Global Shea Butter Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Unrefined shea butter, Refined shea butter), Application, and Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and Rest of the World) - Industry Analysis 2025 to 2033

Global Shea Butter Market Size

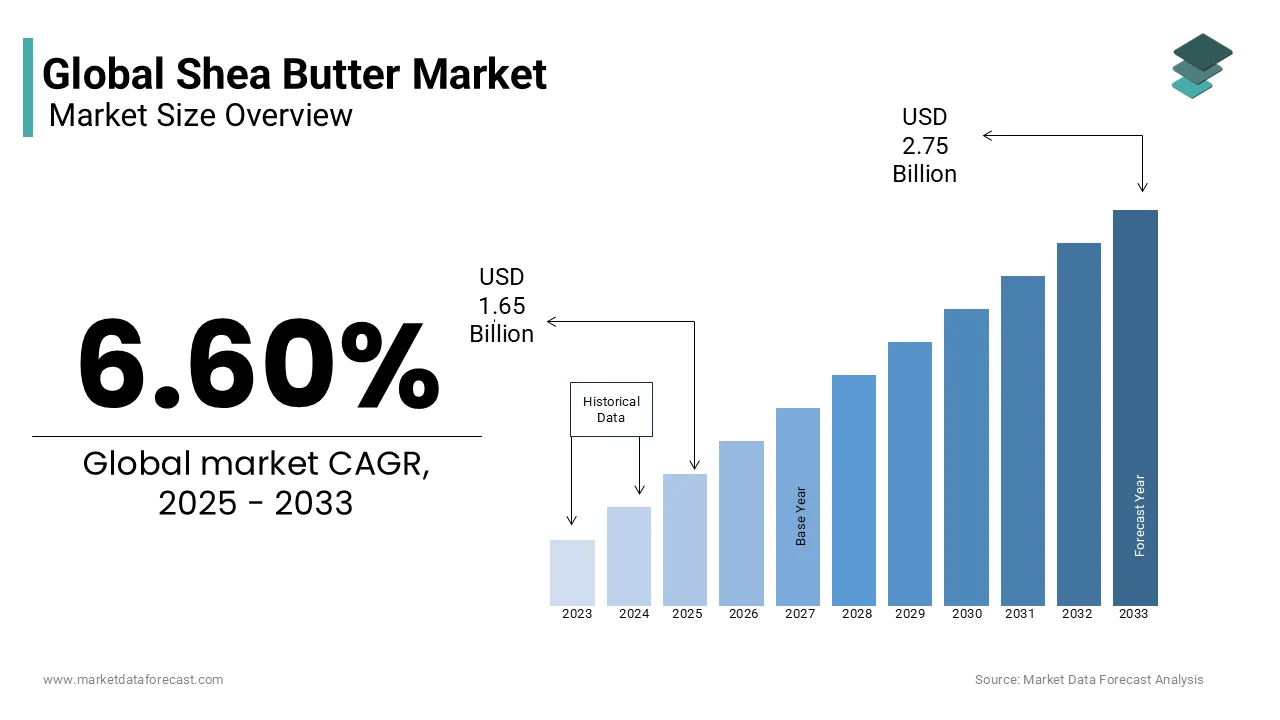

The global shea butter market size was valued at USD 1.55 billion in 2024, and it is estimated to reach at USD 2.75 billion by 2033 from USD 1.65 billion in 2025, expanding at a CAGR of about 6.60% during the forecast period from 2025 to 2033.

Shea butter is used in a variety of hair and skin related products and is a type of fat with various healing properties. It is derived from the seeds of the VitellariaParadoxa (Shea) tree, found mainly in Africa. Shea butter has no artificial chemicals and consists of stearic acid and oleic acid. It is broadly used in cosmetics as skin moisturizers, hair conditioners, and lip gloss. In addition to this, shea butter is used in various industries, such as food and healthcare. Consumers around the world prefer these products. The process of extracting shea butter from walnuts includes multiple methods such as cracking, grinding, roasting, grinding, oil separation, and harvesting and shaping.

As the adoption of shea butter products for cocoa butter or palm oils increases, the market share for shea butter increases. Compared to cocoa and palm oil, shea butter has the advantage of lower fat content and better healing power than before. In addition, shea butter products are potent antioxidants and restore healthy skin and damaged hair. However, cocoa butter contains only polyphenols, which helps relieve stress. Shea butter comprises vitamins A and E, which are essential for the skin and eyes. Also, shea butter contains cinnamic acid, which blocks the skin from UV rays. Also, cocoa butter is an excellent moisturizer, but shea butter is more flexible and can be used in other healing processes, such as skin, hair, and lip healing.

