Global Termite Bait Systems Market Size, Share, Trends and Growth Analysis Report – Segmented By Termite Type (Subterranean, Dampwood and Drywood), Station Type (In-Ground and Above-Ground), Application (Commercial & Industrial, Residential, Agriculture & Livestock Farms) and Region (North America, Europe, Asia-Pacific, Middle East & Africa, Latin America) - Industry Analysis From (2025 to 2033)

Global Termite Bait Systems Market Size

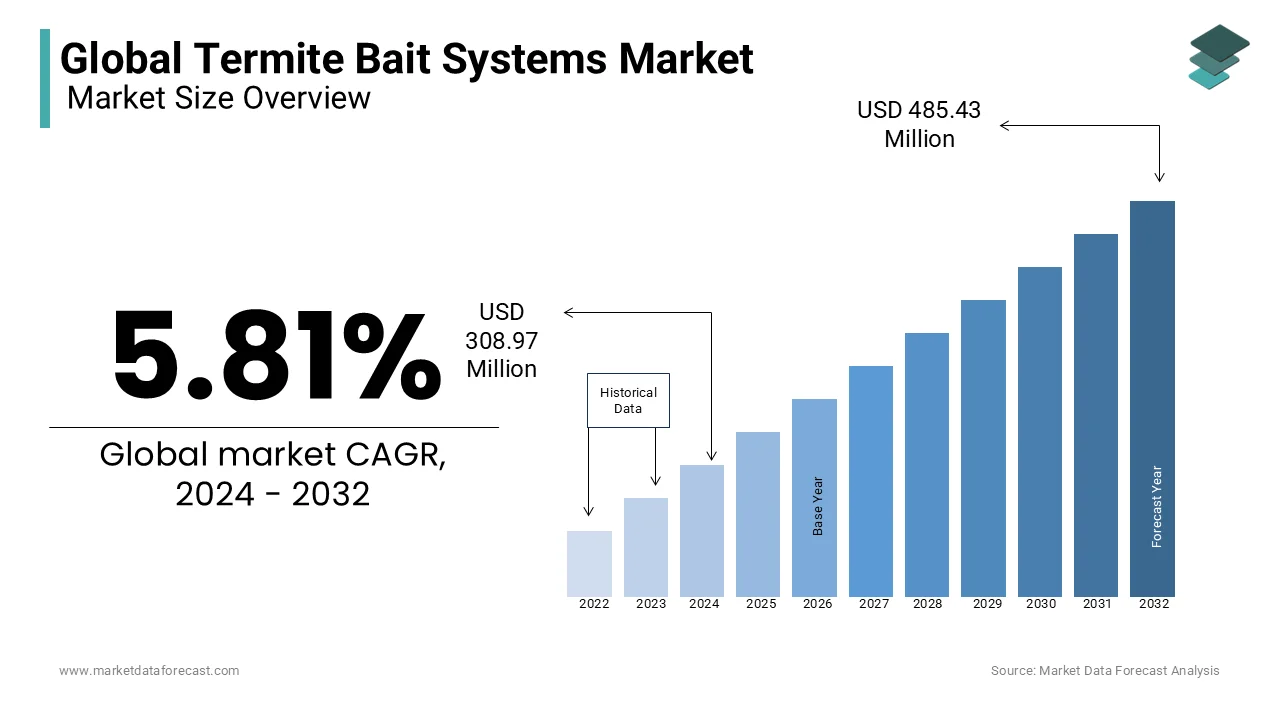

The global termite bait systems market was valued at USD 308.97 million in 2024 and is anticipated to reach 326.92 million in 2025 from USD 513.64 million by 2033, growing at a CAGR of 5.81% from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL TERMITE BAIT SYSTEMS MARKET

The environmental benefits associated with termite bait systems are an important factor contributing to the expansion of this market on a worldwide scale. Due to the growing housing market and the escalating prevalence of the termite population due to poor construction practices, the market for termite bait systems is predicted to grow in the coming years.

Termite baits contain a small amount of wood and pesticides, which help slow the expansion of termites. Termite baits also consist of cardboard, paper, or other acceptable termite foods, combined with a slow-acting substance that is lethal to termites. It also acts as a regulator of insect expansion. Termite treatment in residential areas is done with a liquid termiticide applied to the topsoil.

