Asia Pacific Healthcare IT Market Size, Share, Trends & Growth Forecast Report By Type and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) - Industry Analysis From (2025 to 2033)

Asia Pacific Healthcare IT Market Size

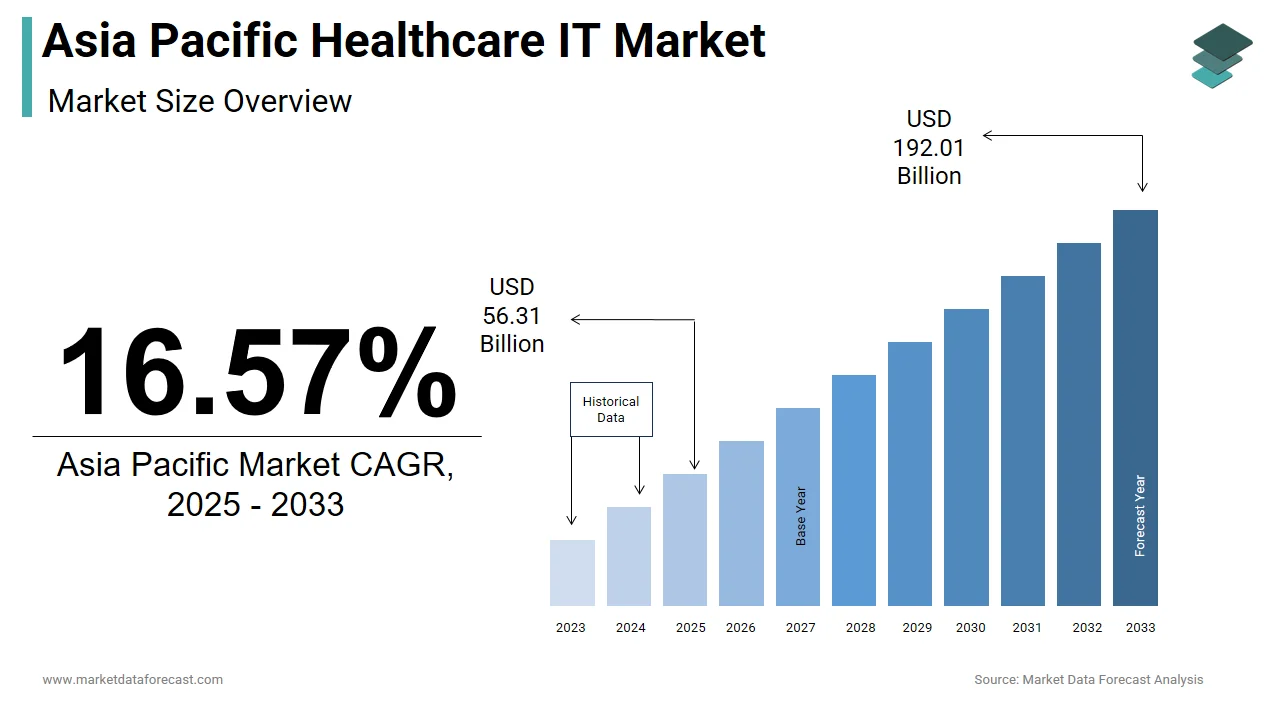

The size of the Asia Pacific healthcare IT market was worth USD 48.31 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 16.57% from 2025 to 2033 and be worth USD 192.01 billion by 2033 from USD 56.31 billion in 2025.

MARKET DRIVERS

Rising Demand for Telemedicine Solutions

The surge in demand for telemedicine solutions is a key driver propelling the Asia Pacific healthcare IT market. The COVID-19 pandemic acted as a catalyst, accelerating the adoption of virtual healthcare services across the region. Governments have also played a pivotal role, with initiatives like Singapore’s National Telemedicine Framework facilitating remote consultations. The growing rural-urban divide in healthcare accessibility further amplifies the need for telemedicine. Also, advancements in AI-driven diagnostic tools have enhanced the accuracy and efficiency of virtual consultations. For example, Ping An Good Doctor, a Chinese telemedicine provider, leveraged AI algorithms to diagnose chronic conditions with high accuracy.

Increasing Adoption of Electronic Health Records (EHRs)

Another significant driver is the increasing adoption of electronic health records (EHRs), which streamline data management and improve healthcare efficiency. The rise of chronic diseases has further intensified the demand for EHRs. A report by the World Health Organization (WHO) highlights that non-communicable diseases account for a significant portion of deaths in the region, necessitating comprehensive patient records for effective management. Additionally, cloud-based EHR platforms have gained traction, enabling real-time data sharing among healthcare providers.