MARKET DRIVERS

Shea butter is obtained from the nuts of the shea tree that contains magnesium, potassium, and protein. The growing demand for cocoa butter alternatives and increased consumption of chocolate and bakery products are expected to lead the market. Additionally, the widespread use of shea butter to replace edible vegetable oils and fats in various food applications will stimulate demand. Bakery and confectionery manufacturers are widely using it as an alternative to cocoa butter due to the limited supply and high price of cocoa. In addition, the high demand for products in the cosmetic and personal care industries will promote market growth. Shea butter contains essential fatty acids like stearic acid and oleic acid and non-saponifiable ingredients like sterol and phenol with moisturizing and conditioning properties. It has a better absorption rate than coconut butter and is suitable for all skin types, and demand is also increasing in the personal care and cosmetic industries.

Furthermore, extensive R&D by cosmetic manufacturers to introduce innovative and compelling products based on shea butter will drive demand in this field. Therefore, personal care and cosmetic applications are supposed to be the largest segment during the outlook period. The increasing consumer willingness to natural products like shea butter and the expanding demand for shea butter in various end-use industries such as cosmetics and food and beverages are key factors driving the growth of the global shea butter market. About 80% of the demand for shea butter is also assumed to come from the confectionery industry. It serves as an alternative to cocoa butter for chocolate makers, and shea butter is rich in flavor and is also used in pancakes and toast.

Cocoa butter is used as a source of fat in chocolate and confectionery to provide the shine, texture, and flavor of the product. As the demand for chocolate and confectionery increases, the demand for cocoa butter increases. However, cocoa butter is experiencing supply restrictions due to a decrease in cocoa production in the leading countries. Therefore, the price of cocoa butter is increasing rapidly, forcing chocolate and confectionery manufacturers to choose alternatives or equivalents to cocoa butter. Manufacturers are increasingly using Shea butter with the potential to replace expensive cocoa butter for chocolate and confectionery applications.

MARKET RESTRAINTS

The high cost of shea butter products is a crucial factor in slowing the growth of the global shea butter market. Furthermore, the availability of a number of alternative products that are cost-effective and readily available to customers to replace shea butter on the market is another critical factor that is suspected of slowing the growth of the global shea butter market during the prognosis period. Furthermore, the absence of minimum quality standards and low levels of industrial organization represents a severe challenge to the growth of the world market for shea butter. The hydrogenation of vegetable oil leads to the production of trans unsaturated fatty acids, which negatively affect cardiovascular health. Because of this, manufacturers are moving toward using margarine and butter processing.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.60% |

|

Segments Covered |

By Type, Application, & region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Star Shea Ltd, Bread For Life, All Pure Nature Ltd, Shea Radiance, VINK CHEMICALS GMBH & CO. KG, Jedwards International, Inc, Lovinah Naturals, Maison Karite Sociedad Limitada, Shebu Industries, Shea Therapy Ltd (formerly trading as AGC Ltd), The Pure Company. |

