Asia-Pacific Cannabidiol Market Size, Share, Trends & Growth Forecast Report By Source Type, Distribution Channel, End Use, & Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From (2025 to 2033)

Asia-Pacific Cannabidiol Market Size

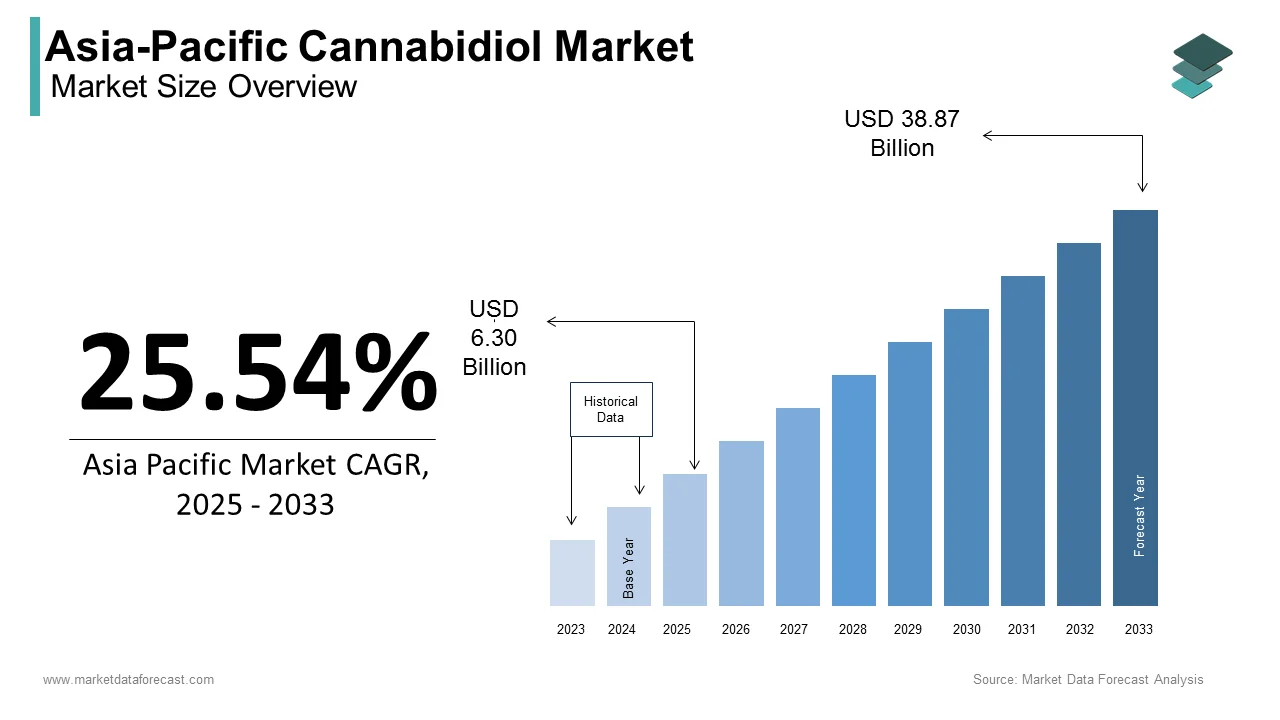

The size of the cannabidiol market in Asia Pacific was valued at USD 5.02 billion in 2024. The Asia Pacific market is expected to be valued at USD 6.30 billion in 2025 and USD 38.87 billion by 2033, exhibiting a CAGR of 25.54% from 2025 to 2033.

MARKET DRIVERS

Growing R&D Activities Around Cannabidiol

The growing R&D activities around cannabidiol, strong collaboration, and emphasis on innovation are majorly propelling the growth of the Asia-Pacific market. The growth in Asia’s scientific and research capabilities, coupled with the cultural history of cannabis in the region, is driving the cannabidiol market. The countries in the region are encouraging the use of cannabidiol for treating patients. For instance, in March 2023, the Cannabis 2023 conference was held in Australia regarding advancements in cannabidiol-based drugs in the Asia Pacific and had attendees including policymakers, government authorities, global leaders, healthcare professionals, scientists, and patients from all around the world.

An increase in awareness about the benefits of cannabidiol is expanding the market share in the region. Both cannabis-derived cannabidiol and industrial hemp-derived cannabidiol are becoming popular, but CBD from cannabis is more effective. Also, APAC countries are passing laws governing the cultivation, export, and patient access of cannabis. As a result, the demand for cannabidiol from licensed producers and for medical research increased manyfold.

