Global Automatic Pill Dispenser Market Size, Share, Trends & Growth Forecast Report By Application (Home Healthcare, Hospital Pharmacies and Retail Pharmacies), Type (Carousels, Centralized Automated Dispensing System, Robots/Robotic Automated Dispensing System, Ward-Based, Decentralized Automated Dispensing, Automated Unit Dose and Pharmacy-Based), Age Group, Indication and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Automatic Pill Dispenser Market Size

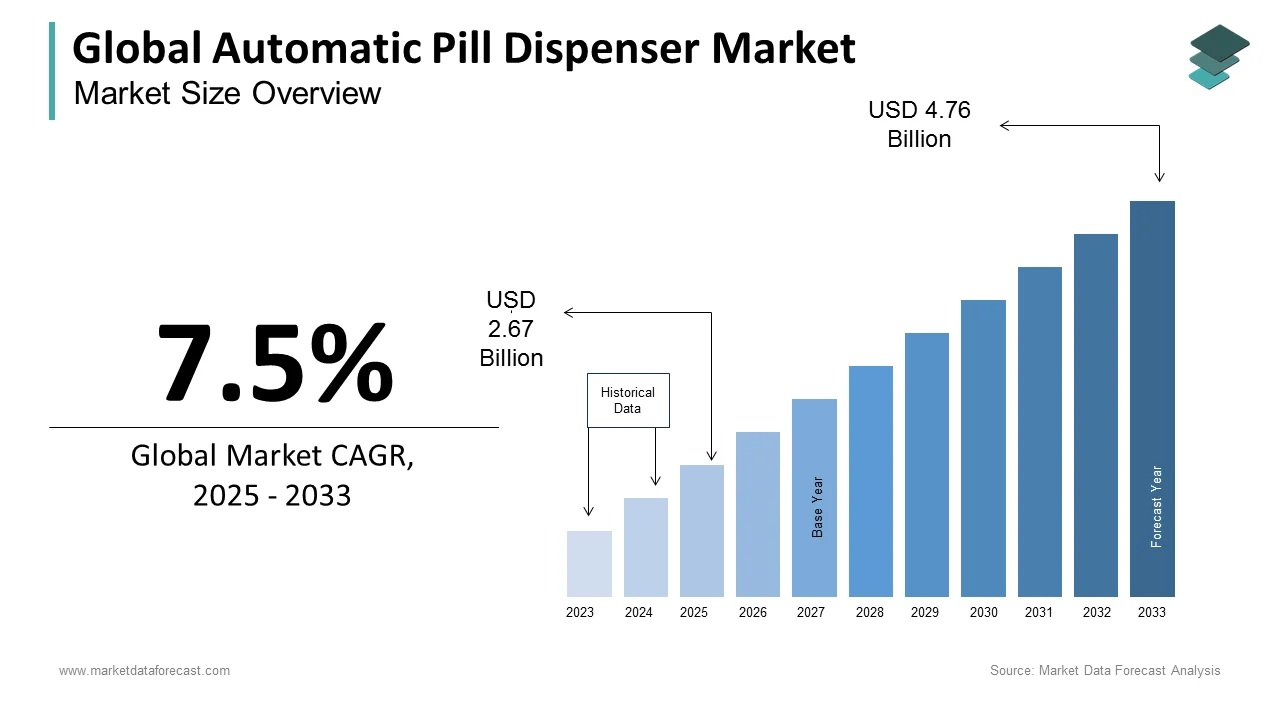

The size of the global automatic pill dispenser market was worth USD 2.48 billion in 2024. The global market is anticipated to grow at a CAGR of 7.5% from 2025 to 2033 and be worth USD 4.76 billion by 2033 from USD 2.67 billion in 2025.

Automatic pill dispenser devices make medication counting, medicine management, dispensing, and inventory control easier for pharmacists, doctors, nurses, patients, and caretakers. Pill dispensers are frequently used for medical purposes. They assist patients, whether elderly or chronically ill, in taking their prescription medicine, over-the-counter medication, or daily supplements on a fixed schedule. Automated pill dispensers are typically cost-effective and provide accurate results. It also lowers the risk of human error and boosts pharmacy productivity. In addition, for patients with complex prescription schedules and memory loss problems, the automated pill dispenser system helps deliver the right drug and dose.

MARKET DRIVERS

The growing prevalence of diseases such as cancer, Alzheimer's, osteoarthritis, diabetes, and chronic obstructive pulmonary disease is primarily propelling the global automatic pill dispenser market.

The automatic pill dispenser machines are very accurate in dispensing medicines. In addition, the growth in the geriatric population and the rise in cardiovascular diseases and respiratory diseases due to an unhealthy lifestyle have supported the pills market's growth, affecting the automatic pill dispenser market. The governments have recognized the potential, and the rising regulatory approval is forecasted to support the market growth. Increasing investment in home care centers is also expected to propel the market's growth. The rising number of product approvals with the launch of new devices, growing awareness regarding the observance of medication, and massive increase in investments in homecare centers are further expanding the market's growth. Increasing high adoption of technological advancements and rising government initiatives in improving healthcare facilities successfully drive the automatic pill dispenser market globally. Creating awareness of the availability of different devices for home healthcare is likely to propel the growth rate of the global automatic pill dispenser market.