MARKET TRENDS

New trends in termite bait systems include bait and ground monitoring systems. These systems can be employed alone or in combination with treatment for greater flexibility. Companies in the termite bait system product ecosystem are capitalizing on this trend and are recommending that end-users use liquid termiticide bait systems when setting up stations. This treatment serves as an alternative in cases where liquid termiticides are not a practical solution to control termites. The market for termite bait systems is a relatively small sector in the termite control industry; however, the market has grown at a significant rate due to the growing need for effective termite management with less toxic methods in different industries, such as commercial and residential in developed countries.

MARKET DRIVERS

The world's urban population grew rapidly from 746 million in 1950 to more than 4 billion in 2016, according to United Nations data.

As a result, there has been a rebound in the housing, infrastructure, and hospitality sectors. Termites were able to adapt to growing urban settlements due to the use of termiticide products in higher doses without the introspection of a certified pest control service provider. This led to escalated resistance to chemicals. Customers in residential areas have also been proactive enough to take such preventative measures for the structural protection of their homes. To maintain public health and hygiene, pest control has been sought as an important tool in urban cities in developed countries. The greater spending capacity of this demographic group has also been a factor in the provision of these services.

MARKET RESTRAINTS

The main factors hampering market expansion are high initial investment, contract maintenance renewal costs, and lack of awareness. In the case of bait systems, the cost of installation and bait components are included in the cost of the active ingredient. Therefore, bait systems are more expensive than conventional chemical treatments. Additionally, bait systems require multiple visits to the structure to monitor for termites and assess whether additional baits are needed.

The market has strong prospects in the coming years, such as a high consumer preference for innovative and sustainable products and growing market opportunities in urban residential areas. Each bait system is composed of an active ingredient, which is an insect expansion regulator or a chitin expansion inhibitor. It is a non-toxic and ecologically sustainable type of insecticide since it maintains the expansion of the larvae until the adult stage, thus reducing their possibilities of reproduction. Therefore, there is an opportunity to develop bait systems using compounds that are completely durable and, in addition, to use natural components that would function as attractants for termites.

MARKET CHALLENGES

The downside to bait systems is the time it takes to remove termite mounds. The effect of the baits is slow compared to the knockdown effects of liquid barriers. After installing the bait stations, it can take several months for termites to find the bait and share it with their nestmates. Also, there may be some degree of termite infestation elsewhere before the slow-acting baits take effect. Therefore, this process can take from several months to a year for the complete elimination of a termite colony. Also, homeowners with a severe termite infestation around their home would not prefer this method as it takes longer.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.81% |

|

Segments Covered |

By Termite type, Station Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

DowDuPont (US), BASF (Germany), Bayer (Germany), Sumitomo Chemical (Japan), Syngenta (Switzerland), and Rentokil Initial (UK). Some emerging players in the termite bait systems market include Spectrum Brands (US) |

SEGMENTAL ANALYSIS

Global Termite Bait Systems Market By Termite Type

Global Termite Bait Systems Market By Station Type

The market for termite bait systems, in terms of station type, is predicted to be dominated by ground bait stations in 2021. The main function of the ground station type is to monitor the activities of floor bait stations. Termites below ground level and around houses and apartments.

Global Termite Bait Systems Market By Application

It is predicted that the commercial and industrial segments will have the largest share in 2021. This dominance can be attributed to the need to avoid major infrastructure losses due to termite damage in the commercial and industrial sectors.