Growing Interest from Patients & Medical Community

The APAC cannabidiol market growth is fueled by the expansion of science as well as by the growing interest from patients and the medical community. For instance, the demand for cannabidiol products has increased in Australia, and the number of licensed doctors has gone up, which further improved cannabidiol access to patients. Advancements in cannabidiol technology will boost the demand for cannabidiol products, like the integration of innovative techniques with research to improve active compound’s potential. Therefore, such developments will propel the market share during the forecast period.

MARKET RESTRAINTS

Low Awareness and Correct Production Practices

Major factors limiting the growth of the APAC cannabidiol market are continuous regulatory changes, little knowledge about raw material quality, limited awareness, correct production practice, molecular absorption, etc. Also, the high cost of cannabidiol products is another issue in front of the APAC market. It is more popular among patients with anxiety, pain, epilepsy, and sleep problems, which increases the prices of these products. Furthermore, companies are also finding it difficult to raise funds because of changing legal status. This increases the cost of products. The side effects of cannabidiol products are one of the major challenges for the APAC cannabidiol market. Also, poor implementation of quality control standards and regulations is hindering the market growth rate. Since cannabis became legal in some Asian countries, daily usage has increased considerably, especially by young adults.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Distribution Channel, End-users, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of APAC. |

|

Market Leader Profiled |

Pharmahemp d.o.o, ENDOCA, NuLeaf Naturals LLC, Folium Biosciences, Elixinol, Cannoid LLC, Medical Marijuana Inc., and Isodiol International Inc., and Others. |

SEGMENTAL ANALYSIS

By Type Insights

REGIONAL ANALYSIS

Geographically, the Asia-Pacific cannabidiol market is projected to have the highest CAGR during the forecast period owing to the growing number of older people and rising occurrences of various health disorders are two major factors propelling the regional market growth. The Chinese cannabidiol market is predicted to account for the major share of the Asia-Pacific market during the forecast period due to the rising awareness of CBD oil's medicinal benefits. China's government permits less than 0.3% of tetrahydrocannabinol (THC). CBD oil-based products such as cosmetics, medicine, and others can be easily available in the shops. They are increasing their knowledge of crop cultivation according to the climatic conditions to promote the growth rate of the market.

The Indian Cannabidiol Market is next to China, leading the dominant share of the market.

Ongoing research and development activities in medicinal products using CBD oil are leveling up the market's growth rate. Increasing incidences of chronic diseases are likely to boost the market demand. CBD oil has various benefits in treating headaches, sleep disorders, cardiovascular problems, and others. For cancer treatment, CBD oil is a natural alternative for pain relief. These beneficial factors contribute to the highest market share in India. The Japanese Cannabidiol Market is likely to have significant growth opportunities in the coming years by adopting the latest techniques in the healthcare sector.

KEY MARKET PLAYERS

Some of the notable companies playing a leading role in the Asia Pacific cannabidiol market profiled in this report are Pharmahemp d.o.o, ENDOCA, NuLeaf Naturals LLC, Folium Biosciences, Elixinol, Cannoid LLC, Medical Marijuana Inc., and Isodiol International Inc., and Others.

MARKET SEGMENTATION

This research report on the Asia Pacific cannabidiol market has been segmented and sub-segmented based on type, distribution channel, end-users, and region.

By Type

- Hemp

- Marijuana

By Distribution Channel

-

B2B

- B2C

- Hospital Pharmacies

- Online

- Retail Stores

By End Users

-

Medical

-

Chronic Pain

- Mental Disorders

- Cancer

- Others

-

- Personal Use

- Pharmaceuticals

- Wellness

- Food & Beverages

- Personal Care & Cosmetics

- Nutraceuticals

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

What factors are driving the growth of the cannabidiol market in the APAC region?

The growing awareness of CBD benefits, changing regulatory landscapes, and growing acceptance of cannabis-based products are majorly driving the growth of the APAC cannabidiol market.

Which countries in the APAC region contribute significantly to the cannabidiol market share?

China, Japan, South Korea, and Australia are primarily contributing to the APAC cannabidiol market.

What challenges does the APAC cannabidiol market face in terms of growth?

Challenges include regulatory uncertainties, limited awareness, and the need for standardized product quality.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]