MARKET RESTRAINTS

High Implementation Costs

One of the primary restraints hindering the growth of the Asia Pacific healthcare IT market is the substantial cost associated with implementing advanced technologies. Hospitals and clinics, particularly in developing economies face significant financial barriers when adopting solutions like EHRs and telemedicine platforms. This financial burden is exacerbated by the limited availability of funding for small and medium-sized healthcare providers. While larger institutions can absorb these costs, smaller players often struggle to justify the expenditure, limiting market penetration.

Cybersecurity Concerns

Another critical restraint is the growing threat of cybersecurity breaches, which undermine trust in healthcare IT systems. As healthcare providers increasingly rely on digital platforms, sensitive patient data becomes vulnerable to cyberattacks. Like, the number of cyberattacks targeting healthcare organizations in the Asia Pacific region surged by 45% in 2022, with ransomware being a major threat. For example, a Singaporean hospital experienced a data breach that compromised the records of over 1.5 million patients. The lack of standardized cybersecurity protocols further exacerbates the issue, leaving many institutions ill-equipped to handle sophisticated threats. Furthermore, the integration of IoT devices into healthcare systems increases vulnerability, creating new entry points for hackers. These challenges not only disrupt operations but also erode patient confidence, posing a significant barrier to the widespread adoption of healthcare IT solutions.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence in Diagnostics

The integration of artificial intelligence (AI) into diagnostics presents a transformative opportunity for the Asia Pacific healthcare IT market. AI-powered tools enable early detection of diseases, predictive analytics, and personalized treatment plans, significantly enhancing patient outcomes. According to Accenture, AI applications in healthcare could save the region up to $45 billion annually by 2030 through improved efficiency and reduced operational costs. The region’s aging population, coupled with the rising prevalence of chronic diseases, creates a fertile ground for AI-driven innovations. Also, the proliferation of wearable devices and mobile health apps generates vast amounts of data, enabling AI algorithms to deliver actionable insights.

Expansion of Smart Hospital Infrastructure

Another promising opportunity lies in the expansion of smart hospital infrastructure, which leverages IoT, big data, and automation to enhance operational efficiency. For example, South Korea’s Seoul National University Hospital implemented a smart bed system that monitors patient vitals in real time, reducing response times. The demand for such innovations is particularly strong in urban centers with overcrowded healthcare facilities. Government initiatives play a crucial role in driving this trend. Additionally, the rise of 5G connectivity enables seamless data exchange, supporting the deployment of IoT-enabled medical devices.

MARKET CHALLENGES

Interoperability Issues Among Systems

A significant challenge facing the Asia Pacific healthcare IT market is the lack of interoperability among disparate systems, which hinders seamless data exchange and collaboration. Many healthcare providers use legacy systems or proprietary software that are incompatible with newer platforms, creating data silos. For instance, a study by EY revealed that a major Indonesian hospital faced a 20% increase in medical errors after attempting to integrate multiple IT systems without standardized protocols. The absence of universal standards for data formats and communication further complicates the integration process, requiring custom solutions that inflate costs and extend timelines.

Limited Skilled Workforce in Healthcare IT

Another pressing challenge is the shortage of skilled professionals proficient in healthcare IT systems and technologies. The rapid evolution of digital health solutions has created a skills gap, leaving many institutions ill-equipped to implement and maintain advanced IT infrastructure. Countries like India and the Philippines, despite having a large talent pool, still face challenges in aligning workforce capabilities with industry requirements. Additionally, the complexity of emerging technologies, such as AI and blockchain, necessitates specialized training programs that are currently underdeveloped. This shortage not only disrupts operations but also increases reliance on external consultants, further inflating operational costs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Component, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Companies such as Cerner Corporation, Oracle Corporation, Mckesson Corporation, Philips Healthcare, Novarad Corporation, GE Healthcare, Carestream Health, eClinicalworks, EPIC Systems Corporation, Siemens Healthcare (Siemens AG), Athenahealth Inc., and Allscripts Healthcare Solutions, Inc. |

SEGMENTAL ANALYSIS

By Type Insights

The EHR segment spearheaded the Asia Pacific healthcare IT market by accounting for a 28% of the total market share in 2024. This dominance is driven by government mandates and the need for interoperable systems that streamline patient data management. For instance, India’s Ayushman Bharat Digital Mission aims to create a unified digital health ecosystem, benefiting billion of citizens through standardized EHR adoption. The rising prevalence of chronic diseases further amplifies demand for EHRs. A report by the World Health Organization (WHO) highlights that non-communicable diseases account for 70% of deaths in the region, necessitating comprehensive patient records for effective management. Additionally, cloud-based EHR platforms are gaining traction, allowing real-time data sharing among healthcare providers.

