycled copper market?

Governments worldwide promote recycling through tax incentives, import/export restrictions, and environmental regulations. For instance, the EU's Circular Economy Action Plan and China's "Green Fence" policy significantly influence the market.

What is the future outlook for the recycled copper market?

The market's future looks promising, with increasing investments in recycling infrastructure, advancements in processing technology, and rising awareness about environmental sustainability. Growth will be further bolstered by the electrification of vehicles and renewable energy expansion.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com