Global Restaurants and Mobile Food Services Market Size, Share, Trends & Growth Forecast Report By Type (Mobile Food Services, Grill Buffets, Cafeterias, Limited-Service Restaurants, and Full-Service Restaurants), By Ownership (Standalone and Chain), By Pricing (Economy and High-End), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Restaurants and Mobile Food Services Market Size

The global restaurants and mobile food services market was at USD 8.58 billion in 2024 and is anticipated to reach a valuation of USD 15.12 billion by 2033 from USD 9.14 billion in 2025, registering a CAGR of 6.50% during the forecast period 2025 to 2033.

The restaurants and mobile food service market includes restaurant and mobile food service sales and related products by entities that provide catering services to customers who order and are served seated and pay after eating. This market includes revenue from restaurant sales to a delivery service but not revenue from the delivery service itself. The mobile food service and restaurant market is segmented into full-service restaurants, limited-service restaurants, coffee shops, grill buffets, and mobile catering.

MARKET DRIVERS

Globalization Enhances Opportunities and Profitability in the Market

Globalization is expected to pave the way for more joint ventures, foreign investment, global expansion, and multinational companies to establish facilities in high-growth regions, allowing restaurateurs to offer their kitchens to clients around the world. Globalization also makes it easier for restaurants to source exotic ingredients and therefore offer more sophisticated and varied dishes to their customers, thus giving restaurants the opportunity to compete globally. Additionally, this has increased the number of potential restaurant vendors, reducing the bargaining power of suppliers and thus contributing to profitability.

For example, McDonald's produces in many countries and has franchises around the world. It invests in and supports initiatives aimed at adapting its products and services to different locations to secure its global brand. This increase in globalization is likely to stimulate investment and thus drive the restaurants and mobile food services market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.50% |

|

Segments Covered |

By Type, Ownership, Pricing, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Yum China Holdings, McDonald's, Darden Restaurants Inc, Chick-fil-A, Subway, and Others. |

REGIONAL ANALYSIS

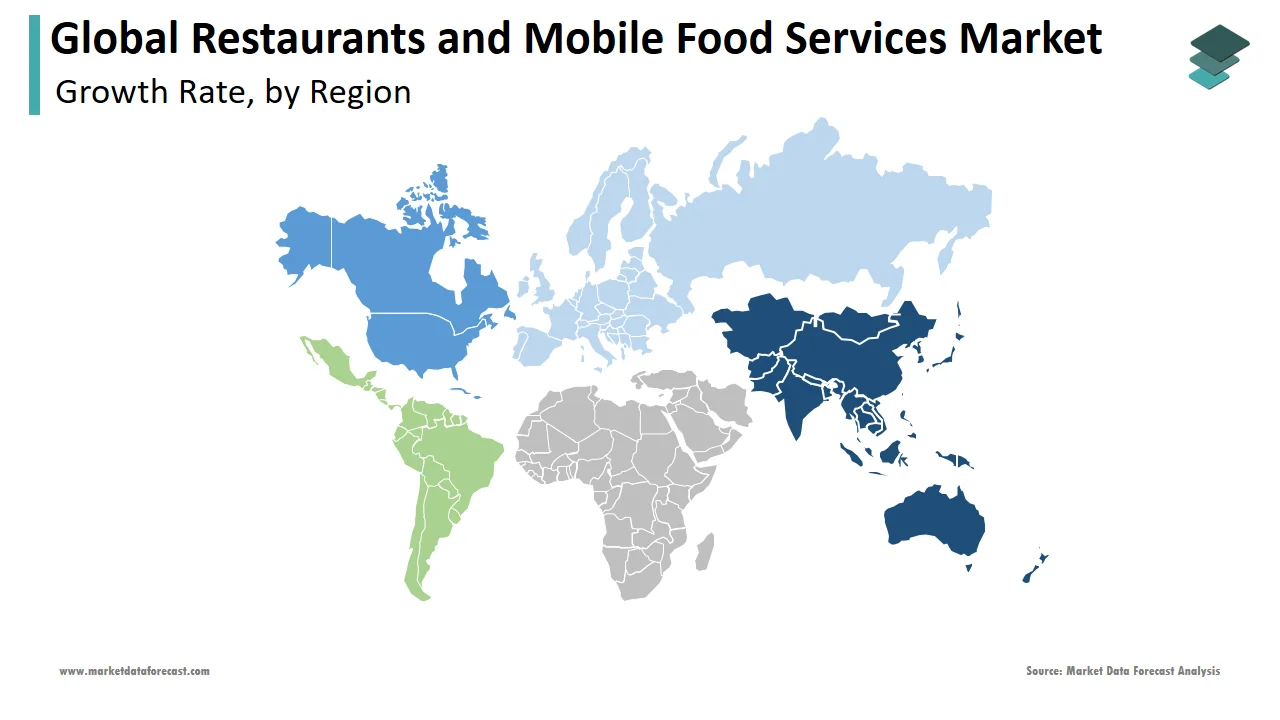

Of these, Asia-Pacific was the largest region in the restaurants and mobile food service market, accounting for 51% of the revenue in 2020. North America was the second-largest region with 24% of the global market. Africa was the smallest region in the market for restaurants and mobile food services. Establishments in the mobile food service and catering market rely heavily on recommendations and reviews, which is why restaurants are promoted through social media platforms.

Mobile apps like GrubHub and JustEat allow customers to view, browse the menu and nutritional information, order, and make reservations. Social media improves customer loyalty and public reputation as customers share photos and reviews, increasing restaurant awareness. For example, restaurants are now embracing live restaurant videos to attract and engage with subscribers online. Therefore, social media is foreseen to be a major driver of the restaurants and mobile food service industry in the coming days.

KEY MARKET PLAYERS

Companies playing a prominent role in the global restaurants and mobile food services market include Yum China Holdings, McDonald's, Darden Restaurants Inc., Chick-fil-A, Subway, and Others.

RECENT MARKET HAPPENINGS

- Grubhub, a leading online and mobile food ordering and delivery marketplace, announced that it has reached an agreement to acquire Tapingo, a leading platform for ordering food.

- Uber is in negotiations to buy online food delivery company Grubhub under a stock deal, according to internal sources. A merger could give money-losing Uber Eats restaurant delivery service an edge over market leader DoorDash at a time when the coronavirus pandemic has shaken Uber's core business, which is commutes between people.

- Groupon acquires the OrderUp mobile ordering and delivery platform as local business markets compete for a share of the revenue from food enthusiasts' smartphones and wallets. Groupon aims to strengthen its presence in the $ 70 billion food ordering and delivery industry, particularly as it spreads to mobile devices. While the online marketplace currently offers many local restaurant and restaurant deals, this acquisition demonstrates Groupon's desire to enable more immediate gratification and impulse purchases for consumers.

- Lavu, an industry leader in mobile payment systems and POS, announced the acquisition of MenuDrive, a branded mobile and online ordering platform for restaurants. Lavu's best mobile point-of-sale system offers restaurateurs a complete management platform that streamlines operations and increases revenue. By leveraging MenuDrive's expertise in the restaurant e-commerce space with Lavu's mobile point-of-sale systems, the combined companies will be even better equipped to help restaurants succeed in today's competitive digital landscape.

MARKET SEGMENTATION

This research report on the global restaurants and mobile food services market is segmented and sub-segmented into the following categories.

By Type

- Mobile Food Services

- Grill Buffets

- Cafeterias

- Limited-Service Restaurants

- Full-Service Restaurants

By Ownership

- Standalone

- Chain

By Pricing

- Economy

- High-End

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com