REGIONAL ANALYSIS

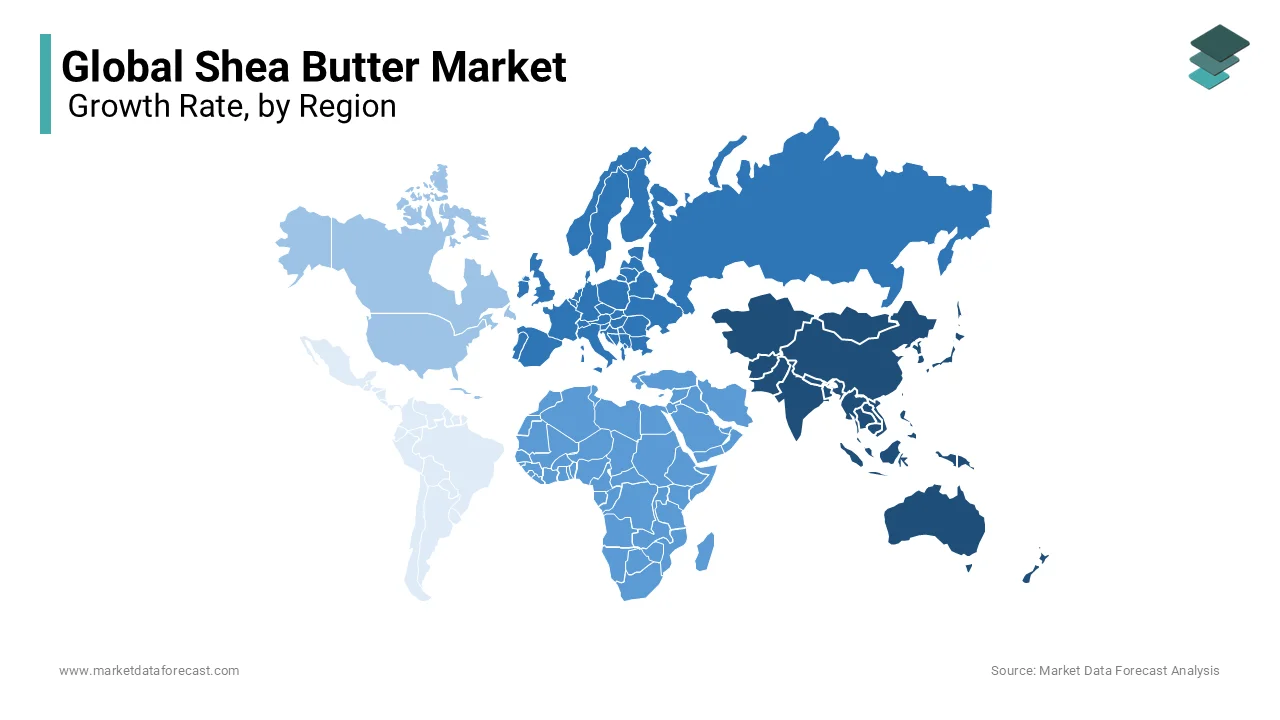

Asia-Pacific, led by Japan, India, and China, is expected to record a CAGR of more than 11% through 2033. The global Shea Butter Market has been categorized based on geography into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa. Changes in consumer preferences and increased awareness of the availability of better health care products skin and health care in the market, followed by strong growth in economies such as India, China and South Korea that lead the reach of the product in this region. The Middle East and Africa shea butter market, led by Burkina Faso and Nigeria, is projected to exceed the CAGR of 10% until 2025. Harvesting and processing of karate shea nuts occurs in the sub-Saharan African belt, and They are then marketed to Asian food and European cosmetic companies. According to the Global Shea Alliance, shea butter is a key commercial product for the African economy, with Burkina Faso, Mali, Ghana, Nigeria, Benin, Togo, and Guinea the main butter producers of shea. The rising dependence of African countries on shea butter exports is a crucial factor promoting the growth of the target market in this area.

Europe accounted for more than 25% of the worldwide shea butter market. The growing concept of premium, high-quality food products with promised health benefits is expected to support the growth of the segment. Changing socio-economic dynamics and increasing purchasing power have forced consumers to pay a high price for basic health products loaded with natural ingredients. Furthermore, strict EU laws to include a minimum of 5% shea butter in chocolate products, indicating a massive growth of shea butter in the European region by 2025.

KEY MARKET PLAYERS

Key Players In Shea Butter Market are Star Shea Ltd, Bread For Life, All Pure Nature Ltd, Shea Radiance, VINK CHEMICALS GMBH & CO. KG, Jedwards International, Inc, Lovinah Naturals, Maison Karite Sociedad Limitada, Shebu Industries, Shea Therapy Ltd (formerly trading as AGC Ltd), The Pure Company.

RECENT HAPPENINGS IN THE MARKET:

-

On November 4, 2019, the Government of Ghana began construction of a shea butter processing plant in Bogrigo in the Bongo District, strengthening domestic production and shea butter in the coming years.

- In August 2018, Palladium invested in Naasakale, a women-owned shea butter manufacturing company, to improve shea production activities in each sector.

- In March 2018, Bunge Limited completed the acquisition of IOI LodersCroklaan.

MARKET SEGMENTATION

This research report on the global Shea Butter Market has been segmented and sub-segmented based on type, application, & region.

By Type

- Unrefined shea butter

- Refined shea butter

By Application

- Cosmetics

- Personal care

- Food

- Medical

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected market size for shea butter by 2033?

The global shea butter market is estimated to reach USD 2.75 billion by 2033.

2. Which region dominates the global shea butter market?

According to the search results, Europe dominated the shea butter market with a share of more than 30% in 2024.

3. What are the key factors driving the growth of the shea butter market?

The growth of the shea butter market is primarily driven by increasing consumer preference for natural and organic skincare products, rising demand in the cosmetics and personal care industry, and the product's versatile applications in food processing.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com