Asia Pacific Digital Out-of-Home Advertising Market Size, Share, Trends & Growth Forecast Report By Application (Indoor, Outdoor), Format (Billboards, Street Furniture, Transit & Transportation, Place-Based Media), Vertical, and Country (India, China, Japan, South Korea, Australia) – Industry Analysis From 2025 to 2033.

Asia Pacific Digital Out-of-Home Advertising Market Size

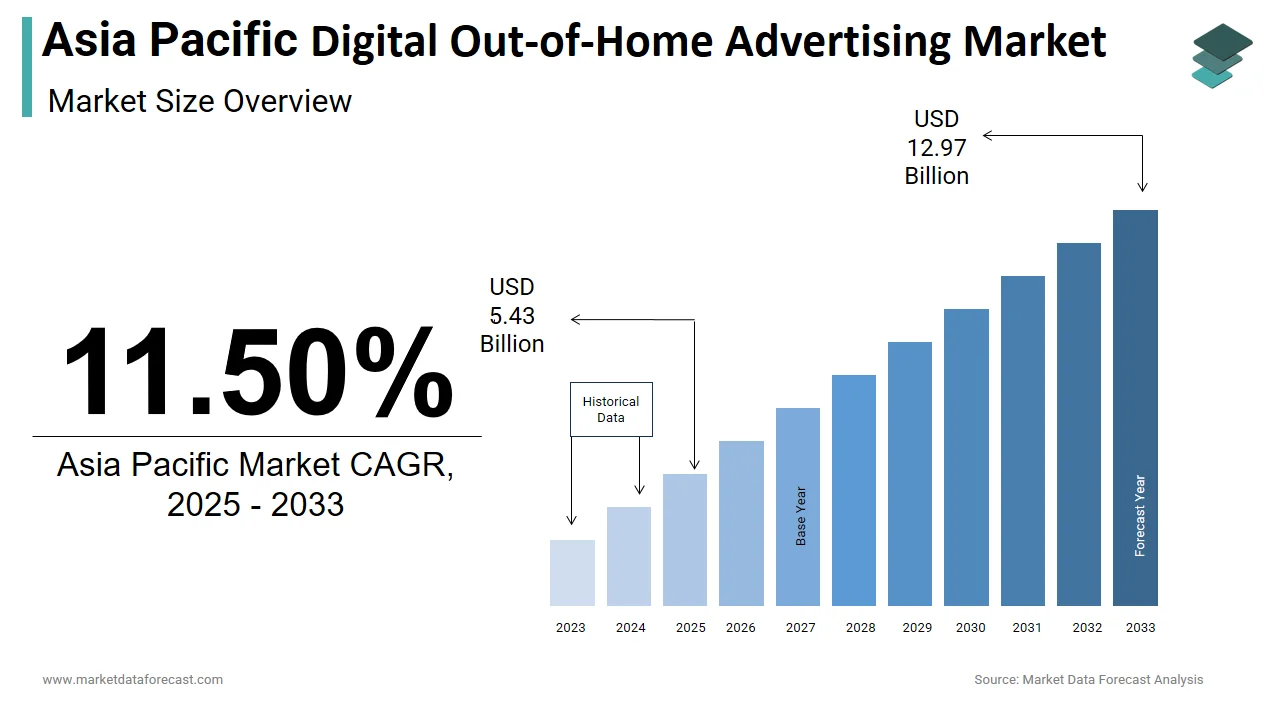

The size of the Asia Pacific digital out-of-home advertising market was worth USD 4.87 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 11.50% from 2025 to 2033 and be worth USD 12.97 billion by 2033 from USD 5.43 billion in 2025.

Digital OOH advertising encompasses formats like billboards, transit screens, and interactive kiosks, enabling brands to connect with audiences in high-traffic urban areas. According to Deloitte, over 60% of advertisers in the region have integrated digital OOH into their marketing strategies with its growing importance as a medium for brand promotion and consumer engagement. For instance, cities like Tokyo and Singapore are transforming their urban landscapes with immersive digital installations that captivate audiences and drive foot traffic. Additionally, the rise of smart cities and IoT-enabled infrastructure has amplified the potential of digital OOH platforms to deliver personalized and contextually relevant advertisements. As per PwC, the integration of AI-driven analytics has further expanded its capabilities by enabling advertisers to optimize campaigns based on real-time audience insights.