Telehealth is the fastest-growing segment within the Asia Pacific healthcare IT market, with a projected CAGR of 22.4%. This rapid development is fueled by the increasing demand for remote healthcare services, particularly in rural and underserved areas. For instance, Practo, a leading Indian telemedicine platform, reported a 500% increase in user registrations during the pandemic. Government initiatives also play a pivotal role in accelerating telehealth adoption. Additionally, advancements in AI-driven diagnostic tools have enhanced the accuracy and efficiency of virtual consultations. For example, Ping An Good Doctor, a Chinese telehealth provider, leveraged AI algorithms to diagnose chronic conditions with high accuracy.

By Component Insights

The services segment commanded the Asia Pacific healthcare IT market by capturing a 45.7% of the total market share in 2024. This segment’s prominence is attributed to the growing complexity of healthcare IT solutions, which require specialized expertise for implementation, maintenance, and training. The rise of smart hospital infrastructure further amplifies demand for IT services. Also, cybersecurity concerns drive demand for managed security services. For example, Singapore’s Ministry of Health collaborated with private entities to launch a nationwide initiative protecting over 1.5 million patient records from cyberattacks.

Software is quickly moving ahead in the Asia Pacific healthcare IT market, with a estimated CAGR of 18.7%. This progress is driven by the increasing adoption of advanced software solutions like AI-powered diagnostics, telemedicine platforms, and healthcare analytics. The proliferation of wearable devices and mobile health apps generates vast amounts of data, enabling software solutions to deliver actionable insights. Additionally, government initiatives promoting digital health ecosystems, such as China’s smart hospital program, further accelerate software adoption.

By End-User Insights

The healthcare provider segment dominated the Asia Pacific healthcare IT market by contributing a 55.5% of the total revenue in 2024. This segment’s lead position is driven by the growing need for efficient patient care and streamlined operations. Hospitals and clinics are increasingly adopting solutions like EHRs, PACS, and telemedicine platforms to enhance service delivery. The aging population in the region further amplifies demand for advanced IT solutions. According to WHO, the elderly population in Asia Pacific is projected to reach 1.3 billion by 2050, necessitating scalable healthcare IT systems. Additionally, smart hospital initiatives, such as South Korea’s deployment of IoT-enabled ICU systems, enable real-time patient monitoring, improving outcomes.

The payer segment is the fastest-growing end-user in the Asia Pacific healthcare IT market, with a projected CAGR of 19.8% from 2025 to 2033. This is fueled by the increasing focus on fraud management and claims processing efficiency. For example, Australian insurers implemented AI-driven fraud detection systems, reducing fraudulent claims. Government regulations also play a pivotal role in accelerating IT adoption among payers. Additionally, the integration of blockchain technology enables secure and immutable record-keeping, enhancing trust among stakeholders. For instance, a Singaporean insurance firm leveraged blockchain to reduce claims processing times by 35%.

COUNTRY LEVEL ANALYSIS

China led the Asia Pacific healthcare IT market by contributing a 40.6% of the total revenue in 2024. The country’s dominance is underpinned by its robust healthcare infrastructure and emphasis on smart hospital initiatives. China’s smart hospital program aims to upgrade over 1,000 public hospitals by 2025, integrating advanced IT solutions to improve service delivery.

India is accelerating in the regional market, with a market share of 20.5%. The country’s burgeoning startup ecosystem and government initiatives like Ayushman Bharat Digital Mission have fueled the adoption of healthcare IT solutions. For instance, Practo’s telemedicine platform reported a 500% increase in user registrations during the pandemic, addressing rural healthcare accessibility challenges.

Japan holds a significant share in the market and is driven by its focus on precision and quality. The country’s aging population necessitates advanced IT solutions like EHRs and telemedicine platforms. According to WHO, Japan’s elderly population accounts for a significant portion of the total, driving demand for scalable healthcare IT systems. For example, Japanese hospitals implemented AI-driven diagnostic tools, reducing medical errors.

South Korea is steadily moving ahead in the market, supported by its prowess in technology innovation, as per Samsung Economic Research Institute. The country’s emphasis on smart hospital infrastructure enables real-time patient monitoring and improves outcomes. For instance, Seoul National University Hospital deployed IoT-enabled ICU systems, reducing mortality rates.

Australia and New Zealand collectively makes a key player of the market. The region’s strong regulatory framework and focus on rural healthcare accessibility drive IT adoption. For example, Australian hospitals partnered with global IT firms to deploy scalable EHR systems, achieving a reduction in administrative inefficiencies.

KEY MARKET PLAYERS

Companies such as Cerner Corporation, Oracle Corporation, Mckesson Corporation, Philips Healthcare, Novarad Corporation, GE Healthcare, Carestream Health, eClinicalworks, EPIC Systems Corporation, Siemens Healthcare (Siemens AG), Athenahealth Inc., and Allscripts Healthcare Solutions, Inc. are playing a vital role in the APAC Healthcare IT Market.

