North America Cannabidiol Market Size, Share, Trends & Growth Forecast Report By Source Type, Distribution Channel, End Use, and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Cannabidiol Market Size

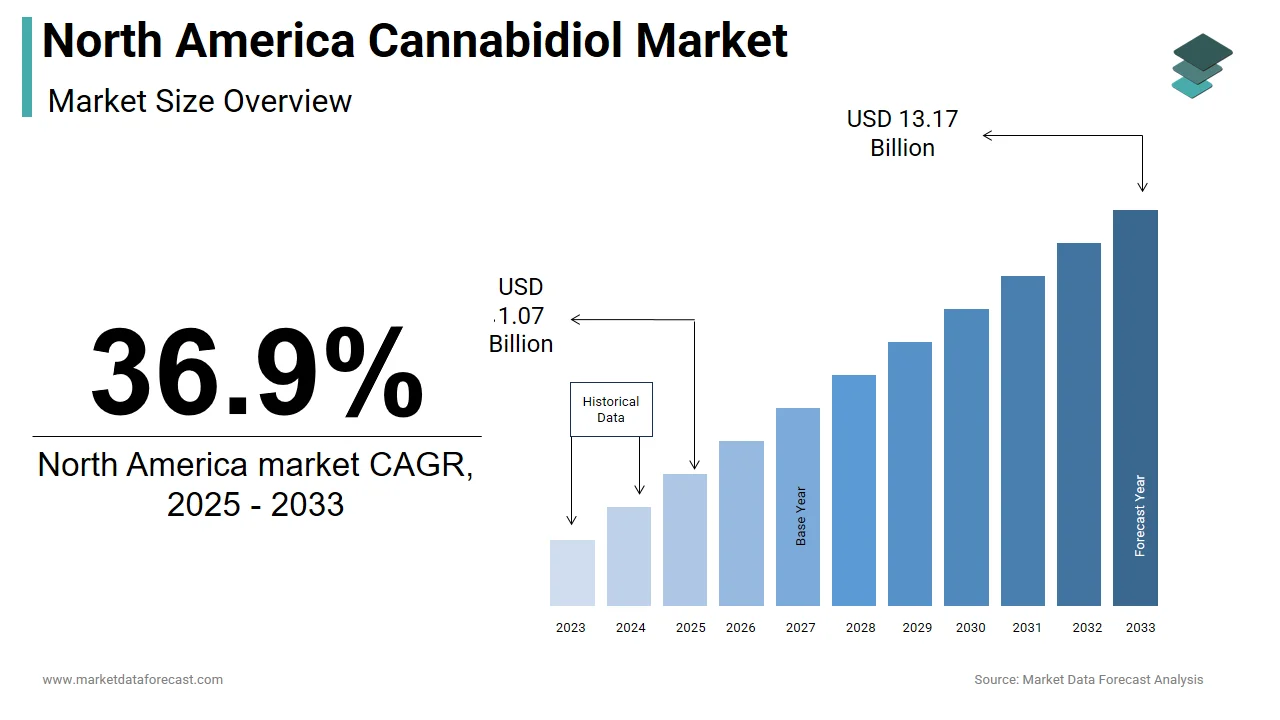

The size of the North America cannabidiol market was worth USD 0.78 billion in 2024. The North america market is anticipated to grow at a CAGR of 36.9% from 2025 to 2033 and be worth USD 13.17 billion by 2033 from USD 1.07 billion in 2025.

MARKET DRIVERS

Rising Demand for Cannabidiol in Healthcare and Fitness

The growing demand for cannabidiol in healthcare and fitness is the primary factor driving the growth of the North American cannabidiol market. Due to the increasing benefits of cannabidiol drugs, many people in North America prefer to take cannabidiol drugs for anxiety, seizures, and cancer symptom relief. In addition, to increasing consciousness of their health, people prefer daily workouts to reduce the chances of heart attack, obesity, and diabetes. As a result, most people work out after taking the cannabidiol-related drug to reduce stress, improve oxygen delivery and reduce pain and inflammation after the workout. Additionally, it also helps to spend more time in the gym and make the body fit by providing energy.

Advancements in Cannabidiol Drug Manufacturing

Increasing advancements in the manufacturing of cannabidiol drugs are the other reason for market growth. Manufacturers are focusing on developing a different form of cannabis that the government legalizes. The manufacturers are also focusing on developing skin care products due to the increasing number of skin problems among Americans. Several cosmetic companies also show interest in manufacturing cannabidiol cosmetic products, which demand market growth. Cannabidiol products were available in different forms, such as oils and lip balm, and edible products, such as coffee, baked products, chocolate, and candies. Increasing government investment, reimbursement policies, and raw material production are the other reasons for the market growth.