MARKET RESTRAINTS

The automatic pill dispensers are run by software, and any small error in the software running can prove fatal for the patients. In addition, the continuous service of pill dispensers can be a challenge in a busy hospital environment. There are many costs involved in setting up these pill dispensers and considering the low return on investment are hampering the growth of the global automatic pill dispenser market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.5% |

|

Segments Covered |

By Application, Type, Age, Indication, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Swisslog Holdings AG, Dickinson and Company, McKesson Corporation, Becton, Cerner Corporation, Yuyama Co., Ltd, Baxter International Inc., Omnicell Inc., Illinois Tool Works, Allscripts Healthcare Solutions, Inc., Capsa Healthcare, ScriptPro LLC, Meditech, Talyst, Inc., Accu-Chart Plus Healthcare System, Optum Inc., Pearson Medical Technologies, Constellation Software Inc., and Others. |

SEGMENTAL ANALYSIS

By Application Insights

Based on the application, the Hospital pharmacy had the largest market share in 2023 due to the rise of diseases and increased population; this segment is expected to grow reasonably. In addition, pill dispensing machines are costly, and hospitals having high-quality healthcare facilities can afford the devices.

The home healthcare segment accounted for the second-largest share in the global automatic pill dispenser market in 2023 and is expected to grow faster from 2025 to 2033. The segment's growth is primarily attributed to an increase in the elderly population. People often have problems memorizing their medication in the elderly, making an automatic pill dispenser useful. In addition, the rise in disposable incomes has also supported the growth of home healthcare.

The retail pharmacy had the third-largest share and is expected to grow significantly during the forecast period. The rise in awareness is a significant factor contributing to the growth.

By Type Insights

Based on the type, the centralized system was the market leader in 2023 and is expected to register a significant growth rate in the future. This is because the rising prevalence of diseases and the increasing population will propel the market's growth.

The decentralized system had the second-highest market share last year and is expected to grow at a healthy rate. The increase in hospitals and other healthcare facilities is the primary reason for the growth rate.

By Age Insights

Based on age, the age group of 65-74 years segment captured the largest share of the global automatic pill dispenser market in 2023. The rise in disposable income and the rising income spent on healthcare are the major factors driving growth.

The people of the age group 85+ years are primarily unable to function themselves; therefore, they require healthcare personnel assistance to give them medicines. In addition, they mostly cannot understand the technology; thus, the market is significantly less for people with 85+ years of experience.

By Indication Insights

The increase in population and accidents has increased the number of people with physical disabilities and thus contributed significantly to the market. The visually impaired people segment is expected to contribute generously to the growth of this market. Rising awareness and ease of use have driven the development of this market.