REGIONAL ANALYSIS

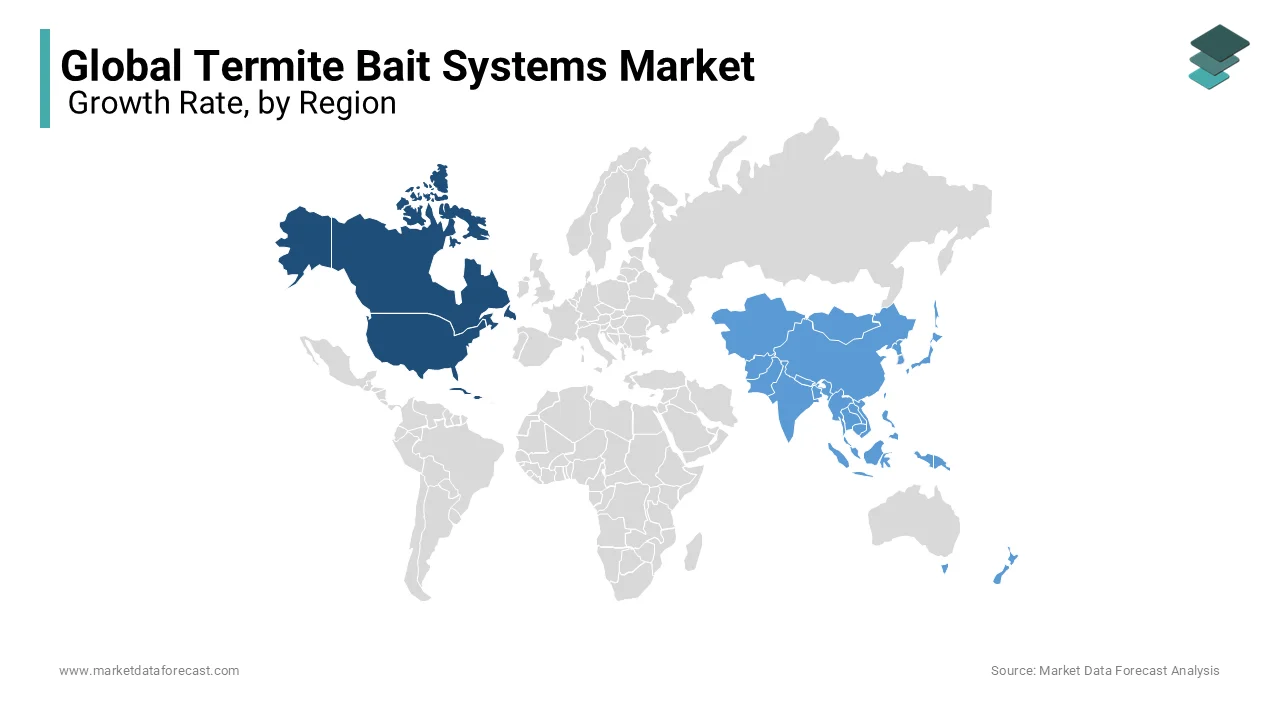

North America accounted for the largest share in 2021, followed by Asia-Pacific, due to the escalating adoption of termite bait systems in countries such as the United States, Canada, Australia and China. Subterranean termites are widespread in North America and are responsible for 90% of handling and damage costs in the United States. Therefore, the North American region dominated the termite bait systems market in 2021. Asia-Pacific is probably the fastest-growing region in the worldwide termite bait systems market during the outlook period. Termites have been believed to cause around RMB 80 billion in structural damage each year in China. In recent years, economic expansion in this region has led companies to invest in developing countries, including China and India. North America is the largest regional market in the world market for termite bait systems.

KEY MARKET PLAYERS

The global market for termite bait systems was dominated by large players such as DowDuPont (US), BASF (Germany), Bayer (Germany), Sumitomo Chemical (Japan), Syngenta (Switzerland), and Rentokil Initial (UK). Some emerging players in the termite bait systems market include Spectrum Brands (US), Ensystex (US), PCT International (Australia), Rollins (US), Terminix International (US), and Arrow Exterminators (US).

RECENT HAPPENINGS IN THIS MARKET

- Whitemire Micro-Gen declares the introduction of Advance Compress Termite Bait II, a bigger bait load product for the developed termite bait systems.

- BASF protects the patent for its bait station against termites in Australia. BASF prevents the manufacturer from infringing on its patents for termite bait stations in Australia. BASF continues to invest in R&D as part of its commitment to sustainable agriculture and healthy environments.

MARKET SEGMENTATION

This research report on the global termite bait systems market is segmented and sub-segmented based on the Termite Type, Station Type, Application, and Region.

By Termite Type

- Subterranean

- Dampwood

- Drywood

By Station Type

- In-Ground

- Above-Ground

By Application

- Commercial & Industrial

- Residential

- Agriculture & Livestock Farms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current market size of the global termite bait systems market?

The current market size of the global termite bait systems market was valued at USD 326.92 million in 2025.

What are the market drivers that are driving the global termite bait systems market?

The world's urban population grew rapidly from 746 million in 1950 to more than 4 billion in 2023, according to United Nations data.

Who are the market players that are dominating the global termite bait systems market?

DowDuPont (US), BASF (Germany), Bayer (Germany), Sumitomo Chemical (Japan), Syngenta (Switzerland), and Rentokil Initial (UK). Some emerging players in the termite bait systems market include Spectrum Brands (US), Ensystex (US), PCT International (Australia), Rollins (US), Terminix International (US), and Arrow Exterminators (US).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com