TOP LEADING PLAYERS IN THE MARKET

Philips Healthcare

Philips Healthcare has established itself as a leader in the Asia Pacific healthcare IT market, leveraging its expertise in smart hospital solutions and medical imaging systems. The company focuses on integrating IoT and AI into healthcare infrastructure to enhance patient care. Its emphasis on interoperability ensures seamless integration of devices and data platforms, addressing critical challenges in healthcare delivery.

Alibaba Cloud

Alibaba Cloud plays a pivotal role in transforming healthcare IT across the Asia Pacific region through its scalable cloud-based platforms. The company’s focus on EHR systems and telemedicine solutions addresses accessibility challenges in rural areas. Its AI-powered diagnostic tools enable early disease detection, enhancing healthcare efficiency.

Fujitsu Limited

Fujitsu Limited contributes significantly to the Asia Pacific healthcare IT market by offering advanced analytics and cybersecurity solutions. The company’s focus on fraud management and claims processing addresses inefficiencies in healthcare financial systems. Its collaboration with Japanese hospitals to integrate AI-driven diagnostic tools underscores its commitment to innovation.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Asia Pacific healthcare IT market employ innovative strategies to strengthen their positions. Partnerships with regional governments and healthcare providers ensure scalability and adoption of solutions like EHRs and telemedicine platforms. Investments in AI and IoT technologies drive advancements in diagnostics and patient monitoring. Additionally, companies focus on addressing cybersecurity concerns through blockchain and managed security services. Expanding into underserved rural areas fosters inclusivity and broadens market reach. Collaborations with startups and academic institutions accelerate R&D efforts, enabling the development of cutting-edge solutions tailored to regional needs. These strategies collectively enhance competitiveness and promote sustainable growth in the market.

COMPETITION OVERVIEW

The Asia Pacific healthcare IT market is highly competitive, characterized by the presence of global giants like Philips Healthcare and regional leaders such as Alibaba Cloud and Fujitsu. These companies leverage their technological expertise and strategic partnerships to offer innovative solutions for healthcare providers, payers, and patients. The market also witnesses the entry of niche players focusing on specialized segments like telehealth and healthcare analytics, intensifying rivalry. Strategic collaborations with governments and private entities are critical differentiators, enabling players to address challenges like interoperability and cybersecurity. Furthermore, the growing adoption of AI, IoT, and blockchain technologies fosters innovation, driving advancements in operational efficiency. This competitive environment encourages continuous improvement, positioning the region as a leader in global healthcare IT innovation.

RECENT MARKET DEVELOPMENTS

- In March 2023, Philips partnered with Indian hospitals to deploy smart ICU systems, reducing mortality rates by 25% through real-time patient monitoring.

- In June 2023, Alibaba Cloud collaborated with Thai hospitals to implement a scalable EHR system, improving patient care coordination by 25%.

- In August 2023, Fujitsu introduced blockchain-based solutions in Singapore, reducing claims processing times by 35% and enhancing transparency.

- In November 2023, Ping An Good Doctor integrated AI-driven diagnostic tools into its platform, achieving a 90% accuracy rate in chronic disease detection.

- In February 2024, Infervision launched an AI-based imaging solution in South Korea, enabling early detection of lung cancer with 95% accuracy and streamlining workflows.

MARKET SEGMENTATION

This Asia Pacific healthcare IT market research report is segmented and sub-segmented into the following categories.

By Type

- EHR (Electronic Health Record)

- RIS (Radiology Information Systems)

- PACS (Picture Archiving and Communication System)

- VNA (Vendor Neutral Archive)

- CPOE (Computerized Provider Order Entry)

- HIE (Healthcare Information Exchange)

- Telehealth

- Healthcare Analytics

- Fraud Management

- Claims Management

By Component

- Services

- Software

- Hardware

By End-user

- Healthcare Providers

- Payers

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

What role do government regulations play in the growth of the healthcare IT market in the Asia Pacific region?

Government regulations play a crucial role in the growth of the healthcare IT market in the Asia Pacific region. Governments are introducing regulations to ensure data privacy and security, and to promote the adoption of digital health technologies.

What factors are driving the growth of the healthcare IT market in the Asia Pacific region?

The growing demand for preventive care, rising adoption of electronic health records, and a focus on patient safety in the region majorly boost the growth rate of the APAC healthcare IT market.

Which countries in the Asia Pacific region are contributing the most to the healthcare IT market?

China, India, and Japan are the countries contributing the most to the healthcare IT market in the Asia Pacific region.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com