REGIONAL ANALYSIS

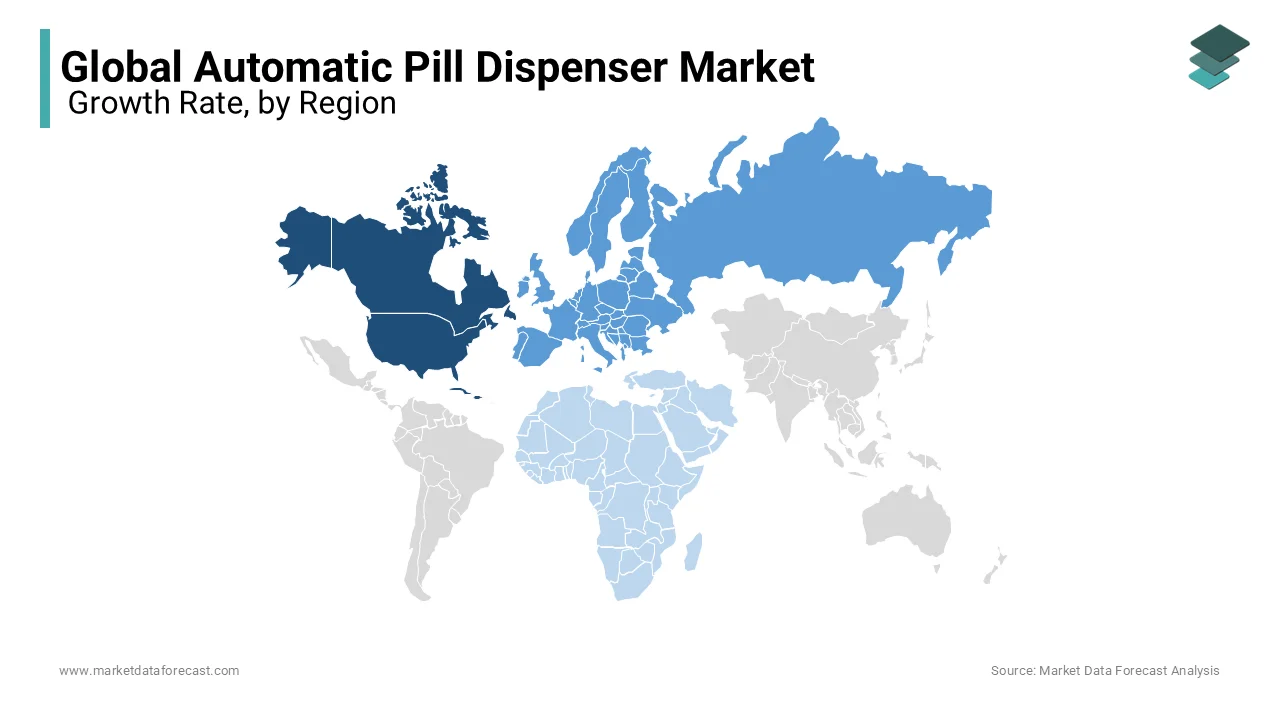

Geographically, the automatic pill dispenser market in North America dominated the global market with more than 50% market share in 2023. Furthermore, the growth rate is expected to be positive during the forecast period. The growing senior population and rising healthcare facilities have helped this region attain a high growth rate. In addition, the increase in disposable incomes has further fuelled growth. During the forecast period, the U.S. is estimated to lead the North American regional market, followed by Canada.

The European automatic pill dispenser market had the second-largest share in the global market in 2023. The growth rate is driven by a rise in the old age population and rising healthcare facilities by private or government means. In this region, the U.K. and Germany are predicted to play a vital role during the forecast period.

The automatic pill dispenser market in Asia Pacific is expected to register the highest growth rate among all the regions. The main reason for this is the increasing population and increasing cases of diseases in countries like India. In addition, government initiatives and growing awareness have increased the popularity of these machines.

The Latin American automatic pill dispenser market is predicted to grow at a steady CAGR during the forecast period. The aging population is growing considerably among Latin American countries, which is anticipated to propel the regional market growth during the forecast period.

The automatic pill dispenser market in MEA is anticipated to grow at a moderate CAGR in the coming years. This is because the countries of MEA are experiencing more significant improvements in healthcare infrastructure, and the awareness around automatic pill dispensers is increasing; these are expected to result in regional market growth.

KEY MARKET PLAYERS

Some of the key competitors dominating the Global Automatic Pill Dispenser Market profiled in this report are Swisslog Holdings AG, Dickinson and Company, McKesson Corporation, Becton, Cerner Corporation, Yuyama Co., Ltd, Baxter International Inc., Omnicell Inc., Illinois Tool Works, Allscripts Healthcare Solutions, Inc., Capsa Healthcare, ScriptPro LLC, Meditech, Talyst, Inc., Accu-Chart Plus Healthcare System, Optum Inc., Pearson Medical Technologies and Constellation Software Inc.

RECENT HAPPENINGS IN THIS MARKET

- In December 2020, Capsa Healthcare announced the launch of NexsysADC Suite. NexsysADC is a practical automated dispensing cabinet for steady and controlled medication storage in many healthcare settings.

- In October 2019, Salem Health announced its partnership with Omnicell XT cabinets. In addition, the company is to launch a new Autonomous Pharmacy to improve the safety and efficiency of its medication management process.

- In March 2019, Swisslog introduced new Insite In-Facility Medication Packaging and Dispensing Service at MHA Business Summit.

MARKET SEGMENTATION

This research report on the global automatic pill dispenser market has been segmented and sub-segmented based on application, type, age, indication, and region.

By Application

- Home Healthcare

- Hospital Pharmacy

- Retail Pharmacy

By Type

- Carousels

- Centralized Automated Dispensing System

- Robots/Robotic Automated Dispensing System

- Ward-Based

- Decentralized Automated Dispensing

- Automated Unit Dose

- Pharmacy-Based

By Age

- 38-64 years

- 65-74 years

- 75-84 years

- 85 years and above

By Indication

- Visual Impairment

- Old Age

- Dementia

- Learning Dementia

- Physical Disability

- Mental Health, excluding dementia

- Parkinson's disease

- Other Diseases

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global automatic pill dispenser market going to be worth by 2033?

As per our research report, the global automatic pill dispenser market size is expected to value USD 4.76 billion by 2033.

At What CAGR, the global automatic pill dispenser market is expected to grow from 2025 to 2033?

From 2025 to 2033, the global automatic pill dispenser is estimated to grow at a CAGR of 7.5%.

Which region led the automatic pill dispenser market in 2024?

Geographically, North America occupied the major share in the global automatic pill dispenser market in 2024.

Which are the significant players operating in the automatic pill dispenser market?

Swisslog Holdings AG, Dickinson and Company, McKesson Corporation, Becton, Cerner Corporation, Yuyama Co., Ltd, Baxter International Inc., Omnicell Inc., Illinois Tool Works, Allscripts Healthcare Solutions, Inc., Capsa Healthcare, ScriptPro LLC, Meditech, Talyst, Inc., Accu-Chart Plus Healthcare System, Optum Inc., Pearson Medical Technologies and Constellation Software Inc. are a few of the promising companies in the global automatic pill dispenser market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com