MARKET DRIVERS

Urbanization and Smart City Initiatives

The rapid pace of urbanization across the Asia Pacific region is a significant driver of the digital OOH advertising market. According to the World Bank, cities are becoming hubs of economic activity and consumer engagement with over 50% of the population residing in urban areas by 2030, as per the World Bank. This demographic shift has created a fertile environment for digital OOH platforms, which thrive in high-density urban settings. For example, cities like Shanghai and Bangalore are investing heavily in smart city initiatives, integrating IoT-enabled infrastructure to enhance connectivity and improve public services. A study by McKinsey & Company revealed that smart city projects can increase ad exposure by up to 40%, as digital OOH platforms leverage real-time data to deliver contextually relevant content.

Integration of Programmatic Advertising

Another major driver is the increasing adoption of programmatic advertising, which enables automated and data-driven buying of digital OOH inventory. For instance, companies in Australia and Japan are using programmatic tools to target specific demographics, ensuring higher engagement rates and better ROI. Additionally, the integration of AI and machine learning allows advertisers to optimize campaigns dynamically, adjusting content based on variables such as weather, time of day, or local events. As per a report by Accenture, over 70% of advertisers in urban areas prioritize programmatic solutions to enhance campaign efficiency, which is driving investments in scalable and innovative platforms.

MARKET RESTRAINTS

High Initial Investment Costs

One of the primary restraints facing the Asia Pacific digital OOH advertising market is the high cost associated with setting up and maintaining digital infrastructure for small and medium-sized enterprises (SMEs). Deploying large-scale digital displays and IoT-enabled systems requires significant upfront investments in hardware, software, and skilled personnel. According to Frost & Sullivan, the average cost of installing a single digital billboard exceeds $50,000 by making it prohibitive for smaller players with limited budgets. Additionally, the shortage of professionals proficient in managing digital OOH platforms further compounds the issue. For example, a survey by KPMG revealed that over 60% of SMEs in Southeast Asia struggle to recruit qualified technicians, forcing them to rely on external consultants or managed service providers. strained.

Regulatory and Content Restrictions

Another significant restraint is the growing emphasis on regulatory compliance and content restrictions in countries with stringent advertising laws. The misuse of sensitive or inappropriate content poses a threat to both advertisers and public spaces, leading to stricter regulations. According to the International Advertising Association, over 50% of consumers in the Asia Pacific are concerned about intrusive or misleading advertisements, undermining trust in digital OOH platforms. For instance, cities like Delhi and Jakarta have imposed bans on certain types of outdoor ads, complicating campaign execution. Additionally, fragmented regulatory frameworks across the region exacerbate the issue, as countries like Thailand and Indonesia lack standardized guidelines for digital OOH content. This inconsistency complicates compliance efforts, which is discouraging organizations from adopting these platforms due to potential legal and reputational risks.

MARKET OPPORTUNITIES

Integration with Emerging Technologies

The integration of emerging technologies such as augmented reality (AR) and artificial intelligence (AI) presents a transformative opportunity for the Asia Pacific digital OOH advertising market. AR-enabled platforms offer unparalleled interactivity, allowing consumers to engage with advertisements in immersive ways. According to Deloitte, AR-driven campaigns can increase brand recall by up to 70%, which is making them highly attractive to industries like retail and entertainment. For example, shopping malls in South Korea and Singapore are leveraging AR kiosks to promote products, ensuring higher engagement and conversion rates. Additionally, AI-powered analytics enable advertisers to optimize campaigns dynamically, adjusting content based on real-time audience behavior. A study by Gartner revealed that AI-driven platforms can improve ad targeting accuracy by 30%, positioning them as key growth drivers in the market.