Rising Awareness of Cannabidiol's Benefits

One of the key factors driving the market's growth in the region is the rising awareness of cannabidiol's health and wellness benefits. CBD nutraceuticals are becoming increasingly popular because they contain multiple amino acids, making them effective protein supplements. In addition, growing applications in medical cannabis and usage and its acceptance among people in developed countries such as the United States and Canada is projected to increase the growth of the North American Cannabidiol Market. Cannabidiol is the most extensively utilized cannabinoid for medicinal purposes due to its absence of psychoactive effects. Consumers are looking for more natural and effective supplements and medicines that will meet all of their nutritional needs, which will help these products gain traction. However, increasing the legalization of cannabis across the North American region is more likely to augment the North American CBD Oil Market growth. Plant-based ingredients are becoming more popular among consumers, particularly in dietary supplements and sports nutrition.

Diverse Medicinal Applications

Cannabidiol oil is utilized in various medicinal applications, including anxiety and depression therapy, stress reduction, diabetes prevention, pain reduction, cancer symptom reduction, and inflammation alleviation. Due to a rising number of people promoting the advantages of cannabidiol, it has become the newest consumer craze. Apart from the pharmaceutical and food and beverage sectors, cannabidiol is extensively accepted in the personal and skin care industries. The North American CBD Oil market is expected to develop rapidly over the projected period, owing to the increased acceptance of CBD-based products to cure diseases. Owing to cannabidiol's outstanding restorative, anti-aging, and anti-acne characteristics, the popularity of cannabidiol-based skincare products is projected to surge. Many firms use CBD oils to treat a variety of skin disorders and decrease inflammation.

MARKET RESTRAINTS

High Cost of Cannabidiol Products

The high cost of cannabidiol products and the unavailability of cannabidiol drugs in a few areas are the major factors restraining North America's market growth. In addition, side effects after using cannabidiol for the long term may challenge the market growth. Some side effects are diarrhea, dry mouth, fatigue, and drowsiness. Furthermore, a lack of awareness about cannabidiol products and the selling of unapproved cannabidiol products in the market also hamper the market growth. The complex regulatory structure for the usage of cannabis is one of the major factors restraining the growth of the North American Cannabidiol Market. However, Companies offering cannabis and cannabis-infused products must comply with different regulatory guidelines, which is expected to be the growth restraining factor for the North American Cannabidiol market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Distribution Channel, End Users, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, and the Rest of North America. |

|

Market Leaders Profiled |

Pharmahemp d.o.O, ENDOCA, NuLeaf Naturals LLC, Folium Biosciences, Elixinol, Cannoid LLC, Medical Marijuana Inc., and Isodiol International Inc. |

REGIONAL ANALYSIS

North America has the highest market share due to the presence of many key players and the increasing acceptance of cannabidiol-related products. Nearly 26% of Americans are using Cannabidiol drugs as per a survey in the year 2022. People in this region are using cannabidiol drugs to treat heart diseases, acne, joint pains, and autoimmune diseases. Increasing clinical trial centers and manufacturing facilities also help with market growth.

The United States holds the maximum share of the market. Most U.S people use cannabidiol drugs for arthritis pain. The drug is available in several forms, such as solid, oil, gel, and ointment. In many areas in the United States, cannabidiol is available for medical use under state law. The government has taken several measures to approve a drug based on cannabidiol which does not harm the patient's health. As a result, they focus on the safety and quality of cannabis for medical use.

In the Canadian region, Health Canada is mainly responsible for distributing and selling cannabidiol-related drugs for medical purposes. In addition, Health Canada is a department responsible for helping the Canadian people to improve their health. As a result, cannabidiol drugs must be sold online and offline with the approval of a license from the government; otherwise, the online site or the medical distribution place will be sealed. In addition, increasing the farming of cannabis plants in the region by the government to manufacture drugs for various diseases also helps the market growth.

KEY MARKET PLAYERS

Pharmahemp d.o.O, ENDOCA, NuLeaf Naturals LLC, Folium Biosciences, Elixinol, Cannoid LLC, Medical Marijuana Inc., and Isodiol International Inc. are some of the companies that dominate the North American cannabidiol market.

MARKET SEGMENTATION

This research report on the North America cannabidiol market is segmented and sub-segmented into the following categories.

By Type

- Hemp

- Marijuana

By Distribution Channel

-

B2B

-

B2C

- Hospital Pharmacies

- Online

- Retail Stores

By End Users

-

Medical

- Chronic Pain

- Mental Disorders

- Cancer

- Others

- Personal Use

- Pharmaceuticals

- Wellness

- Food & Beverages

- Personal Care & Cosmetics

- Nutraceuticals

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com