Expansion into Rural and Tier-II Cities

Another promising opportunity lies in expanding digital OOH advertising solutions to rural and tier-II cities within the Asia Pacific region. Countries like Vietnam, Indonesia, and the Philippines face significant disparities in media access, which is creating a robust demand for innovative tools that address inefficiencies. According to the World Bank, over 40% of rural populations in Southeast Asia lack access to traditional advertising channels, amplifying the need for scalable solutions. For instance, startups in India are using mobile-based platforms to deliver localized and affordable ad content, ensuring continuity of brand messaging for underserved communities. Additionally, government-led initiatives promoting rural development have further bolstered the market, encouraging investments in cost-effective and sustainable technologies.

MARKET CHALLENGES

Shortage of Skilled Workforce

The scarcity of skilled professionals proficient in digital OOH advertising and data analytics poses a significant challenge to the market’s growth. Despite the rising demand for expertise in areas such as programmatic buying, AI-driven targeting, and content creation, the talent pool remains insufficient. In countries like Malaysia and Thailand, universities produce fewer than 500 digital marketing graduates annually, far below industry requirements. This shortage forces organizations to either outsource critical functions or operate with understaffed teams, increasing the risk of inefficiencies and suboptimal outcomes. Additionally, the rapid evolution of advertising technologies necessitates continuous upskilling, which many professionals struggle to achieve due to limited access to advanced training programs. For instance, a survey by EY revealed that only 25% of agencies in the region receive regular training updates. This skills gap undermines efforts to implement effective advertising solutions, leaving enterprises vulnerable to missed opportunities.

Resistance to Digital Transformation Among Traditional Advertisers

Another pressing challenge is the resistance to digital transformation among traditional advertisers, in rural and semi-urban areas. Many businesses underestimate the importance of adopting advanced digital OOH tools, viewing them as unnecessary or overly complex rather than as enablers of competitive advantage. According to Grant Thornton, over 60% of SMEs in the region do not integrate digital OOH into their marketing strategies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Application, Format, Vertical, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

JCDecaux, Stroer SE & Co. KGaA, Clear Channel Outdoor Holdings, Inc., Outfront Media Inc., oOh!media Limited, Lamar Advertising Company, Broadsign International LLC., Focus Media, Global Outdoor Media Limited, and Daktronics Dr. |

SEGMENTAL ANALYSIS

By Application Insights

The outdoor segment dominated the Asia Pacific digital OOH advertising market with 65.4% of share in 2024. The growth of the segment is driven by the ability to reach large and diverse audiences in high-traffic urban areas, which is making it an indispensable medium for brand promotion and consumer engagement. According to the World Bank, over 50% of the region’s population resides in urban centers by amplifying the demand for outdoor digital displays like billboards and transit screens. For example, cities like Tokyo and Singapore have transformed their public spaces with LED billboards and interactive installations, driving foot traffic and enhancing brand visibility. Additionally, the rise of smart city initiatives has further bolstered the adoption of outdoor digital OOH platforms. A study by Deloitte revealed that smart city projects can increase ad exposure by up to 40%, as these platforms leverage real-time data to deliver contextually relevant content. Another driving factor is the growing emphasis on sustainability and energy efficiency. According to PwC, over 70% of advertisers prioritize eco-friendly solutions, such as solar-powered billboards, which align with global environmental goals.

The indoor segment is projected to grow at a CAGR of 22.3% during the forecast period. This rapid expansion is fueled by the increasing adoption of indoor digital displays in shopping malls, airports, and corporate offices to enhance customer engagement and brand recall. For instance, companies in India and Australia are using interactive kiosks and digital signage to promote products and services, ensuring higher conversion rates and customer satisfaction. Another contributing factor is the integration of augmented reality (AR) and artificial intelligence (AI) into indoor displays, enabling immersive and personalized experiences.

By Format Insights

The billboard segment was the largest and held the Asia Pacific digital OOH advertising market by holding 45.5% of share in 2024 owing to their widespread use in urban areas, where they serve as a primary medium for reaching mass audiences. According to the International Advertising Association, over 60% of advertisers in the region prioritize billboards due to their high visibility and impact. For example, cities like Shanghai and Bangkok have integrated large-scale LED billboards into their infrastructure, which is captivating audiences and driving brand awareness. Additionally, advancements in technology, such as dynamic content updates and real-time analytics, have enhanced the effectiveness of billboard campaigns. Another driving factor is the growing emphasis on programmatic advertising.

The place-based media is projected to grow at the highest CAGR of 24.5% in the next coming years owing to the increasing adoption of digital displays in venues such as shopping malls, airports, and stadiums, where they offer targeted and engaging content. For instance, retailers in Japan and South Korea are using place-based media to promote products during peak hours by ensuring higher engagement rates and better sales performance. According to McKinsey & Company, over 70% of consumers in urban areas prefer localized and contextually relevant advertisements, which is driving investments in scalable and innovative solutions. Another contributing factor is the integration of IoT-enabled devices into place-based media platforms, enabling real-time audience insights and dynamic content adjustments.

COUNTRY LEVEL ANALYSIS

China was the top performer in the Asia Pacific digital OOH advertising market by accounting for 35.4% of share in 2024 with the massive population and rapidly growing urbanization have created a fertile ground for digital OOH platforms to thrive. Enterprises and government agencies in China are increasingly adopting advanced technologies like AI-driven analytics and IoT-enabled displays to enhance campaign effectiveness. According to the National Bureau of Statistics of China, over 60% of large organizations have integrated digital OOH into their marketing strategies with its widespread adoption.

Japan is likely to have fastest growth rate in the next coming years. The country’s advanced technological infrastructure and emphasis on precision have positioned it as a leader in adopting AI-driven digital OOH solutions. Japanese corporations prioritize efficiency and innovation, particularly in industries like retail and entertainment. According to the Japan External Trade Organization, over 70% of large enterprises use digital OOH platforms to enhance operational efficiency and compliance. Additionally, the integration of robotics and automation into business processes has gained traction, enabling seamless and scalable solutions. These innovations reinforce Japan’s prominence in the regional market.

India’s booming IT sector and rapidly evolving startup ecosystem are lucratively prompting the growth of the Asia Pacific digital OOH advertising market. Indian enterprises are increasingly leveraging analytics tools to address challenges such as chronic disease management and rural access.

South Korea's Ooh advertising market is likely to grow with focus on innovation and digital transformation has driven the adoption of advanced digital OOH platforms. South Korean enterprises in urban centers, rely on analytics tools to manage chronic diseases and enhance patient care. According to the Korea Chamber of Commerce and Industry, over 50% of large hospitals have implemented AI-driven systems to analyze imaging data for early disease detection by ensuring timely interventions.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC digital out-of-home advertising market profiled in this report are JCDecaux, Stroer SE & Co. KGaA, Clear Channel Outdoor Holdings, Inc., Outfront Media Inc., oOh!media Limited, Lamar Advertising Company, Broadsign International LLC., Focus Media, Global Outdoor Media Limited, and Daktronics Dr.

TOP LEADING PLAYERS IN THE MARKET

JCDecaux

JCDecaux is a global leader in the digital OOH advertising market with renowned for its innovative and sustainable solutions tailored to urban environments. The company specializes in large-scale digital billboards, street furniture, and transit displays, which is leveraging advanced technologies like AI and IoT to deliver engaging content. JCDecaux’s focus on sustainability aligns with global environmental goals, as it integrates energy-efficient LED screens and solar-powered displays into its offerings. Its commitment to innovation and scalability positions it as a trusted partner for businesses seeking to enhance brand visibility globally.

Clear Channel Outdoor

Clear Channel Outdoor specializes in dynamic and interactive digital OOH platforms that cater to industries like retail, entertainment, and transportation. Its solutions emphasize real-time data analytics and programmatic advertising, empowering advertisers to optimize campaigns dynamically. Clear Channel has strengthened its presence in the Asia Pacific by investing in AR-enabled displays and fostering collaborations with startups and academic institutions.

Lamar Advertising

Lamar Advertising offers robust digital OOH platforms that provide end-to-end visibility across formats, ensuring alignment with global and regional standards. Enterprises leverage Lamar’s tools to streamline processes such as campaign management, audience targeting, and performance analytics. Lamar has deepened its engagement in the Asia Pacific by tailoring its offerings to meet local needs, such as regulatory compliance in Japan and Australia.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Integration of Augmented Reality (AR) and Artificial Intelligence (AI)

Leading players are increasingly incorporating augmented reality (AR) and artificial intelligence (AI) into their digital OOH platforms to enhance functionality and user engagement. These technologies enable immersive experiences, allowing consumers to interact with advertisements in real-time. For instance, AR-enabled displays can transform static ads into interactive storytelling mediums, improving brand recall and customer satisfaction. This strategy not only differentiates vendors in a competitive market but also positions them as innovators in the digital OOH space.

Expansion Through Strategic Partnerships

Strategic partnerships with local enterprises, governments, and industry bodies have become a cornerstone of success in the Asia Pacific digital OOH advertising market. Collaborations with public sector organizations help promote awareness campaigns and regulatory compliance initiatives, fostering trust among stakeholders. Additionally, partnerships with technology firms facilitate the integration of advanced tools, ensuring scalability and reliability. These alliances enable companies to expand their reach and influence across diverse markets, which is catering to the unique needs of industries such as retail, healthcare, and finance.

Focus on Localization and Customization

Key players are prioritizing localization and customization to address the unique needs of businesses in the Asia Pacific region. By offering multilingual interfaces and region-specific features, vendors can cater to diverse consumer preferences. This approach not only enhances user experience but also fosters brand loyalty. Additionally, customization allows companies to adapt their solutions to specific industries, such as rural healthcare and telemedicine, ensuring relevance and applicability in diverse operational contexts.

COMPETITION OVERVIEW

The Asia Pacific digital OOH advertising market is characterized by intense competition, driven by a mix of global giants and regional innovators striving to capture market share. Established players like JCDecaux, Clear Channel Outdoor, and Lamar Advertising bring extensive resources and technological expertise, enabling them to dominate key segments such as AI-driven analytics and programmatic advertising. At the same time, regional companies leverage their deep understanding of local cultures and regulatory frameworks to carve out niche positions. The market’s dynamic nature is further amplified by rapid technological advancements, which compel vendors to continuously innovate and adapt. Strategic collaborations with governments and industry bodies play a crucial role in shaping competitive strategies in emerging markets.

RECENT MARKET DEVELOPMENTS

- In April 2024, JCDecaux launched a new AR-enabled billboard campaign in Southeast Asia. This initiative aims to enhance its market presence by offering immersive and interactive advertising experiences that captivate urban audiences.

- In June 2023, Clear Channel Outdoor partnered with a leading retail chain in Australia to integrate its digital OOH platform with the firm’s existing customer engagement systems. This collaboration seeks to streamline marketing processes and improve operational efficiency for end-users.

- In September 2023, Lamar Advertising introduced a blockchain-enabled feature to ensure tamper-proof records for ad placements in India. This move strengthens its dominance in ethical governance practices and addresses growing concerns about transparency.

- In February 2024, JCDecaux acquired a regional startup specializing in AI-driven audience analytics for outdoor advertising. This acquisition allows JCDecaux to expand its capabilities in proactive targeting, which is catering to the evolving needs of enterprises in the Asia Pacific region.

MARKET SEGMENTATION

This Asia Pacific digital out-of-home advertising market research report is segmented and sub-segmented into the following categories.

By Application

- Indoor

- Outdoor

By Format

- Billboards

- Street Furniture

- Transit & Transportation

- Roadways

- Airways

- Railways

- Marine

- Place-Based Media

By Vertical

- Automotive

- Financial Services

- Government

- Media & Entertainment

- Retail

- Real Estate

- Restaurants

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific digital out-of-home advertising market?

The Asia Pacific digital out-of-home advertising market is driven by rapid urbanization, smart city initiatives, high internet penetration, and the adoption of programmatic and AI-driven advertising for targeted, real-time campaigns

2. What challenges affect the Asia Pacific digital out-of-home advertising market?

Key challenges for the Asia Pacific digital out-of-home advertising market include high infrastructure costs, a shortage of skilled professionals, fragmented regulations, and content restrictions across different countries

3. What opportunities exist in the Asia Pacific digital out-of-home advertising market?

Major opportunities in the Asia Pacific digital out-of-home advertising market include AR and AI integration, expansion into rural and tier-II cities, and demand for immersive, interactive, and localized advertising